Dublin, Feb. 27, 2024 (GLOBE NEWSWIRE) -- The "Remittance Market - Global Industry Size, Share, Trends, Opportunity, & Forecast 2019-2029" report has been added to ResearchAndMarkets.com's offering.

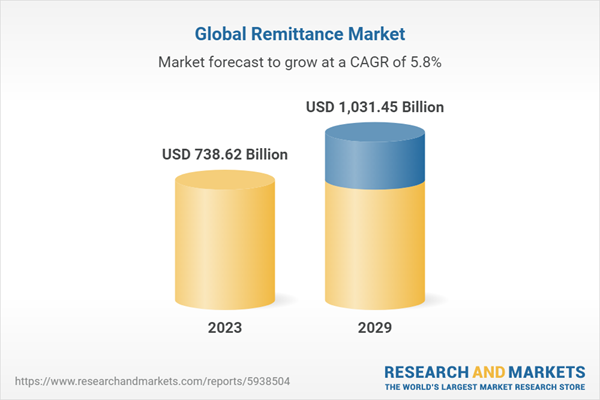

The Global Remittance Market was valued at USD 738.62 billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 5.78% through 2029, reaching USD 1031.45 billion.

The remittance market, a crucial component of the global financial landscape, refers to the transfer of money by foreign workers to their home countries. This market plays a pivotal role in facilitating economic development and supporting the livelihoods of millions of families worldwide. Remittances serve as a lifeline for many developing nations, offering financial stability, poverty alleviation, and improved access to education and healthcare.

Key drivers of the remittance market include increased international migration, globalization, and advancements in technology, which have transformed the way money is transferred across borders. Traditional remittance channels, such as banks and money transfer operators, now coexist with digital platforms and fintech solutions, offering more efficient and cost-effective options for sending and receiving funds.

The market has seen significant growth in recent years, with a rising number of migrants seeking employment opportunities abroad. Governments and financial institutions are actively involved in shaping policies and implementing initiatives to promote a secure and competitive remittance landscape. Despite the positive impact of remittances, challenges such as high transaction costs, regulatory complexities, and fluctuating exchange rates persist, prompting ongoing efforts to enhance the efficiency and inclusivity of the remittance market on a global scale.

Asia Pacific stands as the largest and dynamically evolving market in the personal finance sector. Boasting diverse economies, from established financial hubs to rapidly growing markets, the region witnesses a surge in demand for personalized financial services. A burgeoning middle class, coupled with increasing digital adoption, propels the popularity of personal finance apps and platforms.

Governments and businesses are investing in financial technology, fostering innovation and accessibility. This robust growth in the Asia Pacific underscores the region's pivotal role in shaping the future of personal finance, offering a vast and dynamic landscape for financial services providers and tech innovators alike.

Key Market Drivers

Migration Trends and Workforce Mobility:

- Global migration for economic opportunities drives the need for cross-border financial transactions.

- Migrant workers remit earnings to support families, contributing to the flow of funds in the remittance market.

- Governments implement measures to protect migrant workers' rights and facilitate smoother remittance flows.

Technological Advancements and Fintech Innovation:

- Digital innovation enhances efficiency, speed, and accessibility of cross-border money transfers.

- Fintech solutions leverage digital platforms, mobile apps, and blockchain for cost-effective alternatives.

- Mobile money services and blockchain technology improve transparency, security, and traceability.

Regulatory Landscape and Financial Inclusion Initiatives:

- Governments shape policies on transaction fees, AML regulations, and KYC requirements to balance security and ease of remittance.

- Financial inclusion initiatives expand access to formal banking, promoting regulated remittance channels.

- Collaborations between governments, financial institutions, and fintech companies foster an inclusive remittance market.

Economic Conditions and Currency Exchange Rates:

- Economic growth and stability influence remittance flows, with downturns impacting job opportunities and income.

- Exchange rate fluctuations affect the value of remittances, impacting senders and recipients.

- Stakeholders monitor economic conditions to implement strategies for resilience and sustainability in the remittance market.

Key Market Challenges

High Transaction Costs and Fees:

- Substantial fees associated with traditional and money transfer operators reduce remittance amounts.

- Regulatory compliance expenses, currency conversion fees, and lack of competition contribute to high costs.

- Collaboration needed to explore cost-effective solutions and reduce fees.

Regulatory Complexities and Compliance Burdens:

- Stringent AML and KYC regulations increase operational costs and hinder competition.

- Lack of standardization across regulatory frameworks complicates cross-border operations.

- International cooperation required to establish common standards and minimize barriers.

Limited Financial Inclusion and Access:

- Many lack access to formal financial services, relying on informal channels for remittances.

- Initiatives to expand banking infrastructure and promote digital financial literacy are needed.

- Collaboration essential to bridge the gap and provide secure and regulated remittance services.

Exchange Rate Volatility and Currency Risk:

- Fluctuations in exchange rates impact remittance values, affecting purchasing power.

- Currency risk significant for individuals in countries with unstable currencies.

- Financial instruments and transparency measures can mitigate the impact of volatility.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 189 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $738.62 Billion |

| Forecasted Market Value (USD) by 2029 | $1031.45 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Remittance market.

- Bank of America

- Citigroup Inc.

- JPMorgan Chase & Co.

- MoneyGram International, Inc.

- Ria Financial Services Ltd. (Euronet Worldwide, Inc.)

- TransferWise Ltd.

- UAE Exchange

- Wells Fargo

- Western Union Holdings, Inc.

- Xoom (PayPal Inc.)

Report Scope

Remittance Market, By Application:

- Consumption

- Savings

- Investment

Remittance Market, By Remittance Channel:

- Banks

- Money Transfer Operator

- Others

Remittance Market, By End User :

- Business

- Personal

Remittance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

For more information about this report visit https://www.researchandmarkets.com/r/wi0dxu

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment