BILLERICA, MA--(Marketwire - May 22, 2012) - Trillium Software®, a business of Harte-Hanks, Inc. (

By better managing the quality of claims data and automating data quality processes, insurance companies will more accurately forecast loss reserves, manage allocated expenses, and identify missed opportunities for time-sensitive recoverables including subrogation and catastrophe coding. As a result, insurance firms can reduce overarching expenses, maximize recovery, improve overall claims operations efficiency and identify opportunities to grow their business.

"The quality of insurance data related to improperly reserved claims, misclassified expenses or loss reserves deeply impacts business results and decision-making at insurance companies -- and keeps claims professionals up at night -- especially in light of regulatory and competitive market pressures," said Stephen Applebaum, senior analyst for property & casualty insurance at Aite Group. "By utilizing a solution such as Claims Data Quality, claims professionals can create more visibility into their data in order to more effectively accomplish insurance operations processes that could potentially maximize recovery, improve operational efficiency and increase customer satisfaction. Moreover, the higher the quality of data used to drive the many business analytics programs being adopted, the more valuable will be their output."

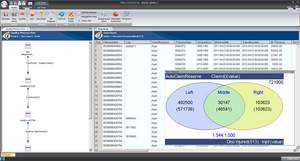

Claims Data Quality is a unique solution designed to meet the needs of insurance companies. It is a combined software and consulting solution, powered by the Trillium Software System®, the leading standalone data quality software platform on the market. Insurance companies engage with Trillium Software consultants using a proven data quality methodology to Assess and Quantify (identify data defects) in an automated fashion, Deploy and Apply insurance-centric business logic to measure impact, and Manage and Establish business-as-usual processes in order to automate data defect analysis and visualization. Trillium also can create the business logic and measurement processes to correct data and monitor progress towards defined objectives, and implement ongoing data quality processes to prevent future data problems.

Clients receive an overall data assessment that reviews all current claims data across repositories, systems, and processes to identify areas that need improvement. This includes an examination of structured data contained in fields and unstructured data from claims adjuster notes and other sources. Resulting analysis, reporting and data assessment information can be delivered in any requested user interface or format -- from business intelligence dashboards and scorecards to spreadsheets and files.

"Insurance claims professionals are making decisions based on poor quality data, which can lead to adverse department performance due to incorrect assumptions on loss reserves, catastrophe management, subrogation maximization and litigation controls," said Michael Chochrek, insurance solutions principal consultant, Harte-Hanks Trillium Software. "Our answer to these data quality challenges is based on deep insurance claims subject matter expertise, world-class data quality assessment capabilities and a proven data quality methodology to help claims professionals understand and solve their data issues."

The solution helps address a number of uniquely-claims-based data problems such as:

- Loss Reserves -- proactive, automated identification of potentially inaccurate loss reserves in order to adjust reserves in a timely and accurate manner to match the true claims exposure and mitigate costly manual remediation processes;

- Allocated Expenses -- automating identification and matching of case files to specific claims activities to minimize expenditures while maximizing value,

- Subrogation and CAT Recovery -- automated identification and remediation of claims for Subrogation and CAT coding to optimize claims recovery amounts and processes.

Claims Data Quality is currently available globally and can be researched at http://www.trilliumsoftware.com/home/business/insurance/cdq.aspx or contact Trillium Software sales at (978) 436-8900 or EMEA +44 (0) 188 940 7600.

About Harte-Hanks

Harte-Hanks® is a worldwide direct and targeted marketing company that provides direct marketing services and shopper advertising opportunities to local, regional, national and international consumer and business-to-business marketers. Visit the Harte-Hanks Web site at http://www.harte-hanks.com or call (800) 456-9748.

Harte-Hanks Trillium Software® enables organizations to achieve Total Data Quality by providing a full complement of technologies and services providing global data profiling, data cleansing, enhancement, and data linking for e-business, customer relationship management, data governance, enterprise resource planning, supply chain management, data warehouse, and other enterprise applications. For more information about Trillium Software and its offerings, call (978) 436-8900 in the United States and in the United Kingdom call +44 (0) 118 940 7666, or visit Trillium Software online at http://www.trilliumsoftware.com.

This document may contain trademarks that are owned or licensed by Harte-Hanks, Inc. and its subsidiaries, including, without limitation, Trillium Software, Trillium Software System, Claims Data Quality and other names and marks. All other brand names, product names, or trademarks belong to their respective holders.

Contact Information:

Media Contacts:

Michael Antonellis

Harte-Hanks Trillium Software

(978) 439-3813

michael_antonellis@trilliumsoftware.com