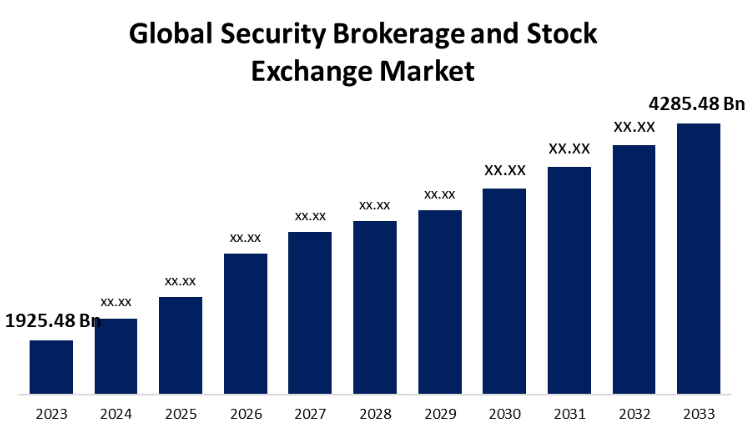

New York, United States , July 17, 2024 (GLOBE NEWSWIRE) -- The Global Security Brokerage and Stock Exchange Market Size is to Grow from USD 1925.48 Billion in 2023 to USD 4285.48 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.33% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5055

A stock brokerage is a financial firm that trades stocks and commodities and buys and sells assets for its customers in return for a brokerage fee. A stock exchange is a standardized and controlled marketplace where investors and stockbrokers can buy and sell stocks, bonds, and other assets. A securities brokerage is a company that, in return for a fee, commission, or other kind of payment, helps a person or an organization purchase, sell, or exchange securities. In the financial market, a security is any financial instrument with significant value that is exchangeable between interested parties. Any financial product or service, such as stocks, bonds, mutual funds, exchange-traded funds, and funds that are for sale or purchase, can be referred to as "securities". On the other hand, stocks are a type of security that, upon purchase, gives the buyer a share of ownership in a company. Furthermore, blockchain-based platforms might provide more efficiency and transparency in settlement procedures, along with faster and safer trading. Stock exchanges are making more and more efforts to expand into foreign markets by joint ventures and acquisitions. More companies and regions than ever before offer securities to investors. Furthermore, environmental, social, and governance (ESG) investing has been more popular in recent years, and many stock exchanges and securities brokerages now offer investment products with an emphasis on ESG. This trend is likely to persist as long as investors continue to think about how their investments impact the community in which they live. Online trading platforms have become increasingly popular recently, allowing investors to buy and sell stocks from the comfort of their homes. This is anticipated to lead to growth in the global market for securities brokerages and stock exchanges. However, breaches of cybersecurity and other security-related issues might have a negative impact on the market share of global stock exchanges and brokerages.

Browse key industry insights spread across 220 pages with 110 Market data tables and figures & charts from the report on the "Global Security Brokerage and Stock Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Stock Exchanges, Derivatives & Commodities Brokerage, Equities Brokerage, Bonds Brokerage, and Others), By Establishment Type (Investment Firms, Banks, and Exclusive Brokers), By Mode (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5055

The stock exchanges segment is anticipated to hold the greatest share of the global security brokerage and stock exchange market during the projected timeframe.

Based on the type, the global security brokerage and stock exchange market is divided into stock exchanges, derivatives & commodities brokerage, equities brokerage, bonds brokerage, and others. Among these, the stock exchange segment is anticipated to hold the greatest share of the global security brokerage and stock exchange market during the projected timeframe. As a result of technological advancements and the growing popularity of advanced financial products. The digital transformation has led to increased efficiency and liquidity in the stock market, boosting the appeal of high-frequency trading, algorithmic trading, and electronic trading platforms. Additionally, the growth of theme and sustainable investing has given the industry a new dimension. Two further elements influencing the shifting landscape are the adoption of cryptocurrencies and the creation of Special Purpose Acquisition Companies (SPACs). The financial business is continually evolving and adapting as markets adjust to changing investor tastes and global economic trends, as demonstrated by the growing stock exchange sector.

The investment firms segment is expected to grow at the fastest pace in the global security brokerage and stock exchange market during the projected timeframe.

Based on the establishment type, the global security brokerage and stock exchange market is divided into investment firms, banks, and exclusive brokers. Among these, the investment firms segment is expected to grow at the fastest pace in the global security brokerage and stock exchange market during the projected timeframe. There are many different investing ideas and possibilities available in the financial market. For the typical person, choosing the best option from the available possibilities can be frightening and confusing due to the high level of risk involved in the banking industry. As a result, people regularly use the services of investment businesses to get advice and support in making sensible decisions.

The online segment is predicted for largest revenue share in the global security brokerage and stock exchange market during the estimated period.

Based on the mode, the global security brokerage and stock exchange market is divided into online and offline. Among these, the online segment is predicted for largest revenue share in the global security brokerage and stock exchange market during the estimated period. The way that the financial markets function is changing as a result of the stock exchanges and securities brokerages quickly growing their internet businesses. By providing investors with rapid access to research materials, trading tools, and market data, modern technology has made the transition to online platforms smoother and easier. Today's democratization of financial participation allows anyone to trade stocks and securities from the convenience of their homes or mobile devices.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5055

North America is estimated for the largest revenue share in the global security brokerage and stock exchange market over the forecast period.

North America is estimated for the largest revenue share in the global security brokerage and stock exchange market over the forecast period. The New York Stock Exchange (NYSE) and Wall Street, the two most significant stock exchanges in the US and Canada, respectively, are located in the region. Other significant financial hubs include Halifax. Technology innovation, a robust regulatory environment, and the concentration of significant financial institutions are the reasons for North America's leadership in securities trading. High-frequency trading and automated trading platforms, which have increased market liquidity and efficiency, originated and were popularized in this region. North America's position as a financial powerhouse is strengthened by the diversity of companies listed there, which attracts investors from throughout the world.

Europe is predicted to grow at the fastest pace in the global security brokerage and stock exchange market during the projected timeframe. The financial system in Europe is well-established and includes reputable exchanges such as the London Stock Exchange and Euronext. The stability of the geopolitical environment in Europe is attributed to several reasons, including a diverse variety of institutional and individual investors, the European Securities and Markets Authority (ESMA), and other strong regulatory authorities. The region's financial system has a significant impact as well.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Security Brokerage and Stock Exchange Market include Bank of America Corporation, Citigroup Global Markets Inc., Smith Barney, Northwestern Mutual Life Insurance Company, INVEST Financial Corporation, Ameriprise Financial Services Inc., Edward Jones & Co. L.P., Raymond James Financial Inc., Genworth Financial Inc., Wells Fargo Advisors LLC, H&R Block Financial Advisors Inc., H.D. Vest Financial Services Inc., Ameritas Investment Corp., Associated Securities Corporation, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5055

Recent Developments

- In February 2023, Goldman Sachs created GS Strats, a cloud-based platform that offers pre-configured algorithmic trading strategies to its clients. This expands Goldman Sachs' market penetration beyond traditional high-frequency trading firms and satisfies the growing need for automated trading solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Security Brokerage and Stock Exchange Market based on the below-mentioned segments:

Global Security Brokerage and Stock Exchange Market, By Type

- Stock Exchanges

- Derivatives & Commodities Brokerage

- Equities Brokerage

- Bonds Brokerage

- Others

Global Security Brokerage and Stock Exchange Market, By Establishment Type

- Investment Firms

- Banks

- Exclusive Brokers

Global Security Brokerage and Stock Exchange Market, By Mode

- Online

- Offline

Global Security Brokerage and Stock Exchange Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Medical Equipment Financing Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Diagnostics Equipment, Therapeutic Equipment, Patient Monitoring Equipment, Laboratory Equipment, and Medical Furniture), By Type (New Medical Equipment, Rental Equipment, and Refurbished Equipment), By End User (Hospitals & Clinics, Laboratories & Diagnostic Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Regtech Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Application (Anti-Money Laundering (AML) & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), By Deployment Mode (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-Life Insurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), By Distribution Channel (Traditional Banks, Digital Platforms, and Insurtech Startups), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter