TORONTO, March 20, 2015 (GLOBE NEWSWIRE) -- With the late winter thaw happening around the country, to be followed by the spring and summer rains, Aviva Canada Inc., one of the country's leading providers of home, auto, leisure and business insurance, is encouraging Canadians to take steps to protect their property from water damage.

"2013 was our worst year for water damage in part due to flooding in Alberta and Toronto," states Sharon Ludlow, President, Aviva Insurance Company of Canada. "But it is important to note that water damage is steadily increasing in terms of the number and cost of claims, and that homeowners and tenants can take steps to protect themselves from loss."

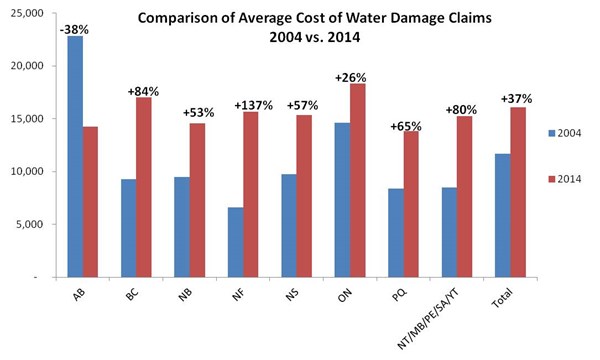

In 2014, water damage claims accounted for 44% of dollars paid out on all Aviva Canada property damage claims, compared with 39% in 2004. The average cost per residential water damage claim has increased significantly – going from $11,709 in 2004 to $16,070 in 2014, a 37% increase.

Aviva Canada paid out $180 million in water damage claims in 2014, a 189% increase versus 2004 and a 57% increase versus 2012. A comparison of the average cost of water damage claims by province is included below (in 2004 Edmonton experienced what was the province's worst overland flooding event in its history, explaining the negative comparison number for AB).

See included graph

*Saskatchewan, Manitoba, PEI and the territories were grouped due to small number of claims.

"The reasons for the upward trend are rather simple," commented Ludlow. "The increasing investment Canadians are putting into their basements, combined with more frequent severe weather events and an aging sewer system that is unable to deal with large amounts of water within a short time period, results in a lot of homes experiencing damage."

It's not just Aviva Canada data that highlights the rise in water damage issue, weather data shows our country is getting wetter. Average yearly rainfall in Canada has increased by 12% in the past 60 years, with 20 more days of rain a year than the 1950s. And catastrophes like overland flooding are on the increase. According to Environment Canada, severe weather events that used to happen every 40 years can now be expected to happen every six years.

Overland water protection coverage is coming

This past February, Aviva Canada announced an insurance industry first – overland water protection for residential property owners and tenants across Canada. While many Canadians are covered for sewer back-up and damage caused by burst pipes, residential overland water damage protection has not previously existed. Available as an endorsement to personal property insurance policies that have sewer back-up protection in place – Aviva Canada's overland water damage coverage will be launched in Alberta and Ontario in May, and then rolled out to other provinces throughout 2015.

Steps Canadians should take this spring to safeguard their homes and possessions from water damage are:

- Get coverage for overland water damage: As noted above, Aviva Canada recently introduced an overland water protection product that will be available this year.

- View our quick video: The video contains many of the tips included below and can easily be shared.

- Inspect your roof: To prevent leaks, get the roof inspected every few years to check the condition of the shingles and replace when necessary.

- Clear out gutters: Prevent blockages, such as leaves and other debris that could force water into your home.

- Install a backwater valve: These valves close automatically if the sewer backs up and can prevent thousands of dollars in damage.

- Scope out your sump pump: If your basement has one, examine it and conduct a test run if it doesn't get used frequently.

- Slope right: Ensure that soil, walkways and patios slope away from the home to allow for proper drainage.

- Check your foundation: As ice melts, if you notice water pooling in certain areas, clear it away from your home.

- Ensure your window wells are debris-free: Clear any accumulated garbage or leaves to allow water to drain properly.

- Ensure street catch basins are not blocked: These prevent snow from building up on the street level, protecting water from seeping towards your property.

- Protect your valuables: If your home is prone to water damage, consider moving valuables away from high-risk areas such as the basement, or place items on high shelves or risers.

- Start right: If you are finishing your basement, make sure to seal your exterior walls.

Without taking such precautions, homeowners could put their homes and family belongings at great risk

Canadians are encouraged to reach out to their insurance broker to make sure they know the extent of their water damage coverage.

About Aviva Canada

Aviva Canada is one of the leading property and casualty insurance groups in Canada providing home, auto and business insurance to more than three million customers. The company is a wholly-owned subsidiary of UK-based Aviva plc and has more than 3,000 employees, 25 locations and 1,700 independent broker partners. Aviva Canada invests in positive change through the Aviva Community Fund, Canada's longest running online community funding competition. Since its inception in 2009, the Aviva Community Fund has awarded $5.5 million to over 100 communities nationwide.

For more information about Aviva Canada, visit AvivaCanada.com, our blog or our Twitter, Facebook and LinkedIn pages.

Photos accompanying this release are available at: