Dublin, March 14, 2024 (GLOBE NEWSWIRE) -- The "Russia Alternative Lending Market Business and Investment Opportunities Databook - 75+ KPIs on Alternative Lending Market Size, By End User, By Finance Model, By Payment Instrument, By Loan Type and Demographics - Q2 2023 Update" report has been added to ResearchAndMarkets.com's offering.

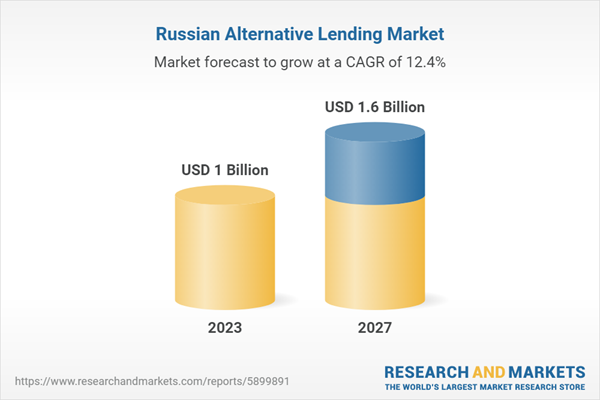

According to the report, the alternative lending market in the country is expected to grow by 22.6% on an annual basis to reach US$ 1 billion in 2023. Medium to long term growth of alternative lending in Russia remains strong. Alternative lending adoption is expected to grow steadily over the forecast period, recording a CAGR of 12.4% during 2023-2027. The alternative lending market in the country will increase from US$822.9 million in 2022 to reach US$ 1.61 billion by 2027.

Embark on a detailed exploration of the alternative lending market with our latest report, dissecting key economic indicators to provide a holistic view of this dynamic landscape. Delve into the alternative lending market's expansive horizons, from overall market size and forecasts to granular analyses of end-user segments, diverse finance models, and payment instrument intricacies.

This report helps in navigating the nuanced relationships between payment instruments and lending models, offering a detailed breakdown of transaction dynamics. Uncover the multifaceted nature of loans, from personalized B2C offerings like payroll advances to strategic B2B solutions like lines of credit. Complementing these insights, delve into consumer attitudes and behaviors, decoding the impact of age, income, and gender on financial choices.

This report provides a thorough knowledge of alternative lending market dynamics, market size and forecast with more than 75+ KPIs. KPIs in both value and volume terms help in getting an in-depth understanding of end market dynamics.

The research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view on emerging business and investment market opportunities.

Report Scope

This report provides in-depth data-centric analysis of Alternative Lending industry in Russia through 127 tables and 150 charts. Below is a summary of key market segments:

Russia Economic Indicators

- Gross Domestic Product at Current Prices

- Population

- Unbanked Population

- Unemployment Rate

- Loan Default Rate

Russia Alternative Lending Market Size and Forecast

- Transaction Value

- Average Transaction Value

- Transaction Volume

Russia Alternative Lending Market Size and Forecast by End User

- End User - Business

- End User - Consumer

Russia Alternative Lending Market Size and Forecast by Finance Models

- P2P Marketplace Consumer Lending

- P2P Marketplace Business Lending

- P2P Marketplace Property Lending

- Balance Sheet Consumer Lending

- Balance Sheet Business Lending

- Balance Sheet Property Lending

- Invoice Trading

- Debt-based Securities

- Equity-based Crowd Funding

- Real Estate Crowd funding

Russia Alternative Lending Market Size and Forecast by Payment Instrument - Transaction Value, Volume and Average Value

- Cash

- Cheques

- Credit Transfer

- Direct Debits

- Debit Card

- Credit Card

- E-Money

Russia Alternative Lending Market Size and Forecast by Payment Instrument to Model

Alternative Lending Market Size and Forecast by Payment Instrument to:

- P2P Marketplace Consumer Lending

- P2P Marketplace Business Lending

- P2P Marketplace Property Lending

- Balance Sheet Consumer Lending

- Balance Sheet Business Lending

- Balance Sheet Property Lending

- Invoice Trading

- Debt-based Securities

- Equity-based Crowd Funding

- Real Estate Crowd Funding

Russia Alternative Lending Market Size and Forecast by Loan Types

- B2C Loans

- Personal Loan

- Payroll Advance

- Home Improvement

- Education/Student Loans

- Point of Sale

- Auto Loans

- Medical Loans

- B2B Loans

- Lines of Credit

- Merchant Cash Advance

- Invoice Factoring

- Revenue Financing

Russia Alternative Lending Analysis by Consumer Attitude and Behaviour

- By Age

- By Income

- Gender

Key Attributes

| Report Attribute | Details |

| No. of Pages | 164 |

| Forecast Period | 2023-2027 |

| Estimated Market Value (USD) in 2023 | $1 Billion |

| Forecasted Market Value (USD) by 2027 | $1.6 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Russia |

For more information about this report visit https://www.researchandmarkets.com/r/rgpdh0

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment