Pune, Aug. 20, 2024 (GLOBE NEWSWIRE) -- Wealth Management Software Market Size Analysis:

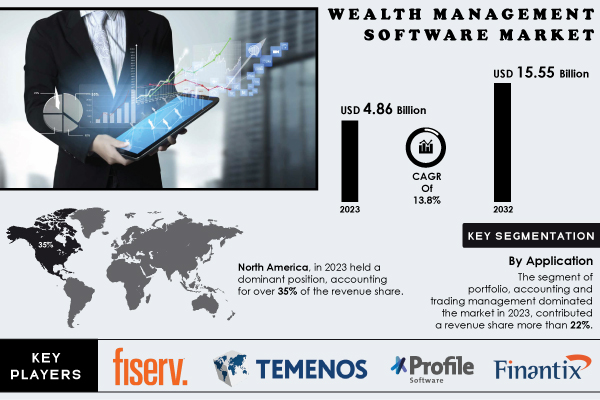

“The report of SNS Insider states that the Wealth Management Software Market was valued at USD 4.86 billion in 2023 and is projected to reach USD 15.55 billion by 2032, growing at a robust CAGR of 13.8% between 2024 and 2032.”

Growing Demand for Wealth Management Software

Demand for increasingly sophisticated, customized services is driving the growth of the wealth management software market. The platform currently provides an array of tools, such as reporting for asset management and financial planning purposes along with a risk analysis tool that enables advisors to facilitate relationships with clients more effectively while minimizing the time spent on managing assets. Advanced technologies like machine learning and automation are one of the key market drivers. It helps them where they can provide AI-based tools and increase the best decision-making while removing inefficiency from the system almost 45% of their customers now use AI-enabled tools to improve decision-making and inefficiency. Advisors can browse very large data sets, and build more accurate investment models and automation systems. For instance, one study found that 39% of wealth management professionals consider a lack of technological capability as a key problem to implementing more sophisticated solutions.

Opportunities in the market are expanding especially now that cloud-based solutions are becoming increasingly widespread, scalable, and cost-effective. The global high-net-worth individual (HNWI) population will grow by 6.3% in 2023, from regions such as North America and Asia-Pacific and wealth management firms are heavily investing in technology resources to offer personalized service on this scale. Despite obstacles, the market is positioned to develop strongly as companies continue with digital transformation efforts.

Get a Sample Report of Wealth Management Software Market@ https://www.snsinsider.com/sample-request/3250

Major Players Analysis Listed in this Report are:

- Fiserv, Inc.

- Temenos Headquarters SA

- Fidelity National Information Services, Inc.

- Profile Software

- SS&C Technologies Holdings, Inc.

- SEI Investments Company

- Finantix

- Comarch SA

- Objectway S.P.A.

- Dorsum Ltd.

- Other Players

Wealth Management Software Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.86 Bn |

| Market Size by 2032 | US$ 15.55 Bn |

| CAGR | CAGR of 13.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • The adoption of advanced financial technology is enhancing efficiency and service quality in wealth management, driving market growth. • Rising demand for automation in wealth management improves operational efficiency and data management, fuelling software adoption. |

Do you have any specific queries or need any customization research on Wealth Management Software Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3250

Recent Developments

March 2023, WealthTech company GBST rebranded and launched an enhanced version of its SaaS Composer wealth management administration software, maintaining its original name and introducing a new brand strategy and visual identity linked to its updated backronym.

In April 2022, HCL Technologies also expanded its global partnership with Avaloq to build out a lifecycle management center for digital wealth management bringing more financial institutions onto the advanced tech model of Avaloq.

Segment Analysis

Based on enterprise size, the wealth management software market is dominated by large enterprises with 56% in 2023. Cloud-based wealth management platforms enabling Large Enterprises to manage digital assets, accounting operations and clients funds in a more efficient way. Enterprises are using new technical features and technologies for handling in their giant data systems to keep up with market trends. However, the Small & Medium Enterprises (SMEs) segment is anticipated to exhibit highest CAGR during 2024–2032. The increasing requirement for compliance and the growing need to save costs on asset monitoring due to SMEs, SME's has forced institutions to adopt wealth management software assisting the growth of this segment.

The banks' sector dominated with the largest revenue share 27% in 2023, based on end users. With the increasing size of economies worldwide and people's wealth, leading banks to adopt wealth management software to enhance client services. The highest growth of trading and exchange firms is expected to grow in the forecast period owing to technology advancements and digitalization in multiple trade activities. To handle assets of clients and give 24/7 access to financial portfolios, these firms are increasingly using wealth management software that is driving growth in this segment.

Wealth Management Software Market Key Segmentation:

By Advisory Mode

- Human Advisory

- Robo Advisory

- Hybrid

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Financial Advice & Management

- Portfolio, Accounting, & Trading Management

- Performance Management

- Risk & Compliance Management

- Reporting

- Others

By End-use

- Banks

- Investment Management Firms

- Trading & Exchange Firms

- Brokerage Firms

- Others

Regional Analysis

North America held the largest share of the wealth management software market in 2023 and accounted for over 35% of the global revenue share. This dominance is driven by the burgeoning number of high-net-worth individuals (HNWIs) in the region, which rose by 5.4% in the United States. Wealth management firms are pushing their services as affluent clients seek more sophisticated solutions for financial advising.

Tech adoption has been even higher in the U.S., where around 48% of firms are now integrating tools like blockchain, machine learning, and digital process automation to help deliver services and engage with clients more effectively. Furthermore, legal changes in the US are forcing companies to implement better software solutions for their own compliance and risk reduction. This combination of factors is solidifying North America's leadership position in the global wealth management software market.

Buy an Enterprise-User PDF of Wealth Management Software Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3250

Key Takeaways

- The report provides detailed insights into market segments, showcasing the most dominant segments in each one of them, as well as their growth prospects

- The report highlights the specific regional partnership deals that are shaping the market, with a particular emphasis on North America's dominant presence in this space.

- The report also highlights various drivers and challenges which are likely to define the high-growth landscape of Alternative Retail Technologies over the forecast period.

Table of Contents – Major Key Points

- Introduction

- Executive Summary

- Research Methodology

- Market Dynamics Impact Analysis

- Statistical Insights and Trends Reporting

- Competitive Landscape

- Wealth Management Software Market Segmentation, by Advisory Mode

- Wealth Management Software Market Segmentation, by Deployment

- Wealth Management Software Market Segmentation, By Enterprise Size

- Wealth Management Software Market Segmentation, By Application

- Wealth Management Software Market Segmentation, By End-use

- Regional Analysis

- Company Profiles

- Use Cases and Best Practices

- Conclusion

Access Complete Report Details of Wealth Management Software Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/wealth-management-software-market-3250

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.