Dublin, Feb. 14, 2024 (GLOBE NEWSWIRE) -- The "Asia-Pacific Automotive LiDAR System-on-Chip (SoC) Market - Analysis and Forecast, 2024-2033" report has been added to ResearchAndMarkets.com's offering.

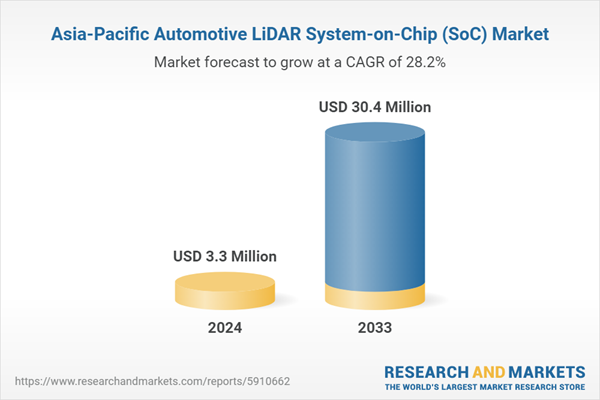

The Asia-Pacific automotive LiDAR system-on-chip (SoC) market (excluding China) is expected to be valued at $3.3 million in 2024, which is anticipated to grow at a CAGR of 28.15% and reach $30.4 million by 2033

Automotive LiDAR system-on-chip (SoC) market growth is anticipated due to the following factors: significant progress in automotive LiDAR research and development (R&D) to enhance the features of the LiDAR system; widespread application of LiDARs in highly automated vehicles; and expected reduction in LiDAR manufacturing costs following the commencement of mass production.

The Automotive LiDAR System-on-Chip (SoC) is a critical component in the development of autonomous vehicles and has a major impact on the prosperity of automakers and suppliers in the Asia-Pacific (APAC) region. The region's automotive LiDAR SoC market for autonomous vehicles is expanding primarily because to the increased focus on efficiency and safety.

Complying with stringent rules and upholding international and national safety standards emphasizes the significance of LiDAR SoC in the advancement of driverless vehicles. For companies making LiDAR SoC systems, the expected expansion of the autonomous car market offers profitable prospects. The automotive LiDAR SoC market, which is in a boom phase and is expected to thrive throughout the forecast period from, is seeing greater application in both semi-autonomous and completely autonomous vehicles.

How can this report add value to an organization?

Product/Innovation Strategy:

The product segment helps the reader understand the different applications of the automotive LiDAR system-on-chip (SoC) products available based on vehicle type, propulsion type, level of autonomy, range type, and perception type. Increasing demand for safety and autonomy is pushing the consumption of automotive LiDAR system-on-chip (SoC). Therefore, the automotive LiDAR system-on-chip business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy:

The Asia-Pacific automotive LiDAR system-on-chip (SoC) market will be an exponentially growing market holding enormous opportunities for the market players.

Some strategies covered in this segment are product launches, market developments, partnerships and collaborations, business expansions, and investments. The companies' preferred strategy has been product development and partnerships and collaborations for the mass production of products, which enable them to strengthen their positions in the Asia-Pacific automotive LiDAR system-on-chip (SoC) market.

Competitive Strategy:

Key players in the Asia-Pacific automotive LiDAR system-on-chip (SoC) market analyzed and profiled in the study involve automotive LiDAR system-on-chip (SoC) manufacturers, automotive LiDAR manufacturers, and autonomous vehicle manufacturers.

Moreover, a detailed competitive benchmarking of the players operating in the apac automotive LiDAR system-on-chip (SoC) market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Analyst's Perspective on Automotive LiDAR System-on-Chip (SoC) Market

The Principal Analyst states, 'The market is in a nascent phase, but with the ongoing technological developments, it is anticipated to spur in the coming years. Businesses are developing innovative systems and introducing new products in the market. Product developments and partnerships are key strategies assisting the market's growth.

The massive shift in consumer preferences has provided a viable opportunity for automotive LiDAR manufacturers to gain substantial ground in this domain. Moreover, increasing awareness regarding autonomous cars and growing safety concerns are expected to increase the adoption of automotive LiDAR system-on-chip (SoC) globally.'

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 126 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value (USD) in 2024 | $3.3 Million |

| Forecasted Market Value (USD) by 2033 | $30.4 Million |

| Compound Annual Growth Rate | 28.1% |

| Regions Covered | Asia Pacific |

Key Topics Covered:

1 Markets

1.1 Industry Outlook

1.1.1 Overview: LiDAR System-on-Chip (SoC)

1.1.2 Trends: Current and Future

1.1.2.1 4D LiDAR Technology

1.1.2.2 Ongoing Efforts by the Industry Players

1.1.2.3 LiDAR System-on-Chip with On-Chip Signal Processing

1.1.3 Supply Chain Network/MAP

1.1.4 Ecosystem/Ongoing Programs

1.1.4.1 Consortiums, Associations, and Regulatory Bodies

1.1.4.2 Government Initiatives

1.1.4.3 Programs by Research Institutions and Universities

1.1.5 Key Patent Mapping

1.1.5.1 Analyst View

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Rapid Technological Advancement in LiDAR in the Automotive Industry

1.2.1.2 Surge in Investments and Funding in LiDAR System-on-Chip Manufacturing Startups for R&D Activities

1.2.1.3 Cost-Effectiveness of LiDAR System-on-Chip

1.2.1.4 Growing Demand for the Miniaturization of Products

1.2.2 Business Restraints

1.2.2.1 Growing Complexity in Integrating All the Components on a Chip Due to Lack of Knowledge

1.2.2.2 Constant Review of Regulatory Policies on Standardization of Chips

1.2.2.3 Semiconductor Shortage Effect

1.2.3 Business Strategies

1.2.3.1 Product Development

1.2.3.2 Market Development

1.2.4 Corporate Strategies

1.2.4.1 Mergers and Acquisitions

1.2.4.2 Partnerships, Joint Ventures, Collaborations, and Alliances

1.2.5 Business Opportunities

1.2.5.1 Growing Trend for the Development of Autonomous Vehicles

1.2.5.2 Manufacturing LiDAR System-on-Chip at Scale

1.2.5.3 Deployment of LiDAR System-on-Chip in Other Applications such as Robotics and Industrial Automation

1.3 LiDAR System-on-Chip (SoC) Architecture and Fabrication

1.3.1 Software and Hardware Systems for LiDAR System-on-Chip (SoC) Industry

1.4 Emerging Applications in LiDAR System-on-Chip (SoC) Industry

1.4.1 Industrial Automation

1.4.2 Robotics

1.4.3 Others

1.5 Measurement Process in LiDAR System-on-Chip (SoC) Industry

1.5.1 Time of Flight (ToF)

1.5.2 Frequency Modulated Continuous Wave (FMCW)

1.6 Impact of COVID-19 on the Industry

2 Regions

2.1 China

2.1.1 Market

2.1.1.1 Buyer Attributes

2.1.1.2 Key Manufacturers of Automotive LiDAR in China

2.1.1.3 Competitive Benchmarking

2.1.1.4 Business Challenges

2.1.1.5 Business Drivers

2.1.2 Application

2.1.2.1 China Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Value and Volume Data, 2024-2033

2.1.2.2 China Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Value and Volume Data, 2024-2033

2.1.2.3 China Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Value and Volume Data, 2024-2033

2.1.3 Product

2.1.3.1 China Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Value and Volume Data, 2024-2033

2.1.3.2 China Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Value and Volume Data, 2024-2033

2.2 Asia-Pacific and Japan

2.2.1 Market

2.2.2 Application

2.2.3 Product

2.2.4 Asia-Pacific and Japan: Country-Level Analysis

2.2.4.1 Japan

2.2.4.2 South Korea

2.2.4.3 Israel

2.2.4.4 Rest-of-Asia-Pacific and Japan

3 Markets - Competitive Benchmarking & Company Profiles

3.1 Competitive Benchmarking

3.2 Market Ranking Analysis

3.3 Company Profiles

3.3.1 Type 1 Companies: Automotive LiDAR System-on-Chip (SoC) Manufacturers

3.3.1.1 RoboSense

3.3.1.1.1 Company Overview

3.3.1.1.1.1 Role of RoboSense in the Automotive LiDAR System-on-Chip (SoC) Market

3.3.1.1.1.2 Product Portfolio

3.3.1.1.2 Business Strategies

3.3.1.1.2.1 RoboSense: Product Development

3.3.1.1.2.2 RoboSense: Market Development

3.3.1.1.3 Production Sites and R&D Analysis

3.3.1.1.4 Analyst View

4 Research Methodology

4.1 Data Sources

4.1.1 Primary Data Sources

4.1.2 Secondary Data Sources

4.2 Data Triangulation

4.3 Market Estimation and Forecast

4.3.1 Factors for Data Prediction and Modeling

List of Figures

Figure 1: Automotive LiDAR System-on-Chip (SoC) Market Overview, Thousand Units, 2024-2033

Figure 2: Automotive LiDAR System-on-Chip (SoC) Market Overview, $Million, 2024-2033

Figure 3: Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Figure 4: Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Figure 5: Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Figure 6: Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Figure 7: Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Figure 8: Automotive LiDAR System-on-Chip (SoC) Market (by Region), $Million, 2024

Figure 9: LiDAR System-on-Chip

Figure 10: LiDAR System-on-Chip (SoC) Market Supply Chain Analysis

Figure 11: Stakeholders in Automotive LiDAR System-on-Chip (SoC) Market

Figure 12: Business Dynamics for LiDAR System-on-Chip (SoC) Market

Figure 13: Key Business Strategies, 2020-2022

Figure 14: Product Development (by Company), 2020-2022

Figure 15: Market Development (by Company), 2020-2022

Figure 16: Key Corporate Strategies, 2020-2022

Figure 17: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2020-2022

Figure 18: Timeline for Autonomous Vehicles

Figure 19: Block Diagram of LiDAR System-on-Chip (SoC)

Figure 20: Time of Flight (ToF) Principle

Figure 21: Frequency Modulated Continuous Wave (FMCW) Principle

Figure 22: Competitive Benchmarking for Automotive LiDAR System-on-Chip (SoC) Manufacturers in China

Figure 23: China Automotive LiDAR System-on-Chip (SoC) Market, $Million and Thousand Units, 2024-2033

Figure 24: Competitive Benchmarking for Automotive LiDAR System-on-Chip (SoC) Manufacturers in Asia-Pacific and Japan

Figure 25: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market, $Million and Thousand Units, 2024-2033

Figure 26: Competitive Benchmarking

Figure 27: Research Methodology

Figure 28: Data Triangulation

Figure 29: Top-Down and Bottom-Up Approach

Figure 30: Assumptions and Limitations

List of Tables

Table 1: Automotive LiDAR System-on-Chip (SoC) Market Overview

Table 2: Key Companies Profiled

Table 3: Consortiums, Associations, and Regulatory Bodies

Table 4: Government Initiatives for Autonomous Vehicles

Table 5: Programs by Research Institutions and Universities

Table 6: Key Patent Mapping

Table 7: Impact of Business Drivers

Table 8: Impact of Business Restraints

Table 9: Impact of Business Opportunities

Table 10: Automotive LiDAR System-on-Chip (SoC) Market (by Region), Thousand Units, 2024-2033

Table 11: Automotive LiDAR System-on-Chip (SoC) Market (by Region), $Million, 2024-2033

Table 12: China Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 13: China Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 14: China Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 15: China Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 16: China Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 17: China Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 18: China Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 19: China Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 20: China Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 21: China Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Table 22: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 23: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 24: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 25: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 26: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 27: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 28: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 29: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 30: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 31: Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), $Million, 2024-2033

Table 32: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 33: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 34: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 35: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 36: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 37: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 38: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 39: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 40: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 41: Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 42: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 43: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 44: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 45: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 46: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 47: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 48: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 49: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 50: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 51: South Korea Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 52: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 53: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 54: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 55: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 56: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 57: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 58: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 59: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 60: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 61: Israel Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 62: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), Thousand Units, 2024-2033

Table 63: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Vehicle Type), $Million, 2024-2033

Table 64: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), Thousand Units, 2024-2033

Table 65: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Propulsion Type), $Million, 2024-2033

Table 66: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), Thousand Units, 2024-2033

Table 67: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Level of Autonomy), $Million, 2024-2033

Table 68: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), Thousand Units, 2024-2033

Table 69: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Range Type), $Million, 2024-2033

Table 70: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception Type), Thousand Units, 2024-2033

Table 71: Rest-of-Asia-Pacific and Japan Automotive LiDAR System-on-Chip (SoC) Market (by Perception), $Million, 2024-2033

Table 72: Automotive LiDAR System-on-Chip (SoC) Market: Market Ranking Analysis, 2024

Table 73: RoboSense: Product Portfolio

Table 74: RoboSense: Product Development

Table 75: RoboSense: Market Development

Companies Mentioned

- RoboSense

For more information about this report visit https://www.researchandmarkets.com/r/j3os2z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment