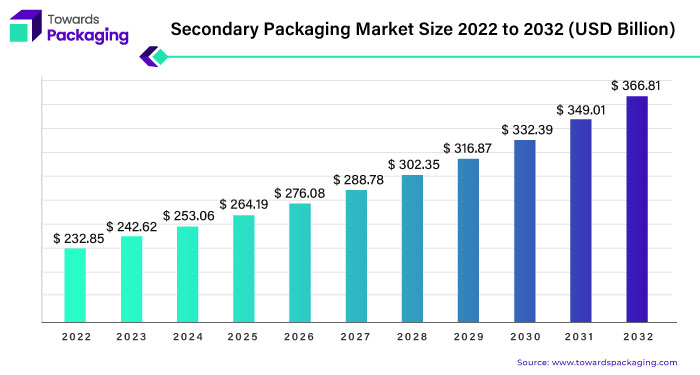

Ottawa, July 18, 2024 (GLOBE NEWSWIRE) -- The global secondary packaging market size is predicted to grow from USD 242.62 billion in 2023 to approximately USD 366.81 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive Secondary Packaging Market Size, Companies, Share a free sample: https://www.towardspackaging.com/personalized-scope/5138

Secondary packaging refers to the outer packaging used to protect and contain primary packaged goods during storage, transportation, and distribution. Unlike primary packaging, which directly holds the product, secondary packaging serves as an additional layer of protection and often includes cardboard boxes, shrink wrap, pallets, and other materials that facilitate handling and storage.

In the context of the market, the secondary packaging industry encompasses the manufacturing and supply of these external packaging materials and solutions. This market is essential for ensuring product integrity, preventing damage during transit, enhancing shelf appeal through branding and labeling, and meeting regulatory requirements for safe and efficient distribution of goods.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Secondary Packaging Market at a Glance

The global secondary packaging market plays a pivotal role in the safe and efficient distribution of various products across industries. Secondary packaging refers to the external packaging materials used to protect and bundle primary packaged goods during transit and storage. It includes items like cardboard boxes, shrink wrap, pallets, and other materials that enhance handling, storage efficiency, and product protection.

This growth is driven by several factors, including increasing demand for sustainable packaging solutions, advancements in packaging technologies, and the expansion of e-commerce and retail sectors globally.

The secondary packaging market continues to evolve with innovations aimed at enhancing sustainability, efficiency, and consumer convenience. As industries adopt advanced packaging solutions to meet evolving consumer expectations and regulatory requirements, the market remains dynamic, offering opportunities for growth and technological advancement in the coming years.

Get a customized Secondary Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5138

Globalization Driving Growth in the Secondary Packaging Market

The globalization of trade significantly impacts the growth of the secondary packaging market. With the expansion of international trade, products are frequently shipped across continents, requiring robust packaging solutions that can endure long journeys and varying climatic conditions. Secondary packaging, including corrugated boxes, shrink wraps, and pallets, ensures that goods arrive at their destinations intact, maintaining their quality and safety.

For instance, consider the global e-commerce boom. Companies like Amazon and Alibaba ship millions of products worldwide daily. These items must be securely packaged to prevent damage during transit. Secondary packaging plays a crucial role in protecting items from mechanical stress and environmental factors such as humidity and temperature changes. This need for reliable packaging solutions has driven innovation and increased demand in the secondary packaging sector.

A recent example highlighting the sector's growth is the expansion of packaging company Amcor PLC.

- In March 2024, Amcor announced the opening of a new state-of-the-art packaging facility in Singapore. This facility is designed to meet the increasing demand for advanced packaging solutions in the Asia Pacific region, driven by the growing export activities and the rising importance of e-commerce. The facility focuses on producing sustainable packaging materials, showcasing the industry's shift towards environmentally friendly solutions to meet global shipping requirements.

Brand Marketing, A Key Driver for the Secondary Packaging Market

Secondary packaging is not just about protection and logistics; it also serves as a powerful marketing tool. Companies increasingly leverage secondary packaging to enhance their brand visibility and communicate essential product information to consumers. This strategic use of packaging helps brands differentiate themselves in a competitive market and connect with their target audience.

A prime example of this is Coca-Cola's holiday packaging campaigns. Every year, Coca-Cola releases special edition packaging for its products, featuring festive designs and messages. This not only enhances the brand's visibility but also creates a sense of excitement and anticipation among consumers. The holiday-themed packaging encourages purchases as gifts, further driving sales during the season.

In addition to seasonal campaigns, companies are also investing in sustainable and visually appealing packaging to attract eco-conscious consumers.

- For instance, in April 2023, Unilever launched its new "Love Beauty and Planet" hair care range with secondary packaging made from 100% recycled materials. The packaging features vibrant colors and clear messaging about the product's eco-friendly credentials, appealing to environmentally conscious shoppers and reinforcing Unilever's commitment to sustainability.

Excess Capacity, A Restraint for the Secondary Packaging Market

The secondary packaging market is significantly influenced by the dynamics of the paperboard industry, which is currently grappling with excess manufacturing capacity. This surplus can lead to pricing pressures and can hinder manufacturers from investing in new, innovative solutions, thereby affecting the overall growth and development of the market.

A recent example of the impact of excess capacity can be seen in Europe. In 2023, several European paperboard manufacturers reported significant challenges due to overcapacity. Companies like Smurfit Kappa and Stora Enso, despite being industry leaders, faced reduced profit margins and were forced to implement cost-cutting measures to remain competitive. These measures included delaying or scaling back investments in new technology and production facilities, which could have advanced the development of innovative and eco-friendly packaging solutions.

The situation is further complicated by the global push towards sustainability. Consumers and regulatory bodies are increasingly demanding environmentally friendly packaging. However, with excess capacity leading to lower prices, manufacturers find it challenging to allocate funds towards developing sustainable alternatives. This creates a paradox where the need for innovation in sustainable packaging is high, but the financial feasibility of such innovation is low due to market pressures.

Sustainable Materials and Design, An Emerging Opportunity for the Market

As the world increasingly emphasizes environmental responsibility, there is a significant opportunity for companies to develop and utilize eco-friendly secondary packaging solutions. This trend is driven by growing consumer demand for sustainable products and regulatory pressures aimed at reducing environmental impact. As a result, the secondary packaging market is poised for transformation through the adoption of materials made from recycled content, bioplastics, and innovative paperboard combinations.

One of the key areas of focus is the use of recycled materials in secondary packaging. Companies are increasingly turning to materials that have been previously used and repurposed, thus reducing the need for virgin resources and minimizing waste. For instance, Amcor, a global leader in packaging, has made substantial investments in developing packaging solutions that incorporate high levels of recycled content.

In 2023, Amcor launched a new line of secondary packaging made from 100% recycled PET, which not only reduces environmental impact but also meets the high-performance standards required for protecting products during transportation.

North America, Strength in Infrastructure and Innovation

North America remains a dominant force in the secondary packaging market due to its robust infrastructure and economic strength. The region benefits from efficient transportation networks and well-established supply chains, which rely heavily on secondary packaging for smooth operations. The retail, food and beverage, pharmaceuticals, and electronics sectors, among others, drive the demand for various secondary packaging solutions to ensure product protection, brand visibility, and regulatory compliance.

In the U.S., the launch of a concentrated laundry detergent designed for e-commerce orders highlights the innovation in secondary packaging. The new packaging reduces overall weight during transit and incorporates a plastic container within a wooden frame, improving handling and minimizing plastic use.

Asia Pacific, Rapid Growth and Technological Advancements

The Asia Pacific region has emerged as a significant player in the secondary packaging market. Economies such as China, India, Japan, and South Korea are experiencing rapid growth, driving the demand for secondary packaging solutions. The increasing disposable income and urbanization in these countries boost the consumption of packaged goods across various industries, including food and beverage, healthcare, and electronics.

In India, the secondary packaging market is expanding with innovations in eco-friendly materials. For example, companies are investing in recycled and biodegradable packaging solutions to cater to the growing environmental consciousness among consumers. Additionally, the region is seeing advancements in packaging automation and design, improving efficiency and sustainability.

- In January 2023, Cosfibel Group, known for luxury gifting and promotional packaging, was acquired by GPA Global, reflecting the strategic investments and growth in the region’s secondary packaging market.

Europe faces challenges related to excess paperboard capacity, which impacts market dynamics and pricing pressures. However, the region continues to demand paper-based packaging solutions, emphasizing sustainability and innovation. The paper and paperboard consumption in Europe remained steady in 2022, indicating the ongoing need for these materials despite market fluctuations.

- In October 2023, JK Paper Ltd in India acquired Manipal Utility Packaging Solutions Pvt Ltd for approximately Rs 90 crore. This acquisition underscores the strategic moves within the industry to optimize manufacturing capabilities and explore alternative resources.

The Paper & Paperboard Dominates the Secondary Packaging Market

Paper and paperboard dominate the secondary packaging market due to their versatility and sustainability. These materials are widely used for their ability to be easily shaped into various packaging forms such as cartons and boxes, which are essential for protecting products during transportation and enhancing shelf appeal. Additionally, the eco-friendly nature of paper and paperboard aligns with growing consumer and regulatory demands for sustainable packaging solutions.

The Corrugated Boxes Holds the Largest Market Share

Corrugated boxes are the leading product in the secondary packaging market. Their sturdy and lightweight nature makes them ideal for shipping and protecting goods across various industries. These boxes are designed to absorb shocks and prevent damage during handling and transportation, ensuring the safe delivery of products. Their adaptability for customization and branding also adds to their popularity among manufacturers and retailers.

The Food & Beverage Dominated the Market in 2023

The food and beverage industry is the largest end-user of secondary packaging. This sector relies heavily on secondary packaging to ensure the safety, freshness, and integrity of products from production to consumption. Packaging solutions such as cartons, wraps, and boxes play a crucial role in maintaining product quality, preventing contamination, and providing consumers with convenient and attractive packaging options. The increasing demand for packaged food and beverages further drives the need for effective secondary packaging solutions.

Recent developments

- In January 2024, Pharmaceutical packaging solutions provider Berry Global Healthcare, which specializes in patient-centered design, presented its most recent line of custom and conventional pharmaceutical packaging products at Pharmapack 2024.

- In January 2023, Cosfibel Group, a prominent leader in the fields of luxury gifting, merchandising, and promotional packaging, has been acquired by GPA Global.

- In October 2023, JK Paper Ltd invested roughly Rs 90 crore to acquire Manipal Utility Packaging Solutions Pvt Ltd. JK Paper announced in a regulatory filing that it had signed into an agreement to buy stock to purchase 100% of Manipal Utility Packaging Solutions Pvt Ltd's shares.

More Insights into Towards Packaging

- The global seafood packaging market size is estimated to grow from USD 13.95 billion in 2022 to reach an estimated USD 24.31 billion by 2032, at 5.7% CAGR from 2023 to 2032.

- The global glass packaging market size is estimated to grow from USD 60.96 billion in 2022 to reach an estimated USD 98.82 billion by 2032, at 5% CAGR from 2023 to 2032.

- The global green packaging market size is estimated to grow from USD 303.83 billion in 2022 to reach an estimated USD 510.93 billion by 2032, at 5.3% CAGR from 2023 to 2032.

- The global pet food packaging market size is estimated to grow from USD 11.38 billion in 2022 to set a foot on USD 22.08 billion by 2032, at 6.9% CAGR from 2023 to 2032.

- The global corrugated packaging market size accepted to grow from USD 276 billion in 2022 and it is predicted to hit around USD 410.50 billion by 2032, at 4.10% CAGR from 2023 to 2032.

- The global cosmetic packaging market size accounted for USD 33.07 billion in 2022 to reach USD 54.13 billion by 2032 at 4.5% CAGR from 2023 to 2032.

- The global edible packaging market size current valuation, standing at USD 1.4 billion in 2022 projected to culminate zenith of USD 5.26 billion by 2032 at 14.2% CAGR between 2023 and 2032.

- The global active packaging market size is estimated to grow from USD 19.2 billion in 2022 at 7.5% CAGR to reach an estimated USD 39.51 billion by 2032, between 2023 and 2032.

- The global antimicrobial packaging market size was at USD 10.77 billion in 2022 to hit around USD 18.81 billion by 2032, at 5.7% CAGR between 2023 to 2032.

- The global automotive packaging market size is estimated to grow from USD 8.18 billion in 2022 to reach an estimated USD 13.87 billion by 2032, at 5.4 % CAGR between 2023 and 2032.

Key market players

- Amcor

- Ball Corporation

- Berry Global

- Crown Holdings

- International Paper Company

- Mondi Group

- Nippon Paper Industries

- Oji Holdings Corp

- Owens-Illinois

- Reynolds Group Holdings

- SCG Packaging

- Stora Enso

- WestRock

Secondary Packaging Market Segments

By Material

- Paper & Paperboard

- Plastic

- Wood

- Metal

- Others

By Product

- Folding Cartons

- Plastic Crates

- Corrugated Boxes

- Wraps & Films

By End Use

- Healthcare

- Food & Beverage

- Industrial

- Others

By Region

- North America

- Asia Pacific

- Europe

- LAMEA

Act Now and Get Your Secondary Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5138

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/