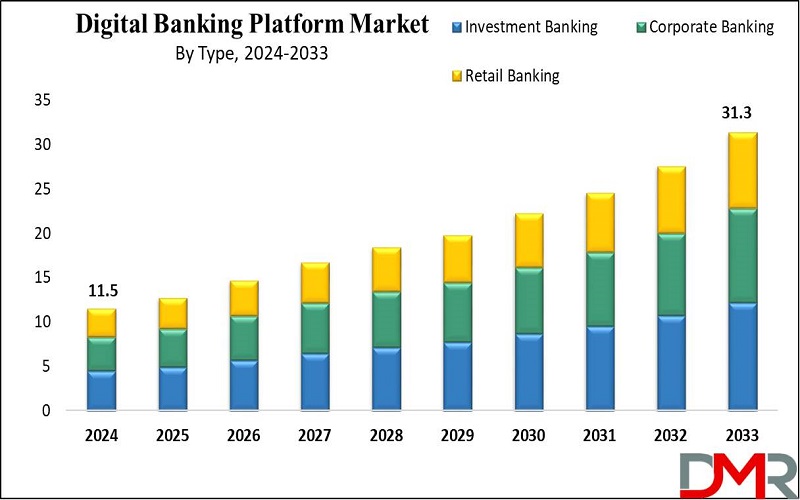

New York, July 02, 2024 (GLOBE NEWSWIRE) -- The Global Digital Banking Platform Market size is expected to reach USD 11.5 billion by 2024 and is further anticipated to reach USD 31.3 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 11.7% from 2024 to 2033.

Digital banking platforms transform modern banking operations by providing complete online & mobile services, using various financial transactions smoothly. Using biometric authentication, AI, & intuitive interfaces, they give importance to user engagement & security. Unlike standard online banking, they use API integration and automation to improve efficiency and provide a holistic digital banking experience while addressing concerns about data security carefully.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/digital-banking-platform-market/request-sample/

The platform segment is expected to maintain its dominance in the digital banking market in 2024, while services are expected to show significant growth. Fintech emergence has driven tech giants to develop platforms, encouraging banks to pursue digital transformations. Cloud adoption improves customer-centric strategies & lowers entry barriers, supporting new service offerings, as technological development focuses on improving efficiency, compliance, and customer experience in digital banking.

On-premises deployment is set to be dominant in the digital banking platform market in 2024, as institutions prioritize control & security. Compliance & data privacy concerns drive preference, mainly among larger banks. Further, cloud adoption is expected to grow highly as it plays a major role in inclusive banking initiatives, providing flexibility and scalability to extend services to deprived communities effectively, highlighting its important role in encouraging financial inclusivity and innovation.

Investment banking is projected to dominate the digital banking platform market with a significant 38.9% revenue share in 2024, driving overall market growth. Post-COVID-19 market re-openings have increased activity in this sector, allowing investment banks to use digital solutions for remote operations & client interactions. Further, retail banking anticipates high growth, requiring adaptation to changing consumer preferences & technological developments to remain competitive in the dynamic banking landscape.

Important Insights

- The Digital Banking Platform Market is expected to grow by USD 31.3 billion by 2033 from 2025 with a CAGR of 11.7%.

- Platforms is set to continue its lead in digital banking in 2024, with services poised for growth, as Fintech innovations drive digital transformations, supported by cloud adoption.

- On-premises deployment is anticipated to lead the digital banking platform market in 2024 for control and security, while cloud adoption promotes financial inclusivity & innovation.

- Investment banking is projected to lead digital banking with a 38.9% revenue share in 2024, driven by post-COVID market activity. Further, retail banking expects growth, demanding adaptation to stay competitive.

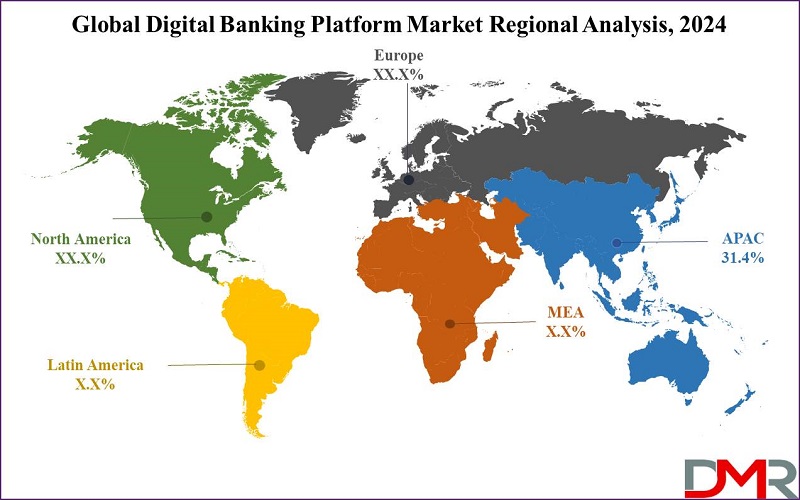

- Asia Pacific is set to lead with a 31.4% share in 2024 for the digital banking platform market, driven by emerging digital firms, while North America's tech infrastructure & innovative banking sector contribute to its market growth.

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/digital-banking-platform-market/download-reports-excerpt/

Global Digital Banking Platform Market: Growth Drivers & Trends

- Increasing Smartphone Penetration: The expansion of smartphones and internet connectivity across the world has largely expanded the user base for digital banking platforms, driving its market growth. As many individuals gain access to mobile devices, the need for convenient & accessible banking services through digital channels rises.

- Rising Customer Expectations for Seamless Banking Experience: Consumers largely expect smooth, user-friendly, and customized banking experiences. Digital banking platforms provide features like real-time account access, mobile payments, and personalized financial insights, meeting these changing customer expectations and driving market growth.

- Cost Reduction for Financial Institutions: Digital banking platforms allow financial institutions to streamline operations, automate processes, and reduce overhead costs associated with traditional brick-and-mortar branches, which impels banks to invest in digital transformation, further fueling market growth.

- Regulatory Support and Compliance Requirements: Regulatory initiatives focused on promoting digital financial services, improving cybersecurity, and supporting innovation in the banking sector contribute to market growth, as regulatory bodies across the world are highly supporting the adoption of digital banking platforms, creating a favorable environment for market expansion.

- Emergence of Fintech Startups and Partnerships: The growth of fintech startups specializing in digital banking solutions, along with partnerships between traditional financial institutions & technology firms, drives innovation and market growth. Collaboration allows stakeholders to use advanced digital capabilities, accelerate product development, and improve competitiveness in the evolving financial services landscape.

- Growing Demand for Contactless Banking Solutions: The growing focus on hygiene and safety, along with changing consumer preferences, has driven the demand for contactless banking solutions. Digital banking platforms provide secure and convenient ways for customers to conduct transactions, manage accounts, and access financial services without physical contact, which is driving market growth as financial institutions give importance to the development of contactless & remote banking capabilities to meet changing customer needs.

Digital Banking Platform Market: Competitive Landscape

The digital banking market consists of established financial institutions, emerging fintech startups, and tech giants. Established banks use brand reputation & customer base, while fintech startups innovate with customer-centric technologies.

Tech giants provide easy digital solutions. Regulatory shifts & changes in customer preferences constantly reshape the landscape, prompting both incumbents & newcomers to invest in digital capabilities and improve customer experiences to maintain competitiveness in this dynamic market.

Some of the prominent market players:

- Appway AG

- SAP SE

- Oracle Corp

- Tata Consultancy Service Ltd

- Worldline SA

- Alkami

- BNY Mellon

- Finastra

- NCR

- Temenos

- Other Key Players

Some of the major players in the market include Appway AG, SAP SE, Oracle Corp, Tata Consultancy Service Ltd, Worldline SA, Alkami, and more.

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/digital-banking-platform-market/

Digital Banking Platform Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 11.5 Bn |

| Forecast Value (2033) | USD 31.3 Bn |

| CAGR (2024-2033) | 11.7% |

| Historical Data | 2017 - 2022 |

| Forecast Data | 2025 – 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Component, By Technology, By Application |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Digital Banking Platform Market Segmentation

By Component

- Platform

- Services

- Professional Service

- Managed Service

By Deployment

- On-Premise

- Cloud

By Mode

- Online Banking

- Mobile Banking

By Type

- Investment Banking

- Corporate Banking

- Retail Banking

Regional Analysis

Asia Pacific is set to lead the digital banking platform market, capturing a major 31.4% share in 2024 and showcasing the highest growth potential. The region experiences significant growth driven by emerging digital firms, transforming banking experiences for both individuals & businesses. With the growing demand for mobile & online banking, established players and newcomers have many opportunities to grow, helped by regulators issuing more licenses and setting standards for banking innovation.

Further, North America provides an advanced technological infrastructure, better internet connectivity, and a tech-savvy consumer base, contributing to its significant market share. The region's strong economy and innovative banking sector drive the adoption of digital banking platforms, providing institutions with a strategic edge in providing personalized digital services and meeting changing customer demands for contactless and online transactions.

Get Ahead in the Market - Request Your Business-Boosting Sample Report@ https://dimensionmarketresearch.com/report/digital-banking-platform-market/request-sample/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Browse More Related Reports

- Air Conditioning Systems Market size was valued at USD 137.9 billion in 2023, and it is further anticipated to reach a market value of USD 258 billion by 2033 at a CAGR of 6.4%.

- Semiconductor Foundry Market is expected to reach a value of USD 114.1 billion in 2023, and it is further anticipated to reach a market value of USD 205.5 billion by 2032 at a CAGR of 6.8%.

- Barrier Films Flexible Electronics Market was valued at USD 40.6 million by the end of 2023 and is further anticipated to grow to a market value of USD 259.5 million by 2033, at a CAGR of 20.3%.

- Lithium-ion Battery Market size is expected to reach a market value of USD 84.3 billion in 2024 which is further projected to be valued at USD 470.5 billion in 2033 at a CAGR of 21.0%.

- Microprocessor Market is expected to reach a value of USD 131.9 billion by the end of 2024, and it is further anticipated to reach a market value of USD 250.2 billion by 2033 at a CAGR of 7.4%.

- Digital Banking Platform Market is expected to reach a value of USD 11.5 billion by the end of 2024, and it is further anticipated to reach a market value of USD 31.3 billion by 2033 at a CAGR of 11.7%.

- Controlled Environment Agriculture Market is projected to reach a market value of USD 127.1 billion in 2024 which is further projected to reach USD 616.6 billion in 2033 at a CAGR of 19.2%.

- Fiber Optics Market is expected to reach a value of USD 15.2 billion by the end of 2024, and it is further anticipated to reach a market value of USD 51.0 billion by 2033 at a CAGR of 14.4%.

- Vibration Control System Market is expected to reach a value of USD 5.8 billion by the end of 2024, and it is further anticipated to reach a market value of USD 10.2 billion by 2033 at a CAGR of 6.5%.

- Telecom Electronic Manufacturing Services (EMS) Market is expected to reach a value of USD 235.4 billion by the end of 2024, and it is further anticipated to reach a market value of USD 462.3 billion by 2033 at a CAGR of 7.8%.

Recent Developments in the Digital Banking Platform Market

- March 2024: Temenos announced that the Cooperative Bank of Oromia, among Ethiopia's largest banks, launched CoopApp & CoopApp Alhuda on Temenos Digital (Infinity), enhancing digital banking for 12 million customers.

- February 2024: Monex USA announced a partnership with Q2's Digital Banking Platform through the Q2 Partner Accelerator Program, supporting direct access to Monex's global financial solutions.

- October 2023: HDFC Bank launched XpressWay, a digital banking platform providing fast, paperless, self-service banking, as well as offering 30+ products including loans, credit cards, and savings accounts.

- October 2023: IndusInd Bank launched INDIE, a digital banking app, focused on reaching 10 million users in three years, contributing to a customer-centric approach.

- July 2023: Citi unveiled CitiDirect Commercial Banking, serving Citi Commercial Bank clients with a unified digital platform offering a complete banking experience.

- April 2023: Liberty Bank announced Alkami's cloud-based digital banking platform, improving personalized communication and integrating services for its retail and business clients.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.