ATLANTA, March 10, 2022 (GLOBE NEWSWIRE) -- Roadside assistance towing programs operate without financial responsibility and expose motorists to financial risks, according to Insurance Risk Services of Georgia. Motorists need to use caution when using Roadside Towing Assistance Programs because of the risks involved. With the advancement in technology and legal changes, the motorist is responsible if damages occur to their vehicle.

With vehicles having traction control systems, carbon fiber, aluminum frames and other expensive computer technology, motorists have no idea which towing company to use, so they depend on roadside assistance programs to help get vehicles safely to repair facilities. However, these roadside assistance programs are the worst for motorists to use because they fail to pay rates needed for training, equipment and operational costs. Roadside assistance programs use third-party dispatch companies that profit off dispatching towing services for insurance carriers and auto manufacturers. Often costing the motorist twice the price. On average, these programs pay $35 for two hook-ups that will not cover fuel, equipment, training and expenses to operate within legal standards. Thereby exposing the motorist to financial risks when incidents occur. Under Georgia law, financial responsibility for payment for services is the responsibility of the motorist/vehicle owner. If a motorist has an issue, they must deal with the tow provider.

With the Russia-Ukraine war, expect to pay more for roadside assistance towing services. Diesel fuel costing an average of $6 per gallon and motor oil being scarce, the roadside programs will have the motorist paying for these costs. Tow providers must cover operating expenses and other costs. Roadside assistance programs do not cover labor or required equipment costs, often resulting in damages to a vehicle. When damages occur, roadside programs hide behind complicated vendor contracts that shield them from liability, leaving the motorist to deal with the problem on their own. When a commercial transportation insurance claim occurs, the claim process takes an average of three months to process and is usually denied due or settled at a fraction of the claim amount.

When a motorist calls in for roadside assistance, they believe they are speaking to the vehicle manufacturer or insurance carrier, but actually it's a call center. Operators have no idea of the equipment needs, costs and legal issues, often giving false information to the motorist about services and costs, causing a motorist to have an outstanding bill for noncovered services because manufacturer equipment and labor are not covered with the programs. To shield the roadside assistance companies from liability exposure, they have discontinued direct telephone communication with tow providers and motorists with the use of smartphone apps or internet software.

With the lack of responsibility and time it takes roadside assistance to arrive at the scene, forget about using roadside assistance towing programs. Find a reputable towing company in your area that meets your needs.

Jason Peacock, jpeacock@insuranceriskservicesga.com

Insurance Risk Services of Georgia

Related Images

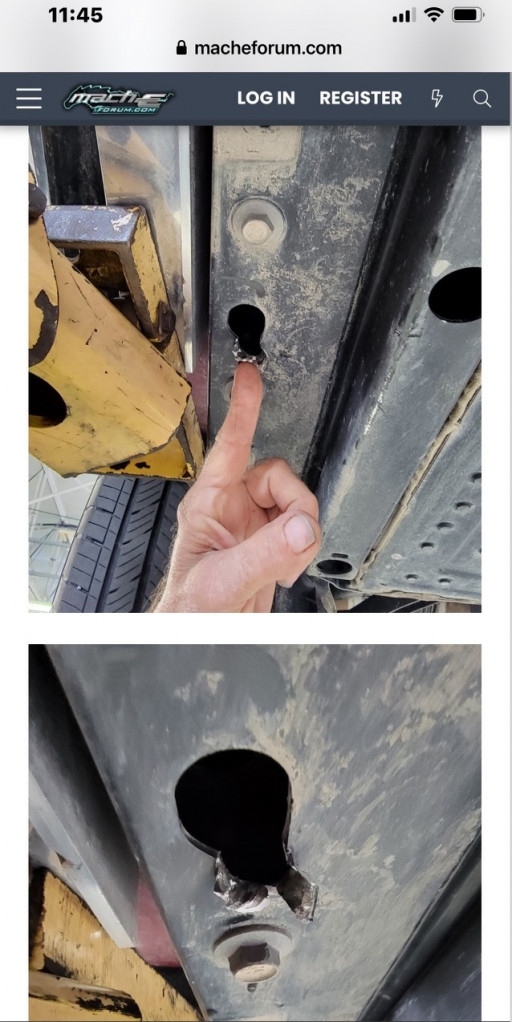

Image 1: 2022 Ford Mach-E Battery Rail Damage caused by a Roadside Assistance Tow Provider

2022 Ford Mach-E Battery Rail Damage caused by Roadside Assistance Tow Provider. No Insurance Coverage from Roadside Assistance or the Tow Provider.

This content was issued through the press release distribution service at Newswire.com.

Attachment