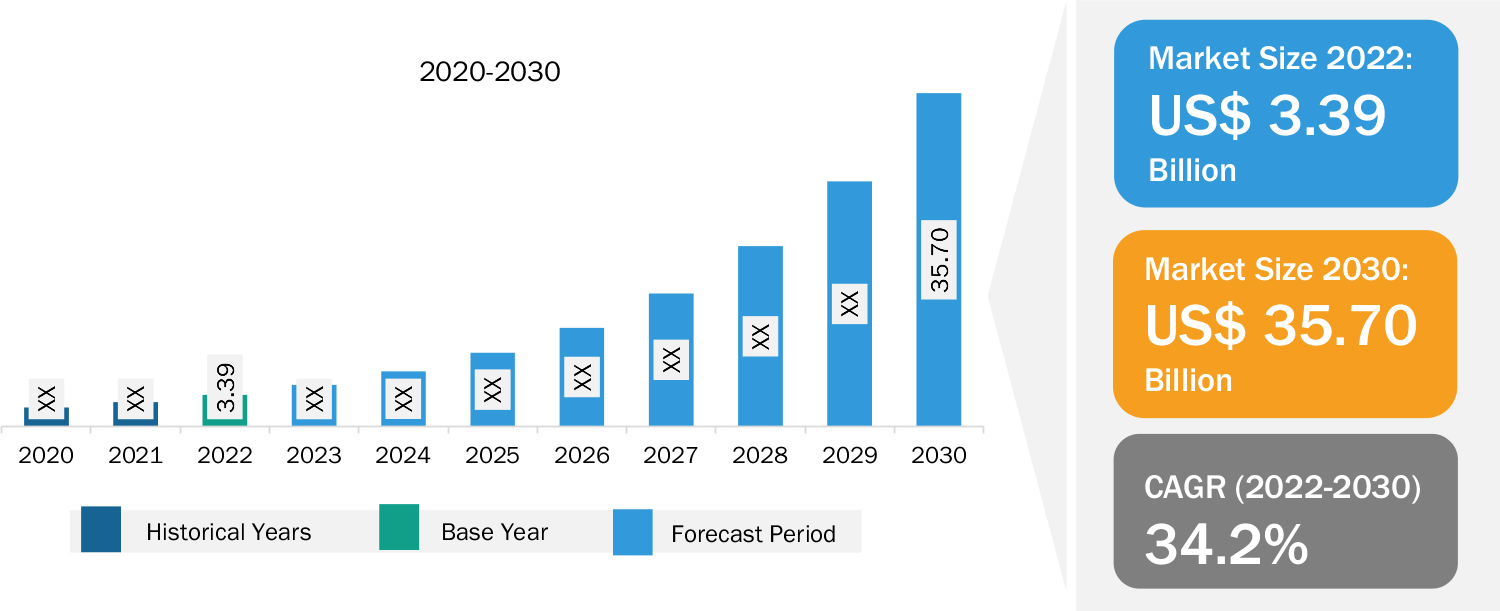

US & Canada, Aug. 29, 2024 (GLOBE NEWSWIRE) -- The Global Electronic Signature Software Market Size, Growth, Demand, Scope, Trends, Analysis to 2030 is expected to register a high CAGR during the forecast period. The primary driving factors include the positive economic outlook and growing cloud technology. However, the lack of awareness, security concerns, and frequently changing regulations regarding digital signatures hinder the market growth. Nevertheless, increased spending on electronic signature software in both developed and developing countries is expected to fuel the growth of the electronic signature software market in the coming years.

Download PDF Brochure: https://www.theinsightpartners.com/sample/TIPTE100000939/

Market Overview:

Source: The Insight Partners Analysis

An e-signature or electronic signature is an effective and legal way to attest electronic documents. It is a secure and trusted system that provides several advantages for businesses to streamline workflow. It helps improve business production speed and accuracy, optimize cost and time, and enhance customer service. Electronically signed documents have a greater potential in the legal sector than handwritten signatures, as these documents are not susceptible to forgery.

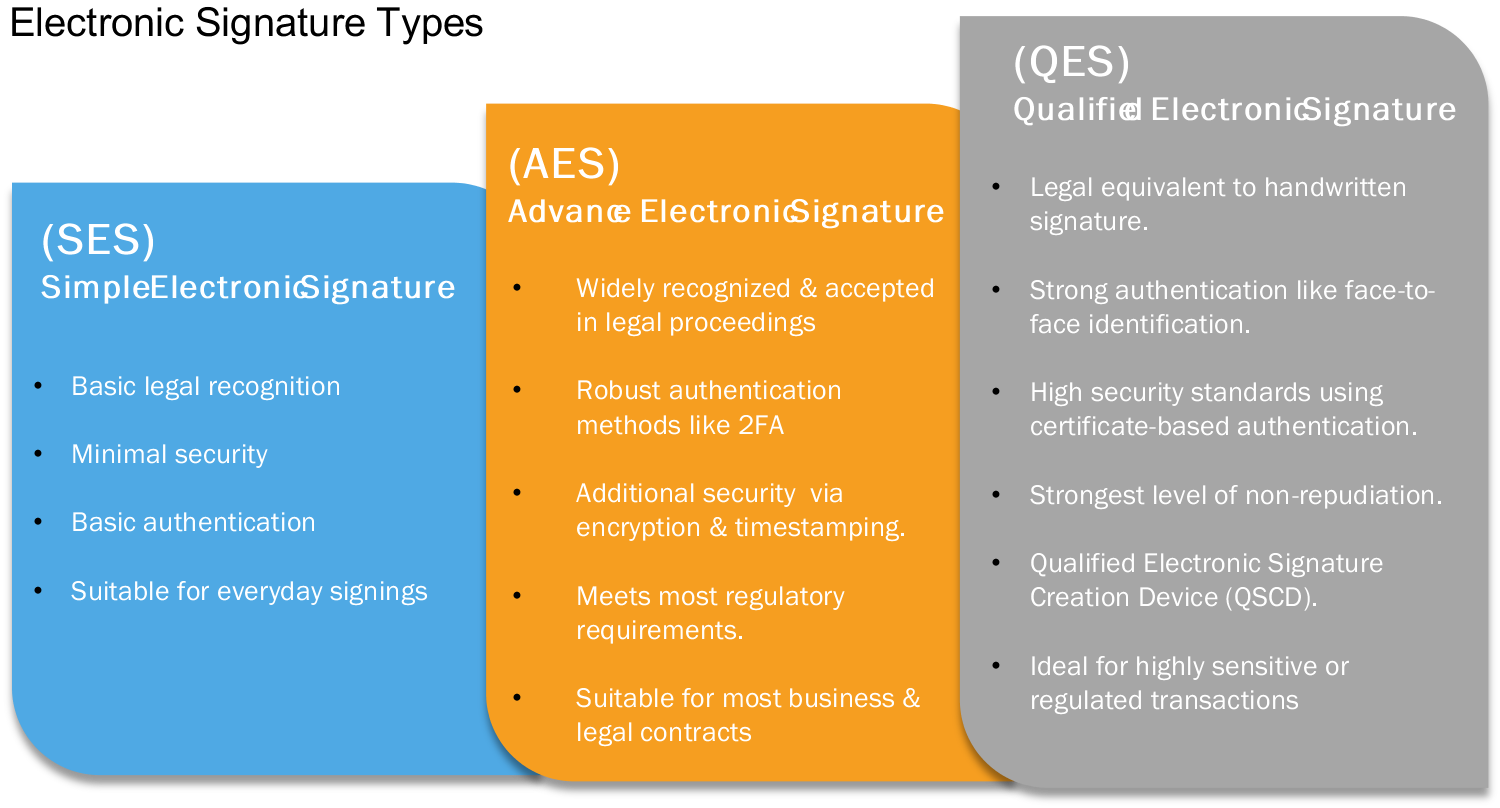

Types of Electronic Signatures:

Source: The Insight Partners’ Analysis

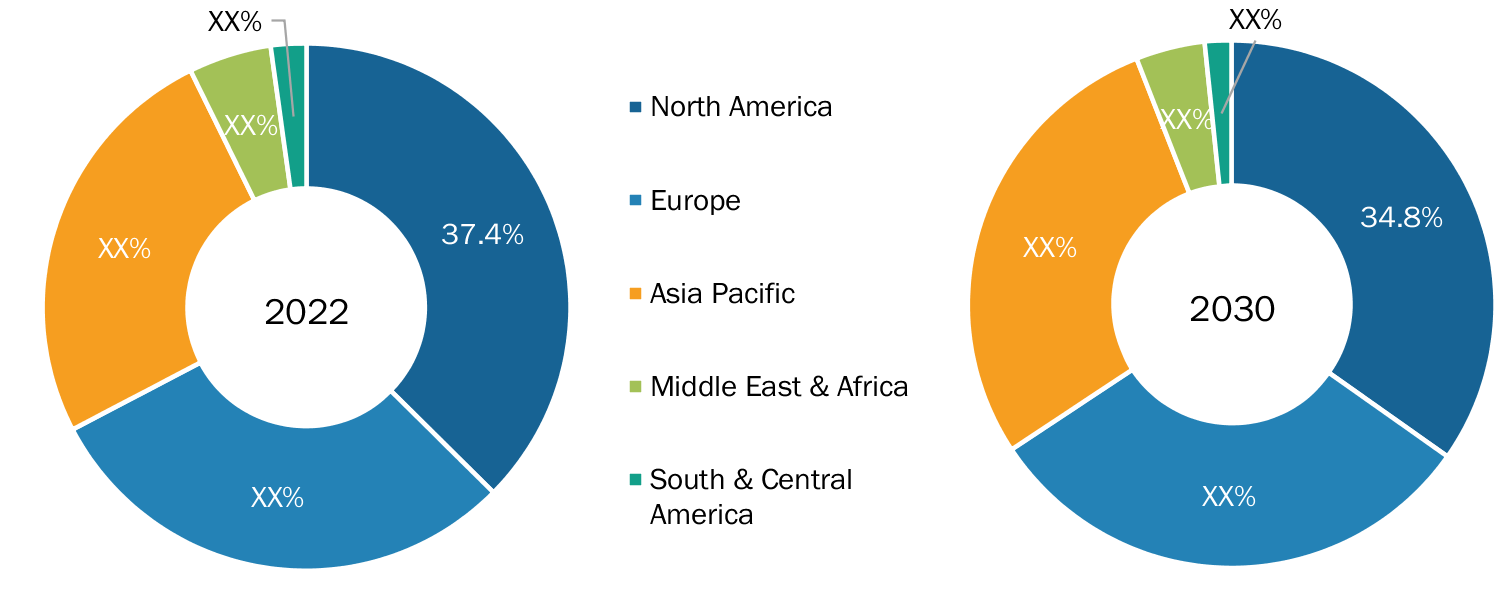

Regional Overview:

Geographically, the global electronic signature software market is segmented into North America, Europe, Asia Pacific, the Middle East, Africa, and South & Central America.

Source: The Insight Partners’ Analysis

Identify The Key Trends Affecting This Market - Download PDF

In 2022, North America held the leading position in the electronic signature software market. The presence of large electronic signature software providers and increasing government initiatives are boosting the regional market. Moreover, the growing adoption of the electronic signature process by several government agencies is expected to further fuel the market in North America. For instance, in October 2021, the US Agency for International Development (USAID) announced the development of a new electronic signature process, streamlining the secured signing and document management process. The use of electronic signatures eliminates the need for printing, physical signing, and scanning in a secure environment. The electronic signature is expanded for all partners conducting business with USAID's Management Bureau Office of Acquisition and Assistance.

Europe is the second-largest contributor to the global electronic signature software market, followed by Asia Pacific. The increasing partnerships among key players in Europe are enhancing the capabilities and seamless integration of electronic signature software. For instance, in May 2023, ZealiD, an EU-qualified digital identity and electronic signature provider, expanded its two-year partnership with DocuSign due to positive co-selling and high customer demand. The app will now include the reselling of the ZealiD by Docusign to its incumbent and new customers. This partnership has led to enhanced capabilities and uniform integration of the ZealiD Qualified Electronic Signature (QES) within the DocuSign platform, providing a complete and secure solution for remote signing and identity verification.

As governments of various countries in APAC spend an enormous time to get approvals and signatures, the adoption of digital technologies, such as electronic signature software, is gaining traction to ease the process and avoid delays across various organizational operations. For instance, several associations, such as the Western Australian Local Government Association (WLGA) and the State of Hawaii, use electronic signatures for fast, secure, and legal signatures.

Key Market Dynamics:

Source: The Insight Partners’ Analysis

Obtain Analysis of Key Geographic Markets - Download PDF

Increasing Use of Electronic Signatures in E-commerce Industry:

The documents in the e-commerce industry are majorly processed electronically. Online businesses and remote workers are driving the need for fast, secure, and legally binding methods of signing documents. Digital signatures streamline processes, decrease paper-related expenditures, improve security, and ensure compliance with regulations and global legal standards. Companies can improve overall efficiency and customer experience by integrating digital signatures into procedures ranging from contract signing to staff onboarding. The use of electronic signatures in the e-commerce industry provides several benefits, such as ease of use by adding e-signatures with a click of a button. With electronic signatures, once the document details are confirmed and validated, signing the documents becomes a simple task. The originating party is capable of receiving signed documents over the Internet within minutes of being signed. It helps the e-commerce players in maintaining document accuracy, reducing time, facilitating easy storage and retrieval of documents, and offering enhanced customer services.

Integration of AI, Blockchain, and Advanced Technologies:

The integration of AI and blockchain technology in electronic signatures provides tamper-proof security. Blockchain technology ensures the originality and authentication of the e-sign. Each block in a blockchain is given a cryptographic hash that uniquely identifies it and every subsequent block in the chain. eSignatures might be recorded on each of these blocks to verify their authenticity, and always know the source in an e-contract or e-document. Moreover, AI can detect and rectify any flaws in a signature that could lead to a forgery claim, reducing the possibility of deception. Further, AI algorithms assist in the matching of handwritten signatures with the previous signatures for verification. Therefore, it can find the difference between authentic and false signatures. AI can also detect fake signatures created using copy-and-paste or complex forgeries, lowering the danger of signature fraud. Various players, such as Lightico and Inkpaper.ai, provide AI and blockchain integration in electronic signatures. Thus, the integration of AI, blockchain, and other advanced technologies is expected to propel the electronic signature software market during the forecast period.

Directly Purchase a Copy of this Report at: https://www.theinsightpartners.com/buy/TIPTE100000939/

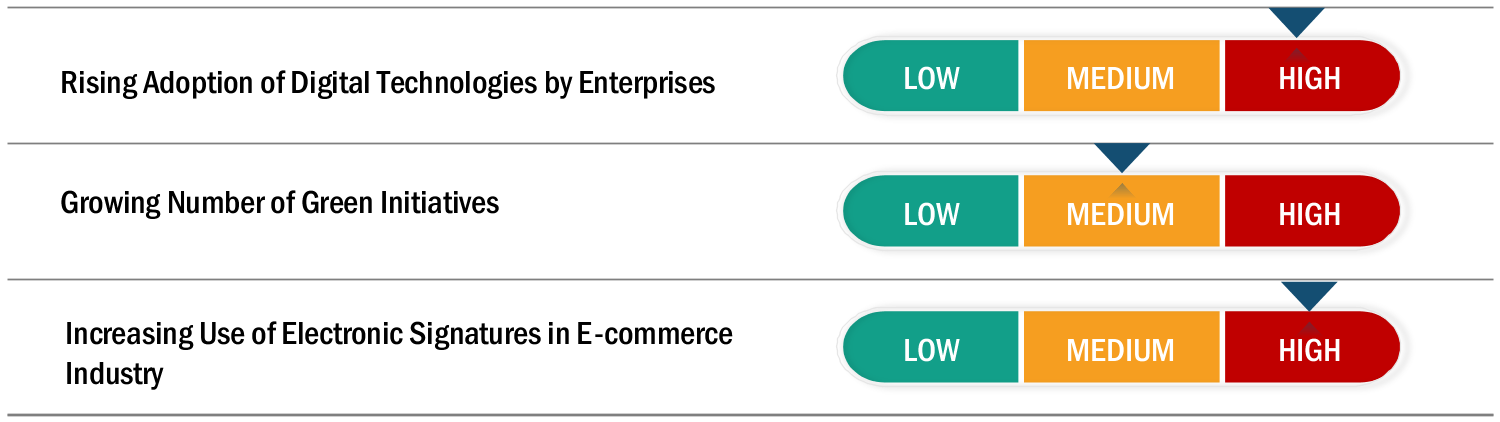

1.1 Impact of Drivers:

The figure below depicts the impact of driving factors of the electronic signature software:

- Impact Analysis of Drivers

Source: The Insight Partners’ Analysis

Competitive Landscape:

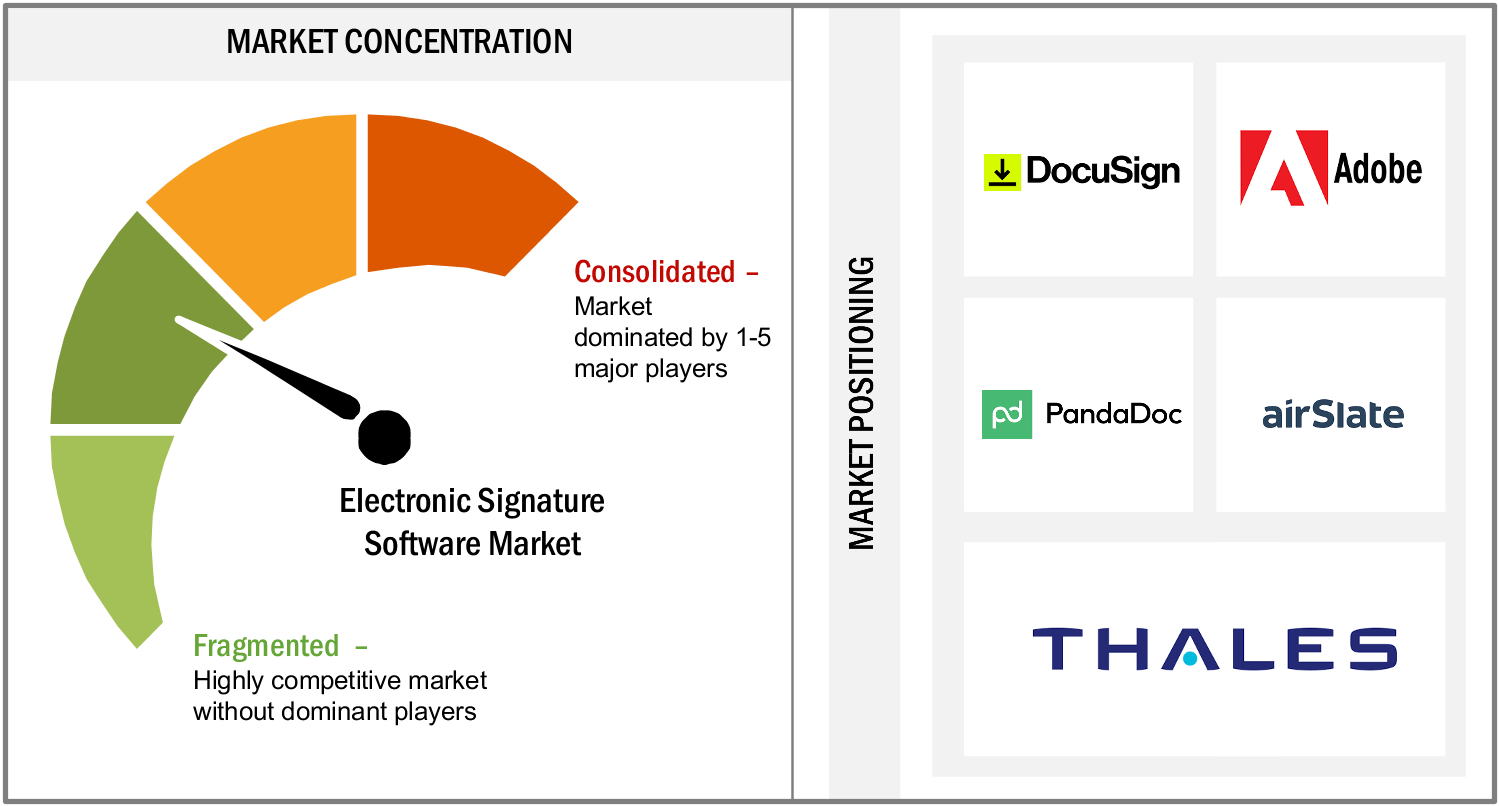

The electronic signature software market is highly fragmented owing to the presence of several local and international players such as DocuSign, Inc.; Adobe; PandaDoc Inc; airSlate Inc.; and Thales.

Source: The Insight Partners’ Analysis

Want More Information about Competitors and Market Players? Get PDF

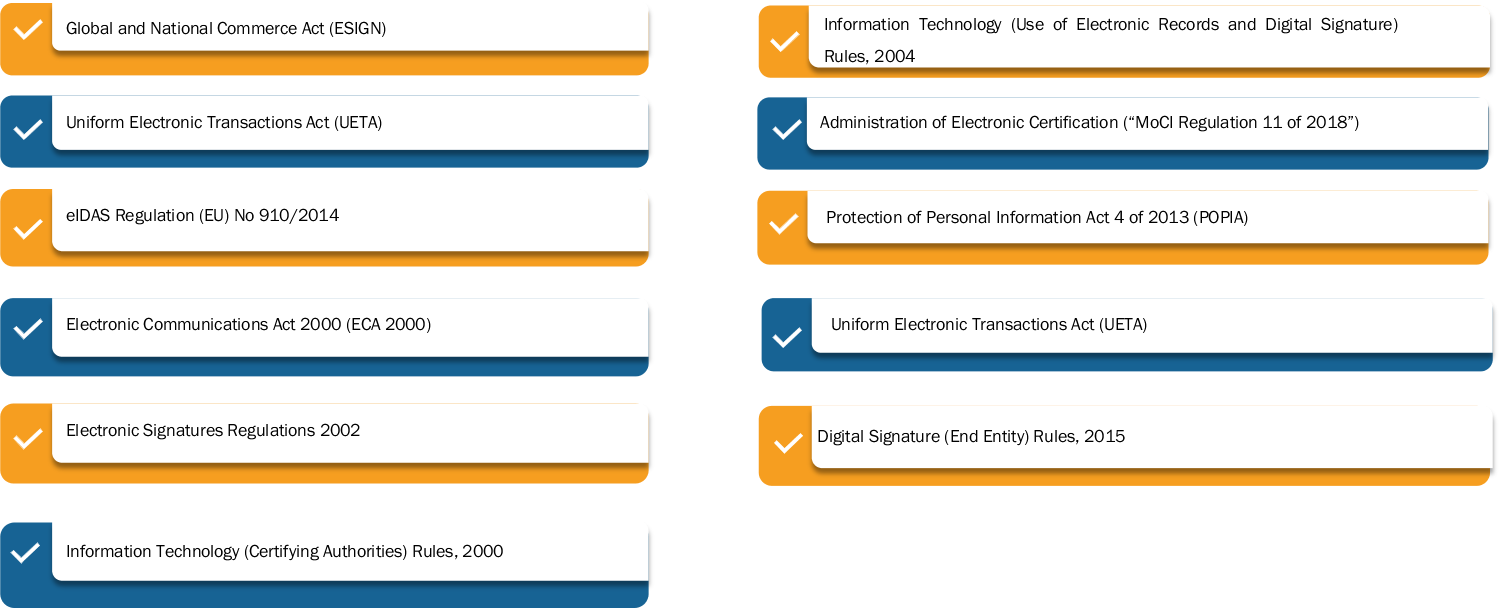

Regulatory Framework:

Electronic signatures, or eSignatures, are becoming widely used in a society that is becoming more digital. However, the legal framework pertaining to eSignatures differs greatly between jurisdictions; thus, both individuals and organizations need to be aware of international rules.

Source: The Insight Partners’ Analysis

Recent Market Developments:

- In December 2023, OneSpan Inc. launched a new partner network program for partners to deliver seamless and secure customer experiences. The program also helps OneSpan Inc. to expand its portfolio with high-assurance identity proofing, secure e-signature solutions, and strong authentication.

- In November 2023, DocuSign Inc. launched WhatsApp integration to expand businesses across the globe. The expansion support company to provide its customers with eSignature integrated with WhatsApp. This helps users get real-time WhatsApp notifications and enables quick and secure signing.

- In April 2023, Adobe Inc. integrated its Acrobat Sign with Salesforce to help organizations operate faster with trusted e-signatures. Acrobat Sign benefits its customers by allowing them to sign in seconds from any device, increasing productivity and speeding the approval process.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement

Related Report Titles:

- Europe Electronic Signature Software Market to Grow at a CAGR of 25.3% to reach US$ 2,155.27 Million from 2020 to 2028

- Dynamic Signature Market Size and Forecasts (2021 - 2031)

- Email Signature Software Market Size and Forecasts (2021 - 2031)

- Signature Pad Market Size and Forecasts (2021 - 2031)

- Signature Verification Market Size and Forecasts (2021 - 2031)

- Digital Signature Market Share Report, Growth Analysis & Forecast 2030

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/electronic-signature-software-market