New York, USA, Sept. 30, 2024 (GLOBE NEWSWIRE) -- KRAS Inhibitors Market: New Treatments Are Set to Change Cancer Care | DelveInsight

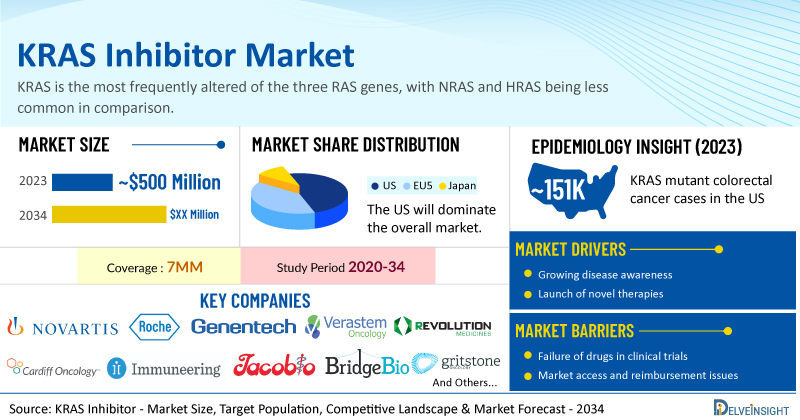

According to DelveInsight’s analysis, the growth of the KRAS Inhibitors market is expected to be mainly driven by increasing incidence, a rise in awareness and access to treatment, and robust pipeline activity for cancer indications in the 7MM.

DelveInsight’s KRAS Inhibitor Market Insights report includes a comprehensive understanding of current treatment practices, emerging KRAS inhibitors, market share of individual therapies, and current and forecasted KRAS inhibitor market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the KRAS Inhibitor Market Report

- As per DelveInsight’s analysis, the total KRAS inhibitors market size in the 7MM was approximately USD 500 million in 2023, which is expected to rise significantly by 2034.

- Among the approved KRAS Inhibitor therapies in the United States, KRAZATI (adagrasib) is expected to have the edge over LUMAKRAS (sotorasib) in revenue generated during the study period (2020–2034).

- The United States had the highest number of KRAS mutation cases in NSCLC among the 7MM. Approximately 46% of all KRAS mutation cases in NSCLC in the 7MM were reported in the United States.

- The competition in the G12C NSCLC segment is getting intense. A number of Chinese biotechs are also active in the KRAS Space.

- Despite G12D being the most prevalent variant, the majority of KRAS therapies for colorectal cancer target the G12C, and the prevalence of this variant type is low in colorectal cancer.

- KRAZATI became the first KRAS inhibitor to get the regulatory nod for the treatment of KRAS G12C–mutant locally advanced or metastatic colorectal cancer.

- When it comes to biomarker-specific therapies for Pancreatic Cancer patients, there remain tremendous unmet needs. KRAS mutations are present in about 60–90% of Pancreatic Cancer patients, of which, G12D is the most common KRAS, present in approximately 40–50% of KRAS mutated patients. Many pharma/biotech key players are turning their eye to target KRAS mutation in Pancreatic Cancer, as this largely unexplored segment may represent a significant market opportunity.

- KRAS Inhibitors Companies involved in the research and development of Pan-KRAS drugs are expected to have tremendous market potential due to the broad target patient population they can address. By targeting multiple KRAS mutations, these drugs have the potential to benefit a wider range of cancer patients, opening up opportunities for improved treatment options and potentially transforming the landscape of cancer care.

- Leading KRAS inhibitor companies such as Novartis, Roche, Genentech, Verastem Oncology, Revolution Medicines, Cardiff Oncology, Immuneering Corporation, Jacobio Pharmaceuticals, BridgeBio Pharma (Navire Pharma), Mirati Therapeutics, Deciphera Pharmaceuticals, Elicio Therapeutics, InventisBio, Gritstone bio, D3 Bio, and others are developing novel KRAS inhibitors that can be available in the KRAS Inhibitor market in the coming years.

- Some of the key KRAS inhibitors in the pipeline include JDQ443, Divarasib, Avutometinib (VS-6766), RMC-4630, Onvansertib, IMM-1-104, Glecirasib (JAB-21822), BBP-398, MRTX1133, DCC-3116, ELI-002, D-1553, SLATE-KRAS, D3S-001, and others.

Discover which therapies are expected to grab the KRAS inhibitor market share @ KRAS Inhibitor Market Report

KRAS Inhibitor Market Dynamics

The KRAS inhibitor market is an evolving sector within oncology, driven by significant advancements in cancer therapeutics. Market dynamics in this field are influenced by several factors, including the high unmet need for effective treatments for KRAS-driven cancers and the competitive landscape of drug development. The approval of LUMAKRAS in 2021 marked a significant milestone, but ongoing clinical trials and research continue to explore additional inhibitors and combination therapies. The promise of these treatments has attracted substantial investment from pharmaceutical companies and biotech firms, driving innovation and accelerating the development pipeline.

The commercial potential for KRAS inhibitors is substantial, given the prevalence of KRAS mutations in various cancers. However, market dynamics are also shaped by challenges such as high drug development costs, potential side effects, and the need for companion diagnostic tests to identify suitable patients. Additionally, the emergence of resistance mechanisms and the development of next-generation inhibitors to overcome these challenges will be critical for maintaining a competitive edge in the market.

Regulatory approval and reimbursement strategies are pivotal for the successful commercialization of KRAS inhibitors. As these therapies become available, healthcare systems must navigate the integration of these new drugs into treatment protocols, considering their cost-effectiveness and impact on patient outcomes. Overall, the KRAS inhibitor market is poised for growth, driven by ongoing research, technological advancements, and the evolving landscape of cancer treatment.

The identification of G12C inhibitors has sparked increased interest in developing novel inhibitors specifically targeting other prevalent KRAS mutations. KRAS mutations are seen most frequently in pancreatic cancer, followed by CRC and NSCLC. The most frequent KRAS variant observed in NSCLC is G12C. In addition, the most common KRAS variation in CRC and pancreatic cancer is G12D. Clinical development efforts are underway to explore alternative strategies for targeting KRAS beyond G12C inhibitors, such as cancer vaccines, adoptive cell therapy, PROTACs, and CRISPR/Cas9.

Since the majority of treatments for NSCLC now target the G12C variant, this variant type is likely to become very crowded and competitive. Future opportunities in G12C may be found in R/R patient’s pool of approved KRAS drugs and in the first-line setting.

KRAS Inhibitor Treatment Market

Generally, treatment for KRAS-mutated cancers includes surgery, radiation therapy, chemotherapy, targeted therapies, immunotherapy, and others. Radiofrequency ablation (RFA) might be considered for some people with small lung tumors near the outer edge of the lungs, especially if they cannot tolerate surgery.

As of now, there have been two KRAS inhibitors targeting G12C mutants that are FDA-approved: LUMAKRAS/LUMYKRAS (sotorasib) and KRAZATI (adagrasib). LUMAKRAS/LUMYKRAS, developed by Amgen, is an inhibitor targeting the RAS GTPase family. It received accelerated approval for treating adults with advanced NSCLC who have a KRAS G12C mutation and have undergone at least one prior systemic therapy. In January 2022, the European Commission also granted conditional marketing authorization for LUMYKRAS for this indication. Additionally, in the same month, Japan approved the drug for treating KRAS G12C-mutated, unresectable, advanced, and/or recurrent NSCLC that has progressed following systemic anticancer therapy.

KRAZATI, a drug being developed by Mirati Therapeutics and now owned by Bristol Myers Squibb, is an oral treatment designed for adult patients with KRAS G12C-mutated locally advanced or metastatic NSCLC who have undergone at least one previous systemic therapy. The FDA approved and commercially launched the drug in the US in December 2022. Most recently, in January 2024, the European Commission granted conditional marketing authorization for KRAZATI to treat KRAS G12C-mutated advanced NSCLC with disease progression following at least one prior systemic therapy. In June 2024, the US Food and Drug Administration (FDA) granted accelerated approval to the combination of KRAZATI and ERBITUX (cetuximab) for the treatment of adult patients with KRAS G12C–mutant locally advanced or metastatic colorectal cancer, as determined by an FDA-approved test, who have received prior treatment with fluoropyrimidine-, oxaliplatin-, and irinotecan-based chemotherapy.

Learn more about the FDA-approved KRAS inhibitor @ KRAS Inhibitor Drugs

Key Emerging KRAS Inhibitors and Companies

Some of the drugs in the pipeline include GFH925 (GenFleet Therapeutics), JDQ443 (Novartis), Avutometinib (Verastem Oncology), GDC-6036 (Roche), and RMC-4630 (Revolution Medicines) among others.

GFH925 is a selective, covalent, and irreversible KRAS G12C inhibitor. In April 2024, GenFleet Therapeutics announced that the FDA granted clinical trial approval for GFH925 in a multi-center, open-label, randomized, and controlled Phase III study treating refractory metastatic colorectal cancer patients. It is a registrational study.

JDQ443 is a novel oral drug that selectively targets and covalently inhibits KRASG12C. Early Phase Ib results from the KontRASt-01 study (NCT04699188) indicated a 57% confirmed overall response rate at the recommended dosage of 200 mg twice daily in patients with advanced NSCLC. The drug is now undergoing a Phase III trial, which aims to compare JDQ443 as a standalone treatment against docetaxel in patients with advanced NSCLC who have a KRASG12C mutation and have previously undergone platinum-based chemotherapy and immune checkpoint inhibitor treatments, either sequentially or in combination. Novartis plans to file a New Drug Application (NDA) for NSCLC and CRC by 2024 and after 2026, respectively.

In January 2024, the FDA granted Fast Track Designation for Verastem Oncology’s investigational therapy, avutometinib, for treating NSCLC. The FDA designation is intended for the use of avutometinib along with Amgen’s LUMAKRAS to treat KRAS G12C-mutant metastatic NSCLC patients previously treated with systemic therapy.

The other KRAS inhibitors in the pipeline include

- Divarasib: Roche/Genentech

- Onvansertib: Cardiff Oncology

- IMM-1-104: Immuneering Corporation

- Glecirasib (JAB-21822): Jacobio Pharmaceuticals

- BBP-398: BridgeBio Pharma (Navire Pharma)

- MRTX1133: Mirati Therapeutics

- DCC-3116: Deciphera Pharmaceuticals

- ELI-002: Elicio Therapeutics

- D-1553: InventisBio

- SLATE-KRAS: Gritstone bio

- D3S-001: D3 Bio

The anticipated launch of these emerging therapies are poised to transform the KRAS inhibitors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the KRAS inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about KRAS inhibitor clinical trials, visit @ KRAS Inhibitor Treatment Drugs

KRAS Inhibitor Overview

KRAS is the most frequently altered of the three RAS genes, with NRAS and HRAS being less common in comparison. The KRAS gene is located on chromosome 12p12.1 and includes six exons, with mutations often occurring in exon 1 at positions 12 and 13, though they can also be found in codons 61, 63, 117, 119, and 146.

KRAS mutations are changes in the KRAS gene, which is responsible for coding a protein involved in cell signaling pathways. These mutations frequently occur in several cancers, such as colorectal, lung, and pancreatic cancers. Historically, targeting KRAS mutations with specific treatments has been difficult. However, recent research has made progress, leading to the development of promising strategies for treating cancers with KRAS mutations, though these treatments are currently available only for NSCLC.

Historically, chemotherapy has been the standard treatment for patients with KRAS-mutant lung cancer and other solid tumors. However, with recent advancements in immunotherapy, there has been a growing focus on combining immunotherapy with chemotherapy for patients with KRAS mutations.

KRAS Inhibitor Epidemiology Segmentation

Western nations have a higher incidence of KRAS mutations than Asian nations. Among the selected cancer types, the most KRAS mutant cases are found in Colorectal Cancer, followed by Pancreatic Cancer and NSCLC. In the United States, there were about ~151,000 cases of KRAS mutant colorectal cancer in 2023. The KRAS inhibitors market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of NSCLC, CRC, and Pancreatic Cancer

- Total KRAS Incident Cases in NSCLC, CRC, and Pancreatic Cancer

- Total KRAS Variant Cases in NSCLC, CRC, and Pancreatic Cancer

| KRAS Inhibitor Report Metrics | Details |

| Study Period | 2020–2034 |

| KRAS Inhibitor Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| KRAS Inhibitors Market Size in 2023 | USD 500 Million |

| Key KRAS Inhibitor Companies | Novartis, Roche, Genentech, Verastem Oncology, Revolution Medicines, Cardiff Oncology, Immuneering Corporation, Jacobio Pharmaceuticals, BridgeBio Pharma (Navire Pharma), Mirati Therapeutics, Deciphera Pharmaceuticals, Elicio Therapeutics, InventisBio, Gritstone bio, D3 Bio, Amgen, and others |

| Key KRAS Inhibitors | JDQ443, Divarasib, Avutometinib (VS-6766), RMC-4630, Onvansertib, IMM-1-104, Glecirasib (JAB-21822), BBP-398, MRTX1133, DCC-3116, ELI-002, D-1553, SLATE-KRAS, D3S-001, LUMAKRAS/LUMYKRAS (sotorasib), KRAZATI (adagrasib), and others |

Scope of the KRAS Inhibitor Market Report

- KRAS Inhibitor Therapeutic Assessment: KRAS Inhibitor current marketed and emerging therapies

- KRAS Inhibitor Market Dynamics: Conjoint Analysis of Emerging KRAS Inhibitor Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, KRAS Inhibitor Market Access and Reimbursement

Discover more about KRAS inhibitor drugs in development @ KRAS Inhibitor Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Key Highlights of the Report |

| 4 | Executive Summary of KRAS Inhibitors |

| 5 | Key Events |

| 6 | Epidemiology and Market Forecast Methodology |

| 7 | KRAS-inhibitors Market Overview at a Glance |

| 7.1 | Market Share (%) Distribution of KRAS-inhibitors by Therapies in 2023 |

| 7.2 | Market Share (%) Distribution of KRAS-inhibitors by Therapies in 2034 |

| 7.3 | Market Share (%) Distribution of KRAS-inhibitors by Indications in 2023 |

| 7.4 | Market Share (%) Distribution of KRAS-inhibitors by Indications in 2034 |

| 8 | Disease Background and Overview |

| 8.1 | Introduction |

| 8.2 | Clinical Significance |

| 8.2.1 | RAS Oncogene and Carcinogenesis as a Multistep Process |

| 8.2.2 | KRAS Mutation as a Prognostic Biomarker |

| 8.2.3 | KRAS Mutation and Personalized Medicine |

| 8.3 | Diagnosis |

| 8.4 | Biomarker testing for KRAS mutation |

| 8.4.1 | NSCLC |

| 8.4.2 | Colorectal Cancer |

| 8.4.3 | Pancreatic Cancer |

| 8.5 | Clinical Relevance of KRAS Mutation by Cancer Type |

| 8.5.1 | Pancreatic Cancer |

| 8.5.2 | Colorectal Cancer |

| 8.5.2.1 | Tumor-based Tests for KRAS Gene Mutations |

| 8.5.3 | Lung Cancer |

| 8.5.4 | Ovarian Cancer |

| 8.5.5 | Hepatocellular Carcinoma (HCC) |

| 9 | Treatment |

| 9.1 | Treatment of NSCLC |

| 9.1.1 | Surgery |

| 9.1.2 | Radiofrequency Ablation (RFA) |

| 9.1.3 | Radiation Therapy |

| 9.1.4 | Chemotherapy |

| 9.1.5 | Immunotherapy |

| 9.2 | Treatment of Pancreatic Cancer |

| 9.2.1 | Surgery |

| 9.2.2 | Ablation or Embolization Treatments |

| 9.2.3 | Radiation Therapy |

| 9.2.4 | Chemotherapy |

| 9.2.5 | Immunotherapy |

| 9.3 | Treatment of Hepatocellular Cancer |

| 9.3.1 | Surgery |

| 9.3.2 | Ablation |

| 9.3.3 | Embolization Therapy |

| 9.3.4 | Radiation Therapy |

| 9.3.5 | Targeted Drug Therapy |

| 9.3.6 | Immunotherapy |

| 9.3.7 | Chemotherapy |

| 9.4 | Treatment of Ovarian Cancer |

| 9.4.1 | Local Treatments |

| 9.4.1.1 | Surgery |

| 9.4.1.2 | Radiation Therapy |

| 9.4.2 | Systemic Treatment |

| 9.4.2.1 | Chemotherapy |

| 9.4.2.2 | Targeted Therapy |

| 9.4.2.3 | Hormone Therapy |

| 9.5 | Treatment for Colorectal Cancer |

| 9.5.1 | Local Treatments |

| 9.5.1.1 | Surgery |

| 9.5.1.2 | Radiation Therapy |

| 9.5.2 | Systemic Therapy |

| 9.5.2.1 | Chemotherapy |

| 9.5.2.2 | Targeted Therapy |

| 9.5.2.3 | Immunotherapy |

| 10 | Guidelines |

| 10.1 | NICE Guidelines for KRAS Mutation Testing of Tumors in Adults with Metastatic Colorectal Cancer (2013) |

| 10.1.1 | Diagnosis |

| 10.1.2 | Management/treatment |

| 10.1.2.1 | Chemotherapy |

| 10.1.2.2 | Biological Agents |

| 10.1.2.3 | Ongoing Care and Support |

| 10.1.3 | Patient Preferences and Issues |

| 10.1.4 | Scope of the Evaluation |

| 10.2 | ESMO Consensus Guidelines for the Management of Patients with Metastatic Colorectal Cancer (2016) |

| 10.2.1 | Recommendation for Tissue Selection |

| 10.2.2 | Recommendation for RAS testing |

| 10.2.3 | Recommendation for Conversion Therapy |

| 10.3 | NCCN Guidelines |

| 10.4 | Japanese Society of Medical Oncology Clinical Guidelines: Molecular Testing for Colorectal Cancer Treatment |

| 11 | Epidemiology and Patient Population |

| 11.1 | Key Findings |

| 11.2 | Assumptions and Rationale |

| 11.3 | KRAS Mutation in NSCLC |

| 11.3.1 | United States |

| 11.3.1.1 | Total Incident Cases of NSCLC in the United States |

| 11.3.1.2 | KRAS Incident Cases in NSCLC in the United States |

| 11.3.1.3 | KRAS Variant Cases in NSCLC in the United States |

| 11.3.2 | EU4 and the UK |

| 11.3.2.1 | Total Incident Cases of NSCLC in EU4 and the UK |

| 11.3.2.2 | KRAS Incident Cases in NSCLC in EU4 and the UK |

| 11.3.2.3 | KRAS Variant Cases in NSCLC in EU4 and the UK |

| 11.3.3 | Japan |

| 11.3.3.1 | Total Incident Cases of NSCLC in Japan |

| 11.3.3.2 | KRAS Incident Cases in NSCLC in Japan |

| 11.3.3.3 | KRAS Variant Cases in NSCLC in Japan |

| 11.4 | KRAS Mutation in CRC |

| 11.4.1 | United States |

| 11.4.1.1 | Total Incident Cases of CRC in the United States |

| 11.4.1.2 | KRAS Incident Cases in CRC in the United States |

| 11.4.1.3 | KRAS Variant Cases in CRC in the United States |

| 11.4.2 | EU4 and the UK |

| 11.4.2.1 | Total Incident Cases of CRC in EU4 and the UK |

| 11.4.2.2 | KRAS Incident Cases in CRC in EU4 and the UK |

| 11.4.2.3 | KRAS Variant Cases in CRC in EU4 and the UK |

| 11.4.3 | Japan |

| 11.4.3.1 | Total Incident Cases of CRC in Japan |

| 11.4.3.2 | KRAS Incident Cases in CRC in Japan |

| 11.4.3.3 | KRAS Variant Cases in CRC in Japan |

| 11.5 | KRAS Mutation in Pancreatic Cancer |

| 11.5.1 | United States |

| 11.5.1.1 | Total Incident Cases of Pancreatic Cancer in the United States |

| 11.5.1.2 | KRAS Incident Cases in Pancreatic Cancer in the United States |

| 11.5.1.3 | KRAS Variant Cases in Pancreatic Cancer in the United States |

| 11.5.2 | EU4 and the UK |

| 11.5.2.1 | Total Incident Cases of Pancreatic Cancer in EU4 and the UK |

| 11.5.2.2 | KRAS Incident Cases in Pancreatic Cancer in EU4 and the UK |

| 11.5.2.3 | KRAS Variant Cases in Pancreatic Cancer in EU4 and the UK |

| 11.5.3 | Japan |

| 11.5.3.1 | Total Incident Cases of Pancreatic Cancer in Japan |

| 11.5.3.2 | KRAS Incident Cases in Pancreatic Cancer in Japan |

| 11.5.3.3 | KRAS Variant Cases in Pancreatic Cancer in Japan |

| 12 | Marketed Drugs |

| 12.1 | Key Competitors |

| 12.2 | LUMAKRAS/LUMYKRAS (sotorasib): Amgen |

| 12.2.1 | Product Description |

| 12.2.2 | Regulatory Milestones |

| 12.2.3 | Other Developmental Activities |

| 12.2.4 | Ongoing Clinical Development |

| 12.2.5 | Safety and Efficacy |

| 12.2.6 | Product Profile |

| 12.3 | KRAZATI (adagrasib): Mirati Therapeutics |

| 12.3.1 | Product Description |

| 12.3.2 | Regulatory Milestones |

| 12.3.3 | Other Developmental Activities |

| 12.3.4 | Ongoing Clinical Development |

| 12.3.5 | Safety and Efficacy |

| 12.3.6 | Product Profile |

| 13 | Emerging Drugs |

| 13.1 | Key Competitors |

| 13.2 | JDQ443: Novartis |

| 13.2.1 | Product Description |

| 13.2.2 | Clinical Development |

| 13.2.2.1 | Clinical Trials Information |

| 13.2.3 | Safety and Efficacy |

| 13.3 | Divarasib: Roche/Genentech |

| 13.3.1 | Product Description |

| 13.3.2 | Other Development Activities |

| 13.3.3 | Clinical Development |

| 13.3.3.1 | Clinical Trials Information |

| 13.3.4 | Safety and Efficacy |

| 13.4 | Avutometinib (VS-6766): Verastem Oncology |

| 13.4.1 | Product Description |

| 13.4.2 | Other Developmental Activities |

| 13.4.3 | Clinical Development |

| 13.4.3.1 | Clinical Trials Information |

| 13.4.4 | Safety and Efficacy |

| 13.5 | RMC-4630: Revolution Medicines |

| 13.5.1 | Product Description |

| 13.5.2 | Other Development Activities |

| 13.5.3 | Clinical Development |

| 13.5.3.1 | Clinical Trials Information |

| 13.5.4 | Safety and Efficacy |

| 13.6 | Onvansertib: Cardiff Oncology |

| 13.6.1 | Product Description |

| 13.6.2 | Other Developmental Activities |

| 13.6.3 | Clinical Development |

| 13.6.3.1 | Clinical Trials Information |

| 13.6.4 | Safety and Efficacy |

| 13.7 | IMM-1-104: Immuneering Corporation |

| 13.7.1 | Product Description |

| 13.7.2 | Other Development Activities |

| 13.7.3 | Clinical Development |

| 13.7.3.1 | Clinical Trials Information |

| 13.7.4 | Safety and Efficacy |

| 13.8 | Glecirasib (JAB-21822): Jacobio Pharmaceuticals |

| 13.8.1 | Product Description |

| 13.8.2 | Other Development Activities |

| 13.8.3 | Clinical Development |

| 13.8.3.1 | Clinical Trials Information |

| 13.8.4 | Safety and Efficacy |

| 13.9 | BBP-398: BridgeBio Pharma (Navire Pharma) |

| 13.9.1 | Product Description |

| 13.9.2 | Other Development Activities |

| 13.9.3 | Clinical Development |

| 13.9.3.1 | Clinical Trials Information |

| 13.10 | MRTX1133: Mirati Therapeutics |

| 13.10.1 | Product Description |

| 13.10.2 | Other Development Activities |

| 13.10.3 | Clinical Development |

| 13.10.3.1 | Clinical Trials Information |

| 13.11 | DCC-3116: Deciphera Pharmaceuticals |

| 13.11.1 | Product Description |

| 13.11.2 | Other Development Activities |

| 13.11.3 | Clinical Development |

| 13.11.3.1 | Clinical Trials Information |

| 13.11.4 | Safety and Efficacy |

| 13.12 | ELI-002: Elicio Therapeutics |

| 13.12.1 | Product Description |

| 13.12.2 | Other Development Activities |

| 13.12.3 | Clinical Development |

| 13.12.3.1 | Clinical Trials Information |

| 13.13 | D-1553: InventisBio |

| 13.13.1 | Product Description |

| 13.13.2 | Other Development Activities |

| 13.13.3 | Clinical Development |

| 13.13.3.1 | Clinical Trials Information |

| 13.13.4 | Safety and Efficacy |

| 13.14 | SLATE-KRAS: Gritstone bio |

| 13.14.1 | Product Description |

| 13.14.2 | Other Development Activities |

| 13.14.3 | Clinical Development |

| 13.14.3.1 | Clinical Trials Information |

| 13.14.4 | Safety and Efficacy |

| 13.15 | D3S-001: D3 Bio |

| 13.15.1 | Product Description |

| 13.15.2 | Other Development Activities |

| 13.15.3 | Clinical Development |

| 13.15.3.1 | Clinical Trials Information |

| 14 | KRAS Inhibitors: The 7MM Analysis |

| 14.1 | Key Findings |

| 14.2 | Market Outlook |

| 14.3 | Key Market Forecast Assumptions |

| 14.4 | Total Market Size of KRAS-inhibitors in the 7MM |

| 14.5 | Market Size of KRAS-inhibitors by Therapies in the 7MM |

| 14.6 | United States |

| 14.6.1 | Total Market Size of KRAS-inhibitors in the United States |

| 14.6.2 | Market Size of KRAS-inhibitors by Therapies in the United States |

| 14.7 | EU4 and the UK |

| 14.7.1 | Total Market Size of KRAS-inhibitors in EU4 and the UK |

| 14.7.2 | Market Size of KRAS-inhibitors by Therapies in EU4 and the UK |

| 14.8 | Japan |

| 14.8.1 | Total Market Size of KRAS-inhibitors in Japan |

| 14.8.2 | Market Size of KRAS-inhibitors by Therapies in Japan |

| 15 | Unmet Needs |

| 16 | SWOT Analysis |

| 17 | KOL Views |

| 18 | Market Access and Reimbursement |

| 18.1 | United States |

| 18.1.1 | Centre for Medicare & Medicaid Services (CMS) |

| 18.2 | EU4 and the UK |

| 18.2.1 | Germany |

| 18.2.2 | France |

| 18.2.3 | Italy |

| 18.2.4 | Spain |

| 18.2.5 | United Kingdom |

| 18.3 | Japan |

| 18.3.1 | MHLW |

| 19 | KRAS-inhibitors Market Access and Reimbursement |

| 20 | Appendix |

| 20.1 | Bibliography |

| 20.2 | Report Methodology |

| 21 | DelveInsight Capabilities |

| 22 | Disclaimer |

Related Reports

Non-small Cell Lung Cancer Market

Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NSCLC companies, including EMD Serono, Merck, Cellular Biomedicine Group, Inc., Celgene, CellSight Technologies, Inc., BeyondSpring Pharmaceuticals Inc., J Ints Bio, Forward Pharmaceuticals Co., Ltd., AstraZeneca, Bristol-Myers Squibb, Teligene US, Rain Oncology Inc, ReHeva Biosciences, Inc., Amgen, Novartis, RedCloud Bio, Parexel, Vitrac Therapeutics, LLC, Mythic Therapeutics, Instil Bio, Mirati Therapeutics Inc., Daiichi Sankyo, Inc., AstraZeneca, Precision Biologics, Inc, Promontory Therapeutics Inc., Palobiofarma SL, Regeneron Pharmaceuticals, Revolution Medicines, Inc., Cullinan Oncology, LLC, Iovance Biotherapeutics, Inc., Innate Pharma, among others.

Non-small Cell Lung Cancer Pipeline

Non-small Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key non-small cell lung cancer companies, including BridgeBio Pharma, Daiichi Sankyo, EMD Serono, Merck, BridgeBio Pharma, Abbvie, Pfizer, Eli Lilly and Company BioNTech SE, Shenzhen TargetRx, Taiho Pharmaceutical, Chong Kun Dang, Bristol Myers Squibb, Innovent Biologics, Xuanzhu Biopharmaceutical, Bayer, GeneScience Pharmaceuticals, InventisBio, Apollomics, Imugene, Ono Pharmaceutical, Pierre Fabre, Jiangsu Hengrui Medicine Co., Bristol-Myers Squibb, Surface Oncology, Inhibrx, Sinocelltech, Mirati Therapeutics, REVOLUTION Medicines, Yong Shun Technology Development, Iovance Biotherapeutics, Galecto Biotech, among others.

HER2-mutant Non-Small Cell Lung Cancer Pipeline

HER2-mutant Non-Small Cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key HER2-mutant non-small cell lung cancer companies, including Dizal Pharmaceuticals, Puma Biotechnology, AstraZeneca, Jiangsu Hengrui Medicine, among others.

Small-cell Lung Cancer Pipeline

Small-cell Lung Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key small-cell lung cancer companies, including Ascentage Pharma, Merck & Co, AstraZeneca, Advenchen Laboratories, GlaxoSmithKline, Advanced Accelerator Applications, Trillium Therapeutics, Vernalis, Oncoceutics, NewBio Therapeutics, Wigen Biomedicine, Linton Pharm, Carrick Therapeutics, Xencor, Jiangsu HengRui Medicine, Aileron Therapeutics, Roche, Ipsen, Celgene, Lee's Pharmaceutical Limited, AbbVie, G1 Therapeutics, Chipscreen Biosciences, Luye Pharma Group, Shanghai Henlius Biotech, CSPC ZhongQi Pharmaceutical Technology, Impact Therapeutics, among others.

Small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key small cell lung cancer companies, including Ascentage Pharma, Merck & Co, AstraZeneca, Advenchen Laboratories, Advanced Accelerator Applications, Trillium Therapeutics, Wigen Biomedicine, Linton Pharm, Carrick Therapeutics, among others.

Oncology Conference Coverage Services

DelveInsight’s Oncology Conference Coverage Services offer a thorough analysis of outcomes from major events like ASCO, ESMO, ASH, AACR, ASTRO, SOHO, SITC, the European CAR T-cell Meeting, and IASLC. This detailed examination provides businesses with essential insights for competitive intelligence and market trend forecasting, supporting the formulation of future strategies.

Other Business Consulting Services

Healthcare Competitive Intelligence

Healthcare Portfolio Management

Case Study

Learn how the engagement with respected KOLs bolstered the client's reputation as a leader in the pharma industry at KOL Profiling

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter