September 26, 2024

Biodexa Pharmaceuticals PLC

(“Biodexa” or the “Company”)

Interim results for the six months ended June 30, 2024

Biodexa Pharmaceuticals PLC (Nasdaq: BDRX), an acquisition-focused clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs, today announces its unaudited interim results for the six months ended June 30, 2024 which will also be made available on the Company’s website at www.biodexapharma.com

OPERATIONAL HIGHLIGHTS

The Company announced the following in the six months ended June 30, 2024:

- Exclusive worldwide licensing of eRapa™, a Phase 3 ready asset with a lead indication of Familial Adenomatous Polyposis (“FAP”) together with access to a $17 million grant.

- Six month data of eRapa in FAP showing an 83% non-progression rate and a statistically significant reduction on overall polyp burden, announced at the Digestive Disease Week scientific meeting in Washington D.C.

- 12 month data of eRapa in FAP showing a 75% non-progression rate and median overall decrease in polyp burden of 17%, presented at the bi-annual InSIGHT scientific meeting in Barcelona.

- 12 month overall survival of patient #1 in the Company’s MAGIC-G1 Phase 1 study of MTX110 in recurrent Glioblastoma (“rGBM”).

- 16.5 months overall survival of patients in a Phase 1 study of MTX110 in Diffuse Midline Glioma, subsequently presented at the International Symposium on Pediatric Neuro-oncology (ISPNO 2024).

- Allowance by the US Patent and Trademark Office of Family 13 (“Prevention of Pancreatic Cell Degeneration”), a key component of tolimidone exclusivity.

Post period end:

- Approval by Health Canada to proceed with a Phase 2a dose confirmation study of tolimidone in Type 1 diabetes to be conducted by the University of Alberta Diabetes Institute.

- An update on the status of cohort A in the MAGIC-G1 study: patients #1 and #2 have deceased with overall survival (OS) since start of treatment of 12 months and 13 months, respectively. Patients #3 and #4 remain alive with progression free survival (PFS) since the start of treatment of 6 and 9 months, respectively and OS thus far of 12 and 11 months respectively.

FINANCIAL HIGHLIGHTS

- Receipt of $6.05 million in gross proceeds from the exercise of certain Series E and Series F warrants to purchase 4.4 million ADSs. The warrant inducement included a reduction in exercise price and issuance of replacement Series G and Series H warrants.

- R&D costs decreased to £2.19 million in 1H24 (1H23: £2.25 million) reflecting a reduction in spend on the MAGIC-G1 study in rGBM, termination of legacy drug delivery projects and lower personnel costs offset by the addition of MTD228 (tolimidone) and MTX230 (eRapa) preclinical and study initiation costs.ministrative costs decreased to £2.03 million (1H23: £2.29 million) as a result of a positive reversal in foreign exchange and a reduction in professional fees offset by increases in share-based payment charge and sundry other costs.

- Administrative costs decreased to £2.03 million (1H23: £2.29 million) as a result of a positive reversal in foreign exchange and a reduction in professional fees offset by increases in share-based payment charge and sundry other costs.

- Net cash used in operating activities (after changes in working capital) in 1H24 was £4.81 million (1H23: £3.88million).

- The Company’s cash balance at June 30, 2024 was £5.06 million. The cash balance at August 31, 2024 was £5.71 million.

Post period end:

- Receipt of $5.0 million in gross proceeds from a Registered Direct Offering of 5.1m ADSs and 0.3m Pre-funded warrants together with a private placement of Series J and Series K warrants.

- Payment of the final match, enabling access to the remainder of the $17 million grant from the Cancer Prevention and Research Institute of Texas (“CPRIT”), which will be used to fund the upcoming Phase 3 registrational study of eRapa in the orphan indication of FAP.

Commenting, Stephen Stamp, CEO and CFO, said “It was a busy first half for Biodexa. Licensing in eRapa, a Phase 3 ready asset with access to $17 million of non-dilutive grant funding, is an enormous step forward. The second half will be about executing on our lead programs. We already have approval from Health Canada for the IIT Phase 2a study of tolimidone in Type 1 diabetes and we are working diligently to set up a global Phase 3 registrational study of eRapa in FAP so we can begin recruiting early next year.”

For more information, please contact:

Biodexa Pharmaceuticals PLC

Stephen Stamp, CEO, CFO

Tel: +44 (0)29 2048 0180

About Biodexa

Biodexa Pharmaceuticals PLC (listed on NASDAQ: BDRX) is a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs. The Company’s lead development programs include eRapa, under development for Familial Adenomatous Polyposis and Non-Muscle Invasive Blader Cancer; tolimidone, under development for the treatment of type 1 diabetes; and MTX110, which is being studied in aggressive rare/orphan brain cancer indications.

eRapa is a proprietary oral formulation of rapamycin, also known as sirolimus. Rapamycin is an mTOR (mammalian Target Of Rapamycin) inhibitor. mTOR has been shown to have a significant role in the signalling pathway that regulates cellular metabolism, growth and proliferation and is activated during tumorgenesis.

Tolimidone is an orally delivered, potent and selective activator of Lyn kinase. Lyn is a member of the Src family of protein tyrosine kinases, which is mainly expressed in hematopoietic cells, in neural tissues, liver, and adipose tissue. Tolimidone demonstrates glycemic control via insulin sensitization in animal models of diabetes and has the potential to become a first in class blood glucose modulating agent.

MTX110 is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the tumor, by-passing the blood-brain barrier and potentially avoiding systemic toxicity.

Biodexa is supported by three proprietary drug delivery technologies focused on improving the bio-delivery and bio-distribution of medicines. Biodexa’s headquarters and R&D facility is in Cardiff, UK. For more information visit www.biodexapharma.com.

Forward-Looking Statements

Certain statements in this announcement may constitute “forward-looking statements” within the meaning of legislation in the United Kingdom and/or United States. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management’s belief or interpretation. All statements contained in this announcement that do not relate to matters of historical fact should be considered forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved.” Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause their actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein.

Reference should be made to those documents that Biodexa shall file from time to time or announcements that may be made by Biodexa in accordance with the rules and regulations promulgated by the SEC, which contain and identify other important factors that could cause actual results to differ materially from those contained in any projections or forward-looking statements. These forward-looking statements speak only as of the date of this announcement. All subsequent written and oral forward-looking statements by or concerning Biodexa are expressly qualified in their entirety by the cautionary statements above. Except as may be required under relevant laws in the United States, Biodexa does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or events otherwise arising.

CHIEF EXECUTIVE’S REVIEW

Our primary focus in the first half of 2024 was on assimilating tolimidone, licensed in December 2023, into our portfolio and searching for additional clinical-stage assets to diversify and advance our pipeline which ultimately led to the licensing of eRapa in May 2024.

eRapa License

In line with our strategy to build a sustainable therapeutics company in rare/orphan diseases, we continue to search for opportunities to broaden and diversify our development pipeline. On April 25, 2024, we entered into a License and Collaboration Agreement (“LCA”) with Rapamycin Holdings, Inc. (d/b/a Emtora Biosciences), relating to the license of eRapa, an oral formulation of rapamycin (also known as sirolimus) for use in all diseases, states or conditions in humans. Under the LCA, we obtained an exclusive, worldwide, sublicensable right to develop, manufacture, commercialize, or otherwise exploit products containing rapamycin. Pursuant to the terms of the LCA, the Company and Emtora established a joint development committee to monitor and progress the development of eRapa.

Emtora has conducted a Phase 1 study of eRapa in prostate cancer, a Phase 2 study in FAP and has an ongoing Phase 2 study in Non-muscle Invasive Bladder Cancer. Preparations are under way for a registrational Phase 3 study of eRapa in FAP.

In consideration for the license, we made an upfront payment of 378,163 ADSs (equal to five percent of our then outstanding Ordinary Shares, calculated on a fully-diluted basis). In addition, we are also responsible for up to an aggregate $31.5 million in sales milestones within the first six months of commercial sale of a first-approved indication of eRapa in certain markets with decreasing milestones for subsequent approvals for additional indications. There is also a one-time $10.0 million milestone payable upon cumulative net sales of $1.0 billion. Further, we are also obligated to pay Emtora single digit tiered royalties on net sales of eRapa, in addition to honouring Emtora’s legacy royalty obligations and paying Emtora fees related to income derived from sublicensing and partnering of eRapa. In addition, a promissory note previously issued by Emtora in favour of the Company in the amount of $0.25 million was forgiven. We also made an additional $0.5 million payment which was used for a match to an advance from the CPRIT. Emtora had secured a grant of $17.0 million from CPRIT to support the Phase 3 study of eRapa in FAP. The grant requires a 1 for 2 match and Biodexa was expected to fund the match of up to $7.5 million, being 50% of the remaining CPRIT grant, which was completed in September 2024. Grant funding is available once the match payment has been certified and CPRIT has approved eligible trial expenses. In certain instances, CPRIT may advance payments before eligible trial expenses have been incurred.

Upon a change of control of the Company, we will issue Emtora a warrant exercisable for 1,604,328 ADSs. The LCA also provides us with the exclusive option to acquire all of the capital stock of Emtora on commercially reasonable terms in the 90 days after acceptance of the filing of an NDA by the U.S. Food and Drug Administration (the “FDA”).

R&D update

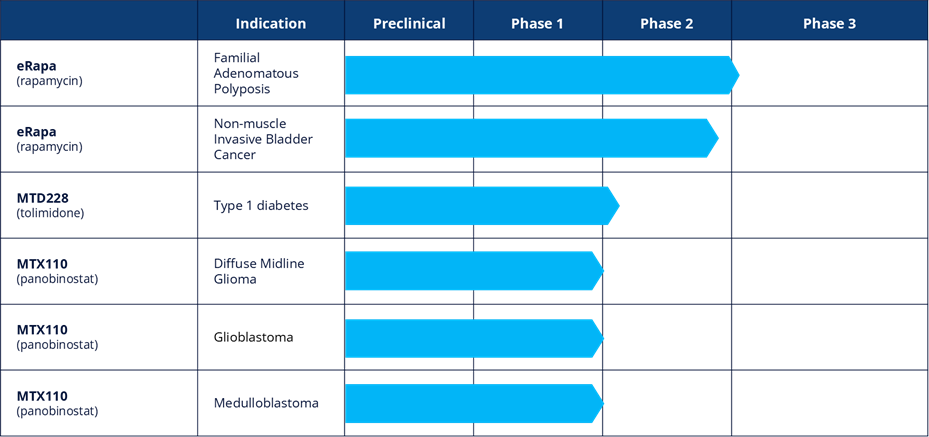

Following the in-licensing of eRapa, our development pipeline has not only advanced in terms of clinical stage but expanded to six programmes overall, four of which are orphan indications:

eRapa

eRapa is a proprietary oral formulation of rapamycin, also known as sirolimus. Rapamycin is an mTOR (mammalian Target Of Rapamycin) inhibitor. mTOR has been shown to have a significant role in the signalling pathway that regulates cellular metabolism, growth and proliferation and is activated during tumorgenesis1. Rapamycin is approved in the US for organ rejection in renal transplantation as Rapamune®(Pfizer). Through the use of nanotechnology and pH sensitive polymers, eRapa is designed to address the poor bioavailability, variable pharmacokinetics and toxicity generally associated with the currently available forms of rapamycin. eRapa is protected by a number of issued patents which extend through 2035, with other pending applications potentially providing further protection beyond 2035.

Familial Adenomatous Polyposis (“FAP”)

FAP is an orphan indication characterized by a proliferation of polyps in the colon and/or rectum, usually occurring in mid-teens. There is no approved therapeutic option for treating FAP patients, for whom active surveillance and surgical resection of the colon and/or rectum remain the standard of care. If untreated, FAP typically leads to cancer of the colon and/or rectum. There is a significant hereditary component to FAP with a reported incidence of one in 5,000 to 10,000 in the US1 and one in 11,300 to 37,600 in Europe2. eRapa has received Orphan Designation in the US with plans to seek such designation in Europe. Importantly, mTOR has been shown to be over-expressed in FAP polyps – thereby underscoring the rationale for using a potent and safe mTOR inhibitor like eRapa to treat FAP.

An open-label Phase 2 study (NCT04230499) was conducted by Emtora in seven U.S. centres of excellence in 30 adult patients. Patients were sequentially enrolled into three dosing cohorts of 10 patients each for a 12-month treatment period: 0.5mg every other day (Cohort 1), 0.5mg daily every other week (Cohort 2), and 0.5mg daily (Cohort 3). Upper and lower endoscopic surveillance occurred at baseline and after six months. Primary endpoints were safety and tolerability of eRapa and percentage change from baseline in polyp burden, as measured by the aggregate of all polyp diameters.

In May 2024, results of the Phase 2 study at six months were presented at the prestigious 2024 Digestive Disease Week annual meeting in Washington D.C. by Carol Burke, MD, the Principal Investigator. In summary, at six months, eRapa appeared safe and well-tolerated with a significant 24% reduction in the total polyp burden at six months compared with baseline (p=0.04) and an overall 83% non-progression rate.

In June 2024, results of the Phase 2 study at 12 months were presented at the bi-annual InSIGHT meeting in Barcelona by Dr Burke. Overall, 21 of 28 (75%) patients were deemed to be non-progressors at 12 months with a median reduction in polyp burden of 17%. In Cohort 2, the likely dosage regimen for Phase 3, eight of nine (89)% of patients were deemed non-progressors at 12 months with a median reduction in polyp burden of 29%. Over the course of 12 months, there were four related Grade 3 or higher and one related Serious Adverse Event reported during the trial and 95% compliance rate at 12 months. One patient was removed from the trial due to non-compliance.

The Phase 3 registrational study is planned to be a double-blind placebo-controlled design recruiting approximately 150 high risk patients diagnosed with germline or phenotypic FAP. The primary clinical endpoint is expected to be the first progression free survival event which will comprise composite endpoints including major surgery. A ‘Type C’ meeting with the FDA is planned for 4Q24 to finalise the protocol and related matters. A $17 million grant from CPRIT will support this study.

Non-muscle Invasive Bladder Cancer (“NMIBC”)

NMIBC refers to tumors found in the tissue that lines the inner surface of the bladder. The most common treatment is transurethral resection of the bladder tumor followed by intravesical Bacillus Calmette-Guerin (“BCG”) with chemotherapy depending upon assessment of risk of recurrence. NMIBC is the fourth most common cancer in men with an incidence of 10.1 per 100,000 and 2.5 per 100,000 in women3.

Our ongoing multi-centre, double-blind, placebo-controlled Phase 2 study in NMIBC is expected to enrol up to 166 patients with primary endpoints of safety/tolerability and relapse free survival after 12 months of treatment. The Phase 2 study, which is supported by a $3.0 million non-dilutive grant from the National Cancer Institute, part of the National Institutes of Health, is expected to read out in mid-2025.

MTD228 – Tolimidone

Tolimidone was originally discovered by Pfizer and was developed through Phase 2 for the treatment of gastric ulcers. Pfizer undertook a broad pre-clinical program to characterize the pharmacology, pharmacokinetics, metabolism and toxicology of tolimidone. Pfizer discontinued development of the drug due to lack of efficacy for that indication in a Phase II clinical trial.

Tolimidone is a selective activator of the enzyme Lyn kinase which increases phosphorylation of insulin substrate-1, thereby amplifying the signalling cascade initiated by the binding of insulin to its receptor.

Type 1 Diabetes (“T1D”)

Tolimidone’s potential utility in T1D has been demonstrated by several ground-breaking preclinical studies conducted by the University of Alberta, where Lyn kinase was identified as a key factor for beta cell survival and proliferation in in vitro and in vivo models. Most importantly, tolimidone was able to induce proliferation in beta cells isolated from human cadavers. From a mechanism of action perspective, tolimidone has been shown to both prevent beta cell degradation and to stimulate beta cell proliferation. In a meta analysis of 1,202 articles and 193 studies, the incidence of T1D was shown to be 15 per 100,000 with a prevalence of 9.5 per 10,000 of the population4.

As a first step in the continued clinical development of tolimidone, a Phase 2a Investigator Initiated Trial (IIT) at the University of Alberta Diabetes Institute is designed to establish the minimum effective dose of tolimidone in patients with T1D. The study, which was approved by Health Canada in July 2024 is expected to recruit 12 patients initially across three dose groups. The study will measure C-peptide levels (a marker for insulin) and HbA1c (a marker for blood glucose) after three months compared with baseline and the number of hyperglycemic events.

MTX110

MTX110 is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the brain tumor, by-passing the blood-brain barrier and potentially avoiding systemic toxicity. All three types of brain cancer being studied are orphan.

Recurrent Glioblastoma (“rGBM”)

Our Phase 1 MAGIC-G1 study (NCT05324501) of MTX110 in rGBM completed the dose escalation part of the study with the recruitment of the fourth patient in Cohort A. In February 2024 we announced Patient #1, who had received sub-optimal infusions of 60µM of MTX110 had survived for12 months from the start of treatment (OS=12). GBM universally recurs and once it does median overall survival according to a retrospective analysis of 299 patients reported in the Journal of Neuro-Oncology is 6.5 months. Post period end, we provided an update on the status of cohort A in the MAGIC-G1 study: patients #1 and #2 have deceased with overall survival (OS) since start of treatment of 12 months and 13 months, respectively. Patients #3 and #4 remain alive with progression free survival (PFS) since the start of treatment of 6 and 9 months, respectively and OS thus far of 12 and 11 months respectively. GBM virtually always recurs with median Progression Free Survival of 1.5–6.0 months and median Overall Survival of 2.0–9.0 months5.

Diffuse Midline Glioma (“DMG”)

In February 2024 we announced headline data from a Phase 1 IIT study conducted by Columbia University in newly diagnosed patients with DMG. As this was the first ever study of repeated infusions to the pons via an implanted CED catheter, the primary objective of the study was safety and tolerability and, accordingly, the number of infusions was limited to two, each of 48 hours, 7 days apart in nine patients. One patient suffered a severe adverse event assessed by the investigators as not related to the study drug. Although not powered to reliably demonstrate efficacy, median overall survival (OS) of patients in the study was 16.5 months compared with median survival rate in a cohort of 316 cases of 10.0 months (Jansen et al, 2015. Neuro-Oncology 17(1):160-166).

Study investigators subsequently presented the results of the trial at the 21st International Symposium on Pediatric Neuro-Oncology (ISPNO 2024) in Philadelphia.

Medulloblastoma

An IIT Phase I study of MTX110 in medulloblastoma remains ongoing at the University of Texas.

Financing

As a pre-revenue biotech company, securing adequate finance to fund operations to an out-licensing and/or partnering event is a constant focus. On the back of the eRapa in-licensing and the subsequent announcement of positive 6-month and 12-month data of eRapa in FAP, we accomplished two financings; the first in May 2024 and the second post period end in July 2024.

May 2024 Warrant Exercises

On May 22, 2024, we raised $6.05 million of gross proceeds from the exercise of previously issued warrants following an agreement between the Company and several accredited investors to exercise existing Series E warrants and Series F warrants to purchase up to an aggregate of 4,358,322 ADSs. The warrant holders agreed to exercise the Series E and/or Series F warrants at an exercise price of $1.50 (reduced from $2.20) per ADS.

In consideration for the immediate exercise of the Series E and/or Series F warrants for cash, we issued one replacement warrant for each Series E warrant exercised in the form of a Series G warrant, and one replacement warrant for each Series F warrant exercised in the form of a Series H warrant. The Series G and Series H warrants are exercisable for five years and one year, respectively, at $2.50 each.

July 2024 Registered Direct Offering and Private Placement

On July 22, 2024, we utilised our capacity under our Registration Statement on Form F-3 to raise $5.0 million in gross proceeds in a Registered Direct Offering with certain institutional investors for the sale of an aggregate of 5,050,808 ADSs and 278,975 pre-funded warrants at a price of $0.94 per ADS. In a concurrent Private Placement, we issued and sold to the Investors (i) Series J warrants exercisable for 5,329,783 ADSs, and (ii) Series K Warrants to purchase an aggregate of 5,329,783 ADSs. The Series J and Series K warrants are exercisable for five years and one year, respectively, at $1.00 per ADS each.

1. https://rarediseases.org/rare-diseases/familial-adenomatous-polyposis/

2.

https://www.orpha.net/en/disease/detail/733#:~:text=FAP%20has%20a%20birth%20incidence,colorectal%20cancer%20(CRC)%20cases.

3. Cassell et al., World J Oncol. 2019 Jun; 10(3): 123–131.

4. National Library of Medicine, Mobasseri et al., published online 2020 Mar 30. doi: 10.34172/hpp.2020.18

5. Birzu et al. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7794906

1H24 FINANCIAL REVIEW

The unaudited results for the six months ended June 30, 2024 are discussed below:

Key performance indicators (KPIs):

| 1H 2024 | 1H 2023 | Change | |

| R&D costs | £2.19m | £2.25m | (3)% |

| R&D as % of operating costs | 52% | 50% | 5% |

| Net cash (outflow)/inflow for the period | £(0.92)m | £2.39m | N/M |

Biodexa’s KPIs focus on the key areas of operating results, R&D spend and cash management. These measures provide information on the core R&D operations. Additional financial and non-financial KPIs may be adopted in due course.

Revenues

Total revenue for the six months to June 30, 2024 was £Nil compared to £0.30 million in the first six months of 2023. The R&D collaboration with Janssen, which represented the entire revenue in 1H23, concluded in September 2023.

Research and Development

R&D costs in 1H24 reduced by £0.06 million, or 3%, to £2.19 million compared with £2.25 million in 1H23. The percentage of R&D costs as a percentage of total operating costs increased to 52% in the period from 50%. The reduction in R&D costs in 1H24 reflects a reduction in spend of £0.54 million on the MAGIC-G1 study in rGBM, the termination of legacy drug delivery projects and lower personnel costs offset by the addition of MTD228 (tolimidone) and MTX230 (eRapa) for a combined expenditure of £0.65 million in 1H24.

Administrative Costs

Administrative costs in 1H24 decreased by £0.26 million, or 11% to £2.03 million from £2.29 million in 1H23. The decrease in administrative costs in 1H24 is a result of a positive reversal in foreign exchange of £0.23 million and a reduction in professional fees of £0.14 million offset by increases in share-based payment charge of £0.12 million and sundry other costs.

Finance Income and Expense

Finance income in 1H24 and 1H23 included gains in respect of an equity settled derivative financial liability of £0.75 million (1H23: £0.39 million). The gains arose as a result of the fall in the Biodexa share price. In addition, the Company earned interest on cash deposits.

Finance expense in the period related to lease liabilities and discounted interest on deferred consideration.

Cash Flows

Cash outflows from operating activities in 1H24 were £4.81 million compared to £3.88 million in 1H23, driven by a net loss of £3.31 million (1H23: £3.57 million) and after negative working capital of £0.87 million (1H23: positive £0.21 million) and other negative non-cash items totalling £0.63 million (1H23: negative £0.52 million).

Net cash used in investing activities in 1H24 of £0.75 million in 1H24 resulted from the purchase of eRapa licence for total consideration of £3.07 million including cash consideration of £0.85 million (1H23: £Nil) offset by £0.10 million of interest received (1H23: £0.02 million).

Net cash generated in financing activities in 1H24 was £4.65 million (1H23: inflow £6.25 million), which was driven by receipts from share issuances, including warrants, net of costs of £4.74 million offset by payments on lease liabilities of £0.09 million.

Overall, cash decreased by £0.92 million in 1H24 compared to an increase of £2.39 million in 1H23. This resulted in a cash balance at June 30, 2024 of £5.06 million compared with £5.23 million at June 30, 2023 and £5.97 million at December 31, 2023.

Going concern

Biodexa has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the six months to June 30, 2024, the Group incurred a consolidated loss from operations of £3.31 million (1H23: £3.57 million) and negative cash flows from operating activities of £4.81 million (1H23: £3.88 million). As of June 30, 2024, the Group had accumulated deficit of £147.88 million.

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation, generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Group's consolidated interim financial information has been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As at June 30, 2024, the Group had cash and cash equivalents of £5.06 million. The Directors forecast that the Group currently has enough cash to fund its planned operations into the first quarter of 2025. If the Company does not secure additional funding before the first quarter of 2025, it will no longer be a going concern and would likely be placed in Administration.

The Directors have prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months from the date of approval of this interim financial information. These forecasts show that further financing will be required before the first quarter of 2025 assuming, inter alia, that certain development programs and other operating activities continue as currently planned. If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares (including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly harm our business, financial condition and prospects.

On August 27, 2024, the Company received notification from the Listing Qualifications Department of The Nasdaq Stock Market LLC advising that the Company was not in compliance with the minimum bid requirement set forth in NASDAQ’s rules for continued listing of its securities. The Company has requested a Hearing Panel which has paused any suspension or delisting action pending the hearing. If the Company's ADSs are delisted, it could be more difficult to buy or sell the Company's ADSs or to obtain accurate quotations, and the price of the Company's ADSs could suffer a material decline. Delisting may impair the Company's ability to raise capital.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies continues to be challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any of alternative courses of action to finance the Group would be successful. This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

The Directors believe there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements.

Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected.

Stephen Stamp

Chief Executive Officer and Chief Financial Officer

Consolidated Statements of Comprehensive Income

For the year six month period ended June 30

| Note | 2024 unaudited £’000 | 2023 unaudited £’000 | |

| Revenue | - | 298 | |

| Research and development costs | (2,189) | (2,251) | |

| Administrative costs | (2,034) | (2,291) | |

| Loss from operations | (4,223) | (4,244) | |

| Finance income | 3 | 839 | 410 |

| Finance expense | 3 | (49) | (22) |

| Loss before tax | (3,433) | (3,856) | |

| Taxation | 4 | 125 | 288 |

| Loss for the period attributable to the owners of the parent | (3,308) | (3,568) | |

| Total comprehensive loss attributable to the owners of the parent | (3,308) | (3,568) | |

| Loss per share | |||

| Basic and diluted loss per ordinary share – pence | 5 | (0.1p) | (3.6)p |

The accompanying notes form part of these financial statements

Consolidated Statements of Financial Position

| | Note | As at June 30, 2024 unaudited £’000 | As at December 31, 2023 £’000 | |

| Assets | ||||

| Non-current assets | ||||

| Property, plant and equipment | 436 | 571 | ||

| Intangible assets | 6 | 6,008 | 2,941 | |

| 6,444 | 3,512 | |||

| Current assets | ||||

| Trade and other receivables | 1,922 | 637 | ||

| Taxation | 547 | 422 | ||

| Cash and cash equivalents | 5,055 | 5,971 | ||

| 7,524 | 7,030 | |||

| Total assets | 13,968 | 10,542 | ||

| Liabilities | ||||

| Non-current liabilities | ||||

| Deferred consideration | 7 | 1,552 | - | |

| Borrowings | 208 | 295 | ||

| 1,760 | 295 | |||

| Current liabilities | ||||

| Trade and other payables | 1,689 | 1,240 | ||

| Deferred consideration | 7 | 459 | - | |

| Borrowings | 174 | 169 | ||

| Derivative financial liability | 8 | 1,159 | 4,160 | |

| 3,481 | 5,569 | |||

| Total liabilities | 5,241 | 5,864 | ||

| Issued capital and reserves attributable to owners of the parent | ||||

| Share capital | 9 | 8,689 | 6,253 | |

| Share premium | 91,242 | 86,732 | ||

| Merger reserve | 53,003 | 53,003 | ||

| Warrant reserve | 3,674 | 3,457 | ||

| Accumulated deficit | (147,881) | (144,767) | ||

| Total equity | 8,727 | 4,678 | ||

| Total equity and liabilities | 13,968 | 10,542 |

The accompanying notes form part of these financial statements

Consolidated Statements of Cash Flows

For the six month period ended June 30

| Note | 2024 unaudited £’000 | 2023 unaudited £’000 | |

| Cash flows from operating activities | |||

| Loss for the period | (3,308) | (3,568) | |

| Adjustments for: | |||

| Depreciation of property, plant and equipment | 67 | 72 | |

| Depreciation of right of use asset | 68 | 70 | |

| Amortisation of intangible fixed asset | 1 | 1 | |

| Finance income | 3 | (839) | (410) |

| Finance expense | 3 | 49 | 22 |

| Share-based payment expense | 150 | 15 | |

| Taxation | 4 | (125) | (288) |

| Foreign exchange losses | 2 | - | |

| Cash flows from operating activities before changes in working capital | (3,935) | (4,086) | |

| (Increase)/Decrease in trade and other receivables | (1,298) | 103 | |

| Increase in trade and other payables | 426 | 309 | |

| Decrease in provisions | - | (207) | |

| Cash used in operations | (4,807) | (3,881) | |

| Taxes payments | - | - | |

| Net cash used in operating activities | (4,807) | (3,881) |

Consolidated Statements of Cash Flows (continued)

For the six month period ended June 30

| Note | 2024 unaudited £’000 | 2023 unaudited £’000 | |

| Investing activities | |||

| Purchases of property, plant and equipment | - | (4) | |

| Proceeds from disposal of fixed assets | - | - | |

| Purchase intangible asset | (852) | - | |

| Interest received | 98 | 24 | |

| Net cash generated from/(used in) investing activities | (754) | 20 | |

| Financing activities | |||

| Interest paid | - | (7) | |

| Amounts paid on lease liabilities | (93) | (95) | |

| Share issues including warrants, net of costs | 9 | 4,738 | 6,354 |

| Net cash generated from/(used in) financing activities | 4,645 | 6,252 | |

| Net increase/(decrease) in cash and cash equivalents | (916) | 2,391 | |

| Cash and cash equivalents at beginning of period | 5,971 | 2,836 | |

| Cash and cash equivalents at end of period | 5,055 | 5,227 |

The accompanying notes form part of these financial statements

Consolidated Statements of Changes in Equity (unaudited)

| Note | Share capital £’000 | Share premium £’000 | Merger reserve £’000 | Warrant reserve £’000 | Accumulated deficit £’000 | Total equity £’000 | ||

| At January 1, 2024 | 6,253 | 86,732 | 53,003 | 3,457 | (144,767) | 4,678 | ||

| Loss for the period | - | - | - | - | (3,308) | (3,308) | ||

| Total comprehensive loss | - | - | - | - | (3,308) | (3,308) | ||

| Transactions with owners: | ||||||||

| Shares issued on May 22, 2024 | 9 | 1,242 | 3,730 | - | 1,690 | - | 6,662 | |

| Costs associated with share issue on May 22, 2024 | - | (369) | - | (125) | - | (494) | ||

| Exercise of warrants during period | 9 | 1,043 | 1,081 | - | (1,348) | - | 776 | |

| Issue of shares to purchase intangible asset | 9 | 151 | 68 | - | - | - | 219 | |

| Share-based payment charge | - | - | - | - | 195 | 195 | ||

| Total contribution by and distributions to owners | 2,436 | 4,510 | - | 217 | 195 | 7,357 | ||

| At June 30, 2024 | 8,689 | 91,242 | 53,003 | 3,674 | (147,881) | 8,727 |

| Note | Share capital £’000 | Share premium £’000 | Merger reserve £’000 | Warrant reserve £’000 | Accumulated deficit £’000 | Total equity £’000 | |

| At January 1, 2023 | 1,108 | 83,667 | 53,003 | 720 | (135,336) | 3,162 | |

| Loss for the period | - | - | - | - | (3,568) | (3,568) | |

| Total comprehensive loss | - | - | - | - | (3,568) | (3,568) | |

| Transactions with owners: | |||||||

| Shares issued on February 15, 2023 | 9 | 1,956 | 3,013 | - | - | - | 4,969 |

| Costs associated with share issue on February 15, 2023 | - | (903) | - | - | - | (903) | |

| Shares issued on May 26, 2023 | 9 | 2,277 | - | - | 103 | (355) | 2,025 |

| Costs associated with share issue on May 26, 2023 | - | - | - | - | (527) | (527) | |

| Share-based payment charge | - | - | - | - | 141 | 141 | |

| Total contribution by and distributions to owners | 4,233 | 2,110 | - | 103 | (741) | 5,705 | |

| At June 30, 2023 | 5,341 | 85,777 | 53,003 | 823 | (139,645) | 5,299 |

The accompanying notes form part of these financial statements

Notes Forming Part of The Consolidated Unaudited Interim Financial Information

For the six month period ended June 30, 2024

- Basis of preparation

The unaudited interim consolidated financial information for the six months ended June 30, 2024 has been prepared following the recognition and measurement principles of the International Financial Reporting Standards, International Accounting Standards and Interpretations (collectively IFRS) issued by the International Accounting Standards Board (IASB), and as adopted by the UK and in accordance with International Accounting Standard 34 Interim Financial Reporting (‘IAS 34’). The interim consolidated financial information does not include all the information and disclosures required in the annual financial information and should be read in conjunction with the audited financial statements for the year ended December 31, 2023.

The accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting periods.

Book values approximate to fair value at 30 June 2024, 30 June 2023 and 31 December 2023.

The condensed interim financial information contained in this interim statement does not constitute statutory financial statements as defined by section 434(3) of the Companies Act 2006. The condensed interim financial information has not been audited. The comparative financial information for the six months ended June 30, 2023 and the year ended December 31, 2023 in this interim financial information does not constitute statutory financial statements for that period or year. The statutory financial statements for December 31, 2023 have been delivered to the UK Registrar of Companies. The auditor’s report on those accounts was unqualified and did not contain a statement under section 498(2) or 498(3) of the Companies Act 2006. The auditor’s report did draw attention to a material uncertainty related to going concern and the requirement, as of the date of the report, for additional funding to be raised by the Company by the fourth quarter of 2024.

Biodexa Pharmaceutical’s annual reports may be downloaded from the Company’s website at https://biodexapharma.com/investors/financial-reports-and-presentations/#financial-reports or a copy may be obtained from 1 Caspian Point, Caspian Way, Cardiff CF10 4DQ.

Going Concern – material uncertainty

Biodexa has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the six months to June 30, 2024, the Group incurred a consolidated loss from operations of £3.31 million (1H23: loss £3.56 million) and negative cash flows from operating activities of £4.81 million (1H23 £3.88 million). As of June 30, 2024, the Group had accumulated deficit of £147.88 million.

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation, generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Group's consolidated financial statements have been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As at June 30, 2024, the Group had cash and cash equivalents of £5.06 million. The Directors forecast that the Group currently has enough cash to fund its planned operations into the first quarter of 2025. If the Company does not secure additional funding before the first quarter of 2025, it will no longer be a going concern and would likely be placed in Administration.

The Directors have prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months from the date of approval of this interim financial information. These forecasts show that further financing will be required before the first quarter of 2025 assuming, inter alia, that certain development programs and other operating activities continue as currently planned. If we raise additional funds through the issuance of debt securities or additional equity securities, it could result in dilution to our existing shareholders, increased fixed payment obligations and these securities may have rights senior to those of our ordinary shares (including the ADSs) and could contain covenants that would restrict our operations and potentially impair our competitiveness, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. Any of these events could significantly harm our business, financial condition and prospects.

On August 27, 2024, the Company received notification from the Listing Qualifications Department of The Nasdaq Stock Market LLC advising that the Company was not in compliance with the minimum bid requirement set forth in NASDAQ’s rules for continued listing of its securities. The Company has requested a Hearing Panel which has paused any suspension or delisting action pending the hearing. If the Company's ADSs are delisted, it could be more difficult to buy or sell the Company's ADSs or to obtain accurate quotations, and the price of the Company's ADSs could suffer a material decline. Delisting may impair the Company's ability to raise capital.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies continues to be challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any of alternative courses of action to finance the Group would be successful. This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

The Directors believe there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements.

Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the timing of clinical trials. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. If we lack sufficient capital to expand our operations or otherwise capitalize on our business opportunities, our business, financial condition and results of operations could be materially adversely affected.

- Accounting for eRapa and CPRIT grant

The LCA entered into with Emtora meets the definition of a Joint Arrangement under IFRS 11, specifically related to the FAP program.

A jointly controlled escrow account was established on completion of the LCA. All FAP program transactions are processed through the escrow account, including the Company’s deposits of matching funds, as set out in the agreement, the receipt of grant funding from CPRIT and the payment of eligible R&D expenses. Although the CPRIT grant and R&D supplier contracts are with Emtora, the joint arrangement nature of the LCA results in Emtora being deemed to be acting as the Company’s agent. Accordingly, the Company recognises 100% of the grant and 100% of the R&D expenditure. The CPRIT grant recognised is on a 1 for 2 match. In accordance with the Company’s accounting policy, the grant, as it is the re-imbursement of directly related costs, is credited to R&D costs in the same period in The Statements of Comprehensive Income. The escrow account is recognised within prepayments, CPRIT grant received in advance is recognised within deferred revenue and any grant not yet received is recognised in accrued income.

In 1H24 the company recognised R&D costs of £0.2 million on the FAP project, this was made up of expenditure of £0.5 million netted against CPRIT grant of £0.3 million.

The balances as at June 30, 2024 were as follows in relation to the FAP project:

Prepayments £1.2 million

Deferred revenue £0.1 million

- Finance income and expense

| Six months ended June 30, 2024 unaudited £’000 | Six months ended June 30, 2023 unaudited £’000 | |

| Finance income | ||

| Interest received on bank deposits | 86 | 24 |

| Other interest | 2 | - |

| Gain on equity settled derivative financial liability | 751 | 386 |

| Total finance income | 839 | 410 |

The gain on the equity settled derivative financial liability in 1H24 and 1H23 arose as a result of the fall in the Biodexa share price.

| Six months ended June 30, 2024 unaudited £’000 | Six months ended June 30, 2023 unaudited £’000 | |

| Finance expense | ||

| Interest expense on lease liabilities | 11 | 15 |

| Interest expense on deferred consideration | 38 | - |

| Other loans | - | 7 |

| Total finance expense | 49 | 22 |

- Taxation

Income tax is recognised or provided at amounts expected to be recovered or to be paid using the tax rates and tax laws that have been enacted or substantively enacted at the Group Statement of Financial Position date. Research and development tax credits are recognised on an accruals basis and are included as an income tax credit under current assets. The research and development tax credit recognised is based on management’s estimate of the expected tax claim for the period and is recorded within taxation under the Small and Medium-sized Enterprise Scheme.

| Six months ended June 30, 2024 unaudited £’000 | Six months ended June 30, 2023 unaudited £’000 | |

| Income tax credit | 125 | 288 |

- Loss per share

Basic loss per share amounts are calculated by dividing the net loss for the period from continuing operations, attributable to ordinary equity holders of the parent company, by the weighted average number of ordinary shares outstanding during the period. As the Group made a loss for the period the diluted loss per share is equal to the basic loss per share.

| Six months ended June 30, 2024 unaudited £’000 | Six months ended June 30, 2023 unaudited £’000 | |

| Numerator | ||

| Loss used in basic EPS and diluted EPS: | (3,308) | (3,568) |

| Denominator | ||

| Weighted average number of ordinary shares used in basic EPS | 3,280,798,115 | 99,191,082 |

| Basic and diluted loss per share: | (0.1)p | (3.6)p |

The Company has considered the guidance set out in IAS 33 in calculating the denominator in connection with the issuance of Pre-Funded, Abeyance Shares, Series A, Series B and Series C warrants as disclosed in note 8. Management have recognised the warrants from the date of grant rather than the date of issue of the corresponding Ordinary Shares when calculating the denominator.

The Group has made a loss in the current and previous periods presented, and therefore the options and warrants are anti-dilutive. As a result, diluted earnings per share is presented on the same basis as basic earnings per share.

- Intangible Assets

| In-process research and development £’000 | Goodwill £’000 | IT/Website costs £’000 | Total £’000 | |

| Cost | ||||

| At January 1, 2023 | 13,378 | 2,291 | 110 | 15,779 |

| Acquisition | 2,938 | – | – | 2,938 |

| At December 31, 2023 | 16,316 | 2,291 | 110 | 18,717 |

| Acquisition | 3,068 | – | – | 3,068 |

| At June 30, 2024 (unaudited) | 19,384 | 2,291 | 110 | 21,785 |

| In-process research and development £’000 | Goodwill £’000 | IT/Website Costs £’000 | Total £’000 | |

| Accumulated amortisation and impairment | ||||

| At January 1, 2023 | 13,378 | 2,291 | 104 | 15,773 |

| Amortisation charge for the year | – | – | 3 | 3 |

| At December 31, 2023 | 13,378 | 2,291 | 107 | 15,776 |

| Amortisation charge for the period | – | – | 1 | 1 |

| At June 30, 2024 (unaudited) | 13,378 | 2,291 | 108 | 15,777 |

| Net book value | ||||

| At June 30, 2024 (unaudited) | 6,006 | – | 2 | 6,008 |

| At December 31,2023 | 2,938 | – | 3 | 2,941 |

The individual intangible assets which are material to the financial statements are as follows:

| Carrying amount | Remaining amortisation period | |||

| June 30, 2024 unaudited £’000 | December 31, 2023 £’000 | June 30, 2024 unaudited £’000 | December 31, 2023 £’000 | |

| MTX228 tolimidone acquired IPRD* | 2,938 | 2,938 | n/a | n/a |

| MTX230 eRapa acquired IPRD* | 3,068 | – | n/a | n/a |

*asset is not yet in use and has not started amortising

On April 25, 2024 the Company entered into a License and Collaboration Agreement (LCA) with Rapamycin Holdings, Inc. (d/b/a Emtora Biosciences), relating to the license of eRapa. In consideration for the License, the Company made an upfront payment of 378,163 ADSs (equal to five percent of our then outstanding Ordinary Shares, calculated on a fully-diluted basis). In addition, a promissory note previously issued by Emtora in favor of the Company in the amount of $0.25 million was forgiven and certain historical liabilities relating to their on-going FAP and NMIBC programs were settled. The Company is also obligated to make quarterly payments to Emtora of $0.25 million less 75% of any research sales by Emtora until the handover trigger event occurs. The obligation meets the definition of a financial liability in accordance with IAS32 and is measured at fair value in accordance with IFRS9. Management have estimated the expected liability to be $3.1 million and the present value as $2.5 million.

| $’000 | £’000 | |

| 378,163 ADSs issued at market value | 274 | 219 |

| Promissory note forgiven | 250 | 197 |

| Historical liabilities settled | 820 | 655 |

| Quarterly payment obligation | 2,494 | 1,997 |

| Recognised as intangible asset purchase (unaudited) | 3,838 | 3,068 |

In addition, the Company is also responsible for up to $31.5 million in sales milestones within the first six months of commercial sale of a first-approved indication of eRapa in certain markets, with decreasing milestones for subsequent approvals for additional indications. There is also a one-time $10.0 million milestone payable upon cumulative net sales of $1.0 billion. Further, the Company is also obligated to pay Emtora single digit tiered royalties on net sales of eRapa, in addition to honouring Emtora’s legacy royalty obligations and paying Emtora fees related to income derived from sublicensing and partnering of eRapa.

The LCA also provides the Company with the exclusive option to acquire all of the capital stock of Emtora on commercially reasonable terms in the 90 days after acceptance of the filing of an NDA by the U.S. Food and Drug Administration (the “FDA”). If the Company does not exercise the option, it would be required to make additional quarterly payments, as disclosed in note 7, until the first commercial sale of the product.

- Deferred Consideration

| As at June 30, 2024 unaudited £’000 | As at December 31, 2023 £’000 | |

| Opening provision at January 1, | - | - |

| On acquisition of licence | 1,997 | - |

| Interest expense | 38 | - |

| Foreign exchange | (24) | - |

| 2,011 | - | |

| Less: non-current portion | (1,552) | - |

| Current portion | 459 | - |

The Company is obligated to make quarterly payments to Emtora of $0.25 million less 75% of any research sales by Emtora until the handover trigger event occurs. The obligation meets the definition of a financial liability in accordance with IAS32 and is measured at fair value in accordance with IFRS9. Management have estimated the expected liability to be $3.1 million and the present value as $2.5 million.

This financial liability is measured on Level 3, the fair value is derived using a discounted cash flow approach. The discount rate applied to the obligation was 11.64% (2023: n/a).

A 1% increase or decrease in the discount rate would decrease or increase the liability by approximately £0.03 million (2023: n/a) and £0.03 million (2023: n/a), respectively. An increase in the liability would result in a loss in the revaluation of financial instruments, while a decrease would result in a gain.

There were no transfers between Level 1 and 2 in the period.

- Derivative financial liability – current

| As at June 30, 2024 unaudited £’000 | As at December 31, 2023 £’000 | |

| At January 1 | 4,160 | 85 |

| Warrants issued | 1,368 | 4,562 |

| Transfer to share premium on exercise of warrants | (3,618) | - |

| Gain recognised in finance income within the consolidated statement of comprehensive income | (751) | (487) |

| 1,159 | 4,160 |

Equity settled derivative financial liability is a liability that is not to be settled for cash.

No warrants recognised as equity settled derivatives were exercised in 2023.

The Company issues warrants exercisable into ADSs of the Company as part of registered direct offerings and private placements in the US. The number of ADSs to be issued when exercised is fixed, however the exercise price is denominated in US Dollars being different to the functional currency of the Company. Therefore, the warrants are classified as equity settled derivative financial liabilities recognised at fair value through the profit and loss account (‘FVTPL’). The financial liability is valued using the Black-Scholes model. Financial liabilities at FVTPL are stated at fair value, with any gains or losses arising on re-measurement recognised in profit or loss. The net gain or loss recognised in profit or loss incorporates any interest paid on the financial liability and is included in the ‘finance income’ or ‘finance expense’ lines item in the income statement. A key input in the valuation of the instrument is the Company share price.

Details of the warrants are as follows:

May 2024 warrants

In May 2024 the Company issued 2,359,012 Series G ADS Warrants and 3,695,218 Series H ADS Warrants as part of the Warrant Inducement Transaction. The exercise price per ADS is $2.50.

December 2023 warrants

In December 2023 the Company issued 3,000,063 Series E ADS Warrants and 3,000,063 Series F ADS Warrants as part of the Registered Offering in the US. The exercise price per ADS is $2.20.

May 2023 warrants

In June 2023 the Company issued 276,689 Series D ADS Warrants as part of a registered direct offering and private placement in the US after securing shareholder approval. The exercise price per ADS was $16.00.

May 2020 warrants

In May 2020 the Company issued 838 ADS warrants as part of a registered direct offering in the US.

October 2019 warrants

In October 2019 the Company issued 392 ADS warrants as part of a registered direct offering in the US.

Warrant re-price

On May 22, 2024 the Company entered into agreements with several accredited investors to exercise existing Series E warrants and Series F warrants, issued in December 2023, to purchase up to an aggregate of 4,358,322 ADSs. The warrant holders agreed to exercise the Series E and/or Series F warrants at an exercise price of $1.50 (reduced from $2.20) per ADS.

| ADS Warrants Number | Original price per ADS | New price per ADS | Equivalent Ordinary Shares (400 Ordinary Shares per ADS) Number | |

| Series E warrants | 1,572,674 | $2.20 | $1.50 | 629,069,600 |

| Series F warrants | 2,463,477 | $2.20 | $1.50 | 985,390,800 |

Warrants and Dara share options

The Group also assumed fully vested warrants and share options on the acquisition of DARA Biosciences, Inc. (which took place in 2015). The number of ordinary shares to be issued when exercised is fixed, however the exercise prices are denominated in US Dollars. The warrants are classified equity settled derivative financial liabilities and accounted for in the same way as those detailed above. The financial liability is valued using the Black-Scholes option pricing model. The exercise price of the outstanding options is $1,903.40.

The following table details the outstanding warrants and options over ADSs and ordinary shares recognised as equity settled derivative financial liabilities as at June 30, 2024, December 31, 2023 and also the movement in the year:

| At December 31, 2022 | Lapsed | Granted | At December 31, 2023 | Lapsed | Granted | Exercised | At June 30, 2024 unaudited | |

| ADSs warrants | ||||||||

| May 2024 grant | – | – | – | – | – | 6,054,230 | – | 6,054,230 |

| December 2023 grant | – | 6,000,126 | 6,000,126 | – | – | (4,282,895) | 1,717,231 | |

| May 2023 grant | – | 276,689 | 276,689 | – | – | – | 276,689 | |

| May 2020 grant | 838 | – | – | 838 | – | – | – | 838 |

| October 19 grant | 392 | – | – | 392 | – | – | – | 392 |

| Ordinary Shares | ||||||||

| DARA Options | 138 | (10) | – | 128 | (29) | – | – | 99 |

Fair value hierarchy

The Group uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation technique:

Level 1: quoted (unadjusted) prices in active markets for identical assets and liabilities;

Level 2: other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either directly or indirectly; and

Level 3: techniques which use inputs that have a significant effect on the recorded fair value that are not based on observable market data.

The fair value of the Group’s derivative financial liability is measured at fair value on a recurring basis. The following table gives information about how the fair value of this financial liability is determined.

| Financial liabilities | Fair value as at June 30, 2024 | Fair value as at December 31, 2023 | Fair value hierarchy | Valuation technique(s) and key input(s) | Significant unobservable input(s) | Relationship of unobservable inputs to fair value |

| Equity settled financial derivative liability – Series H warrants | £179,000 | – | Level 3 | Black-Scholes Model | Volatility rate of 100% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 0.89 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 5.09% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability – Series G warrants | £591,000 | – | Level 3 | Black-Scholes Model | Volatility rate of 95% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 4.33 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 4.33% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability - Series F warrants | £16,000 | £2,592,000 | Level 3 | Black-Scholes Model | Volatility rate of 120% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 0.48 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 5.33% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability – Series E warrants | £343,000 | £1,444,000 | Level 3 | Black- Scholes Model | Volatility rate of 100% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 4.48 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 4.33% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability – Series D warrants | £30,000 | £124,000 | Level 3 | Black- Scholes Model | Volatility rate of 105% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 4.43 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 4.53% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability – May 2020 warrants | – | – | Level 3 | Black- Scholes Model | Volatility rate of 100% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 1.38 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 4.90% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Equity settled financial derivative liability – October 2019 Warrants | – | – | Level 3 | 2023 – Black- Scholes Model | Volatility rate of 100% determined using historical volatility of comparable companies. | The higher the volatility the higher the fair value. |

| Expected life between a range of 0.1 and 1.00 years determined using the remaining life of the share options. | The shorter the expected life the lower the fair value. | |||||

| Risk-free rate of 5.09% determined using the expected life assumptions. | The higher the risk-free rate the higher the fair value. | |||||

| Total | £1,159,000 | £4,160,000 |

Changing the unobservable risk-free rate input to the valuation model by 10% higher while all other variables were held constant, would not impact the carrying amount of shares (2023: nil).

There were no transfers between Level 1 and 2 in the period.

The financial liability measured at fair value on Level 3 fair value measurement represents consideration relating to warrants issued in May 2024, December 2023, June 2023, May 2020 and October 2019 as part of Private Placements, Registered Direct offerings and the Warrant Inducement Transaction.

- Share capital and reserves

| Authorised, allotted and fully paid – classified as equity | As at June 30, 2024 unaudited Number | As at June 30, 2024 unaudited £ | As at December 31, 2023 Number | As at December 31, 2023 £ |

| Ordinary shares of £0.001 each | 3,626,112,922 | 3,626,113 | 1,189,577,722 | 1,189,578 |

| ‘A’ Deferred shares of £1 each | 1,000,001 | 1,000,001 | 1,000,001 | 1,000,001 |

| ‘B’ Deferred shares of £0.001 | 4,063,321,418 | 4,063,321 | 4,063,321,418 | 4,063,321 |

| Total | 8,689,435 | 6,252,900 |

During the period the Company issued the following warrants over ADSs, and these were recognised in the warrant reserve until exercise:

| Pre-Funded Warrants | Abeyance Shares | Series A Warrants | Series B Warrants | Series C Warrants | |

| Exercise price | £0.0001 | £Nil | $214.40 | $214.40 | $16.00 |

| As at January 1, 2023 | – | – | – | – | – |

| Issued: | – | ||||

| Private Placement February 2023 | 155,461 | – | 32,327 | 48,491 | – |

| Registered Direct Offering May 2023 | – | – | – | – | 415,043 |

| Registered Offering December 2023 | 1,911,176 | – | – | – | – |

| Adhera Assignment and Exchange Agreement | 2,275,050 | – | – | – | – |

| Exercised | (155,461) | – | (32,327) | (48,491) | (415,043) |

| As at December 31, 2023 | 4,186,226 | – | – | – | – |

| Exercised | (2,361,865) | – | – | – | – |

| Lapsed | (163) | – | – | – | – |

| Warrant inducement May 2024 | – | 931,585 | – | – | – |

| As at June 30, 2024 (unaudited) | 1,824,198 | 931,585 | – | – | – |

The Series A, Series B and Series C warrants are exercisable on an ‘alternative cashless basis’ effectively allowing the holders to exercise for nil consideration.

Ordinary and deferred shares were recorded as equity.

| 2024 | Ordinary Shares Number | ‘A’ Deferred Shares Number | ‘B’ Deferred Shares Number | Share Price £ | Total consideration £’000 | |

| At January 1, 2024 | 1,189,577,722 | 1,000,001 | 4,063,321,418 | |||

| February to May 2024 | Exercise pre-funded warrants | 944,746,000 | – | – | 0.0040 | 3,732 |

| February to May 2024 | Exercise Series E & F warrants | 98,697,600 | – | – | 0.0043 – 0.0044 | 427 |

| 25 April 2024 | Intangible asset (see note 5) | 151,265,200 | – | – | 0.0015 | 219 |

| 22 May 2024 | Warrant inducement | 1,241,826,400 | – | – | 0.0030 | 3,663 |

| At June 30, 2024 (unaudited) | 277,971,722 | 1,000,001 | 4,063,321,418 | |||

| 2023 | ||||||

| At January 1, 2023 | 5,417,137 | 1,000,001 | – | |||

| February 15, 2023 | Private Placements* | 98,387,275 | – | – | 0.0505 | 4,967 |

| May 26, 2023 | Registered Direct Offering* | 276,697,310 | – | – | 0.0097 | 2,690 |

| June 14, 2023 | Share sub-division and re-designation | 4,063,321,418 | n/a | n/a | ||

| December 21, 2023 | Shares issued to purchase Intangible asset (see note 5) | 323,684,800 | – | – | 0.0040 | 1,279 |

| December 21, 2023 | Registered Offering | 485,391,200 | – | – | 0.0040 | 1,918 |

| At December 31, 2023 | 1,189,577,722 | 1,000,001 | 4,063,321,418 | |||

- Related party transaction

The Directors consider there to be no related party transactions during the periods reported other than Directors Remuneration.

- Contingent liabilities

The Company entered into an Arrangement Agreement with Bioasis on December 13, 2022 as amended on December 18, 2022. Under the agreement the Company agreed to acquire the entire issued share capital of Bioasis for consideration of, in aggregate, approximately C$7.4 million (c£4.4 million). The agreement was subject to shareholder approval. On January 23, 2023 at the General Meeting to approve the Arrangement Agreement none of the special resolutions were passed and, accordingly, the acquisition of Bioasis did not proceed. Under the agreement the Company agreed to reimburse Bioasis US$225,000 for expenses relating to the transaction should the Company’s shareholders not approve the transaction. On March 3, 2023 the Company advised Bioasis that it would offset this liability against the $500,000 loan it advanced to them during December 2022 and January 2023.

As at June 30, 2024 and December 31, 2023 the Company had a contingent liability of $225,000 in relation to this potential liability.

- Events after the reporting date

On July 22, 2024, the Company utilised its capacity under its Registration Statement on Form F-3 to raise $5.0 million in gross proceeds in a Registered Direct Offering with certain institutional investors for the sale of an aggregate of 5,050,808 ADSs and 278,975 pre-funded warrants at a price of $0.94 per ADS. In a concurrent Private Placement, the Company issued and sold to the Investors (i) Series J warrants exercisable for 5,329,783 Depositary Shares, and (ii) Series K Warrants to purchase an aggregate of 5,329,783 Depositary Shares. The Series J and Series K warrants are exercisable for five years and one year, respectively, at $1.00 per ADS each.

On August 27,2024, the Company , received a Staff Determination letter (the “Letter”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company of the Staff’s determination to delist the Company’s securities from The Nasdaq Capital Market because the Company’s securities have had a closing bid price below $1.00 for 30 consecutive business days, which triggers a notice of delisting pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Rule”). Normally, a company would be afforded a 180-calendar day period to demonstrate compliance with the Rule. However, pursuant to Listing Rule 5810(c)(3)(A)(iv), the Company is not eligible for any compliance period specified in Rule 5810(c)(3)(A) because the Company effected reverse stock splits over the prior two-year period with a cumulative ratio of 250 shares or more to one.

Accordingly, and as described in the Letter, unless the Company timely requested a hearing before a Hearings Panel (the “Panel”), the Company’s securities would be subject to suspension/delisting. Accordingly, the Company requested a hearing before the Panel. The hearing request will automatically stay any suspension or delisting action pending the hearing and the expiration of any additional extension period granted by the Panel following the hearing.

On September 19, 2024, the Company announced a ratio change on its ADSs from one (1) ADS representing four hundred (400) ordinary shares, to the new ratio of one (1) ADS representing ten thousand (10,000) ordinary shares (the "Ratio Change"). The effective date of the Ratio Change is expected to be October 4,2024.

vv

Attachment