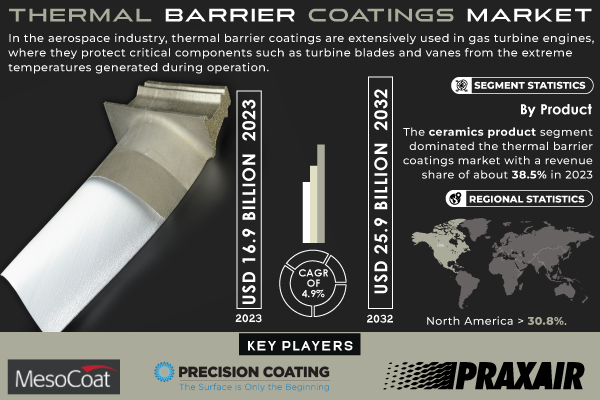

Austin, Sept. 24, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that The Thermal Barrier Coatings Market size is projected to reach USD 25.9 billion by 2032 and grow at a CAGR of 4.9% over the forecast period of 2024-2032.

Growing renewable energy sources along with technological advancements in gas turbines will considerably boost thermal management solutions in power generation which will propel the thermal barrier coatings market. In data released last year, the International Energy Agency estimated that renewables accounted for 29% of global electricity generation in 2022 and could reach over 50% by 2030. To support this shift, advanced materials are required to enhance the efficiency and extend the lifetimes of power generation systems especially gas turbines which remain an important component in both traditional and renewable energy power plants. Major stakeholders in the TBC market, GE and Siemens are compensating on heavy R&D investment for innovation of new formulations that would help enhance thermal resistance under severe conditions.

Request Sample Report of Thermal Barrier Coatings Market 2024 @ https://www.snsinsider.com/sample-request/4120

Key Players:

- Praxair Surface Technologies (Praxair TBC Coating)

- MesoCoat Inc.

- ASB Industries Inc.

- Oerlikon Metco (Metco 204NS YSZ)

- Sulzer Ltd. (HVOF Thermal Spray Coatings)

- Flame Spray Technologies (FST) (FS 35 YSZ)

- Cincinnati Thermal Spray Inc.

- General Electric (GE Power) (GE HA Gas Turbines TBC)

- Mitsubishi Power (M701JAC TBC System)

- APS Materials, Inc. (APS Yttria-Stabilized Zirconia Coating)

- TWI Ltd. (Ceramic Matrix Composites Coatings)

- Zircotec Ltd. (Thermal Barrier Ceramic Coating)

- Linde plc (Linde TBC Solution)

- H.C. Starck GmbH (Thermal Spray Powders for TBCs)

- A&A Coatings (YSZ Thermal Barrier Coating)

- Plasma-Tec, Inc. (Plasma-Sprayed Ceramic Coatings)

- Thermion, Inc. (Thermion Ceramic TBC)

- Precision Coating Inc.

- Praxair Surface Technologies

- Metallisation Ltd.

What are the Growth Factors of the Thermal Barrier Coatings Market?

In aerospace and power generation industries TBCs are critical for gas turbines and aircraft engines to improve performance for prolonged service life. The push for better-quality engines on the grounds of decreased fuel consumption and emissions puts TBCs into use thus the demand for reliable, efficient technologies is raised. The coatings protect engine parts from the temperatures and chemistries of the hostile environment, providing enhanced efficiencies in which engines may be operated. Therefore, TBCs not only extend the lifespan of crucial parts, they also help in increasing fuel efficiency which enables them to match industry standards for sustainability and performance improvement.

Moreover, the U.S. Energy Information Administration (EIA) predicts that natural gas will continue to play a key role as one of the leading sources of electricity generation over the next few years in its Annual Energy Outlook 2021, with natural gas making up almost 40% of total U.S. electricity generation by 2025, mainly due to generators having enough modes for dispatching efficiently under different market conditions. In the latter sector, particularly, TBC technology is becoming a basic necessity in improving the efficiencies of gas turbines (critical to this market) so they can run at higher operating temperatures and associated levels of efficiency demanded by regulators for emissions reduction.

In 2023, Raytheon Technologies, through its Pratt & Whitney division, introduced an advanced TBC system for its geared turbofan engines. This new coating technology significantly improves thermal management, allowing engines to achieve higher performance while reducing emissions.

Which segment of the Thermal Barrier Coatings market is estimated to dominate in Technology?

The HVOC technology held the largest market share around 36% in 2023. As a reliable and versatile technology for high-temperature applications, particularly aerospace and power generation HVOC (High-Volume Off-Gassing) has become the largest segment in the Thermal Barrier Coatings (TBC) market. This technology can be used for the deposition of uniquely durable and heat-resistant coatings, which is ideal for protecting turbine components subjected to severe thermal and oxidative environments. High-volume organic coating (HVOC) processes ensure a uniform and strongly bonded coating with excellent mechanical properties resulting in the prolonged life of engine critical parts. In addition, with industry demands for high performance and emissions constraints growing, HVOC technology meets the higher temperature requirements of engines while sustaining reliability. Rapidly increasing focus on sustainability and energy efficiency, in combination with continuous development of the HVOC process is likely to maintain dominance among manufacturers moving forward, who are looking to boost the performance of gas turbines and aircraft engines.

Thermal Barrier Coatings Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.9 Bn |

| Market Size by 2031 | US$ 25.9 Bn |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Drivers | • Increasing demand for thermal barrier coatings in the aerospace industry • Rising demand for energy-efficient gas turbines in power generation plants drive the market growth. |

If You Need Any Customization on Thermal Barrier Coatings Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/4120

Which segment of the Thermal Barrier Coatings market is estimated to be the fastest-growing in the Application Segment?

The stationary power plants segment is anticipated to register the highest CAGR of 5.8% over the forecast year. Since this segment has become a major contributor towards pollution while there exists an increasing demand for cleaner and more efficient types of power generation technologies. They lower the emissions from power plants by minimizing heat loss. China and India are seeing an economic boom of sorts, especially China where the increase in demand for power is almost palpable. It is leading to the construction of stationary power plants, thereby escalating growth in the thermal barrier coatings (TBC) market.

Key Segments:

By Product

- Metals

- Intermetallics

- Ceramics

- Others

By Technology

- Cold Barrier

- High-Velocity Oxy-Fuel (HVOF)

- Plasma Barrier

- Electric Arc Barrier

- Flame Barrier

By Combination

- Ceramic YSZ

- MCrAlY

- Al2O3 (Aluminium oxide)

- Mullite-based

- Others

By Application

- Stationary Power Plants

- Automotive

- Aerospace

- Others

Which region is estimated the fastest growth in the Thermal Barrier Coatings market?

Asia Pacific held the fastest growth market and share about 25.5% in 2023. The rise in the demand for energy has made governments of developing countries, such as China and India, invest significantly in renewable energy projects and strengthen their power generation capabilities; this factor encourages advanced thermal management solutions like TBCs. The area also boasts the global headquarters of aerospace heavyweights Boeing and Airbus who are both ramping up production due to rapid growth in demand for commercial aircraft. This, in turn, is likely to drive the adoption of TBC technologies through government initiatives (like the "Made in China 2025" strategy, which focuses on promoting high-tech industries such as aerospace and energy.) Taken together these attributes render the Asia-Pacific region a clear powerhouse in the TBC market, indicative of its critical role in global energy and aerospace.

Recent Developments

- In 2023, GE announced a new TBC formulation that improves thermal efficiency and extends the operational life of gas turbines. This innovative coating is designed to withstand higher temperatures, enabling turbines to operate more efficiently while reducing fuel consumption and emissions.

- In late 2022, Siemens unveiled its latest TBC technology for jet engines, focusing on improved coating adhesion and thermal resistance.

Buy Full Research Report on Thermal Barrier Coatings Market 2024-2032 @ https://www.snsinsider.com/checkout/4120

Key Takeaways:

- The TBC market is experiencing significant growth driven by the aerospace and power generation sectors' demand for more efficient and durable engines.

- Innovations in coating technologies, such as HVOC and advanced ceramic materials, are enhancing thermal resistance and durability.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Thermal Barrier Coatings Market Segmentation, by Product

8. Thermal Barrier Coatings Market Segmentation, by Technology

9. Thermal Barrier Coatings Market Segmentation, by Combination

10. Thermal Barrier Coatings Market Segmentation, By Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Description of Thermal Barrier Coatings Market Report 2024-2032 @ https://www.snsinsider.com/reports/thermal-barrier-coatings-market-size-4120

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain