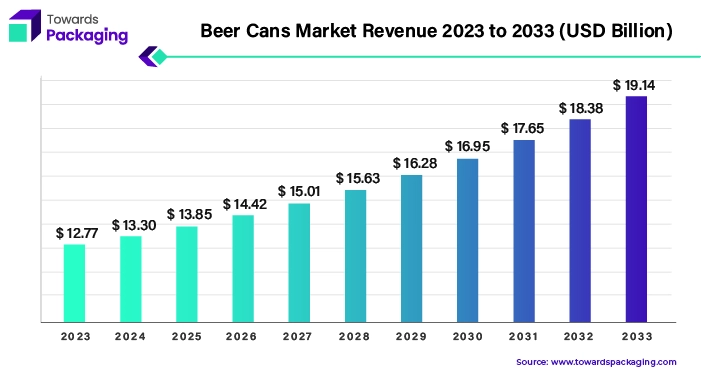

Ottawa, Aug. 27, 2024 (GLOBE NEWSWIRE) -- The global beer cans market size is predicted to increase from USD 12.77 billion in 2023 to approximately USD 19.14 billion by 2033, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive free sample: https://www.towardspackaging.com/personalized-scope/5206

Key Takeaways: Leading Factors of the Beer Cans Market

- Asia Pacific dominated the beer cans market in 2023.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material, the aluminium segment dominated the market with the largest share in 2023.

- By type, the 3 piece can segment is expected to grow at significant rate during the forecast period.

- By application, the 330 ml segment dominated the market in 2023.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Beer Cans Market at a Glance

The beer cans market revolves around the transportation, production and consumption of the beer based on consumer preferences which are driven by cultural shift from elder generation to younger generation. Along with these qualities, preventing the UV rays and providing mobility due to being light-weight are the leading objectives of the market. The lower emission of carbon print and lower energy resource used for recycling has increased the demand for beer cans initializing increasing the beer can market growth.

The utilization of stainless steel and aluminium prolongs the shelf life of beer. Along with customization of beer cans, improvisation of properties like strength and durability increases the growth rate of the beer cans market.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Driver

Beer consumption and Mobility of Beer Cans Drive the Beer Market

The major driving factors are the increasing consumption of beer in younger generation which is due to high incomes and the mobility of the beer cans due to its light-weight feature and instant consumption of beer have driven the beer cans market demand. The focus on sustainable packaging also boosts the market by attracting the market players which are driven by environmental consciousness. The cost-effective nature of cans makes it easy for the production and transportation of the beer which impacts the market growth.

Restraint

Government Regulations: A Challenge to the Beer Can Market

The leading challenge which hinders the growth of the beer can market is strict government regulations. The customs duties increasing on the import and export and the competitive strike between aluminium or steel materials are a major hinderance. Apart from this, economic ups and downs, changing prices and lack of recycling infrastructure can cause challenges for the key players and competition from alternatives like glass bottles are posing threat to the beer can market. Furthermore, the rise in prices due to economic ups and downs can lead to decrease of the market rate.

Get a customized report designed according to your preferences: https://www.towardspackaging.com/customization/5206

Technology and AI: Improvization of the Beer Can Market

AI integration has benefited the industry by researching and inventing new barrier designs, allowing for more sustainable solutions and longer-lasting packaging. Furthermore, technology improvements have made it simple to analyze supply chain demand, detect errors in manufactured materials, and provide complete reports on environmental stresses that will ensure the product's endurance.

- In March 2023, AB InBev had launched an AI beer, Beck’s Autonomous, which was created by using ChatGPT and Midjourney to market, edit and develop the brand based on AI Intelligence. The company also stated that the beer will be available in a hybrid container which includes half glass, half aluminium and which will be a 5% ABV Pilsner style brew. The AI was also used for creating a custom logo and for designing container and also for creating a recipe which used local German products and 100% natural ingredients. The company added to its statement that AI will add new creativity to the beer world and revolutionize the beer industry.

Opportunity

Advantages: Recycling and Leight-weigh Material Expands the Beer Can Market

Beer is a culinary mascot for the market key players due to its production of endorphin, different flavours and ingredients, generation-based preferences. Less use of energy resources compared to glass and use of recycling materials for production of beer can increases the demand and creates opportunities for the market. The use of light-weight material decreases the packaging weight and also saves energy costs by reducing waste material. The premiumization of brand to create community and the increasing demand of crafted beer also creates opportunities for beer cans market.

Asia-Pacific: Rising incomes to Increase Beer Consumption

Asis-Pacific is the leading region for the beer cans market. The market in this region is driven by increased consumption of beer, high disposable incomes and growth in urbanization. Countries like India and China are leading contributors in the beer cans due to cans being portable and convenient. Reduced labor costs, availability of raw materials and overall presence of major players in countries such as Japan, India and China create significant contributors to the market’ expansion to the market.

- In March 2023, the Indian beer startups expanded and launched new products after it has received massive funds. The increased disposable income, the decreasing social stigma around beer and the rising per capita beer consumption has surged the Indian beer startups. Bira 91 beer had secured $200 million and it raised $25 million from Tiger Pacific Capital.

On the other hand, North America is observed to be the fastest growing in the beer cans market during the forecast period. North America has established itself as the mature market with its focus on craft beers and innovating new designs. The demand for environmental consciousness and the recycling features which produce sustainable beer cans are the driving factors of the market. Countries like US and Canada are the leading contributors in the beer cans market. Additionally, the emergence of sustainable activities for the production of beer cans and packaging of the same create substantial opportunities for the market to grow in the forecast period.

- In March 2023, Anheuser-Busch had launched a limited edition for America’s favourite pastime which is Baseball League, Budweiser beer cans, which had Cardinal’s theme, a baseball themed can which featured 14 different MLB teams with each can representing a different team’s logo. The cans were available in cities where Budweiser was sold, and fans were able to purchase the limited edition.

Lastly, Europe is remarked as the notably-growing region in the beer cans market. The cultural shift towards cans due to preferences of younger generation drives the market growth. The premiumization of brands and a focus on the sustainable solutions is the goal of the region. Presence of multiple players that focus on environmentally friendly and sustainable initiatives for product innovation create opportunities for the market.

- In April 2023, Timothy Taylor’s Brewery, which is a traditional family-owned West Yorkshire brewery, had chosen Hopi Cal Storm as its first beer to go in cans due to its accessibility and which had 4% ABV triple hopped pale ale. The Hopi Cal Storm had been brewed in three stages which included five UK-grown hops- Cascade and Whitbread Goldings in the copper, Cascade and Chinook at the hop back stage, then dry-hopped with Jester and Ernest.

Major Breakthroughs by Top Companies in Beer Cans Market

| Company | Drink ON Ltd |

| Headquarters | United Kingdom |

| Recent Development | In September 2023, ON Beer launched a beer, which used alcohol avoidance techniques and provided heightened taste. The company had also stated that the beer will be available through e-commerce platforms. |

| Company | Medusa Beverages |

| Headquarters | New Delhi, India |

| Recent Development | In June 2023, Medusa Beverages Pvt. Limited had launched a batch in Uttarakhand which wanted to increase its demand supply through PAN India participation initiative. The brand is available in 7 states which are Delhi, UP, Punjab, Chandigarh, Chhattisgarh, Silvassa, Himachal Pradesh and Uttarakhand. |

Segmental Insights

By Material

The aluminium cans is the dominating segment in the beer cans market. It is the dominating material due to its properties which are preserving the product and providing flexibility. It is demand due its lightweight feature which reduces transportation expenditure and also reduces carbon footprint. In addition, its recycling feature makes it the dominating segment among the market players.

The fastest growing segment is the steel/tin cans due to its use cost-effective nature and strength. The corrosion resistance and the sanitizing property of steel provides hygiene to the product and increases its shelf life. It is in demand due to its consistency in providing flavours from batch to batch. Brewing being a high temperature and high-pressure process makes it easy for the stainless steel to be an excellent choice for the beer cans market players.

By Type

The 2-piece cans are the dominating segment in the beer cans market. It is demand due to its properties which are strength which provide structural integrity and also reduces transportation costs due to the type being light-weight. It also provides smooth surface for printing and also increase the production speed.

More Insights in Towards Packaging

- The global green packaging market size is estimated to grow from USD 303.83 billion in 2022 to reach an estimated USD 510.93 billion by 2032, at 5.3% CAGR from 2023 to 2032.

- The global pet food packaging market size is estimated to grow from USD 11.38 billion in 2022 to set a foot on USD 22.08 billion by 2032, at 6.9% CAGR from 2023 to 2032.

- The global corrugated packaging market size accepted to grow from USD 276 billion in 2022 and it is predicted to hit around USD 410.50 billion by 2032, at 4.10% CAGR from 2023 to 2032.

- The global cosmetic packaging market size accounted for USD 33.07 billion in 2022 to reach USD 54.13 billion by 2032 at 4.5% CAGR from 2023 to 2032.

- The global edible packaging market size current valuation, standing at USD 1.4 billion in 2022 projected to culminate zenith of USD 5.26 billion by 2032 at 14.2% CAGR between 2023 and 2032.

- The global active packaging market size is estimated to grow from USD 19.2 billion in 2022 at 7.5% CAGR to reach an estimated USD 39.51 billion by 2032, between 2023 and 2032.

- The global antimicrobial packaging market size was at USD 10.77 billion in 2022 to hit around USD 18.81 billion by 2032, at 5.7% CAGR between 2023 to 2032.

- The global automotive packaging market size is estimated to grow from USD 8.18 billion in 2022 to reach an estimated USD 13.87 billion by 2032, at 5.4 % CAGR between 2023 and 2032.

- The global frozen food packaging market size is predicted to grow from USD 43.36 billion in 2022 to reach USD 71.67 billion by 2032, at 5.2% CAGR from 2023 to 2032.

- The global flexible packaging market size is estimated to grow from USD 283 billion in 2022 to reach an expected USD 445.82 billion by 2032, at 4.7% CAGR during the forecast period 2023 to 2032.

Beer Cans Market TOC

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Market Dynamics

- Recommendations

Introduction

- Report Description

- Objectives of the Study

- Market Definition

- Report Scope

- Research Methodology

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Impact of COVID-19 on the Beer Cans Market

Market Segments

By Material

- Introduction

- Aluminium Can

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Steel/Tin Can

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

By Type

- Introduction

- 2 Piece Can

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- 3 Piece Can

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

By Application

- Introduction

- 330 ml

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- 500 ml

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Other

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

By Region

- Introduction

- North America

- U.S.

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Canada

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- U.S.

- Europe

- Germany

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- U.K.

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- France

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Italy

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Spain

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Germany

- Asia Pacific

- China

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Japan

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- India

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- South Korea

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- China

- Latin America

- Brazil

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Mexico

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- Brazil

- Middle East & Africa (MEA)

- South Africa

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- UAE

- Market Size and Forecast

- Market Trends and Opportunities

- Key Players

- South Africa

Competitive Landscape

- Introduction

- Market Share Analysis

- Key Strategies of Leading Players

- Company Profiles

- Can-Pack S.A.

- Toyo Seikan Kaisha, Ltd

- ORG Technology Co., Ltd.

- Shenzhen Xin Yuheng Can Co., Ltd

- Crown Holdings, Inc.

- Swastik Tins Pvt. Ltd.

- Daiwa Can Co.

- Orora Packaging Australia Pty Ltd

- Kaira Can Company Limited

- Kaufman Container

- Silgan Containers

- Ball Corporation

- Reliance, Inc.

- Innopack Suzhou Co., Ltd

- ArcelorMittal

- C.L. Smith

- Stephen Gould

- Penn Tool Co.

- Cincinnati Container Company

- Zooby Promotional

- The Cary Company

- Illing Packaging

- AB Container, Inc.

- IPS Corp.

- J.L. Clark

- Pacific Bridge Packaging, Inc.

- National Packaging Services, Inc.

- Megachem, Inc.

- Paramount Global

- MSC Industrial Supply Co.

Cross-Segment Analysis

By Material and Type

- Aluminium Can

-

- 2 Piece Can

- 3 Piece Can

- Steel/Tin Can

-

- 2 Piece Can

- 3 Piece Can

By Material and Application

- Aluminium Can

-

- 330 ml

- 500 ml

- Other

- Steel/Tin Can

-

- 330 ml

- 500 ml

- Other

By Type and Application

- 2 Piece Can

-

- 330 ml

- 500 ml

- Other

- 3 Piece Can

-

- 330 ml

- 500 ml

- Other

By Material and Region

- Aluminium Can

-

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa (MEA)

- South Africa

- UAE

- North America

- Steel/Tin Can

-

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa (MEA)

- South Africa

- UAE

- North America

Strategic Insights

Go-to-Market Strategies

North America/Europe/Asia Pacific/Latin America/Middle East & Africa (MEA)

- Market Entry Strategies

- Partner with established local distributors.

- Leverage regional trade shows and industry events.

- Implement e-commerce platforms for direct sales.

- Distribution Channel Analysis

- Focus on large retail chains and specialty stores.

- Utilize distribution networks of major beverage companies.

- Explore partnerships with online retail platforms.

- Pricing Strategies

- Competitive pricing to match market leaders.

- Implement discount strategies for bulk purchases.

- Consider value-added services to justify premium pricing.

- Promotional Strategies

- Digital marketing campaigns targeting young consumers.

- Sponsorship of local events and festivals.

- Collaborate with influencers and local celebrities.

Competition Analysis

- Key Competitors

- Market Positioning

- SWOT Analysis

Opportunity Assessment

Emerging Markets

- Asia-Pacific: India, Vietnam, Indonesia

- Latin America: Brazil, Mexico

- Africa: Kenya, Ethiopia, Nigeria, Ghana

- Eastern Europe: Poland, Hungary, Romania

Growth Drivers:

- Economic Growth

- Urbanization

- Technological Advancements

- Regulatory Improvements

Risks and Challenges:

- Political Instability

- Regulatory Uncertainty

- Economic Volatility

Untapped Opportunities

- Market Segments:

-

- Niche Markets

- Innovation Opportunities

- Cross-Sector Applications

- Geographic Expansion:

-

- Underpenetrated Regions

- Localized Products/Services

- Strategic Partnerships:

-

- Alliances and Joint Ventures

- Distribution Networks

- Consumer Trends:

-

- Sustainability

- Health and Wellness

Market Potential Analysis

- Market Size and Growth Rate:

-

- Current Market Size

- Historical Growth Trends

- Projected Growth

- Demand Drivers:

-

- Consumer Behavior

- Economic Factors

- Technological Advances

- Competitive Landscape:

-

- Market Share Analysis

- Competitive Advantages

- Investment Potential:

-

- Return on Investment (ROI)

- Capital Requirements

- Regulatory and Environmental Factors:

-

- Regulatory Environment

- Environmental Impact

New Product Development

Innovation Strategies

- Market Research and Analysis

- Idea Generation

- Technology Adoption

- Partnerships and Collaborations

- Customer-Centric Design

- Agile Development

Product Lifecycle Management

- Concept Development

- Design and Development

- Launch and Introduction

- Growth and Maturity

- Decline and End-of-Life

R&D Initiatives

- Research Focus Areas

- Funding and Resources

- Talent and Expertise

- Collaboration with External Partners

- Innovation Culture

- Intellectual Property Management

Plan Finances/ROI Analysis

Investment Analysis

- Capital Expenditure Assessment

- Risk Evaluation

- Funding Sources and Structuring

- Market Conditions and Trends

- Financial Projections

Return on Investment (ROI) Forecast

- ROI Calculation Methodology

- Break-Even Analysis

- Sensitivity Analysis

- Profitability Forecast

- Cash Flow Projections

Financial Planning and Budgeting

- Budget Allocation and Monitoring

- Revenue and Expense Forecasting

- Cost Management

- Financial Performance Metrics

- Strategic Financial Goals

Supply Chain Intelligence/Streamline Operations

Supply Chain Overview

- Supplier Management

- Inventory Management

- Demand Forecasting

- Procurement Strategies

- Risk Management

Logistics and Distribution

- Transportation Management

- Warehousing Solutions

- Distribution Network Optimization

- Order Fulfillment

- Logistics Technology Integration

Operational Efficiency Strategies

- Process Optimization

- Lean Manufacturing

- Automation and Technology

- Quality Control

- Performance Metrics and KPIs

Cross-Border Intelligence

International Market Dynamics

- Market Growth Rates

- Competitive Landscape

- Consumer Preferences and Trends

- Economic Conditions

- Local Market Conditions

Trade Policies and Regulations

- Import and Export Regulations

- Tariffs and Duties

- Trade Agreements and Treaties

- Compliance Requirements

- Customs Procedures

Cross-Border Trade Opportunities

- Market Entry Strategies

- Partnership and Joint Venture Opportunities

- Distribution and Supply Chain Networks

- Market Expansion and Diversification

- Cross-border E-commerce Opportunities

Business Model Innovation

Innovative Business Models

- Subscription-Based Models

- Freemium Models

- Platform-Based Models

- Direct-to-Consumer Models

- Sharing Economy Models

Revenue Stream Analysis

- Diversification of Revenue Sources

- Pricing Strategies

- Profitability of Different Revenue Streams

- Sales Forecasting

- Cost Structure and Margins

Value Proposition Development

- Customer Needs and Pain Points

- Unique Selling Points (USPs)

- Competitive Advantage

- Product/Service Differentiation

- Customer Value Perception

Blue Ocean vs. Red Ocean Strategies

Market Differentiation

- Blue Ocean Strategies:

-

- Creating Uncontested Market Space

- Innovation and Differentiation

- Value Innovation

- Redefining Market Boundaries

- Red Ocean Strategies:

-

- Competing in Existing Market Space

- Cost Leadership

- Product Differentiation

- Focused Market Positioning

Competitive Strategy Frameworks

- Blue Ocean Frameworks:

-

- Value Curve Analysis

- Strategic Canvas

- Four Actions Framework (Eliminate-Reduce-Raise-Create)

- Blue Ocean Idea Index

- Red Ocean Frameworks:

-

- Porter’s Five Forces Analysis

- SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Competitive Positioning Matrix

- Market Share Analysis

Strategic Growth Initiatives

- Blue Ocean Growth:

-

- Identifying and Exploiting New Market Opportunities

- Developing Innovative Products/Services

- Creating New Demand and Value Propositions

- Building Strategic Alliances for Market Expansion

- Red Ocean Growth:

-

- Enhancing Competitive Positioning

- Increasing Market Share in Existing Markets

- Improving Operational Efficiency and Cost Management

- Targeting Niche Markets and Customer Segments

Integration of AI in the Beer Cans Industry

- Overview of AI Technologies in the Beer Cans Industry

- Applications of AI in the Beer Cans Industry

- Smart Tracking and Inventory Management

- AI-driven Inventory Systems

- Real-time Tracking Solutions

- Predictive Maintenance and Quality Control

- Predictive Analytics for Maintenance

- AI-based Quality Assurance

- Optimization of Supply Chain Logistics

- AI-enhanced Supply Chain Management

- Logistics Optimization Algorithms

- Smart Tracking and Inventory Management

- Benefits of AI Integration

- Enhanced Efficiency and Productivity

- Automation of Processes

- Improved Operational Efficiency

- Cost Savings and Waste Reduction

- Reduction in Operational Costs

- Minimization of Waste

- Improved Sustainability

- Eco-friendly Practices

- Sustainable Resource Management

- Enhanced Efficiency and Productivity

- Case Studies and Examples

- Successful AI Integration Examples

- Lessons Learned from Industry Leaders

- Future Prospects and Innovations

- Emerging AI Technologies

- Future Trends in AI Integration

Production and Consumption Data

- Global Production Volumes

-

- Historical Production Data

- Current Production Statistics

- Future Production Projections

- Regional Production Analysis

-

- Production Trends by Region

- Leading Production Regions

- Consumption Patterns by Region

-

- Regional Consumption Statistics

- Consumer Preferences and Trends

- Key Trends in Production and Consumption

-

- Production Innovations

- Consumption Shifts and Drivers

Conclusion

- Key Insights

- Future Outlook

- Recommendations for Stakeholders

Appendix

- Research Methodology

- Glossary of Terms

- List of Abbreviations

- Sources and References

Act Now and Get Your Beer Cans Market Size, Companies and Insight 2033 @ https://www.towardspackaging.com/price/5206

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/