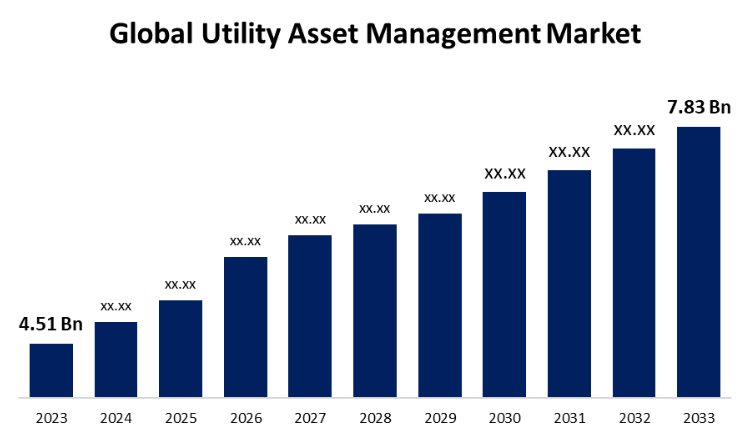

New York, United States , July 09, 2024 (GLOBE NEWSWIRE) -- The Global Utility Asset Management Market Size is to Grow from USD 4.51 Billion in 2023 to USD 7.83 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.67% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4867

Utility asset management is the strategic process of managing the physical assets and infrastructure required to deliver utility services. It guarantees the efficient and well-organized management of every stage of the equipment lifespan, including acquisition, installation, upgrades, maintenance, and disposal. Environmental, health, and safety requirements, improved equipment and worker safety, and improved service quality are all ensured by strong utility asset management. Growing energy consumption, aging infrastructure, distributed energy suppliers, and the need for dependable and efficient energy are some of the drivers driving the utility asset management industry. The increasing frequency of unplanned power outages caused by a range of factors, such as weather-related problems, natural catastrophes, defects in transmission and distribution lines, and sudden grid troubles, is predicted to drive growth in the utility asset management industry. Many governments in developing countries throughout the world are beginning to recognize utility asset management as a smart way to modernize infrastructure, reduce losses from irregular upkeep and service, and maintain the long-term electrical grid. However, mistakes in determining which functional design should be prioritized and inaccuracies in technical knowledge while installing tools and connecting hardware can have a significant negative influence on the system's performance, leading to limited repair times and probable over-maintenance.

Browse key industry insights spread across 230 pages with 110 Market data tables and figures & charts from the report on the "Global Utility Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Utility, and Private Utility), By Component (Software, Hardware, and Services), By Application (Electric, Gas, and Water), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4867

The private utility segment is anticipated to hold the greatest share of the global utility asset management market during the projected timeframe.

Based on the type, the global utility asset management market is divided into public utility and private utility. Among these, the private utility segment is anticipated to hold the greatest share of the global utility asset management market during the projected timeframe. Large-scale non-governmental energy networks and growing investments in grid upgrading are anticipated to enhance the sector's prospects by lowering the frequency of interruptions in electricity supply.

The software segment is anticipated to hold the largest share of the global utility asset management market during the projected timeframe.

Based on the components, the global utility asset management market is divided into software, hardware, and services. Among these, the software segment is anticipated to hold the largest share of the global utility asset management market during the projected timeframe. Due to the growing need in large networks for mobile and remote tools for detection, inspection, and diagnosis. Software for asset management has been introduced by major industry participants. It provides increased dependability through predictive maintenance, inspection, and monitoring systems driven by AI.

The electric segment is predicted to hold the greatest share of the utility asset management market during the estimated period.

Based on the application, the global utility asset management market is divided into electric, gas, and water. Among these, the electric segment is predicted to hold the greatest share of the utility asset management market during the estimated period. The transformer is a crucial part of the network used to transmit power. Management solutions now include a considerable deal of integration with the system to evaluate and optimize operating conditions, life expectancy, and failure reduction.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4867

North America is expected to hold the largest share of the global utility asset management market over the forecast period.

North America is expected to hold the largest share of the global utility asset management market over the forecast period. The market in the region is probably going to be driven by the deregulation of the electric sector. Due to the deregulation of the power sector in several countries, numerous commercial businesses have been able to achieve their strategic goals of minimizing losses and lowering the cost of energy for end users by regularly monitoring and tracking their networks.

Asia Pacific is predicted to grow at the fastest pace in the global utility asset management market during the projected timeframe. One of the factors propelling the market's growth is the integration of automated tracking and monitoring systems into the infrastructure for power distribution and transmission. The region's growing petrochemical, chemical, automotive, and fertilizer sectors have increased energy consumption and required system component maintenance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the global utility asset management market include General Electric, ABB, Eaton, Getac, Fujitsu, Lindsey Manufacturing, Siemens, DNV GL, Aclara Technologies, Sentient Energy, Schneider Electric, IFS, IBM, Hitachi Energy, Black & Veatch, ABS Group, Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4867

Recent Developments

- In November 2023, one of the biggest owner-operators and developers of renewable energy in America, SB Energy USA Corp (SB Energy), entered into a multi-year technical and commercial relationship with Stem, a global leader in AI-driven clean energy solutions and services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global utility asset management market based on the below-mentioned segments:

Global Utility Asset Management Market, By Type

- Private Utility

- Public Utility

Global Utility Asset Management Market, By Component

- Software

- Hardware

- Services

Global Utility Asset Management Market, By Application

- Electric

- Gas

- Water

Global Utility Asset Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Remote Power Panel Market Size, Share, and COVID-19 Impact Analysis, By Type (Floor-standing, Wall-mounted), By Application (Commercial Buildings, Data Centers, Hospitals), By End User (BFSI, IT & Telecom, Healthcare, Government & Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Global Carbon Offset/Carbon Credit Market Size, Share, and COVID-19 Impact Analysis, By Type (Voluntary Market, Compliance Market), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects [Nature-based Projects and Technology-based Projects]), By End User (Energy, Power, Transportation, Industrial, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Global EV Solar Modules Market Size, Share, and COVID-19 Impact Analysis, By Solar Panel Type (Monocrystalline and Polycrystalline), By Battery Type (Lithium-ion, Lead-Acid, and Lead-Carbon), By Application (Passenger Vehicles and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Global Hydrogen Fueling Station Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Station and Mobile Station), By Size (Small & Medium Size and Large Size), By End User (Railways, Marine, Commercial Vehicle and Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter