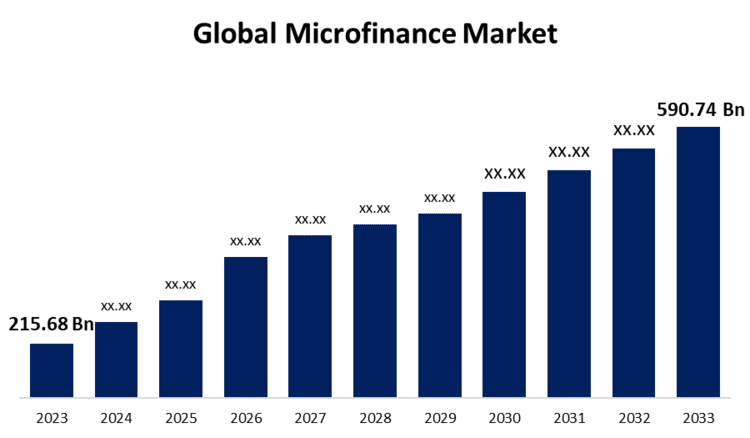

New York, United States , July 08, 2024 (GLOBE NEWSWIRE) -- The Global Microfinance Market Size is to Grow from USD 215.68 Billion in 2023 to USD 590.74 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 10.60% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4861

A type of banking service known as microfinance is provided to low-income individuals or groups who would not be able to access financial services. The main objective of these organizations is to give unbanked individuals all around the world microloans for payment products, insurance, and savings. Low-income and socially disadvantaged customers can access a wide selection of excellent financial products and services from the market, which will help them become financially independent. The demand for microfinance is being driven by initiatives to promote financial inclusion as more people become aware of the advantages of formal financial products. Owing to technical improvements like the growing use of financial technology (fintech) and mobile banking, unbanked people are becoming more accessible, particularly in rural areas. Furthermore, microloans allow people to invest in housing, healthcare, education, and income-generating ventures, resulting in higher living standards and more economic stability. Small businesses that receive microfinance support have the potential to grow, create jobs, and strengthen regional economies. These positive effects on people's lives and communities are driving the global microfinance market. Furthermore, technological advancements have increased the demand for microfinance. Due to the ease with which mobile banking, digital payments, and innovative financial technology have made these services available, microfinance services are now more effective, economical, and scalable. However, microfinance organizations enforce short payback terms and high interest rates. Microloan costs make it difficult for low-income individuals and small businesses to repay the money borrowed.

Browse key industry insights spread across 180 pages with 105 Market data tables and figures & charts from the report on the "Global Microfinance Market Size, Share, and COVID-19 Impact Analysis, By Provider Type (Banks, Microfinance Institutes (MFI), Non-Banking Financial Institutions (NBFCs), and Others), By Service Type (Group and Individual Micro-Credit, Leasing, Micro-Investment Funds, Insurance, and Savings & Checking Accounts), By Purpose (Agriculture, Manufacturing/Production, Trade & Services, Household, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4861

The banks segment is anticipated to hold the greatest share of the global microfinance market during the projected timeframe.

Based on the provider type, the global microfinance market is divided into banks, microfinance institutes (MFI), non-banking financial institutions (NBFCs), and others. Among these, the banks segment is anticipated to hold the greatest share of the global microfinance market during the projected timeframe. Due to, the features of the banking system that are usually suitable for microloan customers come with higher acquisition costs and enhanced security. However, it's important to remember that the industry is anticipated to grow significantly in the future due to the anticipated rise in demand for non-bank microfinancing services. Banks are in a good position to offer microfinance services due to their existing customer base, infrastructure, and regulatory framework.

The group and individual micro-credit segment is predicted to grow at the fastest CAGR in the global microfinance market during the projected timeframe.

Based on the service type, the global microfinance market is divided into group and individual micro-credit, leasing, micro-investment funds, insurance, and savings & checking accounts. Among these, the group and individual micro-credit segment is predicted to grow at the fastest CAGR in the global microfinance market during the projected timeframe. Microcredit is a financial tool that helps low-income individuals and microenterprises break free from the cycle of poverty and reliance on costly informal lenders. Microloans improve financial discipline, simplify future financial undertakings, and make saving money easier. Microloans promote microbusiness growth, which raises revenue, creates jobs, and advances regional economic development. Furthermore, as microenterprises grow, consumer demand for products and services rises, supporting the expansion of the economy overall.

The agriculture segment is expected for the largest revenue share in the global microfinance market during the estimated period.

Based on the purpose, the global microfinance market is divided into agriculture, manufacturing/production, trade & services, household, and others. Among these, the agriculture segment is expected for the largest revenue share in the global microfinance market during the estimated period. The primary goal of the agriculture segment is to provide financial services and support to farmers, agricultural enterprises, and rural communities engaged in agricultural operations. Agriculture is the main industry in many developing countries, and for smallholder farmers and agricultural businesses to invest in the equipment, seeds, fertilizer, and other inputs needed for production, they need to have access to funding.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4861

Asia Pacific is expected to hold the largest share of the global microfinance market over the forecast period.

Asia Pacific is expected to hold the largest share of the global microfinance market over the forecast period. This growth can be attributable to the rise in official policies meant to improve the standard of living for all citizens and combat poverty, which has turned into a significant trend in the microfinance sector. In addition, the vast majority of people reside in rural areas with little access to traditional financial services. Microfinance is thus crucial to providing financial services to this disadvantaged demographic.

Europe is predicted to grow at the fastest pace in the global microfinance market during the projected timeframe. This is a result of the growing importance of microfinance in promoting financial inclusion and helping with entrepreneurship, which has prompted the establishment of microfinance institutions and regulatory frameworks. Small businesses and people can get financial services from a range of institutions, including microfinance banks, social enterprises, cooperatives, and non-governmental organizations, that prioritize sustainable development and social impact.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Microfinance Market include SKS Microfinance (BFIL), Compartamos Banco, ASA International, BRAC, Bandhan Bank, Opportunity International, FINCA International, Accion International, Kiva, Oikocredit, Ujjivan Financial Services, Equitas Small Finance Bank, Fonkoze, PRASAC, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4861

Recent Developments

- In September 2023, The RBI ordered credit reporting firms to create an index customized to the microfinance and commercial sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Microfinance Market based on the below-mentioned segments:

Global Microfinance Market, By Provider Type

- Banks Microfinance Institutes (MFI)

- Non-Banking Financial Institutions (NBFCs)

- Others

Global Microfinance Market, By Service Type

- Group And Individual Micro-Credit

- Leasing

- Micro-Investment Funds

- Insurance

- Savings & Checking Accounts

Global Microfinance Market, By Purpose

- Agriculture

- Manufacturing/Production

- Trade & Services

- Household

- Others

Global Microfinance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-Life Insurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), By Distribution Channel (Traditional Banks, Digital Platforms, and Insurtech Startups), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Facultative Reinsurance and Treaty Reinsurance), By Mode (Online and Offline), By Distribution Channel (Brokers and Direct Writing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter