- "LTE TDD - Making the Most of 4G" by ABI Research Now Available

- "Validating the Market for TDD LTE in the U.S. Marketplace" by IDC Now Available

BELLEVUE, Wash., Oct. 25, 2012 (GLOBE NEWSWIRE) -- Clearwire (Nasdaq:CLWR), a leading provider of 4G mobile broadband services in the U.S., today made available two commissioned research studies that outline the growing prominence of the global TDD-LTE ecosystem and an analysis of Clearwire's vast spectrum holdings.

A photo accompanying this release is available at http://www.globenewswire.com/newsroom/prs/?pkgid=15424

"Given the market's resurgent interest in understanding both our TDD LTE technology choice and our spectrum holdings, we're sharing the independent findings from these recently commissioned research reports today," said John Saw, CTO of Clearwire. "The IDC and ABI reports highlight the benefits and economies of scale of TDD-LTE, our 2.5GHz to 2.6GHz frequency band (Band 41), and Clearwire's unmatched spectrum resources."

The first report is titled "Validating the Market for TDD LTE in the U.S. Marketplace" by John Byrne, Research Director for Wireless Infrastructure at IDC. The second report is titled "LTE TDD - Making the Most of 4G" by Phil Solis, Research Director, Devices, Content & Applications; and Jake Saunders, Vice President and Practice Director, Core Forecasting at ABI Research. Complementary copies of both reports are available at Clearwire's newsroom at http://www.clearwire.com/newsroom. ;

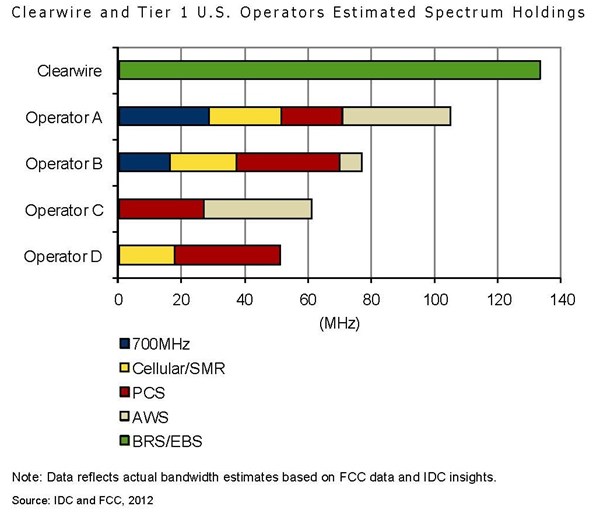

As the IDC report notes, "Clearwire is able to operate on a single bandwidth in excess of 130 MHz on average, including approximately 160 MHz on average in top 100 markets where capacity constraints are the most likely to emerge. As a result, Clearwire has the capability to generate much greater capacity and better network performance by virtue of a significantly fatter pipe vis-à-vis competitors."

The TDD-LTE ecosystem continues to grow with commercial or planned deployments in major population centers, including Japan, China, India, the European Union and Clearwire's deployment in the United States. The ABI Research report "estimates that global TDD LTE coverage will have addressable population coverage of 4.4 billion by 2014 if network rollouts in key countries are aggressive." The report also outlines the economies of scale for the device ecosystem and projects that "every LTE device will support both TDD and FDD technologies," given their commonality.

The reports explore different topic areas, such as:

- The capacity and bandwidth constraints facing other U.S. wireless operators;

- The challenges and timetables associated with acquiring new spectrum via auctions;

- The pervasiveness of the 2.5GHz band among global operators;

- The adoption of TDD-LTE by operators around the world, commonality with other LTE technologies, and the device ecosystem, and more.

About Clearwire

Clearwire Corporation (Nasdaq:CLWR), through its operating subsidiaries, is a leading provider of 4G wireless broadband services offering services in areas of the U.S. where more than 130 million people live. The company holds the deepest portfolio of wireless spectrum available for data services in the U.S. Clearwire serves retail customers through its own CLEAR® brand as well as through wholesale relationships with some of the leading companies in the retail, technology and telecommunications industries, including Sprint and NetZero. The company is constructing a next-generation 4G LTE Advanced-ready network to address the capacity needs of the market, and is also working closely with the Global TDD-LTE Initiative and China Mobile to further the TDD-LTE ecosystem. Clearwire is headquartered in Bellevue, Wash. Additional information is available at http://www.clearwire.com.

The Clearwire Corporation logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=8493

Forward-Looking Statements

This release, and other written and oral statements made by Clearwire from time to time, contain forward-looking statements which are based on management's current expectations and beliefs, as well as on a number of assumptions concerning future events made with information that is currently available. Forward-looking statements may include, without limitation, management's expectations regarding future financial and operating performance and financial condition; proposed transactions; network development and market launch plans; strategic plans and objectives; industry conditions; the strength of the balance sheet; and liquidity and financing needs. The words "will," "would," "may," "should," "estimate," "project," "forecast," "intend," "expect," "believe," "target," "designed," "plan" and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of performance and are subject to a number of uncertainties and other factors, many of which are outside of Clearwire's control, which could cause actual results to differ materially and adversely from such statements. Some factors that could cause actual results to differ are:

- We have a history of operating losses and we expect to continue to realize significant net losses for the foreseeable future.

- Our business has become increasingly dependent on our wholesale partners, and Sprint in particular. If we do not receive the amount of revenues we expect from existing wholesale partners or if we are unable to enter into new agreements with additional wholesale partners for significant new wholesale commitments in a timely manner, our business prospects, results of operations and financial condition could be adversely affected, or we could be forced to consider all available alternatives.

- Sprint owns just less than a majority of our common shares, is our largest shareholder, and may have, or may develop in the future, interests that may diverge from other stockholders.

- If our business fails to perform as we expect, if our assumptions underlying our cash projections prove to be inaccurate, or if we incur unforeseen expenses in the near term, we may require additional capital to fund our current business. Also, we will need substantial additional capital to fund our business and meet our financial obligations beyond the next 12 months. Such additional capital may not be available on acceptable terms or at all. If we fail to obtain additional capital, our business prospects, financial condition and results of operations will likely be materially and adversely affected, and we will be forced to consider all available alternatives.

- Our current plans and projections are based on a number of assumptions about our future performance, which may prove to be inaccurate, such as our ability to substantially expand our wholesale business and the expected timing and costs of deploying LTE on our wireless broadband network.

- We regularly evaluate our plans, and we may elect to pursue new or alternative strategies which we believe would be beneficial to our business, including among other things, expanding our network coverage to new markets, augmenting our network coverage in existing markets, changing our sales and marketing strategy and/or acquiring additional spectrum. Such modifications to our plans could significantly change our capital requirements.

- We plan to deploy LTE on our wireless broadband network, alongside mobile WiMAX, and we will incur significant costs to deploy such technology. Additionally, LTE technology, or other alternative technologies that we may consider, may not perform as we expect on our network and deploying such technologies would result in additional risks to the company, including uncertainty regarding our ability to successfully add a new technology to our current network and to operate dual technology networks without disruptions to customer service, as well as our ability to generate new wholesale customers for the new network.

- We currently depend on our commercial partners to develop and deliver the equipment for our legacy and mobile WiMAX networks, and will be dependent on commercial partners to deliver equipment and devices for our planned LTE network as well.

- Many of our competitors for our retail business are better established and have significantly greater resources, and may subsidize their competitive offerings with other products and services.

- Our substantial indebtedness and restrictive debt covenants could limit our financing options and liquidity position and may limit our ability to grow our business.

- Future sales of large blocks of our common stock may adversely impact our stock price.

For a more detailed description of the factors that could cause such a difference, please refer to Clearwire's filings with the Securities and Exchange Commission, including the information under the heading "Risk Factors" in our Annual Report on Form 10-K filed on February 16, 2012, and subsequent Form 10-Q filings. Clearwire assumes no obligation to update or supplement such forward-looking statements.