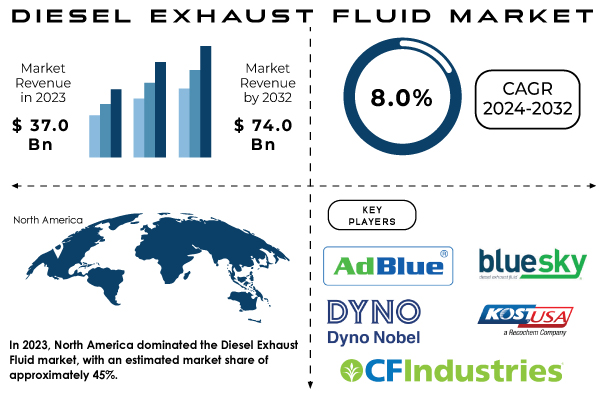

Austin, Sept. 18, 2024 (GLOBE NEWSWIRE) -- The Diesel Exhaust Fluid Market Size was valued at USD 37.0 billion in 2023, and is expected to reach USD 74.0 Billion by 2032, and grow at a CAGR of 8.0% over the forecast period 2024-2032.

Get a Sample Report of Diesel Exhaust Fluid Market @ https://www.snsinsider.com/sample-request/1696

Key Players:

- AdBlue (AdBlue DEF, AdBlue Premium)

- Blue Sky Diesel Exhaust Fluid (Blue Sky DEF, Blue Sky Premium DEF)

- CF Industries Holdings, Inc. (DEF, DEF Plus)

- Cummins Filtration (Fleetguard DFS, Fleetguard Diesel Exhaust Fluid)

- Diesel Exhaust Fluid (DEF) (Standard DEF, Premium DEF)

- Dyno Nobel (DEF, Dyno DEF)

- KOST USA, Inc. (KOST DEF, KOST Pure DEF)

- Old World Industries, LLC (PEAK Blue DEF, Final Charge DEF)

- STOCKMEIER Group (STOCKMEIER DEF, STOCKMEIER SCR Fluid)

- The Potash Corporation of Saskatchewan (PCS DEF, PCS Premium DEF)

- Yara International ASA (Yara Vita DEF, Yara DEF)

- BASF SE (BASF DEF, BASF Blue DEF)

- Chevron (Chevron DEF, Chevron Diesel Exhaust Fluid)

- ENI S.p.A. (ENI DEF, ENI Blue DEF)

- Fluid Energy Group Ltd. (Fluid Energy DEF, Fluid Energy SCR Fluid)

- Groupe Renault (Renault DEF, Renault Premium DEF)

- GS Caltex (GS Caltex DEF, GS Caltex SCR Fluid)

- JX Nippon Oil & Energy (JX DEF, JX SCR Fluid)

- LyondellBasell Industries (LyondellBasell DEF, LyondellBasell SCR Fluid)

- TotalEnergies (TotalEnergies DEF, TotalEnergies Blue DEF)

Diesel Exhaust Fluid Market Report Overview:

The Diesel Exhaust Fluid market trends are high with stringent emission regulations and developments in car technologies. More directly, there's been a global drive towards reducing NOx emissions; Diesel Exhaust Fluid represents an essential step in this regard, with Diesel engines employing selective catalytic reduction SCR systems. These are a must-have in the latest Euro 6 and EPA Tier 4 standards that demand huge reductions in harmful exhaust emissions from diesel vehicles.

The latest developments highlighted rapidly increasing trends toward cleaner diesel technologies. Early in February 2024, a prominent article from MSP Energy revealed how Diesel Exhaust Fluid and renewable diesel changed the face of the automotive industry through refinement and improvement of emissions control as well as support towards sustainability goals. Industry insights from JLG went on to say that for heavy-duty equipment, the use of Diesel Exhaust Fluid is becoming more critical for operation as industries seek more stifling environmental regulations. The market trend towards clean diesel solutions, which not only works but also aligns with world environmental targets, is reflected in this.

Several key dynamics are forming the market. Stricter legislation pressures worldwide along with technological improvements in SCR systems have significantly impacted demand for Diesel Exhaust Fluid. In this context, more efficient SCR technologies have been invented, which have attracted higher consumption of DEF as these systems function based on a very precise amount of fluid needed for their proper working. The automotive industry has also been motivated by the efforts of the sector to incorporate diesel engines that are capable of producing the least number of emissions as compared with the emission norms. Companies are investing in improving formulations and their networks of distribution for better performance and availability of DEF.

Diesel Exhaust Fluid Market Segment Analysis

By Component

- SCR Catalysts

- DEF Tanks

- DEF Injectors

- DEF Supply Modules

- DEF Sensors

- NOx Sensors

By Application

- Agricultural Tractors

- Construction Equipment

By Supply Mode

- Cans & Bottles

- IBCs

- Bulk

- Pumps

By Distribution Channel

- OEM

- Aftermarket

By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

In 2023, the Heavy Commercial Vehicles (HCVs) segment dominated and accounted for approximately 55% of the market share. This is because heavy-duty diesel engines, which are used in trucks, buses, and other construction equipment, have the highest volume of Diesel Exhaust Fluid demanded. Heavy Commercial Vehicles large trucks and construction equipment account for a significant proportion because these face strict emission standards, and most are diesel-powered, to which this characteristic of Diesel Exhaust Fluid is particularly beneficial. For example, with heavy-duty trucks, top truck manufacturers such as Volvo and Daimler have implemented advanced SCR systems that are highly reliant on DEF for better and more stringent emission regulations with excellent vehicle performance.

If you need any Customization in the Report as per your Business Requirement Ask @ https://www.snsinsider.com/enquiry/1696

Trend Analysis: Diesel Exhaust Fluid Market

One of the major trends observed in the Diesel Exhaust Fluid market is fluid efficiency improvement and cost-saving operation through technology and innovation. Diesel engines are now observing an increased trend in introducing smart monitoring systems that will integrate Diesel Exhaust Fluid for instant information on consumption and system performance. Underpinning this trend is the need to achieve greater precision in the utilization of Diesel Exhaust Fluid to drive maximum efficacy of emissions reduction while ensuring minimum downtime. For example, telematics and predictive maintenance tools are increasingly utilized in optimizing the usage of DEF, helping prevent system failures, and reducing overall operation costs of a fleet. Formulations of long-life DEF, along with better storage solutions, are helping to alleviate logistic constraints and increase the life of Diesel Exhaust Fluid, but further strengthens an increasingly vital role for the product in fulfilling very strict environmental regulations.

Regional Analysis

In 2023, North America dominated the Diesel Exhaust Fluid market, with an estimated market share of approximately 40%. This is because the region has strict emission standards while numerous vehicle types in the region have adopted SCR systems on a wide level. For example, stringent NOx emission standards within the United States by the EPA mandated the use of Diesel Exhaust Fluid at huge levels. Strong infrastructure for DEF and supply chain facilities accompany an increased number of commercial vehicles and heavy-duty trucks, which enhances the market leadership of North America. Major truck manufacturers, like Freightliner and Peterbilt, located in North America, have incorporated advanced technologies of SCR in their vehicles, significantly influencing an increase in DEF consumption in that region.

Key Takeaways:

- The Diesel Exhaust Fluid market is thankful for seeing such rapid growth back-to-back propelled by stringent emission regulations and continuous thrust on improving the technological aspects of SCR systems.

- North America has the highest market share as there are more comprehensive regulatory frameworks and a largely extended network of DEF infrastructures.

- Heavy Commercial Vehicles account for the largest market share as DEF is consumed fairly high in a large-scale diesel engine.

- The range of emerging trends goes from smart monitoring of DEF usage to total integration for optimizing overall operational efficiency.

Buy this Exclusive Report Which Includes @ https://www.snsinsider.com/checkout/1696

BENEFITS:

No. Of Pages: 435 Pages Report

Regions/Countries:

- North America (3 Countries)

- Europe (~15 Countries)

- Asia Pacific (~10 Countries)

- Latin America (~5 Countries)

- Middle East & Africa (~5 Countries) (Include Israel)

ME Sheet: Market Estimation in Excel Format

Company Analysis:

- Major 16 companies covered in final report.

- Additional 5 companies will be covered as per client demand complimentary.

Statistical Insights and Trends Reporting:

- Feature Analysis, by Offering

- Performance Benchmarks, by Offering

- Usage Statistics, by Region, 2023

- Integration Capabilities, by Offering

- Regulatory Compliance, by Region

Read Full Report Description @ https://www.snsinsider.com/reports/diesel-exhaust-fluid-market-1696

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.