New York, USA, Oct. 02, 2024 (GLOBE NEWSWIRE) -- SERD Market is Predicted to Exhibit Remarkable Growth Owing to the Usage of Faslodex in Combination, Strong Performance of ORSERDU, and Speedy Progress of Other Oral SERDs, During the Study Period (2020–2034) | DelveInsight

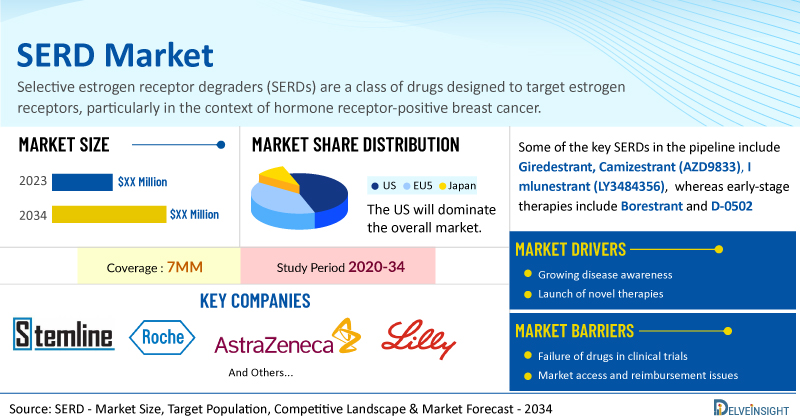

The SERDs market is expected to grow significantly in the coming years. This is due to the increasing cancer diagnosis, high unmet need in ESR1 mutation space, usage, and acceptance of ORSERDU, positive results of camizestrant, and the increasing number of oral SERDs that are under clinical trials by various companies.

DelveInsight’s SERD Market Insights report includes a comprehensive understanding of current prescribing patterns and in patients with or without emerging oral SERDs in both early and advanced forms of breast cancer, failure of clinical trials, market share of individual therapies, and current and forecasted SERD market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the SERD Market Report

- As per DelveInsight’s analysis, the total market size of SERD in the 7MM is expected to rise significantly owing to strong uptake of ORSERDU in endocrine therapy-treated ESR1 mutated patients, usage of faslodex generics, along with the expected entry of other oral SERDs.

- We expect ORSERDU, camizestrant, giredestrant, and imlunestrant together to generate an estimated revenue of USD 3 billion by 2034 in the US in metastatic settings alone. ORSERDU has a label for only ESR1 mutated metastatic HR+/HER2- type, whereas the other SERDs are planning to cover a broader patient segment irrespective of ESR1 mutation along with early-stage patients.

- Stemline’s ORSERDU was launched at a list price of approx. USD 21,000 for a month, and based on PFS of 8.6 months in ESR1 patients, the cost of therapy is expected to be USD 180,000 in a year.

- ORSERDU is not the first approval, Astrazeneca’s intravenous Faslodex was available for 2 decades before it hit USD 1 billion in revenue for the first time in 2018 succumbing to generics in the same year. This impact led to a decline in brand revenue leading to a generation of USD 431 million in 2021.

- Astrazeneca is again planning big with Camizestrant, which is all set to position in both metastatic and early HR+/HER2- breast cancer patients in late-stage trials, which is an extremely large addressable population. Lilly’s Imlunestrant and Roche’s Giredestrant are also being evaluated in early-stage breast cancer.

- The total incident cases of HR+/HER2– breast cancer in the 7MM comprised approximately 475,500 cases in 2023, with 55,000 treatable metastatic cases and approximately 145,000 localized and locally advanced cases in the United States alone.

- Leading SERD companies such as Stemline Therapeutics, Roche, AstraZeneca, Eli Lilly, and others are developing oral next generation SERDs in HR+/HER negative breast cancer, where Roche’s Giredestrant and Lilly’s Imlunestrant are also being evaluated in Endometrial cancer.

- Early-stage players include InventisBio, EnhancedBio, and Zenopharm

- Some of the key SERDs in the pipeline include Giredestrant, Camizestrant (AZD9833), Imlunestrant (LY3484356), whereas early-stage therapies include Borestrant and D-0502

- In May 2024, Menarini Group presented a satisfactory safety profile and promising activity from the ELECTRA and ELEVATE combination studies of ORSERDU (Elacestrant) at the ASCO Annual Meeting. The Phase II portion is ongoing to further assess efficacy and safety, with both elacestrant and abemaciclib crossing the blood-brain barrier (Abstract #1064; #1069).

- In the EMBER Phase Ia/Ib study (Abstract #1027), Lilly’s Imlunestrant in combination with trastuzumab ± abemaciclib or pertuzumab, was well tolerated and showed no drug-drug interactions. The combination also demonstrated preliminary antitumor activity in patients with ER+/HER2+ advanced breast cancer.

- Findings from the EMBER Phase Ia/Ib study, presented at ASCO (Abstract #5589), indicate that imlunestrant, whether used alone or in combination with abemaciclib, is safe, well-tolerated, and shows preliminary signs of efficacy in patients with metastatic ER-positive endometrial endometrioid carcinoma (EEC).

Discover which therapies are expected to grab the SERD market share @ SERD Market Report

The market dynamics for SERDs are shaped by several critical factors, including increasing incidences of ER+ breast cancer and growing demand for targeted therapies. One major driver of the SERD market is the rising prevalence of both ER+ breast cancer and Endometrial cancer. As the global incidence of this condition increases, there is a growing need for advanced treatments. SERDs offer a promising alternative to existing endocrine therapies such as aromatase inhibitors and selective estrogen receptor modulators (SERMs), especially in cases where resistance to these treatments has developed. This need fuels both research and development efforts and market expansion.

The competitive landscape is also a key dynamic. Major pharmaceutical companies and biotech firms are actively involved in the development of SERDs, leading to a surge in clinical trials and potential new product entries. This competitive environment accelerates innovation but can also lead to market fragmentation as various players vie for dominance. Moreover, the patent expirations of existing SERD products can open opportunities for generic competitors, influencing pricing and market share.

Regulatory pathways and reimbursement policies further impact market dynamics. Regulatory agencies' approval processes for new SERDs can significantly affect the speed at which these drugs reach the market. Additionally, insurance and healthcare systems' willingness to cover new therapies can influence the adoption rates of SERDs. In many regions, there are ongoing discussions about the value of new oncology treatments and their cost-effectiveness, which can affect market access and growth.

SERDs such as Roche’s giredestrant and Lilly’s Imlunestrant are also being evaluated in Endometrial cancer patients.

SERD Treatment Market

SERDs are a crucial component of endocrine therapy for ER+ breast cancer. Fulvestrant, a parenteral SERD, is approved for treating metastatic ER-positive breast cancer but is limited by its requirement for large-volume intramuscular injections and low bioavailability. New oral SERDs and other ER antagonists have recently been approved, addressing these limitations. In 2023, ORSERDU received US FDA approval for treating postmenopausal women or adult men with ER-positive, HER2-negative, ESR1-mutated advanced or metastatic breast cancer who have progressed after at least one line of endocrine therapy. Similarly, in September 2023, the European Commission approved ORSERDU as a monotherapy for this patient population, representing a significant advancement in treating this breast cancer subtype in both the US and Europe.

Based on upcoming trials, the focus is on both early-stage and advanced-stage breast cancer, endometrial cancer, and Hepatic Impairment (Phase I by Eli Lilly)

Learn more about the FDA-approved SERD @ SERD Drugs

Key Emerging SERD and Companies

Several key players, including Roche, Eli Lilly, and others, are involved in developing drugs for SERDs for various indications such as breast cancer.

Giredestrant is a novel SERD that completely blocks estrogen receptor signaling with strong receptor binding. The drug is currently being tested in various clinical trials to address both early and advanced breast cancer along with endometrial cancer patients. The company has also started a new Phase III trial (pionERA) comparing giredestrant + CDK4/6 of choice against fulvestrant + CDK4/6 of choice in first-line metastatic breast cancer. Results from the Phase III persevERA trial (for first-line metastatic breast cancer) are anticipated by 2025. In December 2020, giredestrant was granted FDA Fast Track Designation for ER+/HER2− breast cancer in second and third-line metastatic cases. The

Camizestrant (AZD9833) is an oral SERD that has demonstrated anti-tumor activity in various preclinical breast cancer models. In June 2020, AstraZeneca launched the Phase III SERENA-6 trial to assess the safety and efficacy of AZD9833 in combination with a CDK4/6 inhibitor (palbociclib or abemaciclib) for patients with HR+/HER2− metastatic breast cancer who have a detectable ESR1 mutation. Results from the SERENA-6 trial and the SERENA-1 trial are expected after 2024. Additionally, several ongoing trials are evaluating camizestrant both as a monotherapy and in combination treatments for early-stage HR+ HER2- breast cancer patients. The company also anticipates its first estimated filing acceptance after 2024.

The anticipated launch of these emerging therapies are poised to transform the SERD market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the SERD market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about SERD clinical trials, visit @ SERD Treatment Drugs

SERD Overview

Selective estrogen receptor degraders (SERDs) are a class of drugs designed to target estrogen receptors, particularly in the context of hormone receptor-positive breast cancer. Unlike traditional estrogen receptor antagonists that block estrogen from binding to the receptor, SERDs work by not only blocking estrogen binding but also promoting the degradation of the estrogen receptor itself. This dual action results in a more comprehensive suppression of estrogen receptor activity, which is crucial for tumors that have developed resistance to other forms of endocrine therapy.

The development and clinical use of SERDs has been driven by the need to address resistance mechanisms that can arise with the long-term use of conventional endocrine therapies. By degrading the estrogen receptor, SERDs reduce the potential for receptor-mediated signaling pathways that can contribute to cancer progression. Recent advancements in SERD therapies have shown promising results in clinical trials, providing new options for patients with advanced or metastatic breast cancer who have previously exhausted other treatment avenues.

SERD Epidemiology Segmentation

In 2023, the number of total incident cases of HER2-positive breast cancer in the United States was approximately 44,500. Among the HER2-positive breast cancer patients, fewer patients are in Stage IV HER2-positive breast cancer in the United States. The SERD market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of Selected Indication for SERD in the 7MM

- Total Eligible Patient Pool for SERD in Selected Indication in the 7MM

- Total Treatable Cases in Selected Indication for SERD in the 7MM

| SERD Report Metrics | Details |

| Study Period | 2020–2034 |

| SERD Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key SERD Companies | Stemline Therapeutics, Roche, AstraZeneca, Eli Lilly, and others |

| Key SERDs | Giredestrant, Camizestrant (AZD9833), Imlunestrant (LY3484356), ORSERDU (elacestrant), FASLODEX (fulvestrant), and others |

Scope of the SERD Market Report

- SERD Therapeutic Assessment: SERD current marketed and emerging therapies

- SERD Market Dynamics: Conjoint Analysis of Emerging SERD Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, SERD Market Access and Reimbursement

Discover more about SERD drugs in development @ SERD Clinical Trials

Table of Contents

| 1. | Key Insights |

| 2. | Report Introduction |

| 3. | Executive Summary of SERD |

| 4. | Key Events |

| 5. | Market Forecast Methodology |

| 6. | SERD Market Overview at a Glance in the 7MM |

| 6.1. | Market Share (%) Distribution by Therapies in 2020 |

| 6.2. | Market Share (%) Distribution by Therapies in 2034 |

| 7. | SERD: Background and Overview |

| 8. | Treatment |

| 9. | Target Patient Pool |

| 9.1. | Key Findings |

| 9.2. | Assumptions and Rationale: 7MM |

| 9.3. | Epidemiology Scenario in the 7MM |

| 9.3.1. | Total Incident Cases of Selected Indication for SERD in the 7MM |

| 9.3.2. | Total Eligible Patient Pool for SERD in Selected Indication in the 7MM |

| 9.3.3. | Total Treatable Cases in Selected Indication for SERD in the 7MM |

| 10. | Marketed Therapies |

| 10.1. | Key Competitors |

| 10.2. | ORSERDU (Elacestrant): Stemline Therapeutics |

| 10.2.1. | Product Description |

| 10.2.2. | Regulatory milestones |

| 10.2.3. | Other developmental activities |

| 10.2.4. | Clinical development |

| 10.2.5. | Safety and efficacy |

| 10.3. | FASLODEX (fulvestrant): AstraZeneca |

| 10.3.1. | Product Description |

| 10.3.2. | Regulatory milestones |

| 10.3.3. | Other developmental activities |

| 10.3.4. | Clinical development |

| 10.3.5. | Safety and efficacy |

| List to be continued in the report | |

| 11. | Emerging Therapies |

| 11.1 | Key Competitors |

| 11.2. | Giredestrant: Roche |

| 11.2.1. | Product Description |

| 11.2.2. | Other developmental activities |

| 11.2.3. | Clinical development |

| 11.2.4. | Safety and efficacy |

| 11.3. | Camizestrant (AZD9833): AstraZeneca |

| 11.3.1. | Product Description |

| 11.3.2. | Other developmental activities |

| 11.3.3. | Clinical development |

| 11.3.4. | Safety and efficacy |

| List to be continued in the report | |

| 12. | SERD: Seven Major Market Analysis |

| 12.1. | Key Findings |

| 12.2. | Market Outlook |

| 12.3. | Conjoint Analysis |

| 12.4. | Key Market Forecast Assumptions |

| 12.4.1. | Cost Assumptions and Rebates |

| 12.4.2. | Pricing Trends |

| 12.4.3. | Analogue Assessment |

| 12.4.4. | Launch Year and Therapy Uptakes |

| 12.5. | Total Market Size of SERD in the 7MM |

| 12.6. | Market Size of SERD by Indication in the7MM |

| 12.7. | The United States Market Size |

| 12.7.1. | Total Market Size of SERD in the United States |

| 12.7.2. | Market Size of SERD by Indication in the United States |

| 12.7.3. | Market Size of SERD by Therapies in the United States |

| 12.8. | EU4 and the UK Market Size |

| 12.8.1. | Total Market Size of SERD in EU4 and the UK |

| 12.8.2. | Market Size of SERD by Indication in EU4 and the UK |

| 12.8.3. | Market Size of SERD by Therapies in EU4 and the UK |

| 12.9. | Japan Market Size |

| 12.9.1. | Total Market Size of SERD in Japan |

| 12.9.2. | Market Size of SERD by Indication in Japan |

| 12.9.3. | Market Size of SERD by Therapies in Japan |

| 13. | SWOT Analysis |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | Market Access and Reimbursement |

| 17. | Appendix |

| 17.1. | Bibliography |

| 17.2. | Report Methodology |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

Metastatic HER2-Positive Breast Cancer Market

Metastatic HER2-Positive Breast Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, market share of the individual therapies, and key metastatic HER2-positive breast cancer companies including Byondis, Roche, Ambrx, Zymeworks, Jazz Pharmaceuticals, Pfizer, among others.

Metastatic HR+/HER2− Breast Cancer Market

Metastatic HR+/HER2− Breast Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, market share of the individual therapies, and key breast cancer companies including Merck, Arvinas, Olema Pharmaceuticals, Celcuity, Roche, AstraZeneca, Daiichi Sankyo, Eli Lilly, Sermonix Pharmaceuticals, Genentech, Veru Pharma, DualityBio, BioNtech, Evgen Pharma, Carrick Therapeutics, EQRx, G1 Therapeutics, Immutep, among others.

Breast Cancer Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, market share of the individual therapies, and key breast cancer companies including Veru, Sanofi, Roche, AstraZeneca, Eli Lilly, EQRx, Gilead, Sermonix Pharmaceuticals, Evgen Pharma, Tyme, Genentech, Daiichi Sankyo, among others.

Metastatic Breast Cancer Pipeline

Metastatic Breast Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, including clinical and non-clinical stage products, and the key metastatic breast cancer companies, including Roche, RemeGen, SynCore Biotechnology, Allarity Therapeutics, Daiichi Sankyo Company, Jiangsu Alphamab Biopharmaceuticals Co., Ltd, Byondis B.V., Jiangsu Hansoh Pharmaceutical Co., Ltd., Shanghai Miracogen Inc., Ambrx, Inc., Daehwa Pharmaceutical Co., Ltd., Phoenix Molecular Designs, GlycoMimetics Incorporated, Rhizen Pharmaceuticals SA, Menarini Group, Samus Therapeutics, Inc., Hanmi Pharmaceutical Company Limited, Jiangxi Qingfeng Pharmaceutical Co. Ltd., Immutep Limited, Arvinas Inc., G1 Therapeutics, Mirati Therapeutics Inc., Chia Tai Tianqing Pharmaceutical, Shanghai Pharmaceuticals Holding Co., Ltd, Pfizer, OncoTherapy Science, Inc., Eisai Inc., Dizal Pharmaceuticals, Jiangsu Hengrui Medicine Co., Tyme, Inc, Orion Pharma, HiberCell, Inc., Rhizen Pharmaceuticals SA, Hutchison Medipharma Limited, OncoPep Inc., Taizhou Hanzhong biomedical co. LTD, among others.

Metastatic HER2-Positive Breast Cancer Pipeline

Metastatic HER2-Positive Breast Cancer Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key metastatic HER2-positive breast cancer companies, including Byondis, Roche, Ambrx, Zymeworks, Jazz Pharmaceuticals, Pfizer, among others.

Oncology Conference Coverage Services

DelveInsight’s Oncology Conference Coverage Services offer a thorough analysis of outcomes from major events like ASCO, ESMO, ASH, AACR, ASTRO, SOHO, SITC, the European CAR T-cell Meeting, and IASLC. This detailed examination provides businesses with essential insights for competitive intelligence and market trend forecasting, supporting the formulation of future strategies.

Other Business Consulting Services

Healthcare Competitive Intelligence

Healthcare Portfolio Management

Case Study

Learn how the engagement with respected KOLs bolstered the client's reputation as a leader in the pharma industry at KOL Profiling

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter