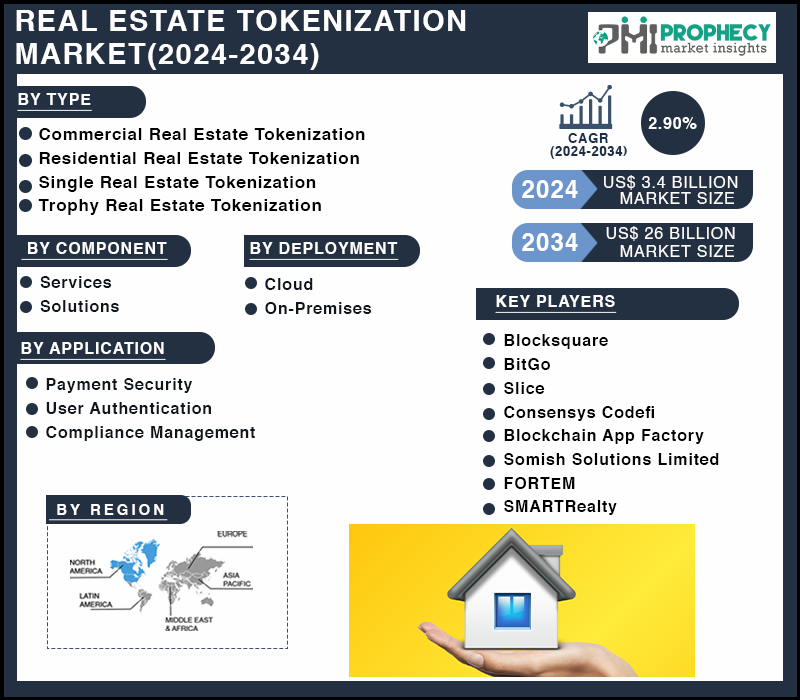

Covina, July 09, 2024 (GLOBE NEWSWIRE) -- The study concludes that the global real estate tokenization market size and share is expected to grow at a CAGR of 2.90% between 2024 and 2034. The market revenue of US$ 3.8 Billion in 2024 is expected to grow up to US$ 26 Billion by 2034. The market provides detailed information regarding the industrial base, productivity, strengths, manufacturers, and recent trends which will help companies enlarge their businesses and promote financial growth.

Real Estate Tokenization Market Size Report Overview

Real estate tokenization refers to the digitalization of title deeds of real estate on a blockchain. These tokens represent ownership or an investment in the underlying real estate property and allow fractional ownership with the benefit of enhanced liquidity through trading on digital asset exchanges. Tokenization is the process of creating a digital representative form that is unique and anonymous for a real object. Tokens can be representative of value for several kinds of assets, including real estate or art pieces, intellectual property, financial instruments such as stocks and bonds, identity, and data.

The recognized problems associated with conventional real estate investing include enormous outlays of funds, protracted procedures, copious amounts of paperwork, and compartmentalized data. Tokenization addresses these recognized problems; it addresses the fractionalizing of ownership and liquidity inherent in real estate investing at the same time as it addresses operational efficiencies and transparency of data within the real estate transaction.

From a historical perspective, real estate is one of the least liquid asset classes due to large capital outlays and expensive and lengthy transaction procedures. Because new financial sector technology is increasingly offering speed, security, and affordability, the current momentum in tokenization is argued to signal the beginning of innovative solutions for real estate in the digital age. Real estate has historically been a well-liked and active investment option.

Download a Free Sample Research Report with Latest Industry Insights: https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/4857

Our Free Sample Report includes:

- Overview & introduction of market study

- Revenue and CAGR of the market

- Drivers & Restrains factors of the market

- Major key players in the market

- Regional analysis of the market with a detailed graph

- Detailed segmentation in tabular form of market

- Recent developments/news of the market

- Opportunities & Challenges of the Market

Competitive Landscape:

The Real Estate Tokenization Market is characterized by rapid growth, technological innovation and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive.

Some of the Key Market Players:

- Blocksquare

- BitGo

- Slice

- Consensys Codefi

- Blockchain App Factory

- Somish Solutions Limited

- FORTEM

- SMARTRealty

To Know More on Market Players, Download a Free Sample Report Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/4857

Analyst View:

Real estate tokenization is the process of making title deeds digital on a blockchain in order to facilitate fractional ownership and increase liquidity, using digital asset exchanges. All this is in real estate tokenization. It solves long processes and high costs characteristic of traditional investment in the industry. All the new innovations are accessible to small investors, with the characteristics of fractional ownership, lower investment minimums, liquidity, worldwide access, and diversification. Services range from regulatory to white-label solutions and development to design of the platform. North America takes the lead in taking part in this market, with a tokenized legal system in the country. Opportunities in tokenization exist in the whole of the Middle East and Africa because of their unique blockchain technologies and markets.

Request for a Discounted Price on this Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/4857

Market Dynamics:

Drivers:

Easily Achievable for Small Investors

- Key benefits of tokenization in real estate include fractional ownership, reducing investment minimums, gaining liquidity at an enhanced level, access to the global level, diversification, and so on. It is possible, in tokenization, to sell affordable fractions of the property—that is, an individual investor can invest without full ownership. This largely liquidates the tokens, which can then be sold in secondary markets where property tokenization is available. This technology also helps break the barriers by showing the possibilities for small investors worldwide to access alternative forms of real estate investment, with possibilities of diversification in their portfolios by investing in several properties or property types tokenized.

Openness and Unchangeability

- Benefits of tokenization in real estate include fractional ownership, investment minimum reduction, enhanced liquidity, access to the global level, diversification, etc. Possibility in tokenization is that an affordable fraction of the property can be sold, that is, that the possibility of one individual investor investing without full ownership is there. An investor can also have smaller shares of the assets, thus making it more accessible for fractionalized ownership. Tokenization generates much more liquidity because real estate assets can easily be bought, sold, and traded in secondary markets, thus making real estate as an investment vehicle way more liquid than previously possible through traditional methods.

Reduce a full report cost by up to 30% with a custom report by requesting here: https://www.prophecymarketinsights.com/market_insight/Insight/request-customization/4857

Market Trends:

Increased Accessibility

- Tokenizing the real estate asset would, however, make it more liquid than ever, leaving the investors' hands-free to buy and sell the token much in the way of acquiring REITs in the open market. Now, what was previously locked away would open, providing owners and investors more access to the funds, from what was discovered to be liquidity.

Segmentation:

Real Estate Tokenization Market is segmented based on Type, Component, Deployment, and Region.

Type Insights

- Tokenization is a way to create fractional ownership, liquidity, less conflict, and quicker actions with more new capital sources potentially open to an investor in commercial real estate by creating digital tokens on some blockchain. This is meant to disintermediate—token holders are to get a proportional share of rental income and property appreciation. While single real estate tokenization covers automation, liquidity, transparency, and peculiar ownership features, trophy real estate tokenization covers digitizing high-value properties and democratizing property ownership globally. However, business control in the hands of many becomes difficult when the rules in the majority of jurisdictions are not clear.

Component Insights

- Services and solutions are available from the creation of platforms to white-label solutions, end-to-end support, and regulatory and compliance know-how in areas of investor outreach, community building, technical maintenance, and updates. Companies provide end-to-end platform development services to businesses and property owners, spanning secondary trading and investor management to the production of tokens and their compliance. White-label products enable companies to launch tokenization platforms much faster without needing to start from nothing. Right from valuing the properties, all the way down to setting up secondary markets and executing token offers, real estate tokenization service providers manage everything. They offer guidance related to technological upkeep, investor engagement, as well as compliance requirements. The idea will be to create an ecosystem in which the tokenization of real estate can be conducted between investors, developers, and property owners in a regulatory-compliant manner and with a smooth user experience.

Deployment Insights

- Real estate tokenizing platforms that are cloud-hosted come with a pay-as-you-go kind of cloud deployment. It makes the allocation worldwide, economical, and scalable. Businesses can also oversee access and infrastructure upkeep from global data datacenters. Companies have another option to gain more control over their infrastructure, data sovereignty, and recurring costs with an on-premises deployment. Many of the factors that influence the choice between cloud or on-premise have to do with budget, control requirements, current infrastructure, and compliance requirements. In all actuality, many businesses use a hybrid approach: They will do some of their IT on-premise, and they will use the cloud for some parts. The most powerful and cost-effective can be the combination of on-premises and cloud deployments.

Real Estate Tokenization Market Scope

| Report Attributes | Details |

| Market value in 2024 | USD 3.8 Billion |

| Market value in 2034 | USD 26 Billion |

| CAGR | 2.90% from 2024 – 2034 |

| Base year | 2023 |

| Historical data | 2019-2022 |

| Forecast period | 2024-2034 |

Recent Development:

- In July 2024, Mantra Chain collaborated with MAG Group to tokenize $500 million worth of Dubai real estate, aiming to democratize investment access. The deal involves a multi-tranche tokenization strategy, enhancing investor security with over-collateralized assets. Focused initially on Keturah Reserve, the partnership seeks to revolutionize real estate investment through blockchain technology.

- In December 2023, XRP Price Corrects, New Real Estate Token Still Bullish With 8% Rise. XRP, Ripple’s token, remains a focal point for crypto investors and market analysts. As the crypto market ebbs and flows, XRP’s latest price movements and strategic legal battles with the SEC have caught significant attention. The steady rise of the new Everlodge is also garnering similar attention.

Regional Insights

- North America: Among the reasons for this is the US maintains the most tokenized real estate nation in North America out of having a very robust legal system, a large real estate market, and early adoption of blockchain technology. This country has adoptively created a well-fleshed securities regulatory framework complete with explicit requirements imposed by the SEC. Indeed even some states, for example, Delaware and Wyoming, have already enacted legislation supporting blockchain technology that allows for the disposition of digital assets. The area of US investment market space is equally covered by institutional and hedge fund investors. Real estate asset tokenization is expanding in major crypto hubs, including New York, San Francisco, and Miami. And also states with attractive locations for projects on real estate tokenization are Delaware and Wyoming, due to the laws passed in these states regarding the promotion of blockchain technology and the creation of digital assets.

- Middle East & Africa: There is great potential to tokenize real estate in the Middle East and Africa due to the size of their respective real estate markets, growing interest in blockchain technology, and the enabling regulatory frameworks to support the same. Already leading developers like MAG are tokenizing assets worth more than $500 million in partnership with blockchain platforms offering the service, such as MANTRA. Most of these countries have been using programs like the Sandbox by the Capital Market Authority to look into the application of blockchain and tokenization in their real estate sectors. Kuwait, Qatar, Bahrain, and most other Middle Eastern countries are currently building transformative frameworks that turn around the tokenization of real estate in attracting adoption to the country. While Kenya is exploring the potential of blockchain technology and tokenization to advance access to affordable housing and real estate investment, South Africa has had some early adoption of tokenization of real estate.

Browse detailed report on "Real Estate Tokenization Market, By Type (Commercial Real Estate Tokenization, Residential Real Estate Tokenization, Single Real Estate Tokenization, and Trophy Real Estate Tokenization), By Component (Services and Solutions), By Deployment (Cloud and On-Premises), By Application (Payment Security, User Authentication and Compliance Management) and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Trends, Analysis and Forecast till 2034" with complete TOC @ https://www.prophecymarketinsights.com/market_insight/Global-Real-Estate-Tokenization-Market-4857

Browse More Research Reports:

- Feed Prebiotics Market Size & Share Research Report, 2024-2034

- Food Allergy Treatment Market Size & Share Research Report, 2024-2034

- Non-Meat Ingredients Market Size & Share Research Report, 2024-2034

- Organic Soy Protein Isolates Market Size & Share Research Report, 2024-2034

- Self-Sovereign Identity (SSI) Market Size & Share Research Report, 2024-2034

- Blue Ammonia Market Size & Share Research Report, 2024-2034

About Us:

Prophecy Market Insights is a specialized market research, analytics, marketing, and business strategy, and solutions company that offers strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high-value opportunities in the target business area. Also, we help our client to address business challenges and provide the best possible solutions to overcome them and transform their business.

Prophecy’s expertise area covers products, services, latest trends, developments, market growth factors, and challenges along with market forecasts in various business areas such as Healthcare, Pharmaceutical, Biotechnology, Information Technology (IT), Automotive, Industrial, Chemical, Agriculture, Food and Beverage, Energy, and Oil and Gas. We also offer various other services such as data mining, information management, and revenue enhancement suggestions.

Contact Us:

Prophecy Market Insights

US: 964 E. Badillo Street

#2042 Covina,

CA 91724

US toll-free: +1 860 531 2574

Rest of World: + 91 7775049802

Follow us on: LinkedIn | Twitter