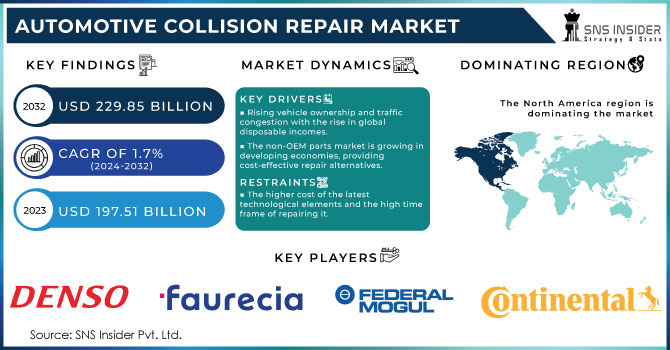

Pune, July 11, 2024 (GLOBE NEWSWIRE) -- The Automotive Collision Repair Market Size is projected to grow at a CAGR of 1.7% over the forecast period of 2024-2032. The market is estimated to reach USD 229.85 billion by 2032.

Get a Sample Report of Automotive Collision Repair Market @ https://www.snsinsider.com/sample-request/3601

Market Players Covered in this Report:

- 3M

- Automotive Technology products

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International

- Johnson Controls

- Mitsuba Corp

- Robert Bosch

Market Demand Analysis:

According to the US Federal Highway Administration in 2022 approximately 301 million vehicles were registered, a number expected to increase by 1.4% each year. According to SNS Insider study this factor holds the maximum weightage in influencing automotive collision repair market growth in a positive way. The crowded nature of traffic indicates that accidents are possible at any given time hence increasing chances of accidents.

Moreover, distracted driving from mobile phone usage alone is responsible for 9% of all crashes nationwide in the US. Moreover, old cars with an average age of almost twelve years are more likely to break down and require repairs after minor collisions. Therefore, these combined patterns indicate that there will be a growing need for automotive collision repair services.

Only around 20% of all global vehicles on road have telematics currently.

This number could rise more than three times to reach 75% by 2030 as per industry experts. This provides a wealth of information on driving habits, potential pre-collision events, and real-time damage assessment during actual crashes. Automotive collision repair facility operators can reduce their turnaround time by up to 30% by using such knowledge effectively i.e., quicker quotes, parts procurement ahead of time and targeting drivers following minor injuries in order to ease service demand through this data stream.

Automotive Collision Repair Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 197.51 Billion |

| Market Size in 2032 | 229.85 Billion |

| CAGR (2024-2032) | 1.7% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Automotive Collision Repair Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/3601

Aluminum and high-strength steel are used heavily in constructing car bodies. According to SNS Insider researches, 63% of mechanics think that such a trend makes them tougher to fix.

Moreover, they become more intricate with the integration of advanced driver-assistance systems (ADAS) like radar and LiDAR sensors. After the repairs, some shops need recalibration services for these systems which are outsourced frequently to dealerships raising the repair time and costs. As this study portrays it well, collision repair facilities cannot avoid investing much into specialized training as well as equipment to follow technology.

Geopolitical Scenario Analysis:

- Ongoing trade barriers and sanctions will be acting as a barrier for the overall supply chain of parts and materials

A recent study stated 72% of US body shops faced delay issues in receiving parts due to international trade issues. This will lead to rise in overall backlogs and higher cost. Secondly, geopolitical instability can impact insurance rates. For instance, a region experiencing conflict could witness increased road accidents prompting insurance providers to hike premiums in anticipation of possible losses later on.

By Vehicle Type Segment Analysis:

Light-duty vehicles are projected to hold more than 65% of the market share, with light-duty vehicles comprising hatchbacks, sedans, SUVs and crossovers as their leading types. Their dominance emanates from huge sales volumes as well as their involvement in many minor accidents. The heavy-duty vehicles sub-segment accounted for 35% share in 2023. This segment is projected to grow at a highest CAGR of 2.7% over 2024-2032.

By Product

- Paints & Coatings

- Consumables

- Spare Parts

By Vehicle Type

- Light-duty vehicle

- Heavy-duty vehicle

By Service Channel

- DIY

- DIFM

- OE

According to SNS Insider, APAC is anticipated to grow at a CAGR of 2.9% (2024-2032).

One of its major reasons is an excess number of vehicles running on roadways, whereby China alone contributed to over 25% of total global car sales in 2023 from where this can be deduced as another result. This implies a higher probability of accidents with approximately 40% of drivers in APAC expected to admit their involvement in accidents at least once per year. Moreover, it has a growing young population that is acquiring increasing levels of disposable income.

Buy an Enterprise User PDF of Automotive Collision Repair Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/3601

Competitive Landscape:

Nearly two-thirds of repair shops are small-scale businesses without access to state-of-the art technologies or standardized repair procedures. Some big chains such as Caliber Collision and Service King have a very large market share above 30%.

Enabled by economies of scale and brand recognition while smaller players who own almost two thirds rely on repeat business within specific territories for their success in this field. Meanwhile, franchising is gaining support among independents circa 5%, which delivers advantages for branding association, training and parts sourcing without having to give up operational independence.

Key Takeaways:

- In 2023 spare parts held around 64% of the market share in product segment. This highlights the importance of readily available, high-quality parts in vehicle restoration.

- The APAC region rise can be attributed to the mix of a high rate of road accidents and booming passenger car sales in the region.

- Original Equipment Manufacturer (OEM) dealerships are projected to maintain a dominant position, while the aftermarket sector is anticipated to experience considerable growth.

- Technology is making its mark with e-commerce platforms expanding across locations where genuine OEM parts can be instantly accessed. It adds efficiency into the repair process and enhances part availability which will create positive impacts on this industry going forward.

Access Complete Report Details @ https://www.snsinsider.com/reports/automotive-collision-repair-market-3601

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.