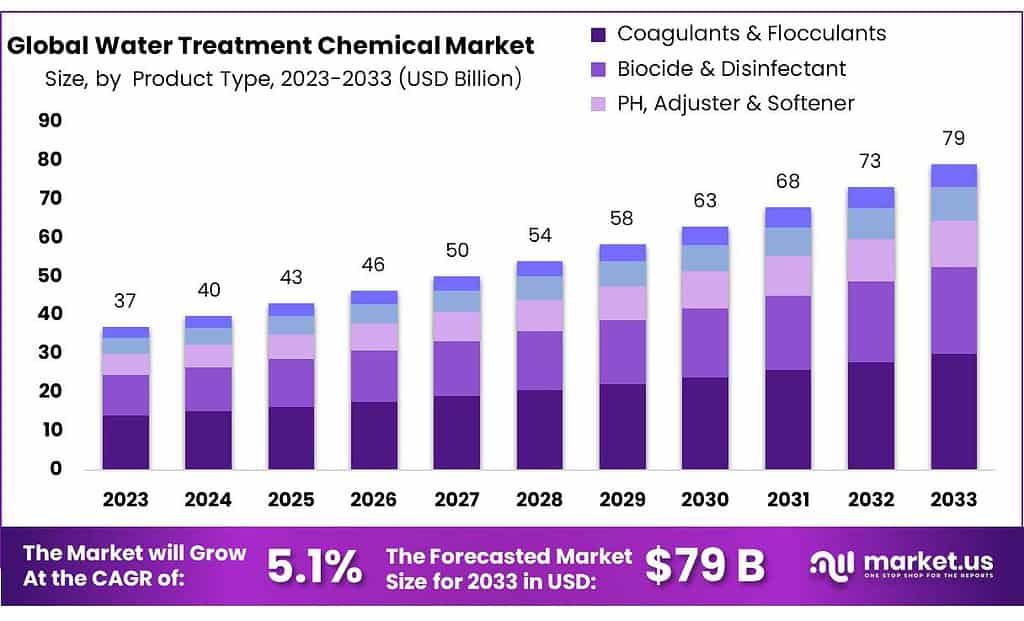

New York, Feb. 07, 2024 (GLOBE NEWSWIRE) -- The net revenue generated by the Water Treatment Chemicals Market size is expected to be worth around USD 79 Billion by 2033, from USD 37 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The water treatment chemicals market encompasses a broad range of chemical compounds used in the treatment and purification of water across various applications. These chemicals are essential in addressing the diverse needs of water treatment processes, including purification, disinfection, and conditioning, to meet the standards for drinking water, industrial processes, and wastewater management. The market includes chemicals for processes such as coagulation and flocculation, pH adjustment, disinfection and oxidation, scale inhibition, corrosion inhibition, and sludge removal.

Key chemicals in this market include coagulants and flocculants, biocides and disinfectants, corrosion inhibitors, scale inhibitors, pH adjusters, and anti-foaming agents. The demand for water treatment chemicals is driven by the need to treat water from municipal and industrial sources to ensure it is safe for human consumption, meets industrial process requirements, and minimizes environmental impact.

Tap into Market Opportunities and Stay Ahead of Competitors - Get Your Sample Report Now

Important Revelation:

- Projected growth from USD 37 Billion in 2023 to USD 79 Billion by 2033, with a CAGR of 5.1%, highlights the market's expanding scope.

- Industrial sectors like oil & gas and food & beverage drive demand, emphasizing the need for chemically treated water for recycling.

- Global water scarcity underlines the critical need for water treatment chemicals, given that only 2.5% of the world's water is freshwater.

- Coagulants and flocculants lead the market, accounting for over 38.1% of revenue in 2023, essential for wastewater treatment in the oil and gas industry.

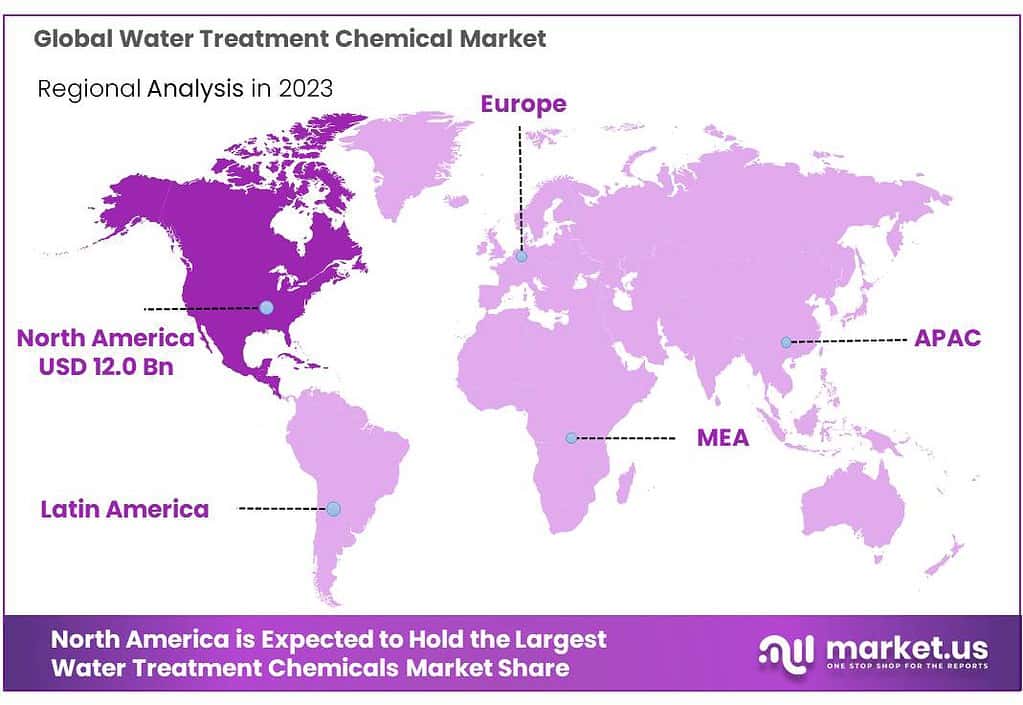

- North America dominates the regional market share, with over 32.2% in 2023, propelled by the growth of water treatment facilities in the oil and gas sector.

Factors Affecting the Growth of the Global Water Treatment Chemicals Market

Various factors, including regulatory requirements, environmental concerns, industrialization, and population growth influence the global water treatment chemicals market's growth. Here are some key factors affecting the growth of the global water treatment chemicals market:

- Increasing Water Pollution: The rising levels of water pollution due to industrial discharges, agricultural runoff, and urbanization contribute to the demand for water treatment chemicals. Governments and regulatory bodies worldwide impose stringent water quality standards, necessitating the use of chemicals to treat and purify water.

- Stringent Environmental Regulations: Environmental regulations and standards set by governments and international bodies drive the adoption of water treatment chemicals. Compliance with these regulations pushes industries to invest in water treatment solutions to meet the required quality standards and reduce the environmental impact of their operations.

- Growing Industrialization: The expansion of industries such as manufacturing, power generation, and chemical processing leads to increased water usage and, consequently, a higher demand for water treatment chemicals. Industries require effective water treatment to meet quality standards, reduce operational costs, and ensure sustainable water use.

- Population Growth and Urbanization: Rapid population growth and urbanization lead to increased demand for clean and safe water. Urban areas generate more wastewater and pollutants, requiring advanced water treatment processes and chemicals to maintain water quality standards and protect public health.

- Technological Advancements: Ongoing research and development in water treatment technologies and chemicals drive innovation in the industry. The introduction of advanced treatment methods and chemicals with enhanced efficiency and environmental sustainability contributes to market growth.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=31750

Some of The Recent Developments Water Treatment Chemicals Market Are:

SUEZ:

- 2023:

- February: Announced plans to reacquire its UK waste-treatment business from Suez.

- July: Partnered with Suez and Ondeo to develop a circular economy project for wastewater treatment in Singapore.

- 2022:

- April: Formed a joint venture with Veolia Environnement for water and wastewater treatment services in the Middle East.

BASF SE:

- 2023:

- June: Launched a new line of biocides for industrial water treatment.

- October: Expanded its production capacity for flocculants and coagulants used in water treatment.

- 2022:

- May: Announced plans to invest €450 million in expanding its water treatment chemicals production capacity.

- October: Partnered with Veolia to develop new sustainable water treatment solutions.

Ecolab:

- 2023:

- January: Launched the "Nalco Water 365" platform for digital water management solutions.

- December: Expanded its "Life Cycle Solutions" program for sustainable water treatment services.

- 2022:

- October: Acquired Purolite, a separation and purification technologies provider.

- November: Launched a new biocide for membrane systems.

Solenis:

- 2023:

- March: Partnered with Veolia to develop and offer combined water treatment solutions.

- December: Launched a new line of sustainable water treatment chemicals.

- 2022:

- March: Acquired Clearon Corp. to expand its pool and spa water treatment portfolio.

- August: Expanded its presence in China with a new production facility.

Маrkеt Key Рlауеrѕ

- SUEZ

- BASF SE

- Ecolab

- Solenis

- Nouryon

- Kemira Oyj

- Dow Chemical Company

- SNF Group

- Cortec Corporation

- Buckman

- Solvay S.A.

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 37.0 Billion |

| Forecast Revenue 2033 | USD 79 Billion |

| CAGR (2024 to 2033) | 5.1% |

| North America Revenue Share | 32.2% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Request for Research Methodology to Understand Our Data-sourcing Process in Detail: https://market.us/report/water-treatment-chemicals-market/request-sample/

Report Segmentation

Product Type Analysis

In 2023, coagulants and flocculants emerged as the dominant product types in oil and gas plants, contributing over 38.1% to the revenue. Coagulants, available in organic and inorganic forms such as aluminum sulfate and aluminum hydroxide chlorine, played a significant role. These chemicals are crucial for effective chemical processing within tanks. Following closely are biocides and disinfectants, representing the second-largest share.

Their popularity stems from their role in controlling microbiological activity during manufacturing, safeguarding efficiency, and preventing microbial contamination. Widely utilized in various industries, including sugar, ethanol, and water treatment, biocides are instrumental in treating wastewater and ensuring optimal conditions in manufacturing systems. They also find applications in ethanol fermentation processes for bacterial control.

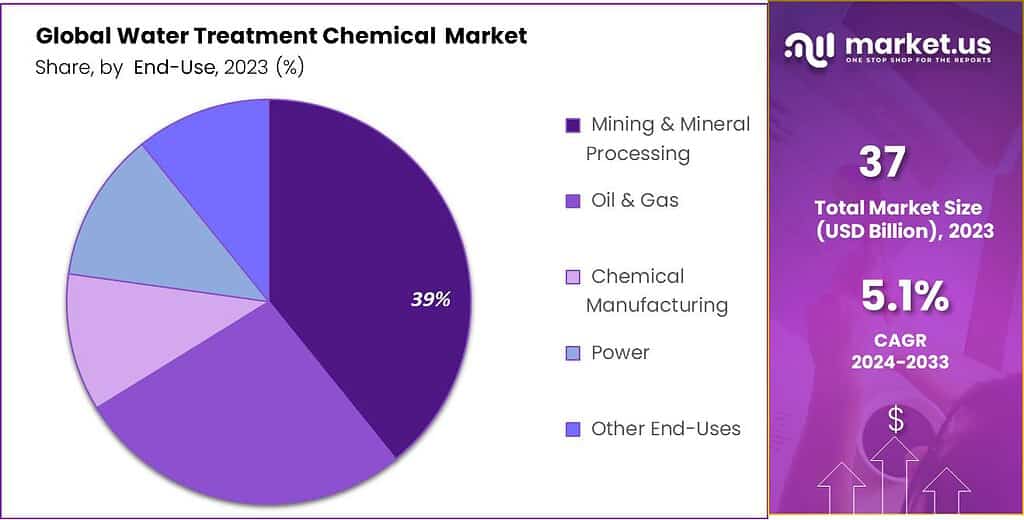

End-Use Analysis

Amid increasing water scarcity in developed regions like North America and Europe, major players are shifting towards water recycling, with the municipal sector claiming over 39.2% revenue share in 2023 due to substantial chemical usage in wastewater treatment. Escalating municipal waste treatment costs prompted industrialists to enhance wastewater treatment facilities, involving processes such as emulsion breaking, flocculation, and sludge elimination.

The oil and gas industry has emerged as a significant end-use sector, driven by its extensive utilization in oil refineries, leading to heightened wastewater generation. Petroleum refineries and chemical plants, relying on steam and water for processes like desalination and fluid catalyst cracking units, necessitate effective water treatment for sustainability. The increasing demand for water treatment chemicals anticipates continued growth in the oil and natural gas industry.

Key Market Segments

By Product Type

- Coagulants & Flocculants

- Biocide & Disinfectant

- pH, Adjuster & Softener

- Defoaming Agent & Defoamer

- Other product types

By End-Use

- Power

- Oil & Gas

- Chemical Manufacturing

- Mining & Mineral Processing

- Other End-Uses

Methodology Details Just a Click Away: https://market.us/report/water-treatment-chemicals-market/request-sample/

Impactful Driver: Technological Advancements

The global demand for chemically treated water is on the rise as only 2.5% of the world's water is freshwater, posing challenges for industries and households. To address this scarcity, water treatment chemicals play a crucial role in efficient water recycling. Industries including oil & gas, power, pulp & paper, mining, chemicals, and food & beverage are rapidly adopting treated wastewater.

Growing economies like China, India, Brazil, Indonesia, Malaysia, Argentina, Chile, and Vietnam are witnessing an increased demand for clean water across homes, farms, and industries, with water treatment chemicals proving to be a cost-effective solution compared to methods like ion exchange, UV filtration, and reverse osmosis. Notably, coagulation, flocculation, and disinfection costs in large water treatment plants are considerably lower than UV and RO alternatives.

The expansion of power, oil & gas, mining, and chemical industries, particularly in regions such as China and India, is a key driver for the heightened demand for these chemicals. Major projects like Brazil's pre-salt oil fields and the global construction of high-capacity power plants using fossil fuels, nuclear, or solar power further contribute to the growing market for water treatment chemicals.

Restraining Factors

Emerging water treatment technologies are gaining popularity due to their eco-friendly and cost-effective nature, contributing to a slowdown in the traditional water treatment chemicals market. Membrane filtration systems, such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, offer precise contaminant removal without the use of chemicals, enhancing water quality and reducing reliance on traditional additives.

Ultraviolet (UV) disinfection is another environmentally friendly method that eliminates pathogens without chemical intervention, addressing environmental concerns and reducing the costs associated with purchasing and disposing of conventional treatment chemicals. The adoption of these advanced and sustainable water treatment methods aligns with industry efforts to prioritize environmental conservation and cost efficiency, potentially impacting the growth of traditional water treatment chemical markets.

Opportunity

The water treatment chemicals market is presented with significant opportunities in the Asia Pacific region, particularly in China and India, driven by a rising population and rapid urbanization. China, facing water scarcity and a large population, emphasizes water quality in its Five-Year Plan for Ecological & Environmental Protection. The government's initiatives to manage water quality, control pollution, and enhance urban water bodies create a robust demand for water treatment chemicals.

Similarly, India, with a substantial population and limited freshwater resources, showcases a clear need for clean water in agriculture and industries. With 16% of the world's population, India represents a substantial market for water treatment solutions. As urbanization progresses and environmental concerns heighten, these countries offer significant opportunities for the water treatment chemicals industry to address water quality challenges and meet the escalating demand, marking an exciting period for industry growth.

Challenges

The water treatment chemicals market faces a significant obstacle due to stringent environmental regulations, particularly from agencies like the EPA, necessitating eco-friendly formulations. Concerns over the environmental impact of chemicals have resulted in stringent rules for companies in this sector. While the industry is pushed towards adopting greener options, challenges arise as these alternatives may not perform as effectively in demanding conditions.

Manufacturers grapple with the economic aspects of green chemistry, making it challenging to develop both effective and economically friendly water treatment chemicals. The shift to green alternatives introduces the risk of bio-fouling, requiring additional biocides that impact cost-efficiency. Striking a balance between the need for stronger formulations for enhanced recycling and environmental considerations poses a complex challenge. Moreover, the vulnerability of patented water treatment chemicals to replication presents a significant issue, with counterfeit products from certain Asian manufacturers undermining basic chemical makers in the market.

Regional Analysis

In 2023, North America dominated the water treatment chemicals market with over 32.2% market share, driven by the surge in unconventional sources like tight oil and shale, particularly in North Dakota and West Texas, spurred by hydraulic fracturing. The increased presence of water treatment plants in the upstream oil and gas sector in response to this trend is expected to positively impact the market in the forecast period.

The U.S. is anticipated to experience a 2.4% compound annual growth rate (CAGR) over the forecast period, attributed to stringent regulations governing wastewater disposal and production. The country's leadership in energy production and the growing demand for water treatment chemicals in the power industry, especially in thermoelectric power plants, will further contribute to market growth.

In Asia Pacific, the demand for boiler chemicals is set to rise, driven by increased manufacturing, industrial activities, and growth in the power sector. China, facing high levels of heavy metals and suspended particles, is actively seeking pretreated water. Organizations like China Water Risk (CWR) play a crucial role in reporting on the risks and impacts of wastewater in China's key industries, contributing to water treatment efforts and addressing associated challenges.

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore Extensive Ongoing Coverage on Chemical Research Reports Domain:

- Recycled Plastics Market size is expected to be worth around USD 114.8 billion by 2033, from USD 52.7 billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2023 to 2033.

- Caustic Soda Market size is expected to be worth around USD 73.4 Bn by 2032 from USD 4.48 Bn in 2022, growing at a CAGR of 5.2% during the forecast period from 2022 to 2032.

- Silico Manganese Market size is expected to be worth around USD 40.05 Bn by 2032 from USD 23.76 Bn in 2022, growing at a CAGR of 5.5% during the forecast period from 2022 to 2032.

- zeolite market was valued at USD 8.5 billion and is expected to be valued at USD 12.7 billion by 2032. Between 2023 and 2032 this market is estimated to register the highest CAGR of 4.2%.

- Superconducting Wire Market size is expected to be worth around USD 3,178 million by 2032 from USD 1,300 million in 2023, growing at a CAGR of 9.6% during the forecast period from 2022 to 2032.

- Carbon Black Market Size was valued at USD 13.2 Bn. and is expected to grow around USD 21.7 Bn by 2032 between 2023 and 2032, this market is estimated to register the highest CAGR of 5.1%.

- flexible Packaging market size is predicted to reach USD 385.2 billion in 2033 up or down from USD 236.5 billion by 2023 and growing by a CAGR of 5.0% over the period between 2023 and 2033.

- Ceramic Tile Market is anticipated to be USD 583.6 billion by 2033. It is estimated to record a steady CAGR of 6.8% in the Forecast period 2023 to 2033. It is likely to total USD 302.3 billion in 2023.

- Graphene Market size is expected to be worth around USD 62 billion by 2033 from USD 2 billion in 2023, growing at a CAGR of 42.5% during the forecast period from 2023 to 2033.

- Ammonia Market size was valued at USD 70.4 Billion. This market is estimated to reach USD 134.9 Billion in 2032 the highest CAGR of 6.9% between 2023 and 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: