Dublin, April 10, 2024 (GLOBE NEWSWIRE) -- The "U.S. Residential Cabinet Market - Focused Insights 2024-2029" report has been added to ResearchAndMarkets.com's offering.

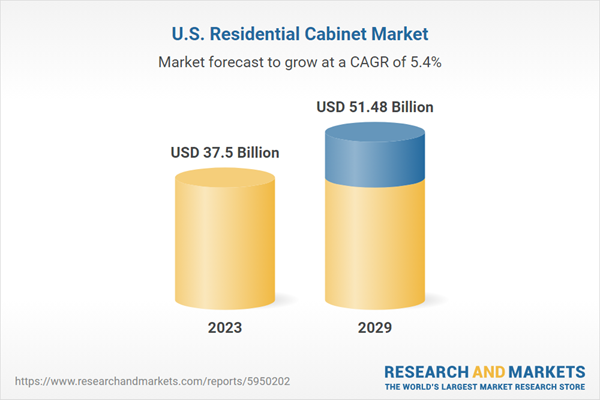

The U.S. Residential Cabinet Market was valued at USD 37.50 billion in 2023, and is projected to reach USD 51.48 billion by 2029, showcasing a CAGR of 5.42%.

The home office cabinet type segment is growing significantly, with the highest segmental CAGR of 6.40% in the U.S. market during the forecast period. The demand for home office cabinets that support remote work drives the segment. Additionally, the technological advancements in the home office cabinets segment influence the market. Cabinets often incorporate features such as cable management, built-in charging stations, and smart storage solutions to meet the tech-savvy requirements of individuals working from home.

The U.S. residential cabinet market report consists of exclusive data on 35 vendors. The U.S. residential cabinet market's competitive scenario is intensifying, with global and domestic players offering diverse products. Regarding market share, a few major players are currently dominating the market. Some companies that are currently dominating the market are MasterBrand, American Woodmark, Arclinea, Cabinetworks Group, and PORCELANOSA.

In response to safety concerns, IKEA, one of the key vendors, has launched a new anti-tip feature for dressing cabinets, a crucial development in the U.S. residential cabinets market. This safety mechanism encourages customers to anchor their dressers to prevent tip-overs, which is particularly important for households with children. The feature restricts drawer opening until the unit is securely attached to the wall, prioritizing safety. Market players should recognize the heightened consumer focus on safety and consider incorporating similar features to meet evolving safety expectations in residential cabinet designs.

The residential construction growth is a significant driver for the U.S. residential cabinet market. As new homes are being built, there is a concurrent demand for cabinets to furnish these spaces. Market players can capitalize on this driver by establishing strategic partnerships with home builders and developers, ensuring that their cabinet offerings align with the evolving trends and preferences in residential construction. By staying abreast of architectural styles and space utilization, manufacturers can position themselves as integral contributors to the residential construction sector.

The surge in renovation and remodeling projects is a key driver influencing the market. Homeowners undertaking renovation endeavors often seek updated and modernized cabinets to refresh the look and functionality of their living spaces. To leverage this driver, market players should offer versatile and adaptable cabinet designs that cater to diverse renovation styles.

Collaborating with interior designers and home improvement professionals can enhance product visibility in renovation projects. Additionally, providing cost-effective solutions and efficient installation services can position manufacturers favorably in the market, meeting the heightened demand generated by the increasing prevalence of renovation and remodeling activities across residential properties.

U.S. RESIDENTIAL CABINET MARKET INSIGHTS

- By distribution channel, the supermarkets & hypermarkets segment has the largest U.S. residential cabinet market share in 2023. The segment is propelling as their outlets offer convenient access to storage solutions, meeting the general needs of homeowners for kitchen, bathroom, and home organization cabinets. Consumer experience within supermarkets & hypermarkets is vital. The layout and display of cabinets contribute to an engaging shopping experience that influences consumer choices.

- The repair & remodeling application segment shows significant growth and has the largest U.S. residential cabinet market share. The growth of the segment is driven by home improvement and renovation projects. The repair & remodeling segment focuses on customization for the design harmony of cabinets. Cabinets are designed to match the changing design preferences of homeowners undertaking renovation projects. The repair & remodeling segment also emphasizes materials' resilience and cabinets' upgradability.

- The ready-to-assemble (RTA) cabinets segment is growing significantly, with the fastest-growing CAGR of 6.10% during the forecast period. The demand for RTA cabinets designed for DIY-friendly installation drives the market, offering cost savings for consumers. The market is also influenced by the unique customization form used in the assembly of RTA cabinets. While not fully customizable like semi-custom or custom-built cabinets, homeowners can assemble them according to their preferences.

KEY QUESTIONS ANSWERED

- How big is the U.S. residential cabinet market?

- What is the growth rate of the U.S. residential cabinet market?

- What are the key drivers of the U.S. residential cabinet market?

- Who are the major players in the U.S. residential cabinet market?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 77 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $37.5 Billion |

| Forecasted Market Value (USD) by 2029 | $51.48 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | United States |

VENDOR LIST

Key Vendors

- Arclinea

- American Woodmark

- Cabinetworks Group

- MasterBrand

- PORCELANOSA

Other Prominent Vendors

- IKEA

- Masco

- Wellborn Cabinet

- Canyon Creek Cabinet Company

- W. W. Wood Products

- Poggenpohl

- eggersmann

- CASTAGNA CUCINE

- Kitchen Cabinet Kings

- Dell Anno

- Jordan's Building Center

- Dura Supreme

- Plato Woodwork

- Bellmont

- Prime Cabinetry

- Cabinets To Go

- Kabinet King

- The Corsi Group

- AyA Kitchens

- Cabinets.com

- Cosmo Cabinets

- Cosmo

- The RTA Store

- Columbia Cabinets

- Fine Kitchen Cabinet

- Wood-Mode

- Republic Elite

- Marsh Cabinets

- Harbour View Kitchen & Bath

- Alpine Cabinet

SEGMENTATION & FORECAST

Type (Revenue)

- Kitchen & Dining Cabinets

- Bathroom & Utility Cabinets

- Living Room Cabinets

- Bedroom Cabinet

- Home Office Cabinets

- Others

Distribution Channel (Revenue)

- Supermarkets & Hypermarkets

- Speciality Furniture & Home Improvement Store

- Online Channel

- Others

Application (Revenue)

- Repair & Remodelling

- New Construction

Installation (Revenue)

- Stock Cabinets

- Ready to Assemble (RTA) Cabinets

- Semi-custom Cabinets

- Custom built Cabinets

For more information about this report visit https://www.researchandmarkets.com/r/7meycz

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment