- Only 63% of global companies plan to increase AI spending in the next 12 months, compared to 93% in 2023

- Despite delays, the tech sector leads with the most deployed initiatives across all industries and half have already realized financial benefits

- Qualitative applications — generating FAQs or providing HR support — have been the most successful to date with roughly a quarter of planned initiatives already implemented

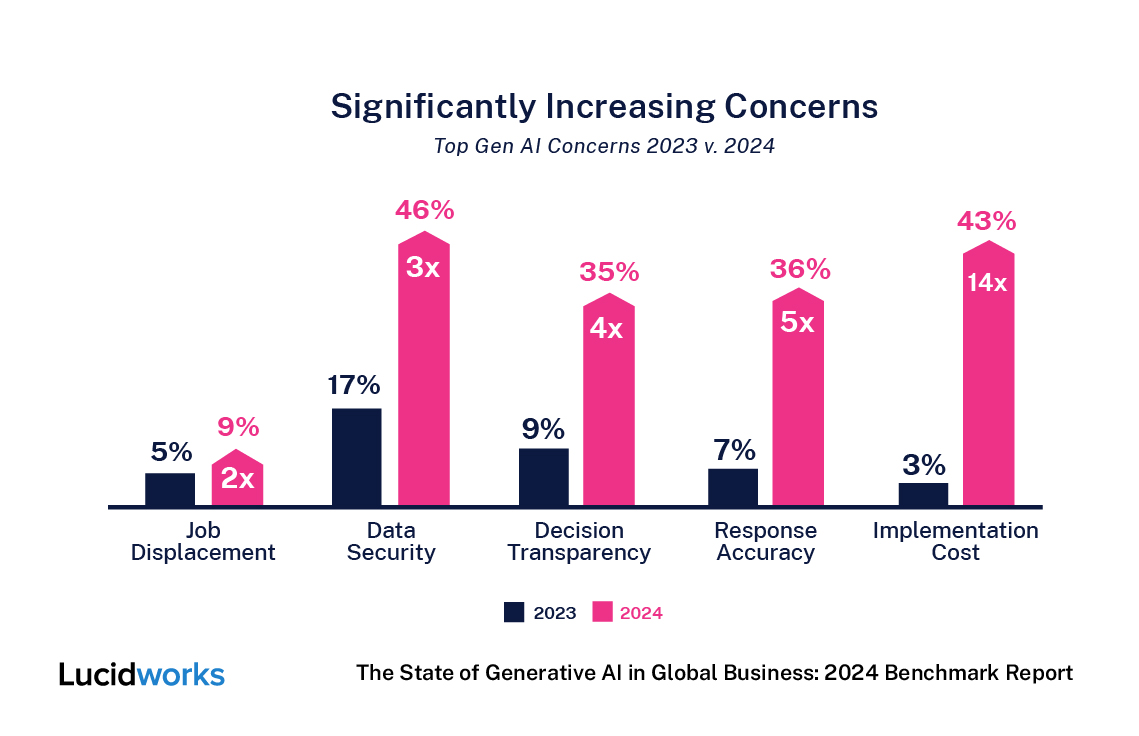

- Concerns about generative AI implementation costs increased by 14x in 2024

SAN FRANCISCO, June 11, 2024 (GLOBE NEWSWIRE) -- Lucidworks, a leader in search and total AI solutions, today released the results of its second annual Generative AI Global Benchmark Study, the largest ongoing global study of its kind. The study surveyed business leaders across North America, EMEA, and the APAC region who are actively pursuing generative AI initiatives. The report explores key areas of generative AI investment and organizations' progress in adopting the technology.

Flattened Spending Points to More Thoughtful Planning

Generative AI's explosive growth is cooling as businesses face cost and security hurdles. Global AI spending plans are down sharply, with only 63% planning increases (vs. 93% last year). USA-based organizations remain above average with 69% planning to increase AI spend. While investment remains high, more companies are prioritizing thoughtful planning to balance the potential of this new technology with managing risks and costs.

Deployment Delays Stall ROI

Despite initial hype, slow deployment and low success rates are commonplace, with only 25% of planned projects fully implemented. This lag is stalling anticipated ROI, with 42% of companies yet to see a significant benefit from generative AI initiatives. Tech and retail sectors stand out with higher deployment and realized gains, but overall, most industries are slow to move beyond the pilot phase.

Implementation Costs Raise Alarms

Security remains a top concern for business leaders, but cost worries have surged 14x in the past year. Additionally, concerns around response accuracy have risen 5x, likely due to issues with hallucinations. This highlights the need for careful large language model selection to balance cost and ensure accurate, secure results.

Practical Applications Are First to Deployment

Businesses are using generative AI to establish clear guidelines for AI use (governance) and automate tasks like generating first drafts of code (reducing G&A costs). This trend is driven by concerns around data privacy, security, and skyrocketing implementation costs. Qualitative applications like generating FAQs are seeing success, but more complex quantitative applications like fraud detection in financial services or predictive maintenance in manufacturing are lagging behind. The ability to analyze unstructured data and generate actionable insights holds the greatest potential for generative AI's future value.

"The initial wave of enthusiasm for generative AI is being met with a more strategic approach,” said Mike Sinoway, CEO, Lucidworks. “Businesses are recognizing the potential of this technology, but they're also cautious about the risks and costs. This is reflected in the flattened spending, which suggests a shift toward more thoughtful planning. This planning ensures AI adoption delivers real value, balancing the need to stay competitive with managing costs and potential risks."

The 2024 benchmark study also includes the following findings:

- Across all organizations, 36% of leaders plan to keep spending flat, compared to only 6% in last year’s survey

- Only 49% of Chinese leaders plan to increase AI spending in 2024, a massive drop from 100% in 2023

- Close to 70% of financial services companies plan to increase spending over the next 12 months, followed closely by tech at 68% and B2C retail at 64%

- Roughly 20% of companies report significant delays during deployment with only one in five planned revenue and growth initiatives and one in eight OpEx cost reduction initiatives implemented

- Retailers have some of the highest concerns around cost (63%), likely due to the required responsiveness and high number of customer queries

- Nearly eight in 10 companies use commercial LLMs and 21% have opted for open source only

- A third of business leaders feel like they’re falling behind competitors despite almost everyone struggling to implement this new technology

Download the complete 2024 Generative AI Global Benchmark Study here and learn more about Lucidworks at Lucidworks.com.

About Lucidworks

Lucidworks clients are more than 2.5x more likely to successfully deploy generative AI initiatives than their peers. The world's largest brands including Crate & Barrel, Lenovo, and Red Hat rely on Lucidworks' suite of products to power commerce, customer service, and workplace applications that delight customers and empower employees. Contact us today to build your AI success strategy.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/70e4f2a7-800d-4978-9f5d-30c0f02edb4d