New York, Sept. 30, 2024 (GLOBE NEWSWIRE) -- Overview

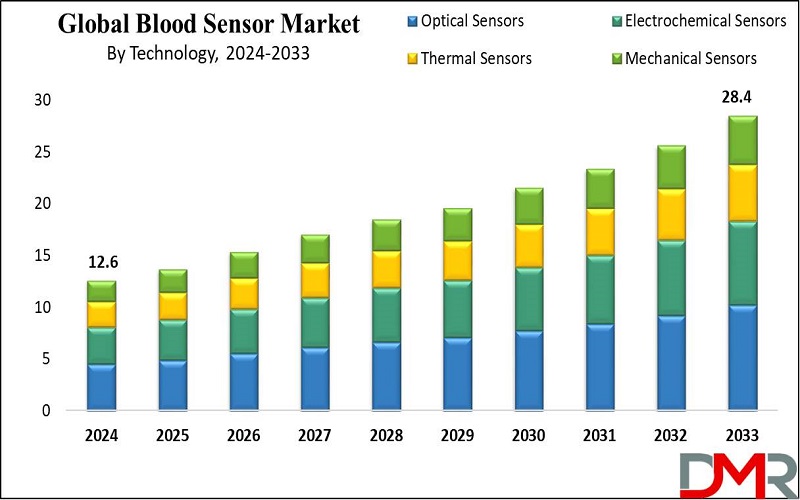

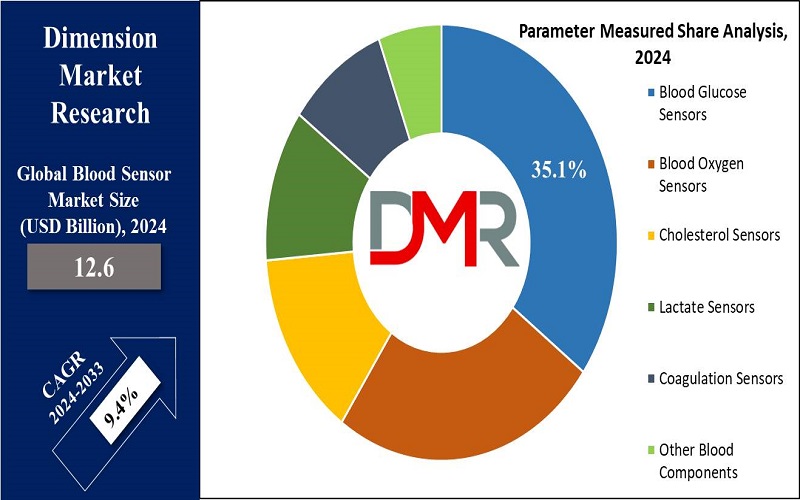

The Global Blood Sensor Market is projected to reach USD 12.6 billion in 2024 which is further anticipated to reach USD 28.4 billion by 2033 at a CAGR of 9.4%.

The global blood sensor market is growing rapidly due to an increase in chronic diseases like diabetes and cardiovascular disorders, non-invasive continuous monitoring devices such as smartwatches and fitness bands have experienced exponential growth worldwide.

Wearable sensors like smartwatches and fitness bands dominate due to their convenience, real-time data availability, and real-time reliability; innovations continue to develop along these lines thanks to medical innovations.

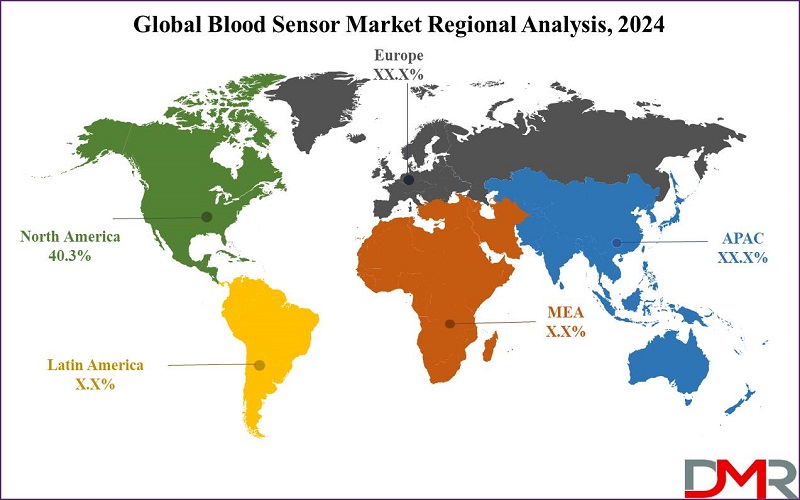

The strong healthcare infrastructures in North America, Europe, and Asia-Pacific as well as rising health awareness are fueling the growth of this market.

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/blood-sensor-market/request-sample/

The US Blood Sensor Market

The US Blood Sensor Market with an estimated value of USD 4.3 billion in 2024 is projected to increase at a compound annual growth rate of 8.8% until reaching USD 9.1 billion by 2033.

The US blood sensor market is experiencing unprecedented growth thanks to new technologies being adopted and supported in this region, driven by rising diabetes and chronic disease cases. Continuous glucose monitoring devices, avoiding painful finger pricks as well as wearable devices like smartwatches and fitness trackers have gained increased adoption.

Companies like Abbott, Dexcom, and Medtronic lead this space with groundbreaking products as the market is also expanding into remote patient monitoring solutions, fueled by the increasing demand for home-based healthcare.

Important Insights

- Market Value: The global blood sensor market is estimated to be worth USD 12.6 billion in 2024 and is projected to reach USD 28.4 billion by 2033.

- US Market Value: The US blood sensor market is expected to be valued at USD 4.3 billion in 2024, growing to USD 9.1 billion by 2033, at a CAGR of 8.8%.

- Type Segment Analysis: Wearable blood sensors are expected to dominate the market in 2024, holding the highest market share.

- Technology Segment Analysis: Optical sensors are projected to lead with a 36.0% market share in 2024 due to their non-invasive, accurate, and versatile nature.

- Parameters Measured Analysis: Blood glucose sensors are anticipated to dominate this segment, accounting for 35.1% of the market share in 2024.

- Regional Analysis: North America is expected to hold the largest market share, about 40.3%, in the global blood sensor market in 2024.

- Global Growth Rate: The global blood sensor market is growing at a CAGR of 9.4% over the forecast period.

Latest Trends

- AI and Machine Learning Integration: AI and machine learning enhance the functionality of blood sensors to quite an extent by analyzing big data and making predictions in terms of analytics. It allows predictive analytics, such as predicting levels of blood sugar, to project future levels and take precautionary measures. AI improves accuracy and error detection, strengthening user confidence and acceptance.

- Shift to Non-Invasive Monitoring: One of the key trends toward adopting non-invasive blood sensors is to avoid painful finger pricking. Advanced optical sensors can directly measure through the skin various parameters of the blood, bringing ease to users and hence promoting better compliance. This technology addresses the discomfort of invasive sensors and promotes continuous monitoring.

Blood Sensor Market: Competitive Landscape

The key players in the global blood sensor market include Abbott Laboratories, Medtronic, Dexcom, and Roche Diagnostics. These companies, who are manufacturers of advanced glucose monitoring systems, are interested in investing in R&D to enhance sensor accuracy, reliability, and user-friendliness.

Strategic partnerships extend the presence of market leaders like Abbott has formed a partnership with Dexcom in this regard. At the very same time, emerging startups bring innovation and competition into the sector.

In that way, the future of the Blood Sensor market is going to be shaped amid a dynamic landscape wherein continuous technological advancements meet strategic initiatives.

Some of the prominent market players:

- Abbott Laboratories

- Medtronic

- Dexcom

- Roche Diagnostics

- Siemens Healthineers

- Koninklijke Philips N.V.

- GE Healthcare

- LifeScan Inc.

- Masimo Corporation

- Omron Healthcare Inc.

- Bio-Rad Laboratories Inc.

- Nova Biomedical

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/blood-sensor-market/download-reports-excerpt/

Blood Sensor Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 12.6 Bn |

| Forecast Value (2033) | USD 28.4 Bn |

| CAGR (2024-2033) | 9.4% |

| North America Revenue Share | 40.3% |

| The U.S. Market Size (2024) | USD 4.3 Bn |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Type, By Technology, By Parameter Measured, By Application, and By End User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

Optical sensors are expected to hold 36.0% of the blood sensor market share in 2024 due to their non-invasive, accurate, and versatile nature. They find extended applications in wearable devices like smartwatches and fitness bands, measuring parameters such as oxygen saturation and glucose levels.

Their accuracy and reliability have increased, and AI integration adds to predictive capabilities. One of the major shares in optical sensor applications comes from the segment associated with continuous monitoring for chronic conditions, fitness metrics, and home-based care.

Blood Sensor Market Segmentation

By Type

- Wearable Blood Sensors

- Smartwatches

- Fitness Bands

- Patch Sensors

- Non-wearable Blood Sensors

- Portable Handheld Devices

- Benchtop Devices

- Implantable Sensors

By Technology

- Optical Sensors

- Electrochemical Sensors

- Thermal Sensors

- Mechanical Sensors

By Parameter Measured

- Blood Glucose Sensors

- Blood Oxygen Sensors

- Cholesterol Sensors

- Lactate Sensors

- Coagulation Sensors

- Other Blood Components

By Application

- Diagnostics

- Disease Detection

- Screening

- Monitoring

- Continuous Glucose Monitoring (CGM)

- Cardiovascular Monitoring

- Remote Patient Monitoring

- Therapeutics

- Chronic Disease Management

- Critical Care

- Post-surgical Care

By End User

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories

- Sports and Fitness Centers

- Research Institutes

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/blood-sensor-market/

Growth Drivers

- Rising cases of chronic diseases: like diabetes and cardiovascular disorders, are boosting the demand for blood sensors. Estimates by the International Diabetes Federation pegged the number of adults suffering from the disease at 537 million in 2021, and the prevalence is likely to continue growing. Continuous glucose monitoring devices provide readings on a second-by-second basis, allowing patients to maintain optimum glucose levels and avoid complications.

- Improvements to Technologies: There are related technological developments in miniaturization, accuracy, and wireless connectivity that keep on helping the market. Diffusion, reliability, and user-friendliness of blood sensors have increased with non-invasive sensors and wearable devices like smartwatches and fitness bands.

Restraints

- High Costs: Advanced blood sensor devices, especially continuous glucose monitors, are expensive hence; thus, access to these advanced technologies may remain out of reach in low-income regions. Large setup and maintenance costs make it not only burdensome for a user but also often draining on health insurance companies. Manufacturers have to take a keen interest in cost-effective production and pricing policies.

- Regulatory Challenges: The blood sensor market gets the most pressure from stringent regulatory requirements from organizations such as the FDA and EMA. This has squinty resulted in extended, costly procedures for product approval within this area of focus. Regional variations in these regulations make it more difficult to enter the market. Businesses have to navigate through such barriers if they want to successfully bring new products to the market.

Growth Opportunities

- Expanding in Emerging Markets: High growth potential is provided by emerging markets, the Asia-Pacific, Latin American, and Middle Eastern. The rapidity of economic development, rising healthcare spending, and increased burden from chronic diseases are factors driving these markets. Improving their healthcare infrastructure and access to healthcare, governments in these regions open opportunities for blood sensor manufacturers.

- Home-Based Health Care Solutions: The trend toward home care and telemonitoring creates an avenue of growth for blood sensors. With wearable and portable devices, continuous registration of real-time data enables the management of a chronic condition from the comfort of one's own home.

Discover additional reports tailored to your industry needs

- Optoelectronics Market is projected to reach a market value of USD 50.2 billion by the end of 2023 and is further anticipated to grow the market value of USD 86.5 billion by 2032, at a CAGR of 6.2%.

- Oncology Market is expected to reach a value of USD 234.6 billion in 2023, and it is further anticipated to reach a market value of USD 533.2 billion by 2032 at a CAGR of 9.6%.

- Insulin Pump Market is expected to reach a market value of USD 6.5 billion in 2023 and is further anticipated to reach a value of USD 28.0 billion at a CAGR of 17.6% for the forecast period (2023-2032).

- Hand Sanitizers Market is expected to hold a market value of USD 7.3 billion in 2023 and is projected to show subsequent growth with a market value of USD 13.6 billion in 2032 at a CAGR of 7.2%.

- exoskeleton Market is expected to reach a value of USD 417.7 million in 2023, and it is further anticipated to reach a market value of USD 1,903.3 million by 2032 at a CAGR of 18.4%.

- Dental Implant Market is expected to reach a value of USD 5.3 billion in 2023, and it is further anticipated to reach a market value of USD 13.3 billion by 2032 at a CAGR of 10.7%.

- Breast Pump Market is expected to be valued of USD 3.2 billion in 2023 & USD 7.0 billion in 2032, and projections indicate a CAGR of 9.2% for the forecasted period of 2023 to 2032.

- Health and Wellness Market is expected to reach a value of USD 3,812.3 billion in 2023, and it is further anticipated to reach a market value of USD 5,499.9 billion by 2032 at a CAGR of 4.2%.

Regional Analysis

North America is projected to dominate the global blood sensor market with a 40.3% share in 2024. This is attributed to the large prevalence of chronic diseases, well-developed infrastructure in the healthcare sector, and investments in healthcare technology.

A strong healthcare system in the US and Canada boosts the demand for, and hence diffusion of, advanced blood sensors. Favorable policies and trends in remote patient monitoring, including preventive healthcare practices, further enhance demand to be able to secure the leadership role of North America within this market.

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/blood-sensor-market/request-sample/

Recent Developments in the Global Blood Sensor Market

- July 2024: Abbott launched FreeStyle Libre 4 with improved accuracy, longer sensor life, and health app integration for better diabetes management.

- June 2024: Dexcom's G7 received FDA approval, offering a smaller, more comfortable design with a faster warm-up time for a better user experience.

- May 2024: Medtronic introduced a non-invasive optical glucose monitoring technology, eliminating the need for finger pricks in diabetes management.

- April 2024: Roche Diagnostics launched Accu-Chek Guide Link, integrating with insulin pumps for improved accuracy and user-friendly diabetes management.

- March 2024: Siemens Healthineers introduced wearable blood sensors for continuous vital monitoring in critical care, providing real-time data for timely interventions.

- February 2024: Philips partnered with an AI company to enhance predictive analytics in blood sensors, improving health monitoring accuracy.

- January 2024: Omron Healthcare released a multifunctional monitor integrating blood pressure, oxygen, and glucose monitoring for comprehensive chronic condition management.

- December 2023: Bio-Rad Laboratories launched a portable blood sensor for point-of-care testing, offering rapid and accurate results in critical care settings.

- November 2023: Masimo Corporation introduced an advanced pulse oximeter with glucose monitoring, designed for continuous hospital and home use.

- October 2023: Nova Biomedical released a blood lactate monitor for sports and fitness, providing real-time lactate levels for optimizing performance and recovery.

- September 2023: LifeScan launched smart glucose meters with mobile app connectivity, offering advanced data analytics and personalized health insights for diabetes management.

- August 2023: GE Healthcare developed an implantable blood sensor for continuous monitoring in critical care, providing accurate and reliable vital data.

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.