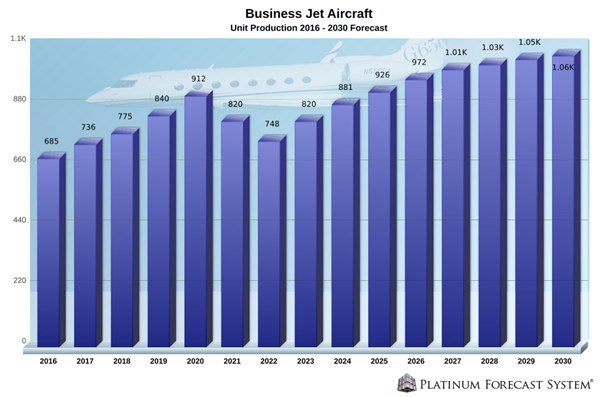

NEWTOWN, Conn., Oct. 31, 2016 (GLOBE NEWSWIRE) -- Although business jet production is unlikely to match the mid-2000s' skyrocketing output any time soon, Forecast International's innovative Platinum Forecast System® shows that a total of 13,252 business jets will be produced during the 15-year period from 2016 through 2030. The Connecticut-based market research firm estimates the value of this production at a staggering $360 billion (in FY16 U.S. dollars).

Forecast International predicts that business jet production, following a slight 5 percent decline in 2016, will increase each year from 2017 through 2020. While a brief, two-year cyclical downturn is anticipated for the 2021-2022 timeframe, the market is projected to rebound the following year, with a consistent rise in production from 2023 through the remainder of the forecast timeframe. Indeed, the last eight years of the forecast period will see the value of production top $210 billion, or more than 58 percent of the 15-year total.

"North American customers have begun returning to the business jet market, shaking off economic and political concerns that had been causing considerable buyer hesitation," said Forecast International senior aerospace analyst Raymond Jaworowski. "So far, this has largely benefitted the market's light and mid-size jet segments, which tend to be heavily populated with U.S. buyers."

Meanwhile, the long-range and large-cabin jet segments tend to be more diverse geographically, and economic slowdowns in key regions such as China, Latin America, and Russia have resulted in weaker demand for these larger jets. However, economic improvement in these regions, as well as increased demand from North American customers, will help boost the market for large-cabin and long-range jets over the longer term.

Overall, North America is the largest regional market for business jets, and is expected to remain so throughout the forecast timeframe. Europe will continue to be the second largest market for business jets, but with a narrowing edge over Asia.

In terms of manufacturer market shares, Textron Aviation's Cessna business unit is projected to lead the market in unit production during the 2016-2030 timeframe, with a 26.7 percent share, followed by Embraer, Gulfstream, Bombardier, and Dassault. When the market is measured in terms of monetary value, the 15-year projections show the same five companies remaining at the top, but with the manufacturers that specialize in larger, longer-range jets taking the lead. Gulfstream is projected to lead in value of production, with a 33.1 percent share, followed by Bombardier, Dassault, Cessna, and Embraer.

The Platinum Forecast System® is a breakthrough in forecasting technology that enables users to select unique criteria to create distinct market segments. With Platinum, users can create customized assessments that quickly identify both risk and future opportunities.

About Forecast International

Forecast International, Inc. is a leading provider of Market Intelligence and Analysis in the areas of aerospace, defense, power systems and military electronics. The firm also maintains a high posture of situational awareness and geopolitical analysis. Based in Newtown, Conn., USA, Forecast International specializes in long-range industry forecasts and market assessments used by strategic planners, marketing professionals, military organizations, and governments worldwide. Forecast International's resources and extensive base of experience can also be readily adapted and efficiently focused to fulfill a broad spectrum of civil and military consulting and special research requirements.

- FI on the Web: www.forecastinternational.com, www.bga-aeroweb.com, www.fi-powerweb.com

- FI on Twitter: twitter.com/ForecastIntl

- FI on Facebook: www.facebook.com/forecastintl

- FI Blog: http://blog.forecastinternational.com/wordpress/

A photo accompanying this release is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=41775