New York, USA, Aug. 19, 2024 (GLOBE NEWSWIRE) -- Factor D Complement Inhibitor Market Will Witness Robust Growth with Emerging Therapies by 2034 | DelveInsight

The factor D complement inhibitor market is projected to experience rapid growth due to the expansion of indications for already approved therapies, such as danicopan for geographic atrophy, and the anticipated approval of emerging therapies like vemircopan during the forecast period. Advances in biotechnology and a rising prevalence of autoimmune diseases are fueling demand for targeted therapies. Additionally, the expanding pipeline of drug candidates and clinical trials are expected to propel market expansion in the coming years.

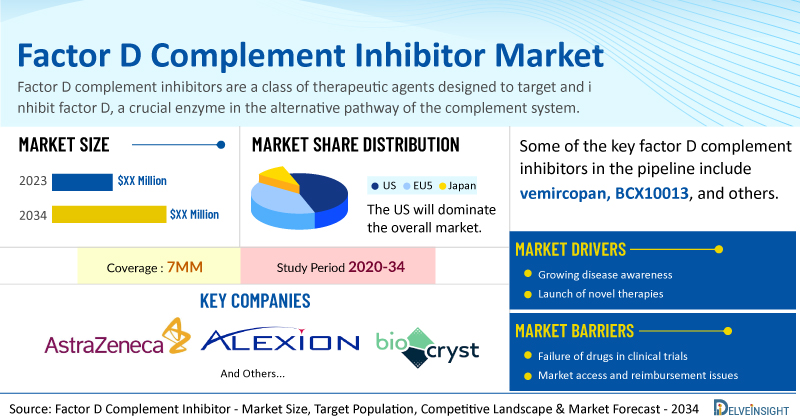

DelveInsight’s Factor D Complement Inhibitor Market Insights report includes a comprehensive understanding of current treatment practices, emerging factor D complement inhibitors, market share of individual therapies, and current and forecasted factor D complement inhibitors market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Factor D Complement Inhibitor Market Report

- As per DelveInsight’s analysis, the factor D complement inhibitors market is anticipated to grow at a significant CAGR by 2034.

- Leading factor D complement inhibitors companies such as AstraZeneca, Alexion (a subsidiary of AstraZeneca), BioCryst, and others are developing novel factor D complement inhibitors that can be available in the factor D complement inhibitors market in the coming years.

- Some of the key factor D complement inhibitors in the pipeline include vemircopan, BCX10013, and others.

- In April 2024, AstraZeneca/Alexion’s VOYDEYA (Danicopan) became the first Factor D inhibitor to get approval as an add-on therapy to ULTOMIRIS (ravulizumab) or SOLIRIS (eculizumab) for treatment of extravascular hemolysis in adults with paroxysmal nocturnal hemoglobinuria (PNH).

- According to DelveInsight’s analysis, there were approximately 12,500 diagnosed prevalent cases of PNH in the 7MM in 2023, with this number expected to increase over the forecast period. Of these, the US accounted for about 50% of these cases, followed by the UK and Germany, which accounted for 21% and 11%, respectively.

- In October 2023, BioCryst began enrollment in a proof-of-concept clinical trial evaluating BCX10013, a potential once-daily, oral Factor D inhibitor for the treatment of PNH.

Discover which therapies are expected to grab the factor D complement inhibitors market share @ Factor D Complement Inhibitor Market Report

Factor D Complement Inhibitor Market Dynamics

The Factor D complement inhibitors market is shaped by a range of dynamics, driven by advancements in medical research and a growing understanding of complement system-related diseases. As research progresses, the pipeline for Factor D inhibitors is expanding, with several candidates undergoing clinical trials, which is expected to significantly impact market growth.

The increasing prevalence of complement system-related diseases is a major driver of the Factor D complement inhibitors market. The rising incidence of chronic conditions like AMD and rare disorders such as aHUS underscores the need for targeted therapies. Additionally, the growing awareness and diagnosis of these conditions are contributing to the market's expansion. As healthcare systems worldwide become more adept at identifying complement-related disorders, the demand for effective treatments, including Factor D inhibitors, is likely to increase.

Regulatory approvals and the introduction of new therapies are crucial factors influencing market dynamics. The success of clinical trials and the subsequent approval of Factor D inhibitors can accelerate market growth. Companies are investing heavily in research and development to bring innovative solutions to the market, which also fuels competition and drives advancements in treatment options. Collaboration between pharmaceutical companies and research institutions is often pivotal in navigating complex regulatory pathways and bringing new inhibitors to market.

Market dynamics are also influenced by pricing strategies and reimbursement policies. As Factor D inhibitors enter the market, pricing strategies will play a critical role in their adoption and accessibility. High costs associated with innovative therapies can impact patient access and market penetration. Consequently, negotiations with health insurance providers and public health systems will be essential for ensuring that these therapies reach the patients who need them.

Finally, the competitive landscape of the Factor D complement inhibitors market is shaped by ongoing research and the development of alternative therapeutic approaches. Companies are not only focusing on Factor D inhibitors but also exploring other targets within the complement system. This broader approach to complement inhibition could lead to a more comprehensive treatment landscape, influencing market dynamics by offering patients a range of therapeutic options and potentially altering the market share among leading pharmaceutical companies.

Factor D Complement Inhibitor Treatment Market

Factor D and the alternative complement pathway play roles in both healthy and diseased states. Normally, this pathway helps defend against infections and maintains the health of various tissues and organs. However, when it becomes dysregulated, it can contribute to the development of a range of diseases throughout the body. While these conditions can impact specific organs or tissues, they often also involve systemic complications and widespread inflammation.

In April 2024, the FDA approved VOYDEYA to be used alongside ULTOMIRIS (ravulizumab) or SOLIRIS (eculizumab) for managing extravascular hemolysis (EVH) in adults with paroxysmal nocturnal hemoglobinuria (PNH). Danicopan has similarly been approved in Japan and the EU for this purpose. AstraZeneca/Alexion’s VOYDEYA (danicopan), an oral medication, is currently the only approved Factor D complement inhibitor for PNH.

Learn more about the FDA-approved factor D complement inhibitors @ Factor D Complement Inhibitor Drugs

Key Emerging Factor D Complement Inhibitors and Companies

Key companies such as AstraZeneca/Alexion (vemircopan), BioCryst (BCX10013), and others are evaluating their products.

Vemircopan is a medication that can be taken orally and inhibits complement Factor D, a serine protease that normally breaks down complement factor B. By doing so, it has the potential to inhibit the complement system. When administered, vemircopan specifically targets and blocks Factor D, preventing it from cleaving complement factor B into Ba and Bb within the alternative pathway of the complement cascade. This action disrupts Factor D-mediated signaling and activation of the alternative complement pathway (ACP), thereby reducing complement-induced hemolysis in paroxysmal nocturnal hemoglobinuria (PNH) and preventing tissue damage from ACP activation. Alexion is currently evaluating vemircopan in a Phase II clinical trial for proliferative lupus nephritis and IgAN.

The anticipated launch of these emerging therapies are poised to transform the factor D complement inhibitors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the factor D complement inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about factor D complement inhibitors clinical trials, visit @ Factor D Complement Inhibitor Treatment Drugs

Factor D Complement Inhibitor Overview

Factor D complement inhibitors are a class of therapeutic agents designed to target and inhibit factor D, a crucial enzyme in the alternative pathway of the complement system. The complement system is a key component of the immune response, helping to identify and eliminate pathogens and damaged cells. Factor D plays a critical role by cleaving factor B, which is essential for the formation of the C3 convertase enzyme complex that amplifies the complement cascade. By inhibiting factor D, these drugs can effectively reduce the overactivation of the complement system, which is implicated in various inflammatory and autoimmune diseases.

Inhibitors of factor D are particularly valuable in managing conditions where complement dysregulation contributes to disease pathology, such as in certain rare genetic disorders and inflammatory conditions. For instance, these inhibitors have shown promise in treating diseases like paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS), where excessive complement activation leads to severe clinical symptoms. By precisely targeting factor D, these therapies offer a more specific approach compared to broader complement inhibitors, potentially leading to fewer side effects and more effective disease management.

| Factor D Complement Inhibitor Report Metrics | Details |

| Study Period | 2020–2034 |

| Factor D Complement Inhibitor Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key Factor D Complement Inhibitor Companies | AstraZeneca, Alexion (a subsidiary of AstraZeneca), BioCryst, and others |

| Key Factor D Complement Inhibitor | vemircopan, BCX10013, VOYDEYA (danicopan), and others |

Scope of the Factor D Complement Inhibitor Market Report

- Factor D Complement Inhibitor Therapeutic Assessment: Factor D Complement Inhibitor current marketed and emerging therapies

- Factor D Complement Inhibitor Market Dynamics: Conjoint Analysis of Emerging Factor D Complement Inhibitor Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Factor D Complement Inhibitor Market Access and Reimbursement

Discover more about factor D complement inhibitor drugs in development @ Factor D Complement Inhibitor Clinical Trials

Table of Contents

| 1. | Factor D Complement Inhibitor Market Key Insights |

| 2. | Factor D Complement Inhibitor Market Report Introduction |

| 3. | Executive Summary of Factor D Complement Inhibitors |

| 4. | Key Events |

| 5. | Factor D Complement Inhibitor Market Forecast Methodology |

| 6. | Factor D Complement Inhibitors Market Overview at a Glance in the 7MM |

| 7. | Factor D Complement Inhibitors: Background and Overview |

| 8. | Factor D Complement Inhibitors Target Patient Pool |

| 9. | Factor D Complement Inhibitor Marketed Drugs |

| 10. | Factor D Complement Inhibitor Emerging Drugs |

| 11. | Seven Major Factor D Complement Inhibitor Market Analysis |

| 12. | Factor D Complement Inhibitor Market Access and Reimbursement |

| 13. | SWOT Analysis |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | Appendix |

| 17. | DelveInsight Capabilities |

| 18. | Disclaimer |

| 19. | About DelveInsight |

Related Reports

Complement Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, market share of the individual therapies, and key complement inhibitors companies including Genentech, Ionis, Roche, AKARI Therapeutics, CARE Pharma, NovelMed Therapeutics, Omeros Corporation, among others.

Paroxysmal Nocturnal Hemoglobinuria Market

Paroxysmal Nocturnal Hemoglobinuria Market Insight, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key PNH companies, including Hoffmann-La Roche, Alexion Pharmaceuticals, Novartis, Regeneron Pharmaceuticals, BioCryst Pharmaceuticals, among others.

Generalized Myasthenia Gravis Market

Generalized Myasthenia Gravis Market Insight, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key generalized myasthenia gravis companies, including UCB Biopharma, Argenx-Halozyme Therapeutics, Horizon Therapeutics, Hoffmann-La Roche, Janssen Research & Development, LLC, Immunovant Sciences GmbH, Sanofi, Cartesian Therapeutics, Takeda, DAS Therapeutics, Chugai Pharmaceutical, Inc., Alexion, Regeneron Pharmaceuticals, Ra Pharmaceuticals, Inc., among others.

Myasthenia Gravis Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key myasthenia gravis companies, including Viela Bio, UCB Pharma, Momenta Pharmaceuticals, Sanofi, Regeneron Pharmaceuticals, Ra Pharmaceuticals, Hoffmann-La Roche, Alexion Pharmaceuticals, Catalyst Pharmaceuticals, Harbour BioMed, Novartis, Takeda, DAS Therapeutics, RemeGen, Cartesian Therapeutics, Nanjing IASO Biotherapeutics, Cabaletta Bio, CytoDyn, Ahead Therapeutics, Toleranzia, Rallybio, among others.

Generalized Myasthenia Gravis Pipeline

Generalized Myasthenia Gravis Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key generalized myasthenia gravis companies, including Biocon, Cartesian Therapeutics, UCB, Momenta Pharmaceuticals, HanAll Biopharma, Roche, Alexion, Novartis, Takeda, BioMarin, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter