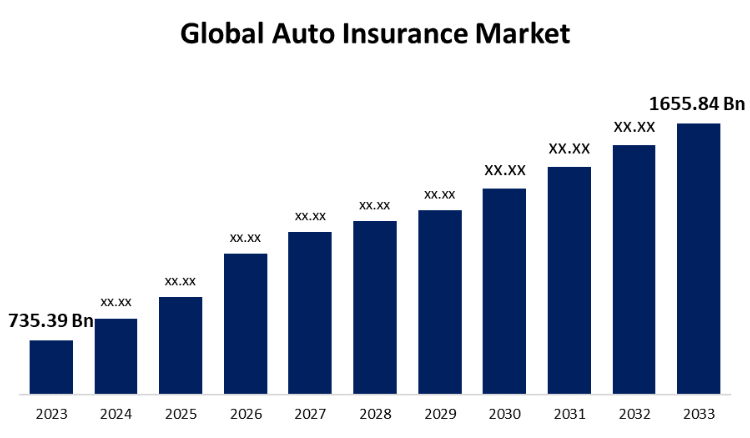

New York, United States , Aug. 21, 2024 (GLOBE NEWSWIRE) -- The Global Auto Insurance Market Size is to Grow from USD 735.39 Billion in 2023 to USD 1655.84 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.46% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4855

A contract between the policyholder and the insurance provider protects policyholders against financial loss in the instance of an accident or theft. In return for the policyholder paying a premium, the insurance company undertakes to pay back the policyholder's losses as detailed in the policy. Auto insurance serves as a safety net for people's finances and provides physical protection against injuries sustained in traffic accidents and car theft. Costs from crashes in which the owner of an insured vehicle is held liable for injuries caused to other motorists, other vehicles, or property like buildings, fences, or utility infrastructure are also included. Furthermore, as the economies of both developed and emerging nations continue to expand thus, a need for commercial vehicles. Due to the rapid expansion of the e-commerce sector, there is a greater need for transportation solutions worldwide and commercial vehicles due to the increased demand. Furthermore, in many nations, it is legally required to get auto insurance. As such, the laws about automobile purchases have a substantial effect on the growth of the auto insurance sector. In addition, the rise in occurrences in recent years such as distracted driving, drunk driving, and traffic injuries has increased the significance of vehicle insurance. Most car owners rely on their auto insurance for financial loss and protection from things like accidents involving other drivers, passengers, or pedestrians. However, lack of awareness and comprehension of auto insurance coverage is a major factor hampering the expansion of the auto insurance industry.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the "Global Auto Insurance Market Size, Share, and COVID-19 Impact Analysis, By Application (Personal and Commercial), By Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, and Others), By Coverage (Third-Party Liability Coverage, Collision/Comprehensive, and Other Optional Coverage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4855

The personal segment is anticipated to hold the greatest share of the global auto insurance market during the projected timeframe.

Based on the application, the global auto insurance market is divided into personal and commercial. Among these, the personal segment is anticipated to hold the greatest share of the global auto insurance market during the projected timeframe. Due to they are more affordable, more comfortable, and more durable, these cars have seen significant growth in the market. The market is expanding due to rising consumer demand for personal automobiles and the fact that passenger cars are produced internationally at a higher rate than commercial vehicles.

The insurance agents/brokers segment is expected to grow at the fastest CAGR in the global auto insurance market during the projected timeframe.

Based on the distribution channel, the global auto insurance market is divided into insurance agents/brokers, direct response, banks, and others. Among these, the insurance agents/brokers segment is expected to grow at the fastest CAGR in the global auto insurance market during the projected timeframe. In response to the growing demand for individualized and customized services, a major trend in the vehicle insurance market insurance agents and brokers are using a variety of websites and online selling platforms. Insurance brokers use their extensive knowledge of risks and the insurance industry, in addition to buying insurance from various businesses, to find and organize the best insurance plans for their clients.

The third-party liability coverage segment is predicted for the largest revenue share in the auto insurance market during the estimated period.

Based on the coverage, the global auto insurance market is divided into third-party liability coverage, collision/comprehensive, and other optional coverage. Among these, the third-party liability coverage segment is predicted for the largest revenue share in the auto insurance market during the estimated period. Third-party liability insurance can be purchased to protect oneself from third-party claims. Third-party coverage protects against claims of losses and damages made by uninsured drivers who are not covered by the policy when it comes to auto insurance. The Motor Vehicles Act makes third-party liability insurance required. The requirement that both new and old car owners be present at the time of vehicle registration is one of the main factors propelling the market's expansion globally.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4855

North America is expected to hold the largest share of the global auto insurance market over the forecast period.

North America is expected to hold the largest share of the global auto insurance market over the forecast period. Major insurance companies, increased consumer awareness of the benefits of auto insurance, high disposable income, growing car demand, and rising middle-class affordability are all contributing factors to the growth of the North American vehicle insurance market. It is anticipated that as consumers become more aware of the benefits of electric vehicles, demand for EVs will rise in the upcoming years. This will result in a significant rise in the requirement for auto insurance in North America.

Asia Pacific is predicted to grow at the fastest pace in the global auto insurance market during the projected timeframe. Rapid urbanization, rising public infrastructure spending, and growing economic activity all contribute to the growing demand for automobiles. The high population and expanding middle class in the region are increasing demand for cars. The government laws in nations like India regulating the purchase of motor insurance are largely accountable for the fast expansion of the Asia Pacific auto insurance sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Auto Insurance Market include AXA SA Group, Liberty Mutual Insurance, Bajaj Allianz, American International Group Inc., Insurethebox, Verisk Analytics Inc., Allianz, State Farm Mutual, Tokio Marine Group, Automobile Insurance, Ping An Insurance (Group), Admiral Group plc, Berkshire Hathaway Inc., and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4855

Recent Developments

- In July 2022, Pay As You Consume (PAYC) is a usage-based insurance cover add-on that was developed by Bajaj Allianz. The company is the first to introduce and launch this type of insurance under the Insurance Regulatory and Development Authority of India (IRDAI), enabling automakers to add on advanced insurance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Auto Insurance Market based on the below-mentioned segments:

Global Auto Insurance Market, By Application

- Personal

- Commercial

Global Auto Insurance Market, By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

Global Auto Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision/Comprehensive

- Other Optional Coverage

Global Auto Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

France Fintech Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premises and Cloud), By Technology (Artificial Intelligence, Application Programming Interface (API), Robotic Process Automation, Data Analytics, and Others), and France Fintech Market Insights, Industry Trend, Forecasts to 2033

Global P2P Fundraising Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud-Based, On-Premises), By Application (SMEs, Large Enterprises), By End-User (Nonprofit Organizations, Educational Institutions, Religious Organizations, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter