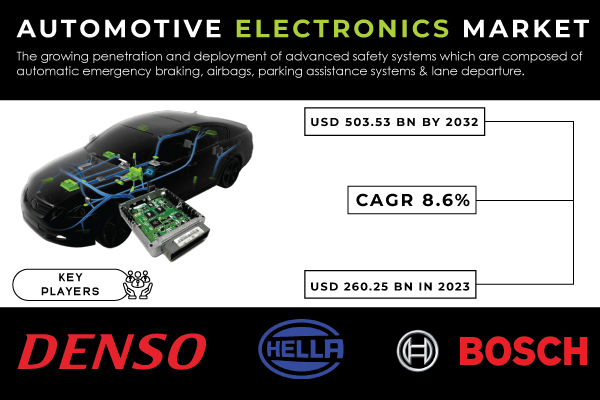

Pune, July 09, 2024 (GLOBE NEWSWIRE) -- The Automotive Electronics Market Size is growing as the automotive industry is going through technological revolutions, driven by changing regulation requirements, and user demands. The automobile as we know it is being totally re-invented with the proliferation of Electric Vehicles (EV), autonomous driving, Advanced Driver Assistance Systems (ADAS), and connected technologies.

The rising demand for electric vehicles with increasing technological innovations drives the growth of the automotive electronics market.

According to the International Energy Agency sales of electric vehicles boomed in 2023. Globally, sales surged by 3.5 million units, representing a 35% jump from 2022. China and the United States led the charge. In China, electric car registrations rose by 35% from 2022, topping out at 8.1 million in 2023, while the United States witnessed a similar surge, with registrations exceeding 1.4 million in 2023, reflecting a rise of over 40% year-on-year.

Get a Sample Report of Automotive Electronics Market @ https://www.snsinsider.com/sample-request/3596

Market Players Covered in this Report:

- Continental AG

- DENSO Corp

- Hella GmbH

- Infineon Technologies

- Robert Bosch

- Valeo

- ZF Friedrichshafen

- Hitachi Automotive Systems

- Xilinx

- Visteon

- SONY Corporation

- Infineon Technology

Compared to conventional fuel-based vehicles, electric vehicles are even more dependent on electronic components for various basic functions. They control power delivery and are monitored to optimize the efficiency and smooth operation. In order to monitor battery health, control temperature, and optimize charging cycles, EVs require sophisticated Battery Management Systems (BMS). When using a lithium-ion battery these systems are essential and will not only extend the life cycle of the power pack but also improve performance. EVs also tend to be some of the first adopters of ADAS such as lane departure warning, automatic emergency braking, and adaptive cruise control. These systems depend on a network of sensors, cameras, and radars all managed by the accurate running of related automotive electronic units. As EVs become more mainstream, the need for electronics to manage their complex systems will continue to propel the automotive electronics market forward.

The automotive electronics market thrives on continuous technological innovation, and the trend is undeniable. While established tech giants like Apple reportedly shelved their EV projects in February 2024, others are forging ahead. In March 2024, Chinese tech giant Xiaomi declared the upcoming delivery of its very first electric vehicle, denoting its entry into the competitive automotive industry. This contrasting news exemplifies the dynamic nature of the EV market, where innovation blooms alongside fierce competition.

Hyundai and LG Electronics are forming a strategic alliance to become major players in the automotive electronics market.

This shift signifies the growing importance of electronics in modern vehicles. LG, already a leader in home appliances, sees automotive electronics as a key future growth area. By supplying components to Hyundai Motor Group, LG is poised to significantly increase its operating profit in 2024. This partnership suggests that LG's automotive electronics business has the potential to become as successful as its current home appliance dominance.

Automotive Electronics Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.92 billion |

| Market Size in 2032 | USD 3.42 billion |

| CAGR (2024-2032) | 7.61% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Automotive Electronics Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/1433

Segmentation Analysis

On the basis of components, current-carrying devices held the dominant share in 2023.

The current-carrying devices led the component segment of the automotive electronics market with the highest revenue share of more than 40% in 2023. This dominance underscores their critical importance in ensuring electrical connectivity and functionality within vehicles. The substantial revenue share reflects their widespread use and high demand, highlighting their essential role in modern automotive systems.

On the basis of application, the safety systems segment led the automotive electronics market in 2023.

In 2023, the safety systems segment emerged as the leading application within the automotive electronics market with more than 35% revenue share. This indicates that electronic components and systems designed to enhance vehicle safety, such as ADAS, airbags, and electronic stability control, saw the highest demand and revenue. The focus on safety systems reflects the growing importance of vehicle safety features in consumer preferences and regulatory requirements, driving significant investment and innovation in this segment.

The automotive electronics market growth is also fueled by the rising demand for vehicle safety and security as well as stringent automotive regulations

The demand for automotive electronics is growing due to several reasons. People are increasingly prioritizing safety features in their vehicles, and governments are making these features mandatory through stricter regulations. This requires more electronic components to be installed in cars. For example, in June 2024, AB Dynamics released an update to Track Applications Suite, which is software made to test and validate advanced driver-assistance systems (ADAS). ADAS are becoming increasingly common, and automakers and suppliers are investing heavily in developing even more advanced safety features. These next-generation systems include active safety measures, provide a 360-degree perception of the surroundings, and incorporate redundancy in perception, processing, and software for ultimate reliability. According to SNS research, by the end of this decade, 68.5 percent of all new passenger vehicles will have some level of automation (SAE level 2+ or higher), making driving safer and potentially even taking over completely in the future.

In the automotive industry, security and functional safety are becoming increasingly critical, even for low-end microcontroller applications. Concurrently, vehicle manufacturers are transitioning from mechanical buttons to touch-enabled surfaces, creating sleek cockpit and steering wheel designs. This shift imposes stringent space constraints on electronic circuits and drives the demand for highly integrated ICs with compact form factors. Addressing these challenges, Infineon Technologies AG introduced the PSoC 4 HVMS family of automotive microcontrollers in April 2024.

Regional Landscape:

Asia Pacific dominated the automotive electronics market with the highest revenue share of more than 40% in 2023. This dominance is due to the region's increasing demand for low-cost per-mile vehicles, extensive user base, and rapid technological advancements. Major countries like China, Japan, India, and South Korea are key contributors, with their strong automotive manufacturing industries and high demand for advanced automotive electronics. Additionally, the region's economic growth, increasing urbanization, and rising disposable incomes have boosted vehicle sales and, consequently, the demand for automotive electronics. As per the electric commercial vehicle maker Switch Mobility, in India, the electric truck segment will be sold between 4,000 to 6,000 units by the end of March 2025. The presence of major automotive and electronics companies in Asia Pacific has led the automotive electronics market further, driving innovation and substantial revenue generation in the automotive electronics sector.

Utilizing its intersection of conventional automobile technology, electronics hardware, and software, Tamil Nadu in India is poised for growth in this sector. The state's new semiconductor and advanced electronics policy aims to increase its contribution to India's electronic exports from 30% to 40%, further enhancing its market position.

Moreover, a leading Taiwanese contract electronics maker- Compal Electronics, Inc., announced plans to build a factory in Poland to target automotive electronics clients. The company will invest over US$ 15.41 million through its subsidiary CGS Technology sp. z.o.o. to acquire land and construct the facility, marking its first manufacturing expansion into the European market.

Recent Developments

- In May 2024, Foxconn and ZF Friedrichshafen AG finalized their joint venture to innovate passenger car chassis systems.

- In March 2024, Visteon and Shinry Technology Companies Ltd. formed a Michigan-based joint venture focusing on new energy vehicle charging and distribution solutions.

- In January 2024, Valeo highlighted its commitment to ADAS and electrification technologies at CES, emphasizing its work on software-defined vehicles.

- In May 2023, Renault Group and Valeo partnered to develop a software-defined vehicle architecture, ensuring vehicles stay up-to-date and can integrate new functionalities without hardware changes.

Buy an Enterprise User PDF of Automotive Electronics Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/1433

Key Takeaways:

- EVs are more electronically driven than ICE vehicles: electric motors, battery management systems (BMS), as well as advanced driver-assistance systems (ADAS) serve significant functions in EVs.

- The governmental regulations related to safety features in vehicles further propel the requirement for automotive electronics.

- Asia Pacific is the leading region of the automotive electronics market due to the large production base in this particular area and the increasing requirement for advanced electronic features from the consumer side.

- Collaboration between automotive and electronics firms to roll out new technologies and solutions.

- AB Dynamics provided the update: New release of Track Applications Suite for ADAS testing and validation as part of investment in advanced safety features.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Automotive Electronics Market Segmentation, By Product

7.1 Introduction

7.2 Calcined Automotive Electronics

7.3 Agglomerated Automotive Electronics

7.4 Sintered Automotive Electronics

8. Automotive Electronics Market Segmentation, By End-Use

8.1 Introduction

8.2 Iron & Steel

8.3 Construction

8.4 Glass & Ceramics

8.5 Water Treatment

8.6 Agriculture

8.7 Others

9. Regional Analysis

10. Company Profiles

11. Competitive Landscape

12. Use Case and Best Practices

13. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/Automotive Electronics-market-1433

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.