San Diego, Jan. 7, 2015 (GLOBE NEWSWIRE) -- PlacementTracker, the leading source for data and analysis to institutions in the PIPE market, today announced the most active investment banks, investors, and law firms in the U.S. PIPE market during 2014.

A total of $28 billion was raised in 850 transactions through the end of 2014. Of this amount, 10 transactions totaling $1.2 billion have been announced but not yet closed as of 1/06/15.

Market activity slowed down considerably in the fourth quarter, but a robust first half of the year helped annual totals maintain the steady pace we've seen over the last four years.

We congratulate all of the active members of the PIPE community for continued success in 2014. Most of these firms are long-time clients of PlacementTracker, and we are dedicated to providing them with access to the very best data and analytics available in our industry.

Most Active Participants Include:

- H.C. Wainwright & Co., LLC as the number one most active investment bank

- Millennium Management, LLC as the number one most active institutional investor

- Sichenzia Ross Friedman Ference, LLP as the number one most active issuer counsel

- Schulte Roth & Zabel, LLP as the number one most active investor counsel

- Ellenoff Grossman & Schole LLP as the number one most active placement agent counsel

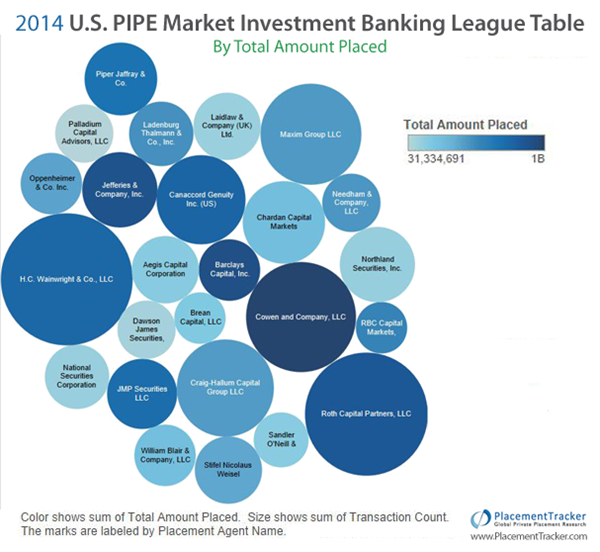

2014 U.S. PIPE Market

Investment Banking League Table

By Number of Transactions:

| Placement Agent Name | Transaction Count | Total Amount Placed |

| H.C. Wainwright & Co., LLC | 46 | $ 882,342,300 |

| Roth Capital Partners, LLC | 40 | $ 1,006,319,095 |

| Cowen and Company, LLC | 32 | $ 1,182,589,167 |

| Maxim Group LLC | 27 | $ 520,622,486 |

| Craig-Hallum Capital Group LLC | 25 | $ 509,668,833 |

| Canaccord Genuity Inc. (US) | 21 | $ 904,302,683 |

| Chardan Capital Markets | 19 | $ 304,755,979 |

| Jefferies & Company, Inc. | 15 | $ 1,049,157,207 |

| Northland Securities, Inc. | 15 | $ 134,481,429 |

| Piper Jaffray & Co. | 14 | $ 799,461,762 |

| JMP Securities LLC | 13 | $ 849,651,007 |

| Stifel Nicolaus Weisel | 12 | $ 445,569,237 |

| Aegis Capital Corporation | 12 | $ 182,685,688 |

| Laidlaw & Company (UK) Ltd. | 12 | $ 120,058,902 |

| Ladenburg Thalmann & Co., Inc. | 11 | $ 563,331,696 |

| National Securities Corporation | 11 | $ 128,863,897 |

| Barclays Capital, Inc. | 10 | $ 1,079,119,500 |

| Oppenheimer & Co. Inc. | 10 | $ 466,440,393 |

| William Blair & Company, LLC | 10 | $ 287,896,054 |

| Needham & Company, LLC | 9 | $ 533,111,330 |

| Dawson James Securities, Inc. | 9 | $ 86,029,543 |

| Palladium Capital Advisors, LLC | 9 | $ 31,334,691 |

| Sandler O'Neill & Partners, L.P. | 8 | $ 178,926,952 |

| RBC Capital Markets, Inc. | 7 | $ 637,867,685 |

| Brean Capital, LLC | 7 | $ 207,126,569 |

Investment Banking rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. On transactions where an investment banking firm has acted solely as Financial Advisor, that transaction has been excluded from that firm's ranking. Co-agented transactions award full transaction credit to all agents participating (regardless of status of lead agent or co-agent). Data is for closed and definitive agreement transactions reported as of 1/06/15.

2014 U.S. PIPE Market Healthcare Sector

Investment Banking League Table

By Total Amount Placed:

| Placement Agent Name | Transaction Count | Total Amount Placed |

| H.C. Wainwright & Co., LLC | 34 | $ 673,760,626 |

| Roth Capital Partners, LLC | 21 | $ 782,323,913 |

| Maxim Group LLC | 19 | $ 365,523,326 |

| Cowen and Company, LLC | 16 | $ 779,677,262 |

| Piper Jaffray & Co. | 12 | $ 647,932,012 |

| Jefferies & Company, Inc. | 11 | $ 792,267,207 |

| JMP Securities LLC | 10 | $ 773,881,007 |

| Chardan Capital Markets | 10 | $ 204,677,748 |

| Canaccord Genuity Inc. (US) | 9 | $ 329,633,731 |

| Ladenburg Thalmann & Co., Inc. | 8 | $ 501,672,521 |

| Stifel Nicolaus Weisel | 8 | $ 304,163,437 |

| Dawson James Securities, Inc. | 8 | $ 81,379,543 |

| Oppenheimer & Co. Inc. | 6 | $ 337,749,993 |

| Aegis Capital Corporation | 6 | $ 146,422,088 |

| Laidlaw & Company (UK) Ltd. | 6 | $ 66,224,522 |

| Leerink Swann, LLC | 5 | $ 311,401,748 |

| MLV & Co. LLC | 5 | $ 221,681,263 |

| Brean Capital, LLC | 5 | $ 195,891,567 |

| Needham & Company, LLC | 4 | $ 375,360,000 |

| William Blair & Company, LLC | 4 | $ 120,883,623 |

| Northland Securities, Inc. | 4 | $ 30,502,099 |

| Barclays Capital, Inc. | 3 | $ 138,868,750 |

| Noble Financial Group | 3 | $ 133,601,957 |

| Summer Street Research Partners | 3 | $ 121,659,810 |

| National Securities Corporation | 3 | $ 80,853,250 |

Investment Banking rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. On transactions where an investment banking firm has acted solely as Financial Advisor, that transaction has been excluded from that firm's ranking. Co-agented transactions award full transaction credit to all agents participating (regardless of status of lead agent or co-agent). Data is for closed and definitive agreement transactions reported as of 1/06/15.

2014 U.S. PIPE Market

Institutional Investor League Table

By Number of Transactions:

| Investor Name | Transaction Count | Total Amount Invested |

| Millennium Management, LLC | 48 | $ 1,000,000 |

| Sabby Management, LLC | 45 | $ 84,264,674 |

| Citadel Advisors, LLC | 39 | Not Disclosed |

| Bank of New York | 30 | Not Disclosed |

| Fidelity Management & Research Corporation | 24 | $ 12,500,000 |

| Perceptive Advisors, LLC | 23 | $ 14,887,808 |

| Heights Capital Management, Inc. | 22 | $ 24,455,339 |

| Broadfin Capital, LLC | 22 | $ 18,404,272 |

| Downsview Capital, Inc. | 21 | $ 15,290,781 |

| Hudson Bay Capital Management L.P. | 19 | $ 100,445,400 |

| D.E. Shaw & Co., L.P. | 19 | Not Disclosed |

| Group One Trading, L.P. | 19 | Not Disclosed |

| Deerfield Management | 18 | $ 213,499,998 |

| Empery Asset Management LP | 18 | $ 32,002,281 |

| UBS O'Connor LLC | 18 | $ 1,500,000 |

| LH Financial Services Corporation | 17 | $ 16,212,394 |

| Equitec Group, LLC | 17 | $ 3,580,273 |

| Wellington Management Company LLP | 16 | $ 168,935,360 |

| Brio Capital Management LLC | 15 | $ 4,183,751 |

| Alyeska Investment Group, L.P. | 15 | $ 2,000,000 |

| DAFNA Capital Management, LLC | 13 | $ 6,466,910 |

| AWM Investment Management (MGP Advisors, LLC) | 13 | $ 4,607,840 |

| Baker Brothers Advisors, LLC | 12 | $ 17,000,006 |

| Iroquois Capital, L.P. | 12 | $ 4,791,381 |

| Wolverine Asset Management, LLC | 11 | $ 3,000,000 |

Investor rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. Investors classified as Corporate Investors and Insurance Companies have been excluded from this ranking. Data is for closed and definitive agreement transactions reported as of 1/06/15.

2014 PIPE Market

Issuer Counsel League Table

By Number of Transactions:

| Legal Counsel | Transaction Count | Total Amount Advised |

| Sichenzia Ross Friedman Ference, LLP | 25 | $ 149,739,779 |

| Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, PC | 17 | $ 261,036,915 |

| Cooley LLP | 16 | $ 673,484,046 |

| DLA Piper | 15 | $ 298,539,452 |

| Skadden, Arps, Slate, Meagher & Flom, LLP | 9 | $ 729,121,919 |

| Graubard Miller | 9 | $ 92,925,628 |

| Greenberg Traurig, LLP | 9 | $ 75,293,238 |

| Latham & Watkins, LLP | 8 | $ 1,327,627,708 |

| Seward & Kissel LLP | 8 | $ 562,701,249 |

| Goodwin Procter, LLP | 8 | $ 219,178,767 |

| Wilmer Cutler Pickering Hale & Dorr, LLP | 7 | $ 700,836,367 |

| Ellenoff Grossman & Schole LLP | 7 | $ 85,738,194 |

| Davis Graham & Stubbs, LLP | 7 | $ 39,491,759 |

| Szaferman Lakind Blumstein & Blader, PC | 7 | $ 16,910,500 |

| Ropes & Gray | 6 | $ 187,938,312 |

| Morrison & Foerster, LLP | 6 | $ 136,635,009 |

| Wyrick Robbins Yates & Ponton, LLP | 6 | $ 87,635,407 |

| Paul Hastings LLP | 6 | $ 86,175,012 |

| Lowenstein Sandler LLP | 6 | $ 75,001,875 |

| Weintraub Tobin Chediak Coleman Grodin | 6 | $ 41,331,412 |

| Dorsey & Whitney, LLP | 6 | $ 31,130,250 |

| TroyGould PC | 5 | $ 219,495,240 |

| Thompson & Hine, LLP | 5 | $ 136,866,941 |

| Manatt, Phelps & Phillips, LLP | 5 | $ 124,817,709 |

| Robinson Brog Leinwand Greene Genovese & Gluck P.C. | 5 | $ 68,102,653 |

Legal counsel rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. Data is for closed and definitive agreement transactions reported as of 1/06/15.

2014 PIPE Market

Investor Counsel League Table

By Number of Transactions:

| Legal Counsel | Transaction Count | Total Amount Advised |

| Schulte Roth & Zabel, LLP | 69 | $ 2,467,478,563 |

| Greenberg Traurig, LLP | 18 | $ 290,735,762 |

| Ellenoff Grossman & Schole LLP | 11 | $ 22,514,918 |

| Sichenzia Ross Friedman Ference, LLP | 5 | $ 35,717,917 |

| Ropes & Gray | 4 | $ 147,731,564 |

| Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, PC | 4 | $ 24,280,000 |

| Wachtell, Lipton, Rosen & Katz | 3 | $ 70,000,000 |

| Brown Rudnick LLP | 3 | $ 61,900,000 |

| Lowenstein Sandler LLP | 3 | $ 60,682,740 |

| Grushko & Mittman, PC | 3 | $ 5,500,000 |

| Skadden, Arps, Slate, Meagher & Flom, LLP | 2 | $ 2,038,473,602 |

| Simpson Thacher Bartlett, LLP | 2 | $ 1,198,000,000 |

| Latham & Watkins, LLP | 2 | $ 416,249,997 |

| Akin, Gump, Strauss, Hauer & Feld, LLP | 2 | $ 319,999,944 |

| Seward & Kissel LLP | 2 | $ 194,100,000 |

| Kirkland & Ellis | 2 | $ 150,000,000 |

| Norton Rose Fulbright | 2 | $ 32,302,396 |

| Winston & Strawn | 2 | $ 26,250,000 |

| Baker Botts, LLP | 2 | $ 22,500,000 |

| Haynes and Boone, LLP | 2 | $ 10,200,000 |

| Goodwin Procter, LLP | 2 | $ 10,000,000 |

| Hansen Black Anderson Ashcraft PLLC | 2 | $ 2,500,000 |

| O'Melveny & Myers, LLP | 1 | $ 700,000,000 |

| Torys, LLP | 1 | $ 700,000,000 |

| Weil, Gotshal & Manges, LLP | 1 | $ 700,000,000 |

Legal counsel rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. Data is for closed and definitive agreement transactions reported as of 1/06/15.

2014 PIPE Market

Placement Agent Counsel League Table

By Number of Transactions:

| Legal Counsel | Transaction Count | Total Amount Advised |

| Ellenoff Grossman & Schole LLP | 50 | $ 566,182,490 |

| Goodwin Procter, LLP | 30 | $ 951,199,579 |

| Lowenstein Sandler LLP | 13 | $ 210,831,154 |

| Proskauer Rose, LLP | 11 | $ 394,028,126 |

| Latham & Watkins, LLP | 10 | $ 807,747,680 |

| Sichenzia Ross Friedman Ference, LLP | 9 | $ 62,593,601 |

| Stikeman Elliott LLP | 7 | $ 151,171,305 |

| Choate, Hall & Stewart, LLP | 6 | $ 74,758,375 |

| Faegre Baker Daniels LLP | 6 | $ 26,800,608 |

| Fried, Frank, Harris, Shriver & Jacobson | 5 | $ 791,520,006 |

| Covington & Burling | 4 | $ 230,847,207 |

| Morrison & Foerster, LLP | 4 | $ 191,855,014 |

| Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, PC | 4 | $ 120,610,875 |

| Blank Rome LLP | 4 | $ 71,538,838 |

| Duane Morris, LLP | 4 | $ 25,185,470 |

| Pillsbury, Winthrop, Shaw & Pittman, LLP | 3 | $ 376,628,705 |

| Dechert, LLP | 3 | $ 124,368,862 |

| Skadden, Arps, Slate, Meagher & Flom, LLP | 3 | $ 81,780,000 |

| Loeb & Loeb, LLP | 3 | $ 38,413,500 |

| Reed Smith, LLP | 3 | $ 33,349,250 |

| Schiff Hardin, LLP | 3 | $ 23,579,521 |

| Gornitzky & Co. | 2 | $ 82,450,000 |

| Nixon Peabody, LLP | 2 | $ 49,287,000 |

| Faegre & Benson, LLP | 2 | $ 20,107,875 |

| Schiff Hardin & Waite | 2 | $ 17,753,904 |

Legal counsel rankings exclude all 144-A Offerings, Equity Lines of Credit, At the Market Transactions, Rights Offerings, Bought Deals, and all PIPE transactions conducted by foreign issuers that trade in the U.S. on the Pink Sheets. Data is for closed and definitive agreement transactions reported as of 1/06/15.

About PlacementTracker

PlacementTracker, a flagship product of Sagient Research

Systems, is well recognized as the leading provider of research,

data, and analytics covering the PIPE market (Private Investment in

Public Equity). With data on every private placement since January

1, 1995, PlacementTracker's web-based platform provides subscribers

with an easy to use, comprehensive means to: evaluate PIPE

transactions & investors, perform quick transaction pricing,

identify potential issuers and investors, and compile comparable

transaction, investor & agent statistics. PlacementTracker's

dynamically updating League Tables are available online

at: http://www.placementtracker.com/leaguetables.cfm.

About Sagient Research Systems

Sagient Research Systems is a publisher of specialized research and

data. They develop and sell proprietary research products to global

enterprises, including investment banks, mutual and hedge funds,

pharmaceutical companies, academic institutions, and government

agencies. In each of 2007, 2008, 2009, 2010, and 2012 Sagient

Research was named to the Inc. 5000 list of fastest growing

companies. In 2012, Sagient was acquired by Informa Plc (LON:INF).

For more information, please visit the Sagient Research Systems website at www.sagientresearch.com.

A photo accompanying this release is available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=29919