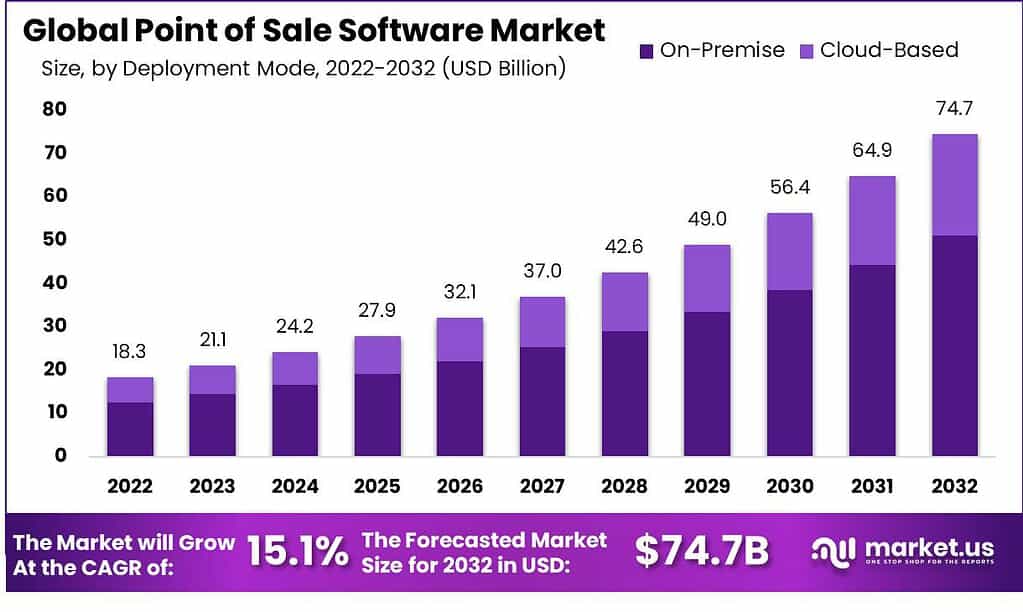

New York, Dec. 05, 2023 (GLOBE NEWSWIRE) -- According to Market.us, The projected value of the global Point of Sale Software Market is anticipated to be USD 21.1 billion by 2023 and is expected to witness substantial growth, reaching USD 74.7 billion by 2032. The market is poised for a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 15.1% during the forecast period from 2022 to 2032.

The global market for point of sale (POS) software is expanding dynamically, propelled by technological innovations and shifting patterns in consumer preferences. This software acts as the central nervous system for industries like retail and hospitality, going beyond just transaction processing to offer an all-encompassing business toolset. It seamlessly combines functionalities such as inventory control, customer interactions, and in-depth business analytics.

Accelerated by the rapid adoption of digital solutions and the migration towards cloud-based platforms, the market is experiencing a robust increase in demand. Furthermore, the rise of mobile-based POS systems and an intensified emphasis on optimizing customer interactions are amplifying this demand. Cutting-edge technologies, including artificial intelligence and machine learning, are introducing smart systems with capabilities for predictive analysis and tailored customer outreach.

Click to Request Sample Report and Drive Impactful Decisions: https://market.us/report/point-of-sale-software-market/request-sample/

Key Takeaway:

- Based on Deployment Mode, the On-Premise segment led with a major revenue share of 68.4%.

- Based on Application, the Fixed POS segment dominated the market with a major revenue share of 55.7%.

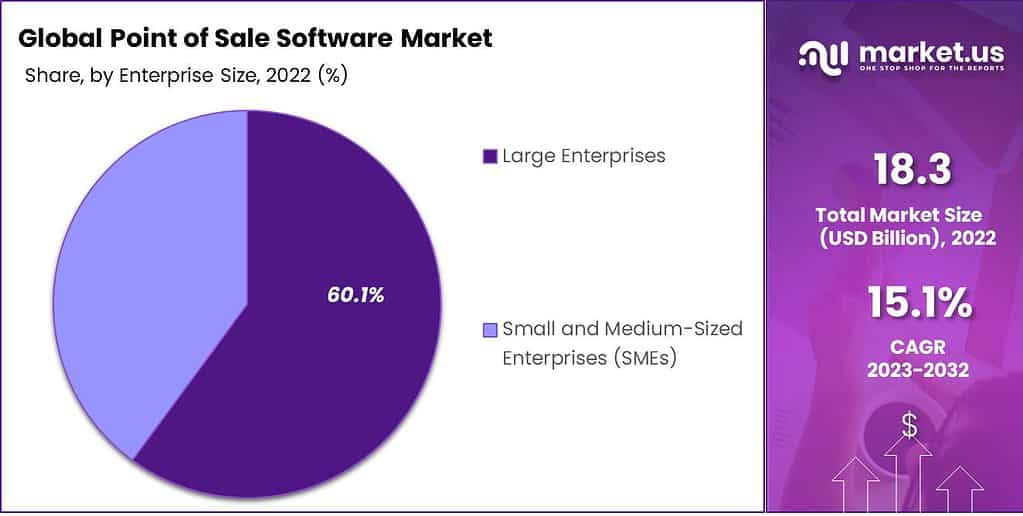

- On the Basis of Enterprise Size, the Large Enterprises segment held the major revenue share of 60.1% to dominate the market.

- Based on Industry Vertical, the Retail segment dominated the market with a major revenue share of 32.6%.

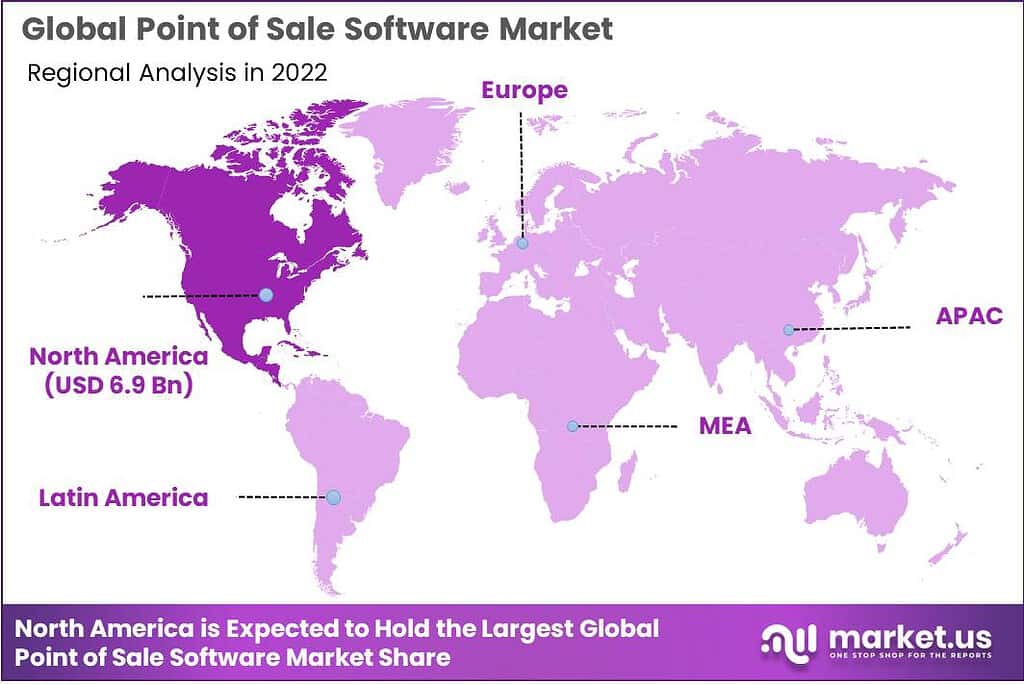

- Based on Region, North America leads the market with a major revenue share of 37.8%.

- Asia Pacific will grow at the fastest CAGR rate from 2023-2032.

Factors Affecting the Growth of the Point of Sale Software Market

- Growing Mobile Payments Adoption: The rapid adoption of smartphones and mobile payment systems is an important factor affecting the PoS market growth. Customers are looking for quick and contactless payment options, and PoS software offering mobile payment compatibility is becoming increasingly popular. Companies that adapt to mobile payment technologies are likely to see growth as they appeal to a broader demographic.

- Globalization: As businesses expand globally, there is a growing need for PoS systems that can handle multiple currencies, tax codes, and languages. Globalization is pushing the boundaries of traditional PoS software, requiring more versatile and robust systems capable of meeting diverse market needs.

- Technological Advancements: Emerging technologies like Artificial Intelligence, machine learning, and blockchain are beginning to be integrated into PoS systems for better analytics, inventory forecasting, and transaction security. As technology evolves, the market for PoS software equipped with these advanced features is likely to expand.

Top Trends in the Global Point of Sale Software Market

The sustained expansion of online shopping platforms has made the integration of point-of-sale (POS) software with e-commerce systems increasingly vital. Consumers now demand a fluid shopping journey that bridges both digital and physical outlets, expecting uniformity in price, product access, and customer information. POS software is evolving to provide cross-channel coherence, allowing businesses to introduce features such as "click and collect," in-store returns for online buys, and synchronized customer databases to meet customers' demands. Such integrations are becoming indispensable for enterprises aiming for success in today's retail environment, which is progressively oriented towards multi-channel operational strategies.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Market Growth

As cyber threats and data breaches become increasingly sophisticated, the need for secure transaction processing is growing. Businesses are now prioritizing PoS systems that offer robust security features such as end-to-end encryption, multi-factor authentication, and secure cloud storage. Ensuring the security of both financial transactions and customer data is becoming a make-or-break factor for businesses when choosing a PoS system. As a result, PoS software vendors who prioritize security not only address a critical market need but also gain a significant competitive advantage, thus stimulating growth in this sector.

Regional Analysis

The North American region led the market by holding a major revenue share of 37.8%. The preeminence of the North American market can be attributed to a multitude of elements. The region boasts a wide-ranging and diverse retail sector, encompassing both multinational retailers and a flourishing ecosystem of small to medium enterprises. The demand for Point of Sale Software in North America was valued at USD 6.9 billion in 2023 and is anticipated to grow significantly in the forecast period. This expansive retail environment necessitates advanced POS systems for efficient inventory control, transaction handling, and customer experience enhancement.

Additionally, North America has been a front-runner in embracing technological innovations and digital payment solutions, amplifying the demand for versatile and sophisticated POS software. Focusing on data protection and compliance with regulations in this region has also contributed to the growth of secure and standard-compliant POS solutions. However, the Asia-Pacific market is projected to register significant growth in the coming years, propelled by its accelerating tech adoption.

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- SAP SE

- Clover Network Inc.

- Oracle Corporation

- Block Inc.

- Shopify Inc.

- Lightspeed Commerce

- NCR Corporation

- H&L Australia

- Idealpos

- Revel Systems

- TouchBistro Inc.

- VeriFone, Inc.

- Toast, Inc.

- Bindo Labs, Inc.

- Epicor Software Corporation

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 21.1 Billion |

| Forecast Revenue 2032 | US$ 74.7 Billion |

| CAGR (2023 to 2032) | 15.1% |

| North America Revenue Share | 37.8% |

| Base Year | 2022 |

| Historic Period | 2016 to 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The surge in retail and e-commerce activities, coupled with increasing consumer demand for efficient and quick transaction processes, has catapulted POS solutions into a must-have technology. Small and medium businesses are increasingly adopting cloud-based POS systems for their low upfront costs and scalability, democratizing access to technology that was previously available mostly to large enterprises. The rapid digitalization of payment methods and the growing use of mobile devices for transactions further fuel market expansion, offering more touchpoints for POS integration. Government regulations promoting digital payments and mandating electronic record-keeping also contribute to market growth.

Market Restraints

A key restraint impeding the growth of the point of sale (POS) software market is the widespread use of outdated systems and infrastructures within many enterprises. A considerable number of companies, particularly those with an extended operational history, continue to depend on dated POS systems that are deficient in contemporary functionalities. The process of phasing out or modernizing these legacy setups usually entails a substantial commitment of both time and financial resources. Because such systems are often deeply integrated into a company's day-to-day activities, switching to newer POS technology becomes complex and expensive. Reluctance to unsettle existing operational processes, coupled with apprehensions about data transfer complications, often discourages firms from embracing up-to-date POS solutions, thereby constraining market expansion.

Market Opportunities

In a time when data serves as a pivotal asset, a significant opening exists for point-of-sale (POS) software vendors to enhance their analytical prowess. Companies are increasingly eager for an in-depth understanding of aspects like customer habits, stock control, and sales patterns. POS systems equipped with cutting-edge analytical features can empower businesses to make informed decisions tailored to marketing approaches fine-tune pricing, and inventory structures. The untapped potential resides in creating and promoting POS software that surpasses mere transaction handling to offer invaluable immediate and forecast analytics. This evolution would enable businesses to carve out a competitive advantage in a progressively focused landscape on data utilization.

Ready to Dive Deeper? Request Our Comprehensive Report Methodology Now: https://market.us/report/point-of-sale-software-market/request-sample/

Report Segmentation of the Point of Sale Software Market

Deployment Mode Analysis

Based on Deployment Mode, the market is classified into cloud-based and on-premise. From these Deployment Modes, the on-premise segment dominates the market by securing a revenue share of 68.4%. The on-premise segment holds a leading position for a variety of factors. Primarily, it provides organizations with a heightened level of control and data security, which is particularly critical for those handling sensitive client information or having distinct regulatory obligations.

Utilizing on-premise systems enables firms to oversee their POS software directly, ensuring that data remains confined to their physical environment and under their supervision. Furthermore, some companies find the upfront costs associated with this deployment method justified by the anticipated long-term cost benefits, mainly due to the absence of recurring subscription charges. In addition, on-premise solutions offer customization options that cater to the specialized requirements of diverse industries or individual businesses, enhancing their appeal for those seeking tailored POS systems.

Application Analysis

Based on Application, the market is classified into fixed POS and mobile POS. Among these Applications, the fixed POS segment dominated the market by securing a revenue share of 55.7%. Fixed POS systems have been a cornerstone in conventional physical businesses such as retail outlets and eateries for quite some time. These enterprises count on the dependability and steadiness of fixed POS setups to handle their daily functions competently. Moreover, these fixed applications offer a wide array of powerful capabilities encompassing inventory oversight, sales analytics, and seamless linkage with other operational platforms. This all-encompassing feature set resonates well with businesses searching for holistic solutions for their point-of-sale operations. Additionally, the ease of use of fixed POS systems renders them a preferred choice for enterprises that have a diverse range of technological expertise among their personnel.

Enterprise Size Analysis

Based on the Enterprise Size, the market is classified into small and medium-sized enterprises (SMEs) and large enterprises. Among these Enterprise Sizes, the large enterprises segment dominated the market, with a major revenue share of 60.1%. The market dominance of large-scale enterprises can be traced back to various critical elements. Such enterprises usually possess considerable financial strength, enabling them to allocate resources toward acquiring elaborate and feature-loaded point-of-sale (POS) software. These advanced platforms are custom-designed to cater to the multifaceted and varied requirements typical of large organizations.

Additionally, these enterprises' expansive operational footprint and broad customer reach call for resilient POS software that can manage elevated transaction volumes and intricate reporting tasks. This type of software is inherently built to accommodate scalability, aligning well with the growth objectives of large firms. Furthermore, these enterprises emphasize data security and regulatory compliance and have the financial means to invest in POS solutions that adhere to rigorous legal benchmarks, thereby safeguarding sensitive customer information and reducing legal vulnerabilities.

Industry Vertical

Based on industry verticals, the market is classified into retail, hospitality, entertainment, healthcare, and other industry verticals. Among these Industry Verticals, the retail segment dominated the market by securing a revenue share of 32.6%. The retail domain stands as one of the most expansive and diverse sectors worldwide, covering an array of businesses from niche boutiques to expansive retail chains. Given its vast scale and variety, the retail sector serves as a significant marketplace for point-of-sale (POS) software solutions.

Moreover, retail enterprises depend profoundly on sophisticated and feature-laden POS systems for effective inventory management, sales processing, and customer experience enhancement. This pronounced dependency positions the retail segment as a key influencer in the innovation and uptake of POS software. Additionally, the swift ascendancy of online shopping has intensified the need for sturdy POS platforms that enable smooth synchronization between digital and physical sales channels. This interoperability is crucial for delivering seamless Omni channel customer experiences, driving the demand for cutting-edge POS software options.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights: https://market.us/purchase-report/?report_id=51827

Market Segmentation

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Fixed POS

- Mobile POS

Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Industry Vertical

- Retail

- Hospitality

- Entertainment

- Healthcare

- Other Industry Verticals

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments

- In May 2023, Oracle Corporation announced the addition of new capabilities in their MICROS Simphony Cloud Point-of-Sale (POS) system, which can help restaurant businesses increase their productivity and sales channels.

Explore Extensive Ongoing Coverage in Information and Communications Technology Market Research Reports Domain:

- Managed services market size is projected to surpass at USD 934.7 Billion by 2032 and it is growing at a CAGR of 11.9% from 2022 and 2032.

- Field Service Management System Market was USD 5.7 bn in 2022 and is expected to reach USD 16.9 bn in 2032 at a CAGR of 11.8% from 2023-32.

- Anti-money laundering market was worth USD 1,189.57 million in 2021 and expected to grow with a CAGR of 15.25%.

- Product Lifecycle Management Market to reach USD 65.3 Billion by 2032, exhibiting a growth rate (CAGR) of 8.6% during 2023-2032.

- Application Development Software Market size is expected to be worth around USD 1152.15 billion by 2032, growing at a CAGR of 21.7%

- Cloud Accounting Software Market is projected to be US$ 2,682.9 Mn in 2019 to reach US$ 5,653.5 Mn by 2029 at a CAGR of 7.8%.

- Electronic Design Automation Software Market was USD 12.4 bn. It is estimated to be USD 29.5 bn in 2032, at a CAGR of 9.3%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: