Dublin, March 11, 2024 (GLOBE NEWSWIRE) -- The "Venture Capital Investment Market Report by Sector, Fund Size, Funding Type, and Region 2024-2032" report has been added to ResearchAndMarkets.com's offering.

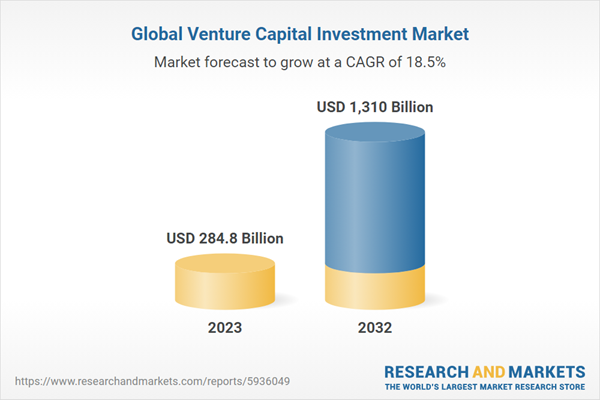

Global venture capital is experiencing unprecedented growth, with recent market analyses predicting a surge to $1.3 trillion by 2032. This dynamic sector, characterized by a compounded annual growth rate (CAGR) of 18.49% from 2023 to 2032, is underpinned by rising investments in technological innovations and an increased commitment to sustainability and green finance.

Technological Innovation Fueling Market Expansion

Emerging technologies such as artificial intelligence (AI), blockchain, and biotechnology are catalyzing venture capital investments. These disruptive innovations are poised to transform various industries, offering unprecedented opportunities for startups. Venture capitalists are eagerly supporting ventures that leverage such technologies to solve complex problems and optimize business processes.

Market Potential in Emerging Economies

The potential in emerging markets is a significant contributor to the expansion of the global venture capital investment market. These markets are experiencing rapid economic growth, increased consumer demand, and offer untapped opportunities for venture-backed companies to scale and penetrate new consumer bases.

Robust Entrepreneurial Ecosystems Driving Growth

A solid entrepreneurial ecosystem, replete with talent, mentorship, and innovation-centric cultures, is vital for sustaining the market's momentum. Regions hosting top universities, incubators, and research facilities are attracting venture capital investments due to their ability to nurture and produce high-potential startups.

Industry Applications Across Diverse Sectors

Venture capital funds span an array of sectors, with software currently dominating the market share. The application of software in industry innovations continues to propel its growth, making it an attractive destination for investors. Other significant sectors benefiting from venture capital include pharma and biotech, media and entertainment, and energy, with sustainability initiatives further driving investments.

Geographic Trends Point to North America's Dominance

North America remains at the forefront of venture capital investment, leading the market share. This dominance is attributed to its robust technology sector and innovation-friendly environment. However, regions like the Asia-Pacific are also gaining momentum, thanks in part to digital transformations and clean energy developments.

Competitive Landscape & Strategic Market Response

The venture capital investment landscape is witnessing active strategic collaborations, research and development, and sustainability initiatives by key players. As competition intensifies, companies are prioritizing digital transformation and aligning their investments with ESG criteria to stay ahead.

Opportunities Outweigh Market Challenges

Despite facing challenges such as regulatory fluctuations and market volatility, venture capital investment opportunities are abundant. The alignment of investment strategies with sustainability, innovation in emerging technologies, and expansion into burgeoning markets offer a positive outlook for investors.

- Segmentation by Sector: A diverse range of sectors including software, healthcare, and energy.

- Segmentation by Fund Size: A comprehensive breakdown ranging from under $50M to above $1B.

- Segmentation by Funding Type: Analysis of first-time and follow-on venture funding.

- Regional Analysis: Insight into venture capital trends across North America, Asia-Pacific, Europe, and more.

The report's findings underscore the vigorous state of the venture capital investment market. With technological advancements, strategic market adaptations, and a focus on ESG principles, the market is positioned for sustained growth and innovation. For entrepreneurs, investors, and market analysts, these insights present a detailed landscape of venture capital investment prospects and strategic approaches.

The full analysis offers an in-depth understanding of the market's dynamics, competitive environment, and growth opportunities through to 2032.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 141 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value (USD) in 2023 | $284.8 Billion |

| Forecasted Market Value (USD) by 2032 | $1310 Billion |

| Compound Annual Growth Rate | 18.4% |

| Regions Covered | Global |

Venture Capital Investment Industry Segmentation:

Breakup by Sector:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Breakup by Fund Size:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

- $500 M to $1 B holds the largest share in the industry

Breakup by Funding Type:

- First-Time Venture Funding

- Follow-on Venture Funding

Breakup by Region:

- North America

- Asia-Pacific

- Europe

- Others

Company Profiles

- Accel

- Andreessen Horowitz

- Benchmark

- Bessemer Venture Partners

- First Round Capital

- Founders Fund

- GGV Management .

- Index Ventures

- Sequoia Capital Operations

- Union Square Ventures

For more information about this report visit https://www.researchandmarkets.com/r/8fo103

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment