Dublin, Jan. 10, 2024 (GLOBE NEWSWIRE) -- The "M2M/IoT Applications in the Agricultural Industry - 3rd Edition" report has been added to ResearchAndMarkets.com's offering.

IoT Applications in the Agricultural Industry analyses the latest developments on the global smart farming market covering precision farming, agricultural drones, in-field monitoring, herd management and farm management software.

The market for in-field sensor systems can be divided into three segments: environmental monitoring, pest monitoring and water management. These solutions typically incorporate wireless connectivity, data logging, cameras and sensors that record measurements of environmental parameters. Semios is the largest vendor in the space by far with an estimated installed base of 750,000 sensor nodes, followed by Pessl Instruments and Davis instruments with installed bases of around 80,000 and 50,000 devices respectively. Top specialised providers of integrated soil moisture monitoring solutions comprise Hortau, AquaSpy and CropX. Remote irrigation control solutions are offered by the largest OEMs of central pivot and drip irrigation systems including Valmont Industries with its Valley Irrigation brand, Lindsay Corporation with its Zimmatic brand and Netafim.

Precision livestock farming technologies are mainly applied to the husbandry of dairy cattle, poultry and pigs. Consolidation and growth of dairy farms have resulted in larger herds per farmer, which makes manual observations challenging. Body-mounted sensor systems together with herd management software are used to achieve satisfactory herd health and timely insemination when a cow is in oestrous. A majority of the leading dairy equipment OEMs including GEA Group, Lely and BouMatic partner with specialised companies to provide advanced sensor technology for herd management. The world's largest dairy equipment manufacturer DeLaval offers its in-house developed activity monitoring system along with its milking and dairy farming infrastructure solutions. Other significant providers of precision livestock farming technologies include Afimilk, Datamars, Nedap and Merck.

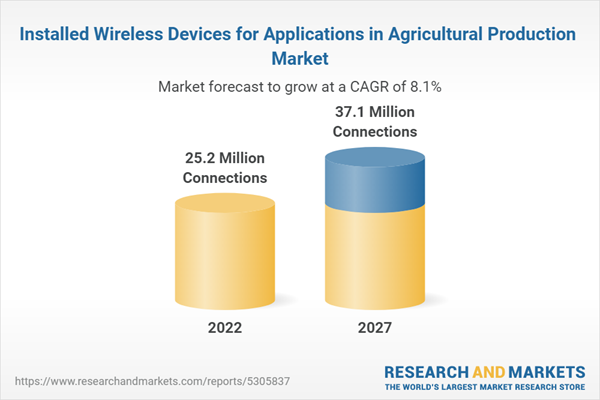

The report's outlook for the smart farming solution market is positive as agricultural production remains greatly underpenetrated by IoT technologies. The number of installed wireless devices for applications in agricultural production is forecasted to grow at a compound annual growth rate (CAGR) of 8.1 percent from 25.2 million connections at the end of 2022 to 37.1 million connected devices by 2027. Cellular connections amounted to 1.7 million at the end of 2022 and are expected to reach 3.9 million in 2027.

The main application areas for cellular communications comprise telematics and in-field sensor systems. LPWA technologies are expected to achieve the highest growth rate and realise a significant market position in the remote monitoring and control segment. 802.15.4-based standards comprise the most employed wireless technology due to its wide adoption in dairy cow monitoring applications.

Key Market Trends

- The emerging digital ecosystem requires a shift towards collaboration

- Larger herds drive the adoption of precision livestock farming technologies

- IoT start-ups attract significant venture capital investments

- System integration and interoperability are high on the agenda

- Dealerships remain as gateways to customers

- OEMs likely to extend free telematics subscription periods

- Freemium strategies will intensify competition between software vendors

- Autonomy will play a significant role in agricultural operations

Highlights from the report:

- Insights from numerous interviews with market leading companies.

- Comprehensive overview of the smart farming value chain and key applications.

- In-depth analysis of market trends and key developments in crop and livestock production.

- Profiles of 84 smart farming solution providers.

- Detailed reviews of the latest precision agriculture initiatives launched by industry players.

- Summary of OEM propositions from manufacturers of agricultural equipment.

- Forecasts by market segment, region and wireless technology lasting until 2027.

This report answers the following questions

- What are the main applications for wireless IoT in agricultural production systems?

- Which are the leading providers of precision farming technologies?

- What offerings are available from technology and service providers?

- What are the main drivers and barriers for technology adoption in agricultural production?

- What are the precision livestock farming strategies of animal monitoring specialists?

- How are the OEMs and agricultural input producers involved in the ecosystem?

- How can drone technology be used in the agricultural sector?

- How will the adoption of cellular connectivity and LPWA technologies evolve?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value in 2022 | 25.2 Million Connections |

| Forecasted Market Value by 2027 | 37.1 Million Connections |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

Key Topics Covered:

1 The Agricultural Sector

1.1 Agricultural production

1.2 Agricultural commodities

1.3 Demand for agricultural commodities

1.4 Agricultural operations

1.5 Agricultural equipment

2 Smart Farming Technologies and Solutions

2.1 Smart farming infrastructure

2.2 Machinery management

2.3 Precision agriculture

2.4 Remote sensing

2.5 Remote monitoring and control

2.6 Precision livestock farming

2.7 Data management and predictive analysis

2.8 Business models and strategies

3 Market Forecasts and Trends

3.1 Market analysis

3.2 Market drivers and barriers

3.3 Value chain analysis

3.4 Market trends

4 OEM Products and Strategies

- AGCO

- ARGO Tractors

- CLAAS Group

- CNH Industrial

- Deere & Company

- Komatsu

- Krone

- Kubota

- Mahindra & Mahindra

- Ponsse

- Rottne

- SDF

- Tigercat

- Vermeer

5 Aftermarket Solution Providers

5.1 Precision farming

- AG Leader Technology

- Agjunction

- DICKEY-john

- Farmers Edge

- Hexagon

- Lacos

- Raven Industries

- Topcon Positioning Systems

- Trimble

- UniStrong

- Yara

5.2 Agricultural drones

- AgEagle

- Aonic

- DJi

- Draganfly

- Hylio

- Jiyi

- Sentera

- TTA

- Wingtra

- XAG

5.3 Environmental and pest monitoring

- Campbell Scientific

- Davis Instruments

- Fieldin

- Prointegra

- Pessl Instruments

- Semios

- Sencrop

- Trapview

- Weenat

5.4 Water management

- Arable Labs

- AquaSpy

- CropX

- EarthScout

- Hortau

- Libelium

- Lindsay Corporation

- Netafim

- Pycno

- Rivulis

- Valmont Industries

5.5 Dairy herd management

- Afimilk

- BouMatic

- CowManager

- Dairymaster

- Datamars

- DeLaval

- Farmnote

- Fullwood JOZ

- GEA Group

- Lely

- Merck

- Moocall

- Nedap

- Stellapps

- Zoetis

5.6 Agricultural software

- 365FarmNet

- Agrivi

- BASF

- Bushel

- The Climate Corporation (Bayer)

- Conservis

- Corteva Agriscience

- Cropin

- DKE-Data

- Farmers Business Network

- Isagri

- Proagrica

- Syngenta

- Telus Agriculture & Consumer Goods

For more information about this report visit https://www.researchandmarkets.com/r/8vgbpo

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment