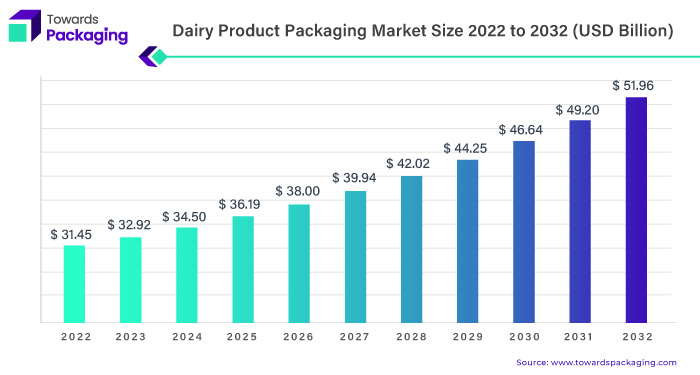

Ottawa, July 03, 2024 (GLOBE NEWSWIRE) -- The global dairy product packaging market size was USD 32.92 billion in 2023, accounted for USD 34.50 billion in 2024, and is predicted to hit around USD 51.96 billion by 2032, a study published by Towards Packaging a sister firm of Precedence Statistics.

By consistently adhering to stringent legal requirements and implementing rigorous industry-specific checks, the dairy industry has maintained high standards of food safety for decades. These practices are regularly updated to meet evolving regulations, which has driven the demand for innovative and reliable packaging solutions. This steady focus on food safety and compliance has emerged as a critical growth factor for the dairy product packaging market.

Get a comprehensive Dairy Products Packaging Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5100

How is Dairy Product Packaging Market Growing?

The dairy product packaging market is experiencing rapid growth, driven by the integral role packaging plays in the food and drink value chain from production to consumption. Packaging supports resilient and sustainable food supply chains by minimizing its environmental footprint and adhering to circular economic principles. It ensures food safety, hygiene, and consumer protection while maintaining a smooth supply chain. The primary function of packaging is to contain, preserve, and protect dairy products throughout their lifecycle, ensuring consumers receive nutritious food in optimal condition.

Effective packaging is tailored to meet the specific requirements of each product at various stages, using the right amount and type of material to minimize economic and environmental impacts. This critical importance of well-designed packaging in maintaining product integrity and supporting sustainable practices within the dairy industry.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

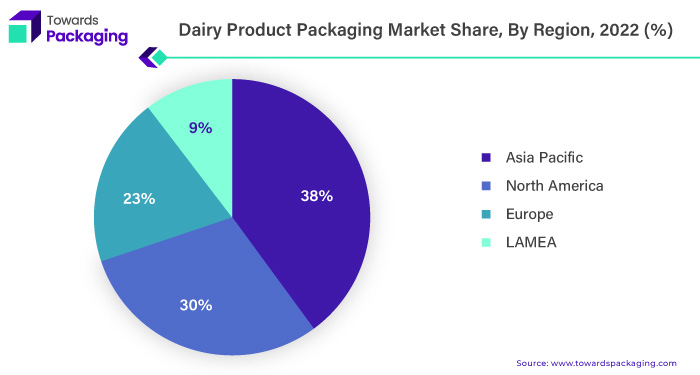

Asia Pacific’s Dominance in the Dairy Product Packaging Market to Sustain

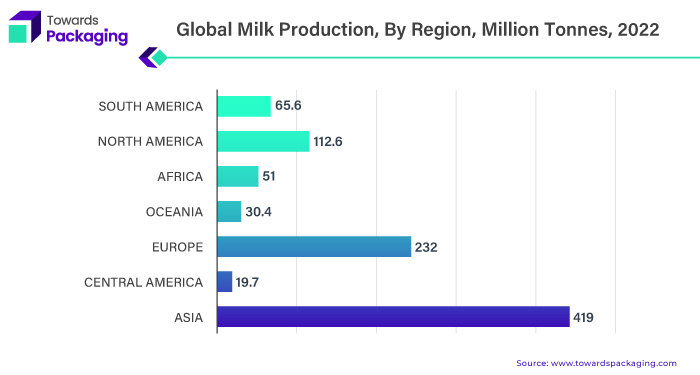

The Asia Pacific region has emerged as a dominant force in the dairy product packaging market, experiencing rapid growth and significantly contributing to the sector's overall expansion. In India, where milk and milk products are dietary staples, the demand for dairy packaging is particularly robust. India, the world's leading milk producer with an annual output of 81 million tonnes, sees 46% of its milk consumed in liquid form and 47% converted into traditional products like ghee, paneer, and curd. The organized sector in India also manufactures a variety of milk products such as ghee, butter, cheese, and ice cream, highlighting the sector's diversity and potential.

Challenges, India's dairy industry is well-positioned for export growth, necessitating continuous efforts to meet global product and packaging standards. Concurrently, China's demand for dairy products influences global market prices, with the North China agricultural region becoming a key supplier of raw milk to domestic processors. These regional dynamics underscore the critical role of the Asia Pacific in driving innovation and growth in the dairy product packaging market.

Get a customized Dairy Products Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5100

North America to be the Second-largest Marketplace

North America stands as the second-largest market for dairy product packaging, characterized by a dynamic business environment and numerous growth drivers. In the U.S., dairy ingredient suppliers provide critical resources for product formulation and ingredient selection, supported by trained R&D experts who assist customers with tailored solutions. Innovative packaging and processing methods in the region extend product shelf life, facilitating efficient storage and distribution across Mexico's diverse climates. The consumption forecast for 2024 predicts a 1% increase to 127,000 MT, with SMP anticipated to be the most demanded dairy ingredient by the domestic processing industry. Mexico's growing functional food market underscores the region's expansion potential in the dairy product packaging sector.

- In April 2022, Mondelēz International announced its acquisition of Grupo Bimbo's confectionery business, Ricolino, for approximately $1.3 billion USD

The Plastic Material to Stand Strong as a Leader in the Dairy Product Packaging Market

The plastic materials segment dominates the dairy product packaging market due to their superior properties, including strength, lightweight, stability, ease of sterilization, and versatility across various applications from films to rigid containers. High-density polyethylene (HDPE) bottles are particularly effective for storing pasteurized milk, while polyethylene terephthalate (PET) is also widely used in milk packaging. Pigmented PET offers additional benefits by protecting food from light, thereby preserving flavor against light-induced lipid oxidation. These characteristics make plastics a preferred choice in the dairy packaging industry, driving innovation and efficiency in product protection and shelf life extension.

Bags and Wraps, by Type to Conquer the market with its Dominant Force

In the dairy product packaging market, bags and wraps dominate, primarily through the use of flexible plastic packaging films. These materials are utilized in various forms such as wrappers, sachets, bags, and pouches for packaging milk and other dairy products. A variety of paper-based materials, including kraft paper, greaseproof paper, vegetable parchment paper, glassine paper, wax-coated paper, plastic-coated paper, paperboards, solid fiber boards, liner boards, and box boards, are also employed. This diversity in packaging types ensures optimal protection and preservation of dairy products, catering to the industry's needs for flexibility, durability, and sustainability.

Market Dynamics

Driver: Sustainability and Efficiency of Dairy Product Packaging

Packaging in the dairy industry must prioritize sustainability without compromising its primary role of protecting food from spoilage, prolonging shelf life, and reducing food waste. Effective packaging maximizes efficiency in the food supply chain, ensuring that the minimal carbon footprint attributed to packaging (approximately 3%) protects the significantly larger carbon footprint of the food (97%). Given that 30% of food is wasted globally, contributing nearly 10% of global greenhouse emissions, the role of packaging becomes even more critical. By extending the shelf life of dairy products and reducing food waste, innovative and sustainable packaging materials and designs are essential drivers of growth in the dairy product packaging market.

Restraints:

Environmental Concerns to act as a Restraint for the Industry

The rapid increase in environmental issues such as global warming, ozone depletion, and uncontrolled water and soil pollution significantly impacts the dairy product packaging market. The environmental footprint of dairy packaging extends across its entire lifecycle—from resource acquisition and manufacturing to distribution, consumption, and waste treatment. Integrating environmental considerations into the design and development of dairy packaging is crucial. This necessity for sustainable practices can limit market growth, as companies must balance ecological responsibilities with economic and operational efficiency.

Innovation and Investments to Create Sustainable Opportunities for the Market

Research, investment, and innovation in sustainable cutting-edge solutions are crucial for reducing packaging waste and enhancing sustainability in an economically viable manner. These advancements positively impact the environmental footprint of dairy products, aligning with the dairy industry's goal of fostering sustainable production while ensuring consumer health protection. Continuous development in dairy product packaging, driven by advances in material technologies and consumer demands, presents significant opportunities. Innovations in packaging techniques can extend food shelf life and provide freshness information without adversely affecting composition. These innovative solutions create substantial growth opportunities in the dairy product packaging market.

- In June 2023, ITC introduced 'Aashirvaad Svasti Daily' milk, a budget-friendly offering for mothers

Major Breakthroughs in the Dairy Product Packaging Market

- In November 2023, Sidel launched a new PET bottle for dairy products to its already established line. These bottles are observed to serve the market within the company's established marketplace.

- In June 2024, Prairie Farms Dairy kicked off June Dairy Month with new product launches and packaging

- In December 2023, IDFA welcomed GELPAC as a new Gold Business Partner.

More Insights of Towards Packaging:

- The global industrial packaging market size forecasted to expand from USD 62.56 billion in 2022 to achieve an approximation USD 101.42 billion by 2032, increasing at a 5.0% CAGR between 2023 and 2032.

- The global electronic packaging market size calculated to go up from USD 1.40 billion in 2022 to realize an expected USD 6.14 billion by 2032, developing at a 16.0% CAGR between 2023 and 2032.

- The global foam packaging market size presumed to grow from USD 17.40 billion in 2022 to fulfill a guesstimated USD 29.28 billion by 2032, thriving at a 5.35% CAGR between 2023 and 2032.

- The global medical device packaging market size speculated to escalate from USD 24.87 billion in 2022 to reach a conjectured USD 52.67 billion by 2032, advancing at a 7.42% CAGR between 2023 and 2032.

- The global virgin plastic packaging market size envisaged to surge from USD 117.23 billion in 2022 to acquire an anticipated USD 322.50 billion by 2032, maturing at a 9.91% CAGR between 2023 and 2032.

- The global aseptic packaging market size to elevate from USD 50.34 billion in 2022 to reach an estimated secure a forecasted USD 138.48 billion by 2032, escalating at a 10.7% CAGR between 2023 and 2032.

- The global rigid packaging market size expected to increase from USD 209.48 billion in 2022 hit a presumed USD 333.17 billion by 2032, augmenting at a 4.8% CAGR between 2023 and 2032.

- The global plastic food packaging market size anticipated to rise from USD 54.98 billion in 2022 to attain a calculated USD 88.28 billion by 2032, increasing at a 4.9% CAGR between 2023 and 2032.

- The global paper and paperboard packaging market size was at USD 297.89 billion in 2022 to secure an estimated USD 452.74 billion by 2032, progressing at a 4.28% CAGR between 2023 and 2032.

- The global footwear packaging market size expected to increase from USD 5.45 billion in 2022 to achieve an approximation USD 8.26 billion by 2032, stretching at a 4.3% CAGR between 2023 and 2032.

Key Players in the Dairy Product Packaging Market

- Mondi Group

- Sealed Air Corporation

- WestRock Company

- ELOPAK

- Nampak Ltd.

- Bemis Company Inc.

- Airlite Plastics

- Ahlstrom

- Huhtamaki Group s

- Tetra Pak.

Market Segmentation

- By Material

- Plastic

- Glass

- Paper & Paperboard

- Metal

- Others

- By Type

- Bags and Wraps

- Films

- Bottles

- Cans

- Pouches

- Boxes

- Carton

- By Product

- Cheese

- Yoghurt

- Butter

- Frozen Products

- Cream

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Act Now and Get Your Dairy Product Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5100

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/