Source : Market.Us

Identity Theft Protection Services Market Set to Hit USD 34.7 Billion by 2032, Amid Growing Application in Cybersecurity

Growing awareness among individuals and businesses regarding the risks associated with identity theft has fueled the demand for protection services. This awareness has been a significant catalyst for market growth. The adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) has enhanced the capabilities of identity theft protection services. These technologies offer real-time monitoring and rapid response to potential threats.

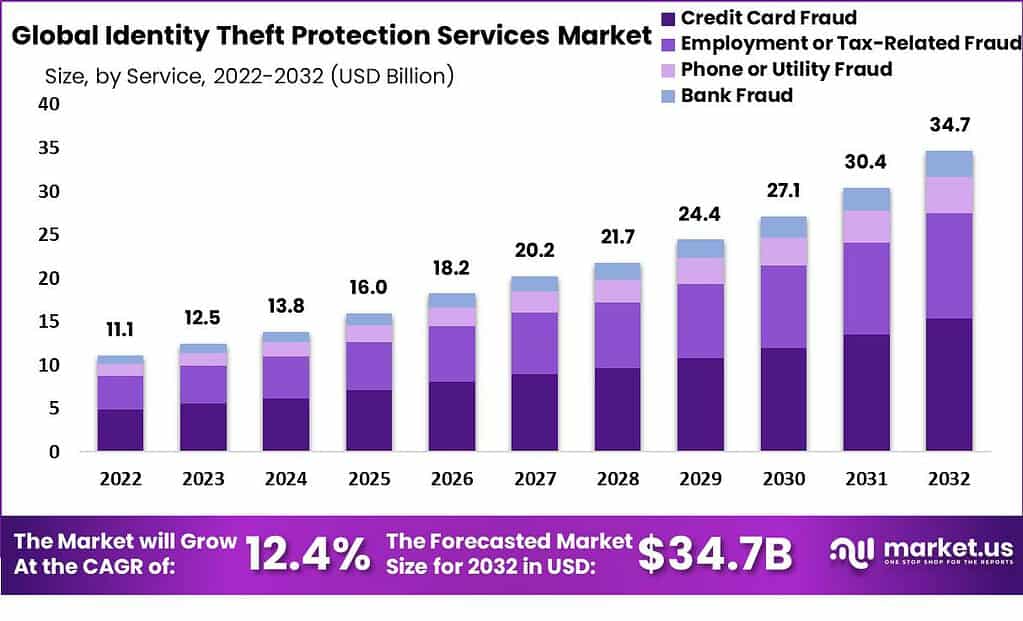

New York, Jan. 29, 2024 (GLOBE NEWSWIRE) -- According Market.us, The Identity Theft Protection Services Market size is expected to be worth around USD 34.7 Billion by 2032, from USD 12.5 Billion in 2023, growing at a CAGR of 12.4% during the forecast period from 2024 to 2033.

Identity theft protection services are designed to help individuals and organizations safeguard their personal and sensitive information from fraudulent activities and identity theft. These services typically include features such as credit monitoring, identity monitoring, dark web monitoring, identity theft insurance, and resolution assistance

The Identity Theft Protection Services Market, driven by increasing cybersecurity concerns and the rising incidence of identity theft, offers a wide array of solutions from various providers. This market is characterized by continuous innovation in response to evolving threats, with an emphasis on technological advancements such as artificial intelligence and machine learning to enhance detection and prevention capabilities. As identity theft remains a persistent and costly issue, the demand for these services is expected to continue growing, making the market a critical component of modern digital security and privacy strategies.

Don't miss out on business opportunities | Get sample pages at https://market.us/report/identity-theft-protection-services-market/request-sample/

Important Revelation:

- The Identity Theft Protection Services market is projected to reach a valuation of USD 34.7 billion by 2032, growing at a robust CAGR of 9.6%. In 2023, it was valued at USD 12.5 billion.

- Credit Card Fraud dominates the market, with a major revenue share of 44.3% in 2022. Bank fraud is expected to grow rapidly due to the demand for swift online transactions.

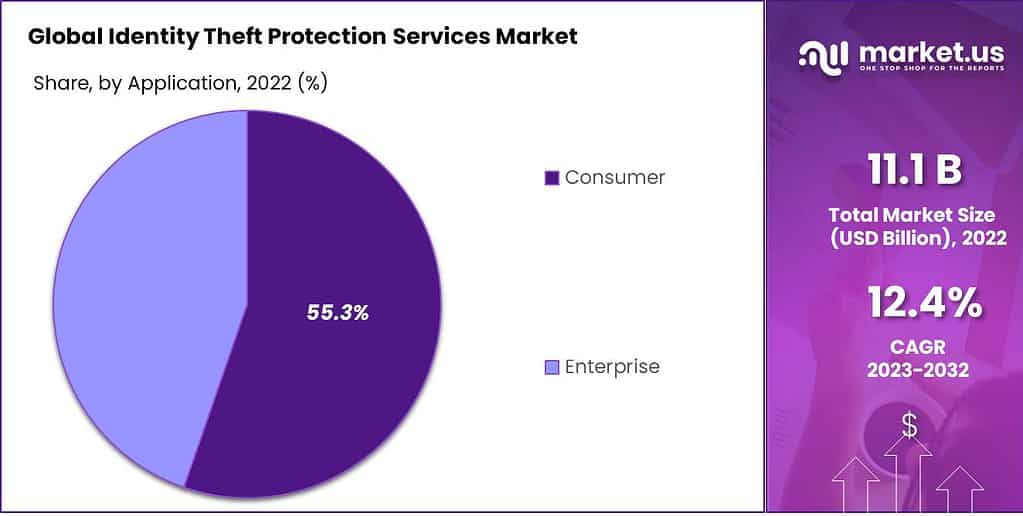

- The consumer segment leads the market with a major revenue share of 55.3% in 2022. However, the enterprise segment is expected to exhibit the highest CAGR in the future.

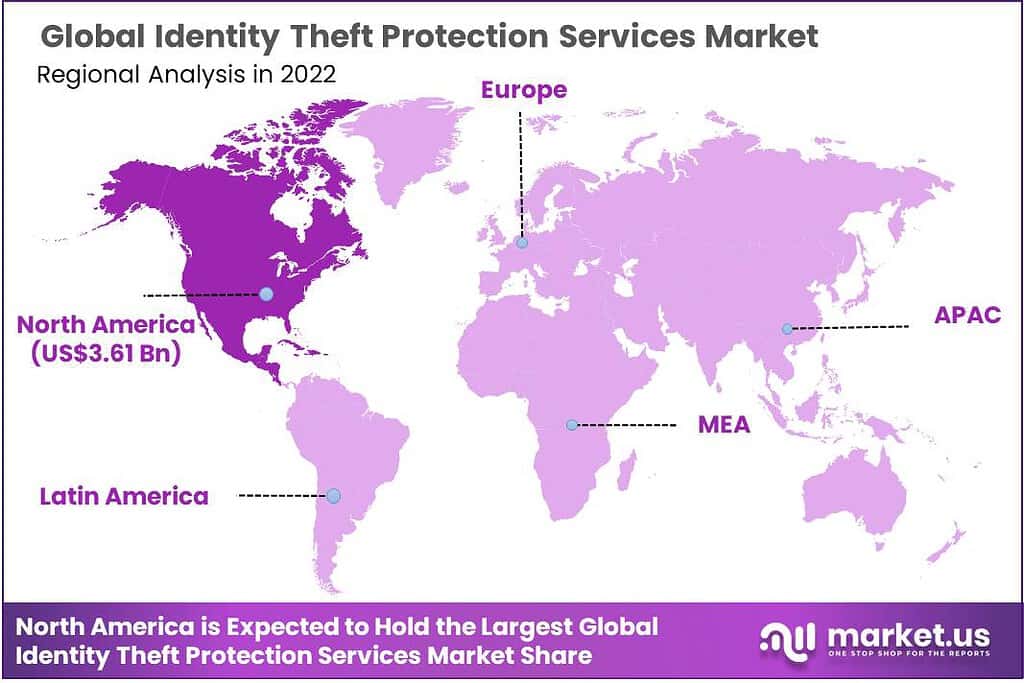

- North America dominates the market with a major revenue share of 32.5% in 2022, while Asia Pacific is expected to be the fastest-growing regional market.

- Some of the key players in the market include Symantec Corporation, Experian plc, Equifax Inc., TransUnion, McAfee Corp., Identity Guard, and others.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=12695

Factors Affecting the Growth of the Global Identity Theft Protection Services Market

- Increasing Incidence of Identity Theft: The rising frequency and sophistication of identity theft incidents are driving the demand for identity theft protection services. As cybercriminals continue to exploit vulnerabilities in digital systems, individuals and organizations are becoming more aware of the risks and seeking comprehensive protection measures.

- Stringent Data Protection Regulations: The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), has compelled organizations to prioritize the security of personal data. Compliance with these regulations requires robust identity theft protection measures, leading to the growth of the market.

- Growing Cybersecurity Concerns: The ever-evolving landscape of cybersecurity threats, including data breaches and hacking incidents, has intensified concerns about identity theft. Individuals and businesses are increasingly investing in identity theft protection services to mitigate the risks associated with cyberattacks.

- Increasing Digitization: The rapid digitization of personal information, fueled by the proliferation of online transactions, social media, and cloud storage, has expanded the attack surface for cybercriminals. This digital transformation has made individuals and organizations more vulnerable to identity theft, leading to a greater need for protection services.

- Technological Advancements: The advancement of technologies such as artificial intelligence (AI), machine learning (ML), and blockchain has enhanced the capabilities of identity theft protection services. These technologies enable more accurate detection of suspicious activities and provide proactive protection against identity theft incidents.

Driver: Growing Cybersecurity Concerns

The growth of the Identity Theft Protection Services Market can be attributed to the increasing concerns related to cybersecurity. In an era marked by the proliferation of digital transactions and the internet's pervasive presence in our lives, individuals and organizations alike are becoming acutely aware of the risks associated with identity theft and cyberattacks. This heightened awareness has driven the demand for identity theft protection services, as consumers and businesses seek comprehensive solutions to safeguard their sensitive information and financial assets.

Restraint: Cost of Services

One notable restraint in the Identity Theft Protection Services Market is the cost associated with these services. While the importance of protecting one's identity is undeniable, the expenses incurred in securing such services can be a deterrent for some consumers. The need for striking a balance between providing robust identity theft protection and ensuring affordability is a challenge that service providers in this market must address to cater to a broader customer base.

Opportunity: Expansion of Online Transactions

An exciting opportunity on the horizon for the Identity Theft Protection Services Market lies in the continued expansion of online transactions. With the global shift towards e-commerce, digital banking, and other online activities, the potential for identity theft has grown significantly. This presents a fertile ground for identity theft protection services to thrive, as consumers and businesses seek proactive measures to safeguard their digital identities and financial assets.

Challenge: Lack of Awareness

A substantial challenge faced by the Identity Theft Protection Services Market is the lack of awareness among potential customers. Many individuals and businesses remain uninformed about the risks of identity theft and the availability of effective protection services. Bridging this awareness gap through targeted marketing and education campaigns is crucial for market players to tap into the full potential of this industry.

Are you a start-up willing to make it big in the business? Grab an exclusive sample of this report here

Report Segmentation

By Type Analysis

In 2022, the Credit Card Fraud segment held a dominant market position in the Identity Theft Protection Services market, capturing more than a 44.3% share. Credit card fraud has remained a significant concern for individuals and businesses due to its prevalence and potential financial impact. With the widespread use of credit cards for online and offline transactions, cybercriminals have targeted credit card information for unauthorized purchases and fraudulent activities.

The increasing sophistication of hacking techniques and the growth of e-commerce have contributed to the rise in credit card fraud incidents. To address this challenge, identity theft protection services focusing on credit card fraud offer features such as real-time monitoring, alerts for suspicious activities, and assistance in resolving fraudulent transactions. These services help individuals and organizations detect unauthorized credit card usage promptly, minimizing financial losses and protecting their credit profiles.

Additionally, with the introduction of advanced technologies like machine learning and AI, credit card fraud detection has become more accurate and efficient. The growing adoption of these services has been driven by the increasing awareness among consumers about the risks associated with credit card fraud and their proactive approach to protecting their financial information. As a result, the Credit Card Fraud segment has maintained its dominant position in the market, and its significance is expected to continue in the coming years.

By Application Analysis

In 2022, the Consumer segment held a dominant market position in the Identity Theft Protection Services market, capturing more than a 55.3% share. This predominance can be attributed to several key factors. Firstly, the escalating prevalence of digital transactions and online activities among individuals has heightened the risk of personal data breaches. This trend is further exacerbated by the increasing sophistication of cyber-attacks targeting personal information. Consequently, there is a growing awareness among consumers about the importance of safeguarding their digital identities, leading to higher demand for identity theft protection services.

Additionally, regulatory changes and an emphasis on data privacy have played a significant role. With regulations like the General Data Protection Regulation (GDPR) in Europe and similar laws in other regions, individuals are more conscious of their rights and the need to protect their personal information. This regulatory environment has both educated and incentivized consumers to seek services that ensure their digital safety.

For a better understanding, refer to this sample report, which includes corresponding tables and figures@ https://market.us/report/identity-theft-protection-services-market/request-sample/

Top Key Players

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- Symantec Corporation

- Experian plc

- Equifax Inc

- TransUnion

- RELX PLC

- PrivacyGuard

- Identity Guard

- McAfee Corp.

- AllClear ID Inc.

- F-Secure Corporation

- IdentityForce, Inc.

- IDShield

- Other Key Players

Recent Developments

- In 2023, Symantec (LifeLock): McAfee+ Family Plan Launch: Introduced in January 2023, this comprehensive offering bundles online security, privacy, identity protection, device security, and management for families under one plan. Covers up to six members in the US.

- In 2023, Experian: Data Breach Resolution Services: Launched new services to help individuals resolve identity theft issues arising from data breaches, including assistance with victim notifications and credit report corrections.

- In 2023, TransUnion: TrueIdentity 2.0: Launched an updated version of their TrueIdentity platform with improved identity theft detection, credit monitoring, and restoration capabilities.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 12.5 Billion |

| Forecast Revenue 2033 | USD 34.7 Billion |

| CAGR (2023 to 2032) | 12.4% |

| North America Revenue Share | 32.5% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Segmentation

Based on Type

- Credit Card Fraud

- Employment or Tax-Related Fraud

- Phone or Utility Fraud

- Bank Fraud

Based on Application

- Consumer

- Enterprise

Regional Analysis

In 2023, North America held a dominant market position in the Identity Theft Protection Services market, capturing more than a 32.5% share. This significant market share is primarily driven by the high prevalence of identity theft incidents and the robust digital infrastructure in the region. The United States, in particular, has witnessed a notable increase in identity theft cases, fueled by the widespread use of online banking, e-commerce, and social media platforms. These factors collectively contribute to the heightened vulnerability of consumers to identity theft and fraud.

Moreover, the regulatory landscape in North America, especially in the U.S., has been a critical factor in the growth of the identity theft protection services market. Initiatives such as the Identity Theft and Assumption Deterrence Act and the Fair and Accurate Credit Transactions Act have raised public awareness about identity theft and the importance of monitoring and protecting personal information. This regulatory push, coupled with high consumer awareness, has led to increased adoption of identity theft protection services.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Check out more related studies published by Market.us:

- Workflow Management System Market size is expected to be worth around USD 70.9 Billion by 2032, growing at a CAGR of 23.30%

- Green Technology Market Size Was USD 13.8 Billion In 2022 And Projected To Reach a Revised Size Of USD 112.4 Bn By 2032.

- Federated Learning Market is anticipated to be USD 311.4 Mn by 2032. It is estimated to record a steady CAGR of 10.2% in the forecast period.

- Microphone market accounted at USD 3.8 bn in 2022 and is expected to reach USD 5.04 bn in 2032 at a CAGR of 3.5% between 2023 and 2032.

- Self-service kiosk market is anticipated to be USD 48.3 billion by 2033. It is estimated to record a steady CAGR of 7.3%.

- Hyperspectral Imaging Market is estimated to garner a market size of USD 51.2 Billion by 2032; rising at a CAGR of 13.5% from 2023 to 2032.

- Cloud Security Posture Management (CSPM) Market is anticipated to reach a high of USD 15.6 Billion by the year 2032, CAGR of 12.3%

- Computer Aided Engineering Market is likely to attain a valuation of USD 26.0 Billion by 2033, rise at an astounding CAGR of 10.6%.

- Micro mobile data center market is expected to reach around USD 14.3 billion in 2032. this market is estimated to register a CAGR of 13.1%.

- Underwater Drone Market projected to be valued at USD 12.2 billion in 2032; Grow at 12.4% over the forecast period 2023-2032.

- POS Terminals Market is projected to surpass around USD 234.8 billion by 2033, growing at a CAGR of 9.8% during the forecast period.

- Digitally Printed Wallpaper Market is expected to grow by US$ 17 billion in 2032; registering a CAGR of 18.4%.

- 360 Degree Camera Market size is expected to be worth around USD 8 Billion by 2032, growing at a CAGR of 22.50% during the forecast period.

- Digital Pen Market size is expected to be worth around USD 1,860.0 Million by 2032, growing at a CAGR of 11.80%.

- Online Video Platform Market is anticipated to expand from USD 10.3 Billion in 2023 to USD 57.2 Billion by 2033, grow at a CAGR of 18.7%.

- Emission Monitoring System (EMS) Market is anticipated to be USD 9.7 billion by 2033 and It is estimated to record a steady CAGR of 9.5%.

- Laboratory Information Management System Market size is USD 4.7 Bn by 2033 from USD 1.8 Bn, growing at a CAGR of 10.1%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: