Pune, Nov. 18, 2024 (GLOBE NEWSWIRE) -- On-board Connectivity Market Size Analysis:

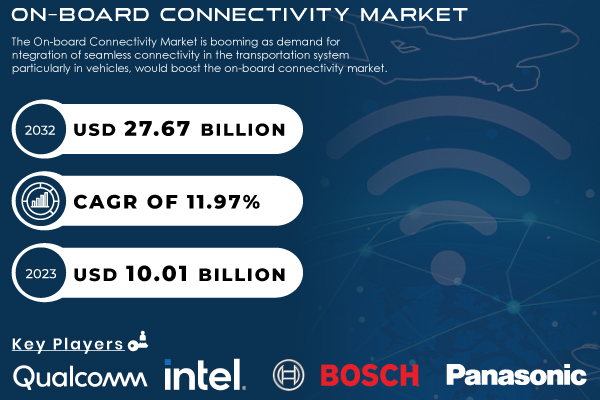

“The SNS Insider report indicates that the On-Board Connectivity Market size was valued at USD 10.01 billion in 2023 and is expected to grow to USD 27.67 billion by 2032, growing at a CAGR of 11.97% over the forecast period from 2024 to 2032.”

A massive digital revolution is fundamentally changing the automotive industry and increasing the need for connectivity solutions in vehicles. This market is driven by the increasing adoption of autonomous vehicles, connected car technologies, and advanced infotainment systems. They are driven to enhance the driving experience, improve safety, and provide real-time vehicle, infrastructure and cloud connectivity. This growth is largely being powered by increasing mobile device internet dependency. In-car solutions are changing with such connectivity and need to be faster, more reliable, and feature-rich as consumers want seamless, high-speed connections. Innovations like 5G, IoT, and AI are revolutionizing real-time data transmission, voice control, advanced navigation, and provide an ecosystem that extends from the vehicle to smart homes. For Instance, In North America, the adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to remain high, with more than 80% of vehicles in the U.S. featuring connected technologies

Additionally, the government regulation and consumer need for advanced safety features such as automatic emergency braking systems (AEBS) and vehicle-to-vehicle (V2V) communication is expected to further drive the growth for strong connectivity solutions. These requirements have prompted automakers to implement cutting-edge technologies to enable key safety features. In addition, rapid expansion in electric vehicles (EVs) is driving the market. EVs rely on high-end connectivity in order to manage battery performance, monitor energy consumption, and connect with smart charging networks. These vehicles are often fitted with complex infotainment, diagnostics, and energy management systems that rely on robust on-board connectivity.

Moreover, with the increasing shared mobility services like ride-sharing and car-sharing platforms, the market is also witnessing a significant uplift. Through connectivity solutions, fleet operators can monitor vehicles, optimize routes, and digitally interface to provide a better experience for customers.

Get a Sample Report of On-board Connectivity Market@ https://www.snsinsider.com/sample-request/3808

Major Players Analysis Listed in this Report are:

- Qualcomm – Snapdragon Automotive Connectivity Platform

- Intel – Automotive 5G Telematics Solutions

- Harman International (Samsung) – Harman Ignite Platform

- Robert Bosch GmbH – Connected Vehicle Cloud Services

- Panasonic Corporation – Panasonic Automotive Connectivity Solutions

- Continental AG – Telematics Connectivity Module (TCM)

- Valeo – Valeo Smart Connectivity Module

- Denso Corporation – Denso V2X (Vehicle-to-Everything) Communication System

- Sierra Wireless – AirPrime Embedded Modules for Automotive Connectivity

- ZF Friedrichshafen AG – ZF ProConnect Connectivity Platform

- NXP Semiconductors – Automotive Connectivity Solutions for V2X

- AT&T – AT&T Connected Car Platform

- Vodafone Group – Vodafone Automotive IoT Telematics Solutions

- Ericsson – Connected Vehicle Cloud

- Verizon – Hum by Verizon (Connected Car Service)

- Huawei Technologies – Huawei 5G-V2X Connectivity Solutions

- Gemalto (Thales Group) – Cinterion IoT Modules for Automotive Connectivity

- Renesas Electronics – Renesas V2X Communication Solutions

- LG Electronics – Automotive Communication and Infotainment Solutions

- Tesla, Inc. – Tesla In-Car Connectivity and OTA (Over-the-Air) Updates

On-board Connectivity Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 10.01 billion |

| Market Size by 2032 | USD 27.67 Billion |

| CAGR | CAGR of 11.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | •Popularity of features like remote vehicle management and over-the-air updates is further driving the need for better connectivity in vehicles. •The adoption of Internet of Things (IoT) technologies is making transportation networks smarter and more interconnected, enhancing connectivity features. •The need for continuous connectivity in vehicles to access real-time data, navigation, and entertainment is growing rapidly. |

Do you have any specific queries or need any customization research on On-board Connectivity Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3808

Segmentation Analysis

By Industry

In 2023, the on-board connectivity market was dominated by the transportation segment with respect to revenue as well as volume, owing to the limited supply of and soaring end-use industries coupled with augmenting demand for sophisticated connected automobile systems integrated system enabling vehicle safety and navigation and vehicle infotainment systems. It reflects the scope of connected vehicles, EVs, and autonomous vehicles. Growing connected vehicle technology deployment which allows real-time data exchange, such as in-car Wi-Fi, GPS navigation, and vehicle-to-everything (V2X) communication, where vehicles engage in communication with other vehicles. Increasing adoption of IoT technologies and the regulatory framework for vehicle safety also support the growth of this segment. As autonomous and electric vehicles progress, the proven, high-speed link that will maintain the technology rolling will just become much more vital throughout the key following years.

The entertainment segment is anticipated to register the highest CAGR during the forecast period. As the world has always been on-demand for media intake and real-time streaming among other similar uses, connected vehicles now provide novel forms of internet connectivity for travelers and enable entertainment such as movie-watching, music enjoyment, and music-gaming). The rollout of 5G networks with faster speeds and lower latency is fueling this growth. Additionally, the increasing demand for personalized in-car entertainment such as virtual assistants and content personalization is one more factor driving the automotive infotainment demand during the forecast time frame. Pertaining to this segment may experience significant growth on account of the emergence of new technology along with the evolving demand of consumers towards in-vehicle entertainment experiences identical to home.

On-board Connectivity Market Segmentation:

By Type

- Solution

- Service

By Industry

- Transportation

- Aviation

- Maritime

- Railway

- Entertainment

- Monitoring

- Communication

Regional Landscape

North America held the largest revenue share in 2023, owing to demand for connected vehicles, technological advancement, and mature automotive infrastructure resulting the largest share of on-board connectivity market in North America region. In particular North America has led the way, with the U.S. in the vanguard of development also in in-car connectivity solutions like Wi-Fi(R), Navigation, and V2X. These elements are pushing very high consumer-level expectations for connected car features and also various automotive companies and major technology players to invest heavily in research and development. In addition, the regional expansion is forecast to heighten due to government combined with regulatory efforts that will be focused toward standards for vehicle safety along with increasing presence for electric and autonomous. North America, with an established in-vehicle connectivity ecosystem is expected to maintain leadership in the on-board connectivity market owing to the growth of automotive IoT adoption in the region in the upcoming years.

On-board connectivity market in the Asia-Pacific region is projected to grow at the highest growth rate (CAGR) throughout the analysis period, due to the increasing production of automobiles, growing consumer requirement for digital services, and rapid development of 5G technology in the region. The huge population and urbanization of China, Japan, and South Korea have also led to an explosion of connected car services. Specifically, China has been pouring money into smart cities and autonomous car technology, two trends that are likely to drive demand for connected cars. Asia-Pacific is in a good position to make substantial headway with infrastructure for 5G that will accelerate high-bandwidth solutions, from in-car streaming services to V2X communication. This kind of deepening development may eventually play a role to make the Asia-pacific region becomes one of the key contributors for the future growth when the market begins its growth path.

Buy an Enterprise-User PDF of On-board Connectivity Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3808

Recent Developments

In January 2024, Qualcomm Technologies announced its partnership with BMW Group to integrate advanced in-car connectivity solutions for their upcoming vehicles, incorporating 5G connectivity and AI-driven systems to enhance driver assistance and infotainment capabilities.

In February 2024, Ford Motor Company revealed its collaboration with Google to integrate Google’s cloud-based technologies into their vehicles, enabling better navigation, in-vehicle digital assistants, and seamless integration with various Google services.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. On-board Connectivity Market Segmentation, by Type

8. On-board Connectivity Market Segmentation, by Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Details of On-board Connectivity Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/on-board-connectivity-market-3808

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.