Dublin, Jan. 19, 2024 (GLOBE NEWSWIRE) -- The "The Shared & Unlicensed Spectrum LTE/5G Network Ecosystem 2023-2030: Opportunities, Challenges, Strategies & Forecasts" report from SNS Telecom & IT has been added to ResearchAndMarkets.com's offering.

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum - frequencies that are not exclusively licensed to a single mobile operator.

Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA (General Authorized Access) tier of the 3.5 GHz CBRS band in the United States and Japan's 1.9 GHz sXGP (Shared Extended Global Platform) band.

In addition, vast swaths of globally and regionally harmonized license-exempt spectrum - most notably, the 600 MHz TVWS (TV White Space), 5 GHz, 6 GHz and 60 GHz bands - are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled 5G NR and LTE networks for a diverse array of use cases - ranging from mobile network densification, FWA (Fixed Wireless Access) in rural communities and MVNO (Mobile Virtual Network Operator) offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

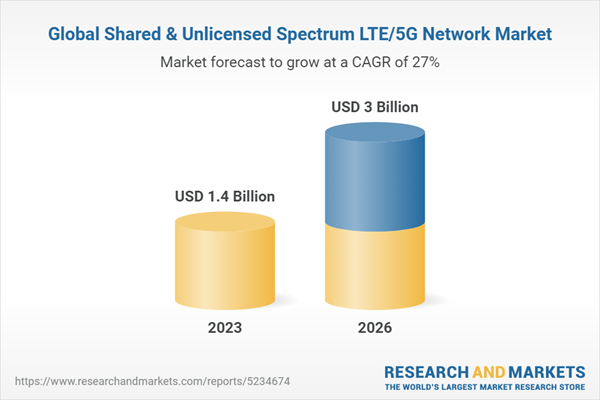

The report estimates that global investments in 5G NR and LTE-based RAN (Radio Access Network) infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

This report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2023 to 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 15 frequency bands, seven use cases and five regional markets.

The report covers the following topics:

- Introduction to shared and unlicensed spectrum LTE/5G networks

- Value chain and ecosystem structure

- Market drivers and challenges

- Enabling technologies and concepts, including CBRS, LSA/eLSA, local area licensing, AFC, 5G NR-U, LTE-U, LAA/eLAA/FeLAA, sXGP and MulteFire

- Key trends such as the growing prevalence of private cellular networks in industrial and enterprise settings, neutral host small cells, fixed wireless broadband rollouts, MVNO offload and mobile network densification

- Business models, use cases and application scenarios

- Future roadmap of shared and unlicensed spectrum LTE/5G networks

- Spectrum availability, allocation and usage across the global, regional and national domains

- Standardization, regulatory and collaborative initiatives

- 100 case studies of 5G NR and LTE deployments in shared and unlicensed spectrum

- Profiles and strategies of more than 400 ecosystem players

- Strategic recommendations for 5G NR and LTE equipment suppliers, system integrators, service providers, enterprises and vertical industries

- Market analysis and forecasts from 2023 to 2030

Key Questions Answered

- The report provides answers to the following key questions:

- How big is the opportunity for 5G NR and LTE networks operating in shared and unlicensed spectrum?

- What trends, drivers and challenges are influencing its growth?

- What will the market size be in 2026, and at what rate will it grow?

- Which submarkets and regions will see the highest percentage of growth?

- What are the existing and candidate shared/unlicensed spectrum bands for the operation of 5G NR and LTE, and what is the status of their adoption worldwide?

- What are the business models, use cases and application scenarios for shared and unlicensed spectrum?

- How are CBRS and other coordinated shared spectrum frameworks accelerating the uptake of private cellular networks for enterprises and vertical industries?

- How does the integration of shared and unlicensed spectrum relieve capacity constraints faced by traditional mobile operators?

- What opportunities exist for cable operators, neutral hosts, niche service providers and other new entrants?

- How is the commercial availability of 5G NR-based shared and unlicensed spectrum network equipment setting the stage for Industry 4.0 and advanced applications?

- Who are the key ecosystem players, and what are their strategies?

- What strategies should 5G NR and LTE equipment suppliers, system integrators, service providers and other stakeholders adopt to remain competitive?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 845 |

| Forecast Period | 2023 - 2026 |

| Estimated Market Value (USD) in 2023 | $1.4 Billion |

| Forecasted Market Value (USD) by 2026 | $3 Billion |

| Compound Annual Growth Rate | 27.0% |

| Regions Covered | Global |

Market Drivers

- Continued Growth of Mobile Data Traffic

- New Revenue Streams: FWA, IoT & Vertical-Focused Services

- Private & Neutral Host Network Deployments

- Shared & Unlicensed Spectrum Availability

- Lower Cost Network Equipment & Installation

- Expanding Ecosystem of Compatible Devices

Market Barriers

- Cell Site & Network Deployment Challenges

- Restricted Coverage Due to Transmit Power Limits

- Interference & Congestion Concerns in Unlicensed Bands

- Resistance From Other Spectrum Users

- Competition From Non-3GPP Technologies

- Economic & Supply Chain-Related Factors

Forecast Segmentation

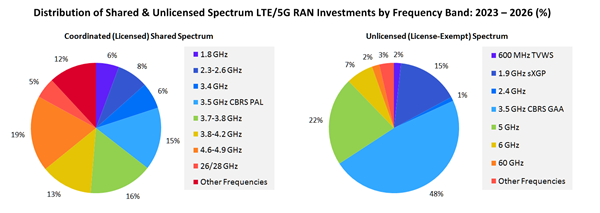

Market forecasts for LTE and 5G NR-based RAN equipment operating in shared and unlicensed spectrum are provided for each of the following submarkets and their subcategories:

- Air Interface Technologies

- LTE

- 5G NR

- Cell Types

- Indoor Small Cells

- Outdoor Small Cells

- Spectrum Licensing Models

- Coordinated (Licensed) Shared Spectrum

- Unlicensed (License-Exempt) Spectrum

- Frequency Bands

- Coordinated (Licensed) Shared Spectrum

- 1.8 GHz

- 2.3-2.6 GHz

- 3.4 GHz

- 3.5 GHz CBRS PAL

- 3.7-3.8 GHz

- 3.8-4.2 GHz

- 4.6-4.9 GHz

- 26/28 GHz

- Other Frequencies

- Unlicensed (License-Exempt) Spectrum

- 600 MHz TVWS

- 1.9 GHz sXGP

- 2.4 GHz

- 3.5 GHz CBRS GAA

- 5 GHz

- 6 GHz

- 60 GHz

- Other Frequencies

- Coordinated (Licensed) Shared Spectrum

- Use Cases

- Mobile Network Densification

- FWA (Fixed Wireless Access)

- Cable Operators & New Entrants

- Neutral Hosts

- Private Cellular Networks

- Offices, Buildings & Corporate Campuses

- Vertical Industries

For more information about this report visit https://www.researchandmarkets.com/r/8eke48

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachments

- Distribution of Shared & Unlicensed Spectrum LTE/5G RAN Investments by Frequency Band: 2023-2026 (%)

- Global Shared & Unlicensed Spectrum LTE/5G Network Market