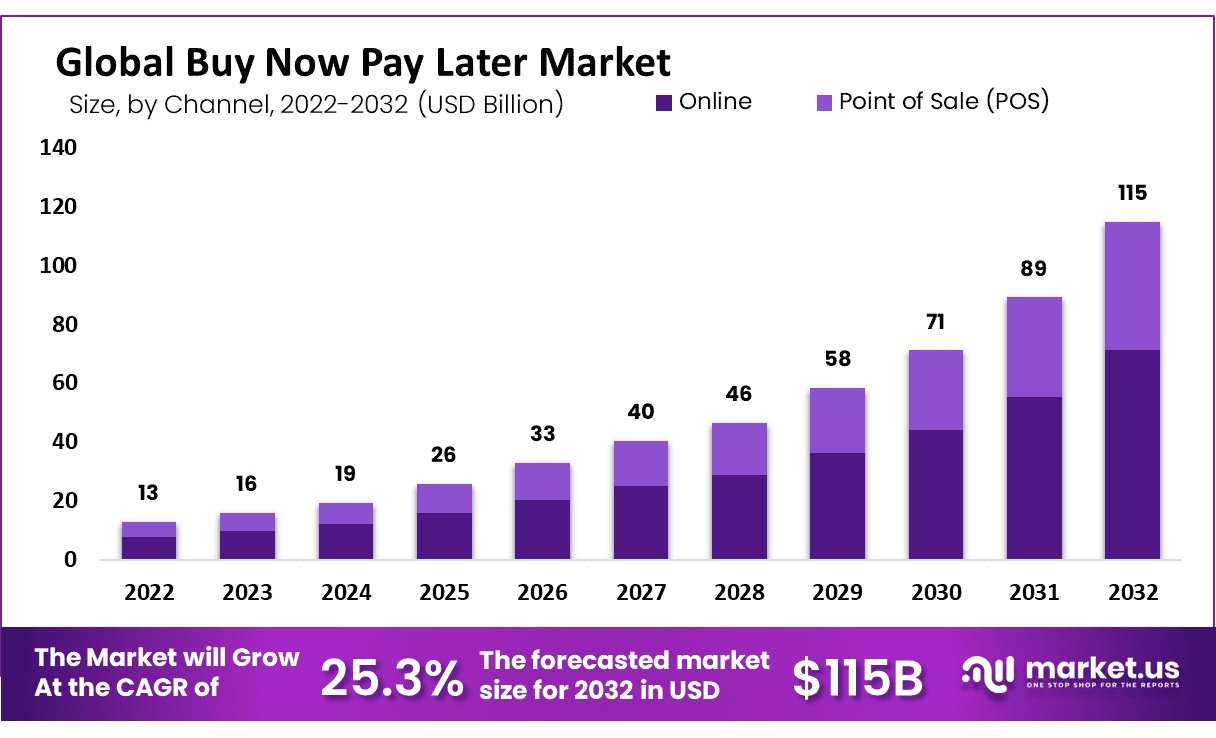

New York, July 10, 2023 (GLOBE NEWSWIRE) -- According to Market.us, The Buy Now Pay Later Market is projected to reach USD 115 Bn by 2032 at a CAGR of 25.3%, from USD 13 Bn in 2022.

Customers can buy online or in-store with the buy now pay later option without making full payment. Some factors driving the market include digitization, growing merchant adoption, and frequent usage of younger customers. Payments for stationery items when purchasing high-priced goods like laptops, smartphones, smart televisions, etc., benefit younger customers.

Key Takeaway:

- By channel, the Online segment held a dominating revenue share of more than 62% of the buy now pay later market.

- By end-users, the retail segment had the highest revenue share of almost 71.3%

- North America held the highest revenue share of 53.2%.

- Asia Pacific is anticipated to be the second-largest region

Customers who want to purchase can take advantage of BNPL services, which provide a fixed payment schedule, a simplified checkout procedure, zero interest, and options for quick approval. BNPL services are used by customers all over the globe to avoid paying interest on credit cards, make purchases that don't fit into their budgets, and borrow money without having their credit checked.

Factors affecting the growth of the Buy Now Pay Later Market

Several factors can affect the growth of the buy now pay later market. Some of these factors include:

- Rising Number of E-commerce Platforms with Online Payments: Growing use of online payment methods in the majority sectors have surged the buy now pay later market growth.

- Repeat Usage By Younger Consumers: Younger consumers take the benefits by making stationery products payments for buying high-cost products like laptops, smart tv, smartphones, etc.

- Avoid Paying Credit Card Interest: Consumers across the globe use BNPL services to avoid paying credit card interest, making purchases that don’t fit in their budget, and borrowing money without a credit check.

- Increase In Awareness: The government is also taking the initiative in raising awareness regarding service and high availability of multiple payment options.

- Affordable and Convenient Payment Service: Buy now pay later provides individuals with a number of advantages, one of which is the availability of instant credit card fund transfer service at the point of sale platform and affordable and convenient payment services

Market Growth

The increasing use of online payment methods in various industries, including banking, health insurance, retail, consumer goods, and others, has led to an expansion of the global point-of-sale installment loans buy now pay later market. According to the UNCTAD (United Nations Conference on Trade and Development), more than 80% of consumers worldwide have used digital payment methods for online shopping. Due to rising global e-commerce sales, there was also a significant demand for BNPL services.

Regional Analysis

The expansion of the regional market, for example, may be the cause of the significant number of prominent players' presence. To offer BNPL services for hotel reservations, a number of fintech companies in this region are collaborating with entertainment companies. Asia-Pacific is expected to experience the fastest CAGR over the forecast period. The BNPL trend is gaining traction across the region because it enables customers to access credit and postpone payments. The region's increased adoption of BNPL solutions can be attributed to Millennial and Generation customers. The region's growing mobile internet penetration is also anticipated to provide growth opportunities for the regional market over the forecast period.

Sure, here is the country-wise revenue share (%) for the Buy Now Pay Later market in 2023:

| Country | 2022 - Revenue Share (%) |

| The United States | 29 |

| Germany | 16 |

| Australia | 12 |

| Japan | 19 |

| North America | 46 |

| Europe | 44 |

| United Kingdom | 17 |

Country Wise Growth Rate (%)

| Country | Growth Rate CAGR (%) |

| India | 30 |

| China | 25 |

| South Korea | 20 |

| Canada | 15 |

| Mexico | 10 |

| France | 5 |

| Singapore | 5 |

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Key Players aim at many strategic policies to grow their business globally. R&D, acquisitions, and mergers help improve the market growth of buy now pay later technology. List of key players:

- Affirm, Inc.

- Afterpay Pty Ltd

- com, Inc.

- Atome

- Flipkart Internet Private Limited

- Grab Holdings Inc.

- Hoolah Holdings Pte Ltd.

- Klarna Inc.

- LatitudePay Australia Pty Ltd

- Laybuy Group Holdings Limited.

- Mastercard International Incorporated

- Monzo Bank Limited

- One97 Communications Limited (Paytm)

- Openpay Pty Ltd.

- Payl8r (Social Money Ltd.)

- PayPal Holdings, Inc.

- Perpay Inc.

- Sezzle Inc

- SPLITIT USA INC.

- Zip Co Limited

- Other Key Players

Scope of Report

| Report Attribute | Details |

| Market Value (2022) | USD 13 Bn |

| Market Size (2032) | USD 115 Bn |

| CAGR (from 2023 to 2032) | 25.3% |

| North America Revenue Share | 53.2% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The Buy Now Pay Later Market is driven by several factors: Rising Number of E-commerce Platforms with Online Payments, Repeat Usage By Younger Consumers, Avoid Paying Credit Card Interest, Increase in awareness, Affordable and Convenient Payment Service. Furthermore, strategic collaborations between major industry players and government initiatives to provide subsidies on medical costs have also served as key drivers for this market.

Market Restraints

Numerous other options exist, such as paying the payment with credit or debit cards and postdated cheques. Customers and businesses in a number of developing nations, including India, Brazil, Asian nations, and others, are unaware of the BNPL service. Customers' credit scores must also be checked before offering BNPL to them. The service offers straightforward monthly installment payment options for customers to take advantage of. Growth is hampered by consumers', retailers', and merchants' general lack of awareness of multiple payment options.

Market Opportunities

The availability of instant credit card fund transfer services at the point of sale platform and affordable and convenient payment services are two of the advantages of the payment method known as buy now pay later that drive the expansion of the buy now pay later market. The buy now, pay later platform facilitates transactions using UPI methods and supports a QR-code option that enables individuals to scan a code to make a payment, both of which contribute to the expansion of the market. The buy now, pay later platform facilitates the market's global expansion by allowing customers to make secure payments without swiping their debit cards. The buy now, pay later platform's significant benefits, such as the ability to monitor transaction details digitally, remind customers to make payments, and raise their credit score, have accelerated the global market's expansion.

Report Segmentation of the Buy Now Pay Later Market

Channel Insight

The online segment holds the largest global buy now pay later market revenue. Many businesses are forming partnerships as part of the post-pandemic resurgence plan to concentrate on adopting fast-growing online methods like buy now pay later. Over the forecast period, the POS channel is anticipated to expand. Numerous businesses are offering financing options like POS BNPL to enhance the customer experience and build relationships with them. Additionally, based on customer loyalty, businesses offer programs for transparent POS installment loans. As a result, businesses are seeing an increase in repeat business.

End-User Insight

With a revenue share of over 71.3% during the forecast period, the retail segment is anticipated to be the most lucrative in the global buy now pay later market. Because it makes it simple for customers to spread the purchase cost over a predetermined period and allows for interest-free payments, buy now, pay later adoption is on the rise. Over the forecast period, a promising CAGR is anticipated for the healthcare sector. The industry increasingly uses BNPL payment methods as a low-friction alternative to credit cards. Rather than using credit cards, customers prefer to pay with BNPL to avoid expensive hidden fees and interest that keep going up. The rising costs of treating various diseases, including cancer, chronic heart disease, and cardiovascular diseases, are also anticipated to drive demand for buy now, pay later services over the forecast period.

Market Segmentation

Based on Channel

- Online

- Point Of Sale (POS)

Based on Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

Based On End-Users

- Banking, Financial Services & Insurance (BFSI)

- Consumer Electronics

- Fashion & Garment

- Healthcare

- Leisure & Entertainment

- Retail

- Other End-Users

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Recent Development of the Buy Now Pay Later Market

- In January 2022: Santander, Spanish Bank launched its buy now, pay later application 'Zinnia' for the European market. The Zinnia app helps consumers purchase monthly interest-free installment payments across European countries.

- In January 2022: Temenos, the banking software firm, launched an AI-based BNPL banking service within the Temenos Banking Cloud platform. The platform is based on Artificial intelligence (A.I.) technology that offers consumers and merchants opportunities through alternative credit products.

- In January 2022: Afterpay Limited partnered with several retailers such as Calvin Klein, Nordstrom, and Tommy Hilfiger. With this partnership, Afterpay Limited provides this service for these retailers' online and retail stores. This allowed the consumers to shop and use the buy now, pay later service.

Browse More Related Reports

- Travel Now Pay Later Services Market reached USD 42.74 Bn. This market is expected to grow at a CAGR of 7.9%.

- Payment Gateway Market was valued at USD 26.1 billion and is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5% between 2023 and 2032.

- Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 65.6 Billion in 2022, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

- Commercial Payment Cards Market size is expected to be worth around USD 33.69 billion by 2032 from USD 15.750 million in 2022, growing at CAGR of 7.9% during the forecast period 2023 to 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog:

- https://medicalmarketreport.com/

- https://chemicalmarketreports.com/

- https://techmarketreports.com/

- https://foodnbeveragesmarket.com/