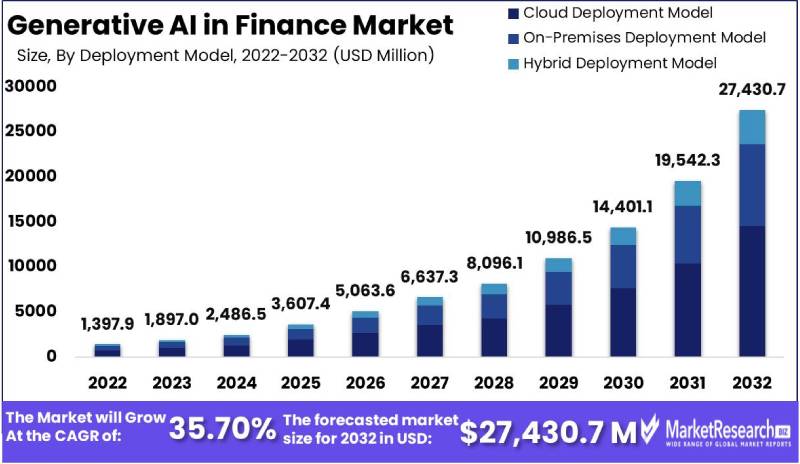

New York, June 05, 2023 (GLOBE NEWSWIRE) -- According to MarketResearch.Biz, the Generative AI in Finance Market size is projected to surpass around USD 27,430.7 million by 2032, and it is poised to reach a CAGR of 35.70% from 2023 to 2032. It accounted for USD 1,397.9 billion in 2022.

Generative AI is an emerging technology that is starting to gain traction in the finance industry. Generative AI can be used to create synthetic data that mimics real-world financial data, which can be used to train machine learning models to recognize patterns, identify trends as well as make predictions. It involves applying machine learning algorithms to produce new data and insights that can be utilized to guide financial decision-making across a variety of industries, including finance. In the context of finance, generative AI can be used to analyze large volumes of financial data, such as stock prices, trading volumes, and other market indicators, and generate new insights that can be used to make investment decisions, manage risk, and detect fraud in finance.

Request a Generative AI in Finance Market Report to find out more about the major revenue-generating segments @ https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Key Takeaway

- By deployment model, the cloud deployment segment accounted for the largest share of generative AI in finance market in 2022.

- By application, the risk management segment has dominated the market in 2022.

- By technology, the deep learning technology segment was dominant in the market, with the largest market share in 2022.

- In 2022, North America dominated the market with the highest revenue share 47.2%.

Factors affecting the growth of Generative AI in Finance Market

There are several factors that can affect the growth of generative AI in finance market. Some of these factors include:

- Growing demand for automation: finance institutions are under increasing pressure to reduce costs as well as improve efficiency. Generative AI can help automate a range of tasks, such as fraud detection, and risk analysis. This will help companies improve their

- Increasing volume of financial data: The finance industry generates large amounts of data, which can be difficult to process as well as analyze using traditional methods. Generative AI can help to analyze this data more quickly and accurately, providing insights & predictions that can be used to inform business decisions

- Need for better risk management: The finance industry is highly regulated and faces significant risks, such as fraud & cyber-attacks. Generative AI can help to identify potential risks and threats more quickly and accurately than traditional methods, improving overall risk management.

Get a brochure to learn how the Generative AI in Finance Market report can make a difference in your business strategy @ https://marketresearch.biz/report/generative-ai-in-finance-market/#inquiry

Top Trends

- Increasing use of predictive analytics: Predictive analytics is a branch of data analytics that uses machine learning algorithms to identify patterns and make predictions. In the finance sector, predictive analytics can be used for fraud detection, risk management as well as investment recommendations. By using generative AI for predictive analytics, financial institutions can make more informed decisions & reduce risks.

- Emphasis on explainable AI: Explainable AI is an emerging field of research that focuses on developing algorithms that can explain their decision-making process. In the finance sector, explainable AI is becoming increasingly important as regulators require greater transparency as well as accountability from financial institutions.

- Use of generative adversarial networks (GANs): GANs are a type of generative AI that can generate synthetic data that simulates fraudulent behavior, enabling financial institutions to better detect & prevent fraud.

Market Growth

Several factors driving the growth of the market. Such as the rising adoption of AI technologies by financial institutions to enhance their operations as well as customer services, the increasing volume of financial data generated by organizations, and the need to improve risk management & fraud detection capabilities. Moreover, the rising requirement for personalized financial services, such as wealth management and financial planning is expected to drive the adoption of generative AI solutions in the finance sector. Additionally, the emergence of explainable AI is expected to further boost the growth of the market, as it helps ensure transparency as well as accountability in AI decision-making processes.

Regional Analysis

North America is one of the largest markets for generative AI in finance. The region benefits from a strong financial infrastructure, an acceptable regulatory framework, and advanced technological expertise. The greatest market in this region is the United States, which has a high rate of generative AI technology adoption. Due to reasons like rising AI investment, a significant customer base, and favorable government policies, the European generative AI in finance market is expanding quickly. Major markets in this region include the UK, Germany, France, and Spain. In the upcoming years, the Asia-Pacific generative AI in finance market is anticipated to rise significantly, propelled by rising financial institutions' investments in AI, rising consumer demand for personalized financial services, and a growing customer base. China, Japan, and India are the major markets in this region.

Competitive Landscape

The generative AI in finance market is highly competitive, with a large number of established players and new entrants. Here are some of the major players in the market such as IBM is a leading player in the AI industry and offers a range of AI solutions for the finance industry, including AI-powered fraud detection, risk management, and personalized banking services.

Have Queries? Speak to an expert, or To Download/Request a Sample, Click here.

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | US$ 1,397.9 Mn |

| Market Size (2032) | US$ 27,430.7 Mn |

| CAGR (from 2023 to 2032) | 35.70% |

| North America Revenue Share | 47.2% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

- Machine learning algorithms have advanced: Deep learning and reinforcement learning are two of the most advanced algorithms in machine learning. They allow models to be trained on large amounts of data as well as produce highly accurate predictions. Financial institutions can now use generative AI for many applications including portfolio optimization and fraud identification.

- A rising amount of data: The finance sector is generating vast amounts of data every day, which can be challenging to analyze using traditional methods. Generative Ai can help financial institutions to leverage this data by generating new insights & predictions that can inform decision-making.

- Cost savings: Generative AI can help financial institutions reduce costs by automating processes that were previously performed manually, including data analysis and fraud detection. This can enable financial institutions to enhance their efficiency and reduce their operational costs.

Market Restraints

Data privacy and security concerns, Limited interpretability, and Implementation challenges are Restraining the Growth of the Market.

- Data privacy and data security concerns: Generative AI needs access to a large amount of financial information, which could raise questions about data security & privacy. Financial institutions need to ensure they collect and store data securely, as well as comply with regulations regarding data privacy.

- Limitation in interpretability: Because generative AI models are complex and hard to interpret, it can be difficult for financial institutions to understand how they make predictions. It can be difficult to detect errors or biases within the models. This may limit the utility of generative AI in certain applications.

- Implementation challenges: Implementing solutions based on generative AI can be difficult, especially for smaller financial institutions which may lack the expertise or resources to create and deploy such solutions. Hiring data scientists, creating algorithms, and integrating generative AI with existing systems and processes can be expensive.

Market Opportunities

The growth opportunities for generative AI in finance are significant, and there are several areas where generative AI has the potential to transform the industry. Some of these growth opportunities include:

- Risk management: Generative artificial intelligence can be used in financial services to better manage risks. This will allow financial institutions to identify risk and manage it more effectively. The use of generative AI is also used for fraud detection, prevention and assessment, and management of credit and market risks.

- Chatbots and virtual assistants: The banking sector may employ generative AI to create chatbots & virtual assistants that can offer customer support and assistance. These chatbots and virtual assistants can be programmed to understand and respond to client inquiries as well as offer tailored advice depending on customer data.

Grow your profit margin with Marketresearch.biz- Purchase This Premium Report at@ https://marketresearch.biz/purchase-report/?report_id=37125

Report Segmentation

Deployment Model Insight

Based on the deployment model, Cloud Deployment is currently the dominant deployment model in the Generative AI in Finance Market. Cloud-based technologies are increasingly being adopted by the financial sector, and cloud deployment offers many benefits, including scalability. flexibility, and cost-effectiveness. Cloud deployment allows financial institutions to quickly and easily access AI resources and capabilities, without needing to invest in hardware and infrastructure. In recent years, on-premises and hybrid deployments have also seen significant growth. This is because some financial institutions choose to keep their AI data and infrastructure on-premises, either for regulatory or security reasons, but others do it to benefit from both cloud and on-premises deployment models.

Application Insight

Based on the application, The Risk Management segment dominates the Generative AI in Finance Market by Application. The market is dominated by the Risk Management application segment due to increasing demand for AI-powered risk management solutions that can assist financial institutions in identifying, analyzing, and mitigating risks in real-time. By analyzing huge amounts of data, and identifying risks, generative AI can assist financial institutions in making more informed decisions. Other application segments, such as Fraud Detection and Investment Research, as well as Trading Algorithms, are expected to grow significantly in the next few years, as financial institutions adopt AI technology to improve their efficiency.

Technology Insight

Based on the technology, Deep Learning Technology dominates the generative AI in finance market. Deep Learning has revolutionized the field of machine learning by allowing computers to learn complex patterns from large amounts of data. This makes it ideal for analyzing financial information and forecasting market movement. Deep learning algorithms are capable of processing huge amounts of data including stock prices and trading volumes. This technology is also being used to develop trading algorithms that can buy and sell automatically based on market data in real-time. The technology of natural language processing involves the analysis and generation of human language. This technology is used for applications like sentiment analysis.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at@ https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Market Segmentation

Based on the Deployment Model

- Cloud Deployment

- On-Premises Deployment

- Hybrid Deployment

Based on the Application

- Risk Management

- Fraud Detection

- Investment Research

- Trading Algorithms

- Other Applications

Based on the Technology

- Deep Learning Technology

- Natural Language Processing Technology

- Computer Vision Technology

- Reinforcement Learning Technology

- Other Technologies

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Key Players

- IBM Corporation

- NVIDIA Corporation

- DataRobot, Inc.

- Symphony Ayasdi

- Kavout

- AlphaSense

- Other Key Players

Recent Development

- Goldman Sachs announced in 2022 their plans to employ Generative AI for creating synthetic data sets used for testing trading strategies and risk assessments.

- JPMorgan Chase announced their AI initiative to monitor large volumes of transaction data to detect suspicious patterns that could indicate any fraudulent activities.

- 2022: BlackRock announced their intention to use artificial intelligence that is generative to expand their portfolio of risk management and optimization solutions.

- 2022: FICO unveiled plans to use Generative AI for creating synthetic credit card applications which will improve its Fraud detection algorithms.

- 2022: Moody's Analytics announced it would use artificial intelligence-generated synthetic credit ratings for training its credit risk models.

Related Reports

- Generative AI in the Financial Services Market size is expected to be worth around USD 9,475.2 Mn by 2032 from USD 847.2 Mn in 2022, growing at a CAGR of 28.1% during the forecast period from 2023 to 2032.

- Generative AI in Insurance Market size is expected to be worth around USD 5,543.1 Mn by 2032 from USD 346.3 Mn in 2022, growing at a CAGR of 32.9% during the forecast period from 2023 to 2032.

- Generative AI in Retail Market size is expected to be worth around USD 8,386 Mn by 2032 from USD 395 Mn in 2022, growing at a CAGR of 36.8% during the forecast period from 2023 to 2032.

- Money Transfer Services Market size is expected to be worth around USD 110.8 Bn by 2032 from USD 26.5 Bn in 2022, growing at a CAGR of 15.8 % during the forecast period from 2023 to 2032.

About Us:

MarketResearch.biz (Powered by Prudour Pvt. Ltd.) delivers customized research solutions by actuating its broad spectrum of research methodologies, databases, and resources, and this is further strengthened by our global experience in syndicated and customized industry projects. Our tailor-made research services include quick market scans, country reports, in-depth market analysis, competition monitoring, consumer research and satisfaction studies, supplier research, growth planning, and quite a lot more.

Follow Us on LinkedIn: https://www.linkedin.com/company/marketresearch-biz/

Follow Us on Facebook: https://www.facebook.com/marketresearch.biz

Follow Us on Twitter: https://twitter.com/PrudourResearch