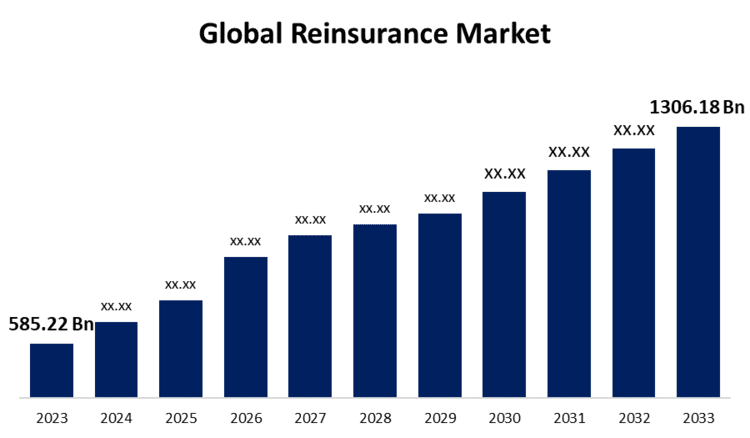

New York, United States , July 12, 2024 (GLOBE NEWSWIRE) -- The Global Reinsurance Market Size is to Grow from USD 585.22 Billion in 2023 to USD 1306.18 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.36% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4973

Under a reinsurance agreement, the insurance company or the ceding firm will be protected against the risks mentioned in the contract by the reinsurance company, reinsurer, or reinsurer broker. Its goals are to reduce the net amount at risk from certain risks like insolvency and unfavorable market conditions and to strengthen the surplus position and financial stability of the ceding company. Additionally, reinsurance increases the maximum amount of risk that the ceding firm might take on for any given risk and permits it to take on more business. Reinsurers assume a portion of the primary insurer's obligation in exchange for premium payments. Furthermore, the increased frequency of catastrophic events, including natural disasters and climate-related catastrophes, has led to a significant increase in the need for reinsurance. As these events become more common and severe, primary insurers face greater financial risks, and insurers are depending more and more on reinsurers to share the cost of these significant risks to minimize potential losses and maintain financial stability. Furthermore, the emergence of alternative funding sources, particularly insurance-linked securities (ILS), has resulted in increased liquidity and capacity in the global reinsurance market. While they look for unorthodox opportunities, investors can actively participate in taking on insurance risks by using ILS instruments like catastrophe bonds. This injection of alternative money enhances the overall resilience of the reinsurance industry. However, the demand for the global reinsurance market is substantially hampered by low interest rates, lower investment returns, and volatility in the financial markets.

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Reinsurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Facultative Reinsurance and Treaty Reinsurance), By Mode (Online and Offline), By Distribution Channel (Brokers and Direct Writing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4973

The treaty segment is anticipated to hold the greatest share of the global reinsurance market during the projected timeframe.

Based on the type, the global reinsurance market is divided into facultative reinsurance and treaty reinsurance. Among these, the treaty segment is anticipated to hold the greatest share of the global reinsurance market during the projected timeframe. The expanding size and complexity of insurance portfolios are two important drivers of the need for treaty reinsurance. Primary insurers often cover high-risk volumes across a range of business lines; hence, effective risk management approaches are necessary. Through treaty reinsurance, insurers can reduce the likelihood of financial result volatility and optimize their capital allocation by assigning a significant portion of their risks to reinsurers. These factors will boost category growth during the projection period.

The offline segment is expected to grow at the fastest pace growth through the forecast period in the global reinsurance market.

Based on the mode, the global reinsurance market is divided into online and offline. Among these, the offline segment is expected to grow at the fastest pace growth through the forecast period in the global reinsurance market. Buying a life insurance policy offline means going to a branch office of a company or working with a local agent. By using this method, a person can speak with agents who are educated about various plans and can help them choose the finest one. Additionally, face-to-face encounters with insurance brokers facilitate the exchange of questions and personalized advice.

The direct writing segment is anticipated for the largest revenue share in the global reinsurance market during the projected timeframe.

Based on the distribution channel, the global reinsurance market is divided into brokers and direct writing. Among these, the direct writing segment is anticipated for the largest revenue share in the global reinsurance market during the projected timeframe. There are no middlemen in direct written distribution; instead, the reinsurer engages directly with the primary insurer. This approach offers greater control over pricing and underwriting as well as transparency. Direct writing also fosters closer relationships between the ceding business and the reinsurer, which could lead to more customized reinsurance solutions, according to statistics from the reinsurance industry. By simplifying claims processing and communication processes, direct writing can increase efficiency and reduce administrative costs for all parties.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4973

North America is expected to hold the largest share of the global reinsurance market over the forecast period.

North America is expected to hold the largest share of the global reinsurance market over the forecast period. The reinsurance industry has witnessed a notable shift in focus towards innovative risk management tactics due to a rise in natural disasters. Insurers regularly seek reinsurance coverage for climate-related risks, such as wildfires and storms. In addition, advances in insurtech and data analytics are impacting product creation and enhancing expertise in risk modeling.

Asia Pacific is predicted to grow at the fastest pace in the global reinsurance market during the projected timeframe. The Asia-Pacific region's significant reinsurance industry expansion is being driven by growing economies and more knowledge of insurance. Insurers are increasingly using reinsurers to control risk, particularly in developing nations. The reinsurance market in the Asia-Pacific area is evolving due to a surge in insurtech usage and regulatory improvements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Reinsurance Market include Munich Re, Swiss Re, Hannover Re, Berkshire Hathaway Re, SCOR SE, Lloyd's, Korean Re, China Re, Everest Re, PartnerRe, TransRe, Arch Capital Group and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4973

Recent Developments

- In May 2024, Citizens Property Insurance Corporation unveiled its US$ 5.5 billion reinsurance plan for 2024. The strategy is designed to manage Florida's increasing property risk and adapt to shifting circumstances in the reinsurance market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Reinsurance Market based on the below-mentioned segments:

Global Reinsurance Market, By Type

- Facultative Reinsurance

- Treaty Reinsurance

Global Reinsurance Market, By Mode

- Online

- Offline

Global Reinsurance Market, By Distribution Channel

- Brokers

- Direct Writing

Global Reinsurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Medical Equipment Financing Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Diagnostics Equipment, Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, and Medical Furniture), By Type (New Medical Equipment, Rental Equipment, and Refurbished Equipment), By End User (Hospitals & Clinics, Laboratories & Diagnostic Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Security Brokerage and Stock Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Stock Exchanges, Derivatives & Commodities Brokerage, Equities Brokerage, Bonds Brokerage, and Others), By Establishment Type (Investment Firms, Banks, and Exclusive Brokers), By Mode (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Regtech Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Application (Anti-Money Laundering (AML) & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), By Deployment Mode (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Long-Term Care Insurance Market Size, Share, and COVID-19 Impact Analysis, By Service (Nursing Care, and Home Healthcare), By Payer (Out-of-Pocket and Public), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter