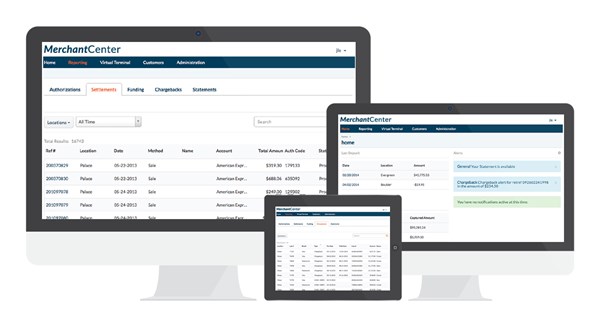

PHILADELPHIA, July 15, 2014 (GLOBE NEWSWIRE) -- CardConnect, one of the nation's fastest-growing providers of payment processing services, today announced the launch of the CardConnect Merchant Center, an online account for each of its 50,000 merchant customers to view and manage their transactions in real time.

A photo accompanying this release is available at http://www.globenewswire.com/newsroom/prs/?pkgid=26486

CardConnect believes the Merchant Center will be the easiest and most intuitive online merchant portal in the payments industry. Within their account, merchants can access reports on all of their payment processing data – from deposits, authorizations and settlements to funding, chargebacks and statements.

"Merchants need to know how and when they are getting paid, but most reporting tools fall short because they are overly complicated, convoluted and missing key pieces of data," said Robert Nathan, Chief Technology Officer at CardConnect. "What the CardConnect Merchant Center does is take all of a merchant's transaction information, from every sales channel and location, and break it down into digestible reports. Everything can be done in three clicks or less."

The CardConnect Merchant Center – available at no additional charge to all businesses that use CardConnect to process payments – mirrors what consumers receive through their online banking accounts. Its features include:

-

Reporting and Reconciliation: Provides fully detailed reports related to deposits, authorizations, settlements, funding and chargebacks, plus the ability to view and download all statements.

-

Transaction Management: Securely processes card-present and card-not-present transactions, in addition to allowing merchants to manage all voids, refunds and receipts.

-

Account Alerts: Sends notifications for important account updates, such as when a chargeback occurs or a new statement is available.

-

Scalability and Flexibility: Accommodates businesses with single or multiple locations, along with the ability to configure different sets of permissions for each user.

-

All-Inclusive: Any merchant processing with CardConnect receives access to this online account.

-

Paperless: Merchants can go green by opting out of paper statements.

- Premium Add-Ons: Access for merchants to easily add features like the CardConnect Virtual Terminal, Gateway and secure EMV devices.

"We are dedicated to having the CardConnect Merchant Center become the next wave of payment processing," said Jeff Shanahan, President and CEO at CardConnect. "This is the foundation we will continually build upon so that any business using CardConnect can have instant access to the latest tools for securing and optimizing all types of transactions. Managing payments should not be a complicated process, and now it never will be."

Current CardConnect merchants can activate their account within the Merchant Center by visiting cardconnect.com/activate.

About CardConnect

CardConnect is a leading provider of payment processing and technology services that helps more than 50,000 merchants nationwide – from Fortune 500 companies to small and mid-sized businesses – accept billions of dollars in card transactions each year. The company's payment gateway and security solutions address the complex needs of merchants accepting credit, debit, check, gift card and loyalty transactions. Founded in 2006, CardConnect is one of the 10 largest independent sales organizations (ISOs) of First Data Merchant Services, the world's largest electronic payment processor. For more information, visit www.cardconnect.com.