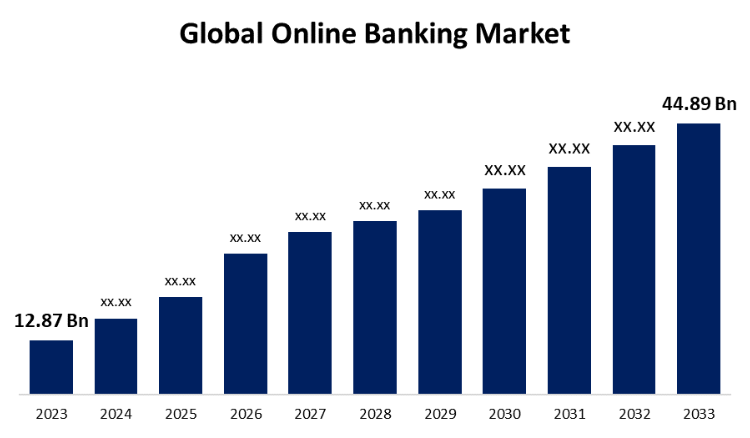

New York, United States, July 08, 2024 (GLOBE NEWSWIRE) -- The Global Online Banking Market Size is to Grow from USD 12.87 Billion in 2023 to USD 44.89 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 13.31% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4808

A payment service that enables consumers to conduct financial transactions online is called online banking. Convenience is its primary appeal, thus why online or internet banking is a common term for it. It provides time-saving banking services along with real-time problem-solving capabilities. Banks should strive to achieve a more seamless experience across online and mobile platforms and accelerate customer engagement to suit the needs, desires, and preferences of their customers. Furthermore, high-speed internet offers a smoother, more responsive client experience. The ability for users to progressively move funds, settle payments, and keep track of their records improves the overall effectiveness of online banking services. Online banking services become more widely available with faster internet. Furthermore, due to they can connect more easily, customers who reside far away can use online banking platforms more frequently, which is driving the worldwide industry's expansion. Improved internet speeds could allow for the much faster transmission of large volumes of data. Online banking platforms can leverage this functionality for real-time data analytics, helping financial organizations create more customized services, understand client behavior, and make informed decisions. However, hackers could use stolen login credentials to access user accounts, customers are extremely concerned about security and privacy.

Browse key industry insights spread across 200 pages with 115 Market data tables and figures & charts from the report on the "Global Online Banking Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Payments, Processing Services, Customer & Channel Management, Wealth Management, and Others), By Banking Type (Retail Banking, Corporate Banking, and Investment Banking), By Technology (Cloud Computing, AI and Machine Learning, Blockchain, and Biometrics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4808

The polyurethane segment is anticipated to hold the greatest share of the global epoxy tooling The payments segment is anticipated to hold the greatest share of the global online banking market during the projected timeframe.

Based on the service type, the global online banking market is divided into payments, processing services, customer & channel management, wealth management, and others. Among these, the payments segment is anticipated to hold the greatest share of the global online banking market during the projected timeframe. Online payment channels are becoming more and more popular among consumers because of their convenience and time-saving advantages over conventional methods. This has become one of the main market trends. Online banking solution providers have also partnered with media & multiplexes, entertainment, and utility service providers as vendors. This gives consumers the ability to use online banking services to make many additional frequent payments.

The corporate banking segment is expected to grow at the fastest CAGR in the global online banking market during the projected timeframe.

Based on the banking type, the global online banking market is divided into retail banking, corporate banking, and investment banking. Among these, the corporate banking segment is expected to grow at the fastest CAGR in the global online banking market during the projected timeframe. Corporate banking refers to parts of banking that are especially relevant to business clients. These Internet banks serve a wide range of clients, including big, small, and billion-dollar companies with offices all over the world. The corporate banking department offers treasury and cash management, commercial real estate, trade finance, equipment leasing, loans and credit products, and employer services.

The cloud computing segment is projected for the largest revenue share in the online banking market during the estimated period.

Based on the technology, the global online banking market is divided into cloud computing, AI and machine learning, blockchain, and biometrics. Among these, the cloud computing segment is projected for the largest revenue share in the online banking market during the estimated period. Online banking has fundamentally transformed as a result of cloud computing, which provides scalable and reasonably priced choices for handling, storing, and processing massive volumes of financial data. Banks may reduce IT costs, boost operational effectiveness, and launch new services more quickly by utilizing cloud infrastructure.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4808

North America is expected to hold the largest share of the global online banking market over the forecast period.

North America is expected to hold the largest share of the global online banking market over the forecast period. A wide range of demographic groups in North America have made extensive use of online banking services. The increasing popularity of digital banking among both consumers and organizations can be attributed to its efficiency, transparency, and convenience of use. North American banks recognize that innovation will have a long-term impact on their industry as they seek to grow their customer base and compete with non-financial and fintech companies. Many banks in North America are focusing on technological advancements. This will let banks make changes to their back-office procedures and key frameworks more rapidly.

Asia Pacific is predicted to grow at the fastest pace in the global online banking market during the projected timeframe. Due to the rising need for quickly available banking services as well as the expanding use of digital technologies. The area, which includes South Korea, Japan, and China among its highly developed economies, has seen a surge in the use of digital banking services. The region is seeing an increase in the number of fintech companies that provide advanced services to the financial sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Online Banking Market include Temenos, Tata Consultancy Services Limited, Sopra Steria, SAP SE, Oracle, Microsoft, Intellect Design Arena Limited, Infosys Limited, I-flex Solutions, Fiserv, Inc., First Source Bank, Finastra, EdgeVerve Systems Limited, and Others key companies.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4808

Recent Developments

- In August 2022, ACI Worldwide is the leading provider of mission-critical real-time payment software in the market. ACI Worldwide declared that One Equity Partners, a middle-market private equity group, had acquired its online banking products ("OEP"). To respond to commercial and business banking clients, the first innovation stage, known as ACI Computerized Commercial Banking, uses a programming interface.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Online Banking Market based on the below-mentioned segments:

Global Online Banking Market, By Service Type

- Payments

- Processing Services

- Customer & Channel Management

- Wealth Management

- Others

Global Online Banking Market, By Banking Type

- Retail Banking

- Corporate Banking

- Investment Banking

Global Online Banking Market, By Technology

- Cloud Computing

- AI and Machine Learning

- Blockchain

- Biometrics

Global Virtual Warehousing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter