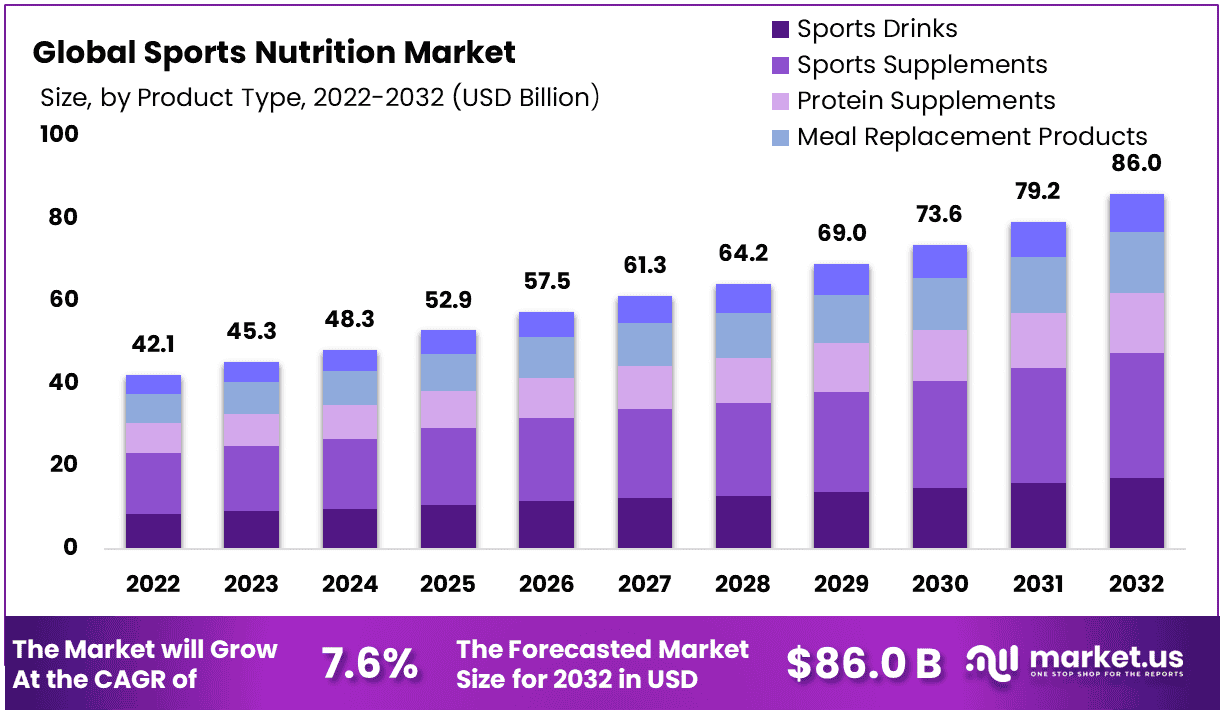

New York, Sept. 18, 2023 (GLOBE NEWSWIRE) -- According to a recent report by Market.us, the Global Sports Nutrition Market size is expected to be worth around USD 86.0 Billion by 2032 from USD 42.1 Billion in 2022, growing at a CAGR of 7.6 % during the forecast period from 2023 to 2032.

The importance of nutritional supplements in sports and fitness can't be overstated. Such products play an essential role in optimizing training outcomes, hastening recovery periods, maintaining optimal body weight, minimizing the risk of injuries, and ensuring performance consistency. The surging number of gyms, wellness clubs, and fitness facilities further bolsters this market, providing targeted guidance on the efficacy and application of sports nutrition. Data from the International Health Racquet and Sports Club Association (IHRSA) revealed that as of 2021, there were 32,270 health clubs in the US, with a membership base of 4.5 billion individuals.

Get a glance at the market contribution of the segments, Request a PDF Sample@ https://market.us/report/sports-nutrition-market/request-sample/

Key Takeaway

- By Product Type in 2022, Sports supplements comprised 43% of the total market share in 2022. This is due to increasing awareness about fitness and the commercial availability of supplements for athletes.

- By Formulation, the largest share, over 39%, was held by powder formulation in 2022. Market growth is supported by the increasing popularity of sports events and the rise of fitness and health centers in the region.

- By Application, in 2022, the post-workout segment held a market share of 36% of the total market because of the increased prefernec for fitness and an active lifestyle.

- By Consumer, in 2022, the adult segment accounted for 64% of the total market. This can be attributed to the large number of consumers aged between 18 and 64 years.

- By Distribution Channel, in 2022, brick-and-mortar accounted for a dominating share of 74%. This segment has seen significant growth due to the existence of many specialty stores and fitness centers.

- By End-User, the fitness enthusiasts segment dominated with a market share of more than 40% in 2022.

- In 2022, North America dominated the market with the highest revenue share of over 43.8%.

Factors affecting the growth of the sports nutrition industry

Several factors can have an impact on the growth of the sports nutrition industry. Some of these factors include:

- Increasing Health Consciousness: As a society, there has been a noticeable shift toward health and wellness. The rising awareness around the importance of physical fitness has created a larger consumer base for sports nutrition products. More people are engaging in regular exercise and seek nutritional supplements that can enhance their performance and recovery.

- Increasing Acceptance of Protein Supplements: Initially reserved for bodybuilders and professional athletes, protein supplements have now penetrated mainstream consumer categories. Today, they are consumed by people from all walks of life who are interested in maintaining a healthy lifestyle.

- Celebrity Endorsements and Sponsorships: High-profile endorsements from athletes, celebrities, and fitness influencers lend credibility to sports nutrition products and can substantially influence consumer buying habits.

Market Growth

Protein supplements, for instance, have gained mainstream acceptance, expanding their reach beyond bodybuilders to everyday fitness enthusiasts. Another driving force behind this market expansion is the growing preference for plant-based supplements known for their immune-boosting properties. With increasing consumer awareness, the demand for these plant-based options have increased rapidly.

Manufacturers, recognizing the immense potential, have tapped into the power of digital marketing channels. Social media platforms like Instagram and YouTube have become pivotal in increasing consumer awareness and driving adoption rates. According to a survey conducted by Netcomm Suisse E-commerce Association in conjunction with the United Nations Conference on Trade and Development, the e-commerce sales of pharmaceuticals and health-related products have seen a significant jump of 9.0%. This underscores the growing trust and acceptance of online platforms for health-related purchases, including sports nutrition products.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/sports-nutrition-market/#inquiry

Regional Analysis

North America dominates the global sports nutrition market, accounting for 43.8% of revenue in 2022. High demand, product launches, and government initiatives contribute to market growth. Innovations from BASF and Flex Pharma, such as PeptAIde and HOTSHOT, support regional market growth, promoting sports-related activities.

Scope of the Report

| Report Attributes | Details |

| Market Value (2022) | USD 42.1 Billion |

| Market Size in 2032 | USD 86.0 Billion |

| CAGR (2023 to 2032) | 7.6% |

| North America Revenue Share | 43.8% |

| Historic Period | 2022 |

| Base Year | 2016 to 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The demand for sports nutrition products and supplements is on the rise among fitness enthusiasts and lifestyle consumers. The market is driven by the availability of sports supplements in bars, gels, and powders, as well as sports drinks made from vitamins and fruits in various flavors. The growth in this market is driven by partnerships, collaborations, and increased investments by key players, allowing consumers to enjoy a wide range of tastes and flavors.

Market Restraints

High-quality sports nutrition products often come with premium prices, deterring budget-conscious consumers and slowing market growth. To differentiate and meet evolving consumer demands, companies must continually innovate and stand out in the saturated market.

Market Opportunities

Research into new ingredients and formulations is driving innovation in the sports nutrition industry, improving product effectiveness and differentiation. Novel protein sources, bioactive compounds, and advanced delivery systems are enhancing product appeal. Personalized sports nutrition solutions, such as AI-driven recommendations and genetic profiling, can gain a competitive edge and build customer loyalty.

Market Trends

Sports nutrition companies are focusing on transparency and clean labeling to build trust among consumers. They aim to provide detailed information about supplements, ingredients, and manufacturing processes, ensuring consumers are aware of hidden additives. Additionally, they are leveraging the trend of snacking for performance, offering convenient, nutritious snacks like protein bars, chips, and shakes to support post-workout recovery and energy levels.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Report Segmentation of the Sports Nutrition Market

Product Type Insight

In 2022, sports supplements held a 43% market share due to increasing health consciousness and widespread availability in commercial settings. The growth of gyms and fitness facilities further bolstered this segment's popularity. The industry's future expansion is expected due to the continuous rollout of innovative products and research into advanced ingredients.

Formulation Insight

In 2022, powder formulation dominated the market with over 39% share, driven by growing sports events and fitness centers. Powdered supplements are easier to digest, contain stable ingredients, and have longer shelf life, particularly for protein powders. The segment is also undergoing innovations, such as thick shakes for athletes, providing sustained energy and concentrated nutrients compared to conventional powders.

Application Insight

In 2022, the post-workout segment dominated the market with 36% share of the global market, driven by increased fitness and active lifestyles. Supplements boosting muscle strength and recovery are popular, enhancing future performance. Growth is supported by increased fitness centers and accessibility of post-workout products. Pre-workout applications are expected to grow fastest due to obesity and healthy lifestyles. Key players such as in 2020, NOW Sports introduced new products, for instance, BCAA Blast Powder.

Consumer Insight

In 2022, the adult segment accounted for 64%, driven by the growing demand for women's nutrition products and increased activity levels among the 18-64 age group. This growth is fueled by increased spending on sugar-free, vegan, and convenient supplements, as well as the growing trend towards holistic well-being.

Distribution Channel Insight

In 2022, offline stores held a 74% share due to their abundance of specialty stores and fitness centers. Trust is a key factor driving growth in this channel, as physical stores are more trustworthy than online platforms. Online platforms are expected to experience rapid growth due to discounts on supplements for athletes, and players may adopt strategies to compete with retail partners, potentially leading to further expansion of these channels.

End-User Insight

Fitness enthusiasts dominated the end-user segment in 2022 with a market share of 40%. This group of population is becoming popular due to their shifting trend toward healthy lifestyle and wellbeing. Public consciousness toward a healthy lifestyle got a boost due to the COVID-19 pandemic period. People became more aware about the benefits of supplements as opposed to the drugs or medicines, which contain chemicals that migh possible unbalance the body.

Market.us has identified key trends, drivers, and challenges in the market, which will help clients improve their strategies to stay ahead of their competitors. - View a PDF sample report @ https://market.us/report/sports-nutrition-market/request-sample/

Market Segmentation

Based on Type

- Sports Drinks

- Isotonic

- Hypotonic

- Hypertonic

- Sports Supplements

- Protein Supplements

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Omega -3 Fatty Acids

- Others

- Meal Replacement Products

- Other Product Types

Based on Application

- Pre-workout

- Post-workout

- Other Applications

Based on Formulation

- Tablets

- Capsules

- Powder

- Soft gels

- Other Formulations

Based on Consumer

- Children

- Adult

- Geriatric

Based on Distribution Channel

- Online Platforms

- Offline Stores

Based on End-User

- Athletes

- Fitness Enthusiasts

- Bodybuilders

- Other End-Users

Regional Analysis

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

Major players are leveraging strategies like mergers, acquisitions, collaborations, product differentiation, partnerships, competitive pricing, and new product launches to gain a significant global market share, such as Clif Bar & Company's launch of prebiotic snack bars in February 2021.

The following are some of the major players in the global sports nutrition industry:

- Iovate Health Sciences

- Abbott

- Quest Nutrition

- PepsiCo

- Cliff Bar

- The Coca-Cola Company

- MusclePharm

- The Bountiful Company

- Other Key Players

Recent Development of the Sports Nutrition Market

- In January 2022, Hydroxycut, a sports nutrition brand owned by Lovate Health Scie, launched "Cut" to help consumers reduce body fat percentage.

- In November 2021, Solabia-Algatech Nutrition introduced a multi-blend supplement, AstaPure MAX, that aids in alleviating muscle soreness and post-exercise pain.

Browse More Related Reports

- Enzymes Market size is expected to be worth around USD 21.3 Billion by 2032 from USD 11.5 Billion in 2022

- Dental Caries Detectors Market size is expected to be worth around USD 767 Mn by 2032 from USD 303 Mn in 2022

- Body Fat Measurement Market was valued at USD 748 million and is expected to reach USD 1407 million in 2032.

- Food Safety Testing Market was valued at USD 19.6 Billion, this market is estimated to register the highest CAGR of 7.8% and is expected to reach USD 40.8 Billion

- Protein Engineering Market size is expected to be worth around USD 9,329 Million by 2032 from USD 2,691 Million in 2022

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog:

- https://medicalmarketreport.com/

- https://chemicalmarketreports.com/

- https://techmarketreports.com/

- https://foodnbeveragesmarket.com/