Pune, Aug. 27, 2024 (GLOBE NEWSWIRE) -- Automated Test Equipment Market Size & Growth Prospect:

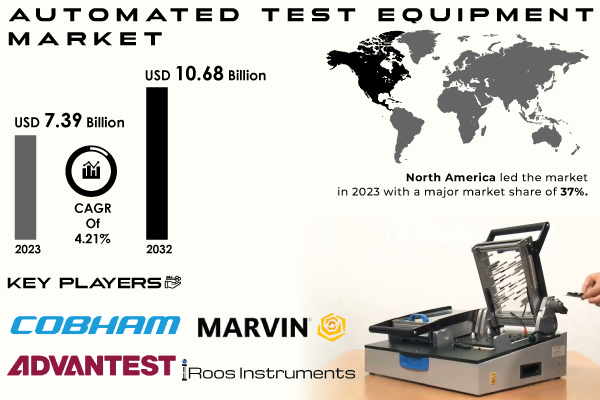

“According to SNS Insider Report, The Automated Test Equipment Market was valued at USD 7.39 billion in 2023 and is estimated to reach USD 10.68 billion by 2032, growing at a CAGR of 4.21% over the forecast period 2024-2032.”

The Growing Demand For ATE Systems In The Age Of 5G

ATE systems are playing a crucial role in the rapid evolution of the technology landscape. As electronic devices become increasingly sophisticated, particularly with the advent of 5G networks, the need for efficient and accurate testing solutions has skyrocketed. The growing demand for consumer electronics, combined with the expanding 5G infrastructure, is driving significant growth in the ATE market.

The 5G rollout in the United States has been particularly rapid, with subscriber numbers surging in recent years. This surge has created a pressing need for ATE systems to ensure the reliability and performance of 5G-enabled devices and networks. The telecommunications industry, in particular, is heavily reliant on ATE to meet the stringent quality standards required for modern communication technologies.

Download Sample PDF of Automated Test Equipment Market 2024-2032 @ https://www.snsinsider.com/sample-request/1555

Top Market Players Listed in this Research Report are:

- Advantest Corporation.

- Cal-Bay Systems Inc

- Marvin Instruments Corp.

- Roos Instruments Inc.

- Shinbashi Inc.

- Cobham Plc

- Agilent Technologies Inc

- Teradyne Inc

- Danaher Corporation

- LTX-Credence

- National Instruments Corp.

- Chroma ATE Inc

- Astronics Test Systems

Automated Test Equipment (ATE) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.39 Billion |

| Market Size by 2032 | USD 10.68 Billion |

| CAGR | CAGR of 4.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | • By Product (Memory ATE, Discret, Non-Memory ATE, Others) • By Type (Integrated Circuit Testing, Hard Disk Drive Testing, Printed Circuit Board Testing, Others) • By Component (Industrial Pcs, Mass Interconnects, Handlers/Probers, Others) • By Vertical (Automotive & Transportation, IT & Telecommunications, Consumer Electronics, Aerospace & Defense, Healthcare, Others) |

| Key Growth Drivers | • Rising Demand for Advanced ATE Systems Driven by 5G and Next-Gen Wireless Technologies. |

Segment Analysis

By Component:

On the other hand, Industrial PCs dominate the market as the leading component segment. These systems are integral to ATE setups, offering the computational power and flexibility required to manage complex testing processes. The dominance of Industrial PCs is attributed to their widespread use across various testing applications, particularly in high-end testing scenarios that demand robust processing capabilities and reliability.

By Type:

Printed Circuit Board (PCB) Testing continues to dominate the market. PCBs are fundamental components in virtually all electronic devices, making their testing an indispensable part of the manufacturing process. The dominance of PCB testing is maintained by its critical role in ensuring the functionality and reliability of electronic products before they reach the market.

By Product:

Memory ATE remains the dominant product segment, owing to the vast application of memory devices across various industries, including computing, automotive, and consumer electronics. The dominance of Memory ATE is sustained by the continuous demand for efficient testing solutions that can manage the high volumes and complexities associated with modern memory devices.

By Vertical:

The Consumer Electronics segment continues to dominate the market. The proliferation of consumer electronic devices such as smartphones, tablets, and wearables necessitates extensive testing to ensure quality and functionality. The high volume of production in this sector ensures the sustained dominance of ATE in consumer electronics.

Do you have any specific queries or need any customization research on ATE Market, Enquiry Now@ https://www.snsinsider.com/enquiry/1555

Key Market Segmentation

Regional Analysis

In 2023, Asia Pacific held the largest market share, driven by the presence of major semiconductor manufacturers and the increasing adoption of advanced manufacturing technologies in the region. The rapid industrialization and technological advancements in countries like China, Japan, and South Korea are contributing to the robust growth of the Automated Test Equipment Market in this region.

North America is expected to exhibit significant growth over the forecast period, supported by the strong presence of leading ATE manufacturers and the growing demand for advanced testing solutions in sectors such as aerospace & defense, automotive, and IT & telecommunications.

Recent Developments

- In April 2024, Teradyne, Inc. announced the launch of its new UltraFLEXplus platform, designed to address the complex testing needs of next-generation semiconductor devices, enhancing both speed and accuracy in the testing process.

- In June 2023, Advantest Corporation completed the acquisition of R&D Altanova, Inc., a move aimed at expanding its capabilities in high-performance device testing and strengthening its position in the global ATE market.

- In August 2024, National Instruments (NI) unveiled its latest PXI-based automated test system, which integrates advanced software and hardware to provide a scalable solution for testing a wide range of electronic devices.

Buy an Enterprise User PDF of Automated Test Equipment (ATE) Market Outlook 2024-2032@ https://www.snsinsider.com/checkout/1555

Key Takeaways

- The Automated Test Equipment Market is expected to experience steady growth over the next decade, driven by advancements in semiconductor technology and the increasing complexity of electronic devices.

- Handlers/Probers and IC Testing are emerging as key growth segments, while Industrial PCs and PCB Testing maintain their dominant positions in the market.

- Asia Pacific and North America are poised to lead the global market, supported by technological advancements and strong industry presence.

- Recent developments in the market highlight the ongoing innovation and strategic moves by key players to strengthen their market positions.

TABLE OF CONTENTS – Analysis of Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Automated Test Equipment Key Vendors and Feature Analysis, 2023

5.2 Automated Test Equipment Performance Benchmarks, 2023

5.3 Automated Test Equipment Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. Automated Test Equipment Market Segmentation, by Component

7.1 Chapter Overview

7.2 Industrial PCs

7.2.1 Industrial PCs Market Trends Analysis (2020-2032)

7.2.2 Industrial PCs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Handlers/Probers

7.3.1 Handlers/Probers Market Trends Analysis (2020-2032)

7.3.2 Handlers/Probers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Mass Interconnects

7.4.1 Mass Interconnects Market Trends Analysis (2020-2032)

7.4.2 Mass Interconnects Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automated Test Equipment Market Segmentation, by Type

8.1 Chapter Overview

8.2 Integrated Circuit (IC) Testing

8.2.1 Integrated Circuit (IC) Testing Market Trends Analysis (2020-2032)

8.2.2 Integrated Circuit (IC) Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Printed Circuit Board (PCB) Testing

8.3.1 Printed Circuit Board (PCB) Testing Market Trends Analysis (2020-2032)

8.3.2 Printed Circuit Board (PCB) Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Hard Disk Drive Testing

8.4.1 Hard Disk Drive Testing Market Trends Analysis (2020-2032)

8.4.2 Hard Disk Drive Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automated Test Equipment Market Segmentation, by Product

9.1 Chapter Overview

9.2 Non-Memory ATE

9.2.1 Non-Memory ATE Market Trends Analysis (2020-2032)

9.2.2 Non-Memory ATE Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Memory ATE

9.3.1 Memory ATE Market Trends Analysis (2020-2032)

9.3.2 Memory ATE Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Discrete

9.4.1 Discrete Market Trends Analysis (2020-2032)

9.4.2 Discrete Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

….

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of Automated Test Equipment Market Forecast 2024-2032@ https://www.snsinsider.com/reports/automated-test-equipment-market-1555

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.