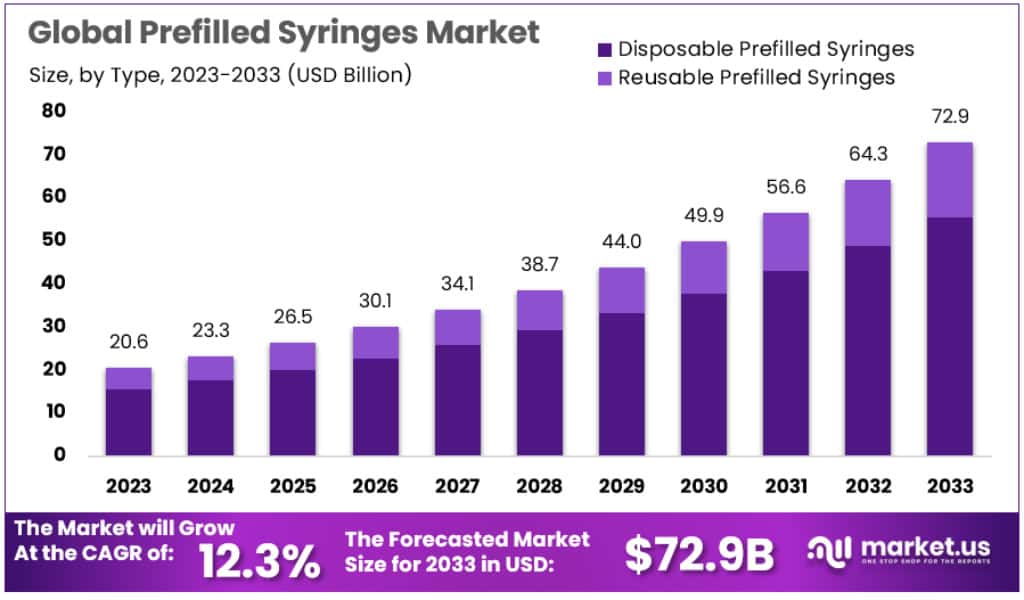

New York, Jan. 22, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Global Prefilled Syringes Market size is forecasted to exceed US$ 72.9 Billion by 2033, with a promising CAGR of 12.3% from 2024 to 2033.

A pre-filled syringe is a syringe that is preloaded with a specific dosage of medication and is equipped with an attached needle. This design streamlines the injection process, eliminating the need for manual measurement of medication before administration. The healthcare industry is increasingly favoring pre-filled syringes due to their user-friendly nature, which reduces the risk of dosage errors, enhances convenience, and offers various other advantages.

Access a comprehensive market analysis featuring key trends, drivers, and challenges, empowering clients to optimize their strategies and outshine competitors. Check out the PDF sample report @ https://market.us/report/prefilled-syringes-market/request-sample/

Key Takeaway

- By type, the market shows 2 segments, namely - disposable and reusable. the disposable type maintained a stronghold on the market in 2023.

- As far as applications are concerned, the market is segmented into diabetes, anaphylaxis, rheumatoid arthritis and others. Diabetes was the leading segment with the highest market share.

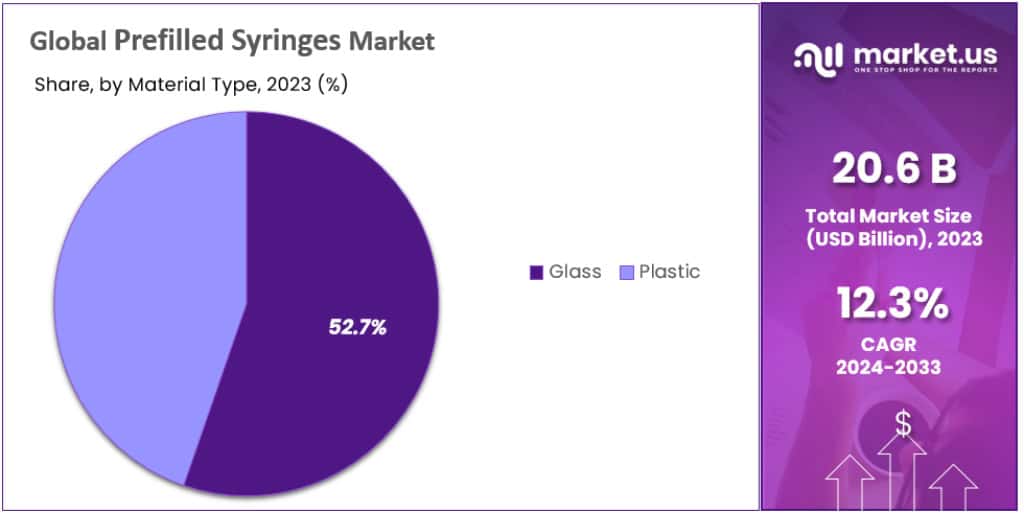

- Based on material type, the market is bifurcated into glass and plastic. Glass syringes are much more popular than plastic ones and thus claimed a revenue share of 52.7%.

- When classified based on distribution channel, the market is divided into hospitals, mail order pharmacies and ambulatory surgical centres. Among these, hospitals remained the largest contributor in 2023.

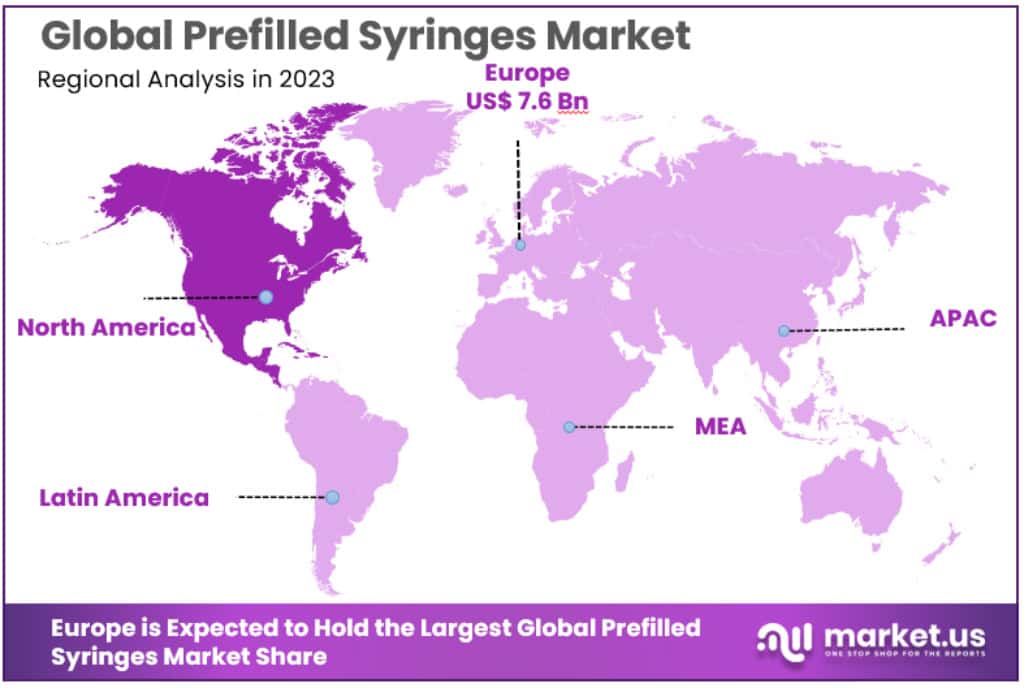

- Europe emerged as a top contributor to the market in 2023, with North America following close behind.

Factors affecting the growth of the Prefilled Syringes market

- The increasing number of chronic diseases have accelerated the growth of the market.

- While prefilled syringes are considered relatively safe, they can cause injuries. The additional cost of making them injury-proof may have negative influence on the market.

- Such syringes can assist in improving quality of healthcare in developing countries. This creates unexplored opportunities, that can be exploited to boost market growth.

- There are cheaper substitutes available for prefilled syringes can hinder market expansion.

Top Trends in the Global Prefilled Syringes Market

There is a notable shift in the pharmaceutical industry from traditional chemical drugs to biologics and biosimilars, driven by their efficacy in targeted treatments and reduced potential for drug interactions. A growing number of these advanced drugs are now being packaged in prefilled syringes. For instance, as of January 2022, the FDA had approved 33 biosimilars, and this trend is expected to continue. Patients are increasingly expressing a preference for biosimilar drugs delivered via prefilled pens over traditional syringes, indicating a shift towards user-friendly and convenient drug administration methods in the healthcare landscape.

Market Growth

The prefilled syringe market is experiencing robust growth, driven by a combination of technological advancements, increasing prevalence of chronic diseases, and a growing emphasis on patient-friendly drug delivery systems. Key players such as Becton Dickinson (BD), West Pharmaceutical Services, SCHOTT Pharmaceutical Packaging, AptarGroup, and Gerresheimer have introduced innovative products, elevating safety, efficiency, stability, and user convenience in the prefilled syringe landscape. The market's expansion is further fueled by the rising demand for biologics and biosimilars, which are often packaged in prefilled syringes.

Additionally, the global healthcare spending trend, expected to triple by 2040, presents a significant opportunity for the continued growth of prefilled syringes, particularly in regions like Europe and North America where the market is already prominent. The continual focus on product development, strategic collaborations, and addressing evolving healthcare needs positions the prefilled syringe market for sustained growth in the foreseeable future.

Macroeconomic Factors

The overall expenditure on healthcare services and products is a crucial factor. As healthcare spending increases globally, the demand for advanced drug delivery systems such as prefilled syringes is likely to rise, especially as these syringes become preferred choices for various medications. The prevalence of chronic diseases, such as diabetes, autoimmune disorders, and cardiovascular diseases, impacts the demand for prefilled syringes.

As the incidence of chronic illnesses increases, there is a higher need for convenient and precise drug administration, favoring the growth of the prefilled syringe market. Ongoing advancements in technology, especially in materials, manufacturing processes, and drug formulations, play a significant role. Innovations that enhance the safety, stability, and convenience of prefilled syringes can drive market growth.

Regional Analysis

In 2023, Europe held a leading position in the prefilled syringes market, commanding a substantial 37.1% share and boasting a market value of USD 7.6 billion. The region's prominence can be attributed to a widespread adoption of biologics for managing chronic diseases, coupled with a robust trend toward advanced self-injection methods. Key European companies playing a pivotal role in manufacturing prefilled syringes contribute significantly to the market's growth.

Notably, in November 2022, the Schreiner Group and SCHOTT Pharma collaborated to introduce a new syringe embedded with RFID technology, showcasing the region's commitment to innovation. This technological advancement is expected to enhance supply management in hospitals, further propelling the prefilled syringes market in Europe.

Following Europe, North America is a significant player in the prefilled syringes market. The region is witnessing an uptick in demand driven by the rising prevalence of chronic diseases such as diabetes and rheumatoid arthritis. This surge in chronic conditions is fueling the need for precise and sustained drug delivery, creating a favorable environment for prefilled syringes. The market's growth in North America is further supported by continuous new product launches and the robust networks established by leading companies in the pharmaceutical and healthcare sectors. This combination of factors contributes to the expansion of the prefilled syringes market in the region.

Gain a deeper understanding of how our report can elevate your business strategy. Inquire here: https://market.us/report/prefilled-syringes-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 20.6 Billion |

| Forecast Revenue 2033 | USD 72.9 Billion |

| CAGR (2024 to 2033) | 12.3% |

| Europe Revenue Share | 37.1% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

Prefilled syringes find extensive use, particularly in the treatment of chronic diseases such as heart problems, diabetes, and autoimmune conditions, where patients require regular self-administration of medication. The global increase in the prevalence of long-term and lifestyle-related diseases significantly contributes to the expanding market for prefilled syringes. Their popularity is further fueled by the ease and safety they offer for self-administration by patients. The convenience and user-friendly nature of prefilled syringes make them a preferred choice for individuals who need to manage their health by administering medication regularly.

Market Restraints

Prefilled syringes, while considered safer than drawing medicine from vials, still pose a risk of needle stick injuries if they lack appropriate safety features. Approximately 500,000 injuries occur annually in the US, and 1,000,000 in Europe due to this issue. The imperative for syringes with built-in safety features is evident; however, their production presents challenges due to associated costs and manufacturing complexities. The healthcare industry is actively addressing this concern, working towards the development of safer prefilled syringes to mitigate the incidence of needle stick injuries and enhance overall safety for both healthcare professionals and patients.

Market Opportunities

The insufficient availability of healthcare services, particularly in regions like Africa and South Asia, remains a critical global challenge, leaving around 400 million people without essential healthcare. Despite this gap, there is a notable trend of increasing healthcare spending globally, with expenditures rising from 8% to nearly 10% of GDP, amounting to approximately $8 trillion annually. Forecasts indicate that this spending is projected to triple by 2040. This upward trajectory creates a significant opportunity for the expanded utilization of prefilled syringes in these expanding healthcare markets. Prefilled syringes, known for their convenience and safety features, could play a crucial role in addressing healthcare needs and improving medical delivery methods in regions experiencing growth in healthcare spending.

Get Immediate Delivery | Secure Your Copy of This High-Quality Research Report Now https://market.us/purchase-report/?report_id=45833

Report Segmentation of the Prefilled Syringes Market

Type Insight

In 2023, disposable prefilled syringes established a significant market dominance, claiming over a 76% share. This segment's prominence is propelled by the convenience and safety it offers. Disposable prefilled syringes are designed for single use, eliminating the need for cleaning and sterilization and reducing the risk of infections. Their widespread adoption in vaccination programs and chronic disease management further contributes to their popularity in the healthcare industry.

Application Insight

In 2023, diabetes emerged as the leading market segment for prefilled syringes, commanding a substantial share of over 51.9%. This dominance is primarily attributed to the pivotal role that prefilled syringes play in the administration of insulin, a critical component in diabetes management. The high preference for prefilled syringes among diabetic patients is driven by their user-friendly design, precise dosing capabilities, and overall convenience, especially for individuals who require regular insulin injections.

Material Type Insight

In 2023, glass prefilled syringes secured a prominent market position, commanding a share exceeding 52.7%. This dominance is primarily attributed to the superior stability and lower reaction rates with medications exhibited by glass syringes. Renowned for their exceptional chemical resistance, these syringes play a crucial role in maintaining the purity and effectiveness of medications. Additionally, their clarity and durability contribute to their preference in various medical applications, solidifying their reputation as a reliable choice in the healthcare industry.

Distribution Channel Insight

In 2023, hospitals emerged as key players in the distribution of prefilled syringes, dominating the market with a share exceeding 48.9%. This dominance is primarily attributed to the pivotal role hospitals play as primary centers for various medical treatments, where the extensive use of prefilled syringes is integral. The preference for prefilled syringes in hospitals is driven by the necessity for efficient, safe, and rapid medication delivery, meeting the demands of both inpatient and outpatient care requirements.

Recent Development of the Prefilled Syringes Market

- In June 2023, Gerresheimer rolled out SmartPack, an advanced prefilled syringe packaging system. Engineered to safeguard prefilled syringes from potential damage and tampering during shipping and storage, SmartPack addresses critical concerns in the transportation and storage of these medical devices.

- In July 2023, AptarGroup introduced Click2Pen, an innovative prefilled syringe delivery system. Designed to enhance patient convenience, this system facilitates easier self-administration of injections, emphasizing user-friendly design.

- In August 2023, SCHOTT Pharmaceutical Packaging launched OPTIMA, a groundbreaking prefilled syringe known for its enhanced durability and break-resistant properties. This innovation aims to surpass the capabilities of traditional prefilled syringes.

- In September 2023, West unveiled NovaPure, a cutting-edge prefilled syringe closure. This closure is engineered to elevate the stability and integrity of prefilled syringes, addressing crucial aspects of product preservation.

- In October 2023, BD introduced the BD Intevia, a novel prefilled syringe platform. Geared towards enhancing safety and efficiency in both prefilled syringe manufacturing and administration, this platform signifies a significant advancement in the field.

Market Segmentation

Type

- Disposable Prefilled Syringes

- Reusable Prefilled Syringes

Material Type

- Glass

- Plastic

Application Outlook

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Other Applications

Distribution Channel

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

By Geography

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Access a comprehensive market analysis featuring key trends, drivers, and challenges, empowering clients to optimize their strategies and outshine competitors. Check out the PDF sample report @ https://market.us/report/prefilled-syringes-market/request-sample/

Competitive Landscape

The competitive landscape of the prefilled syringe market is marked by dynamic innovation and strategic initiatives among key players. Becton Dickinson (BD) entered the market with the BD Intevia platform, emphasizing safety and efficiency in manufacturing and administration. West Pharmaceutical Services introduced NovaPure, a closure enhancing stability, while SCHOTT Pharmaceutical Packaging launched OPTIMA, prioritizing durability. AptarGroup's Click2Pen focuses on patient convenience, and Gerresheimer's SmartPack addresses protection during shipping. These developments underscore the intense competition and commitment to advancements in safety, convenience, and product integrity within the prefilled syringe market, with companies vying to distinguish their offerings and meet the evolving needs of healthcare delivery.

Market Key Players

- Gerresheimer AG

- Becton, Dickinson and Company

- SCHOTT AG

- West Pharmaceutical Services Inc.

- Unilife Corporation

- Nipro Medical Corporation

- Owen Mumford

- Haselmeier AG

- BD

- Other Key Players

Browse More Related Reports

- Radiopharmaceuticals Market size is expected to be worth around USD 10.3 Billion by 2032 from USD 4.5 Billion in 2022

- Influenza Vaccine Market size is expected to be worth around USD 6.2 Billion by 2022 from USD 12.6 Billion in 2032

- Veterinary Vaccines Market size is expected to be worth around USD 22.1 Billion by 2032 from USD 11.2 Billion in 2022

- Bronchoscopes Market was valued at USD 2.8 Bn. Between 2023 and 2032, this market is estimated to reach USD 7.0 Bn

- Ophthalmic Drugs Market was worth USD 35.6 billion and will reach USD 74.7 billion by 2032

- Cell Therapy Market size is expected to be worth around USD 26.8 Billion by 2033, from USD 5.6 Billion in 2023

- Biopharmaceuticals Market size is expected to be worth around USD 566 billion by 2032 from USD 263 billion in 2022

- Fibrin Sealants Market size is expected to be worth around USD 2,561.1 Million by 2032 from USD 1,209.3 Million in 2022

- Radiotherapy Market size is expected to be worth around USD 32.6 Billion by 2032 from USD 6.5 Billion in 2022

- Population Health Management Market size is expected to be worth around USD 100.6 Billion by 2032 from USD 27.8 Billion in 2022

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: