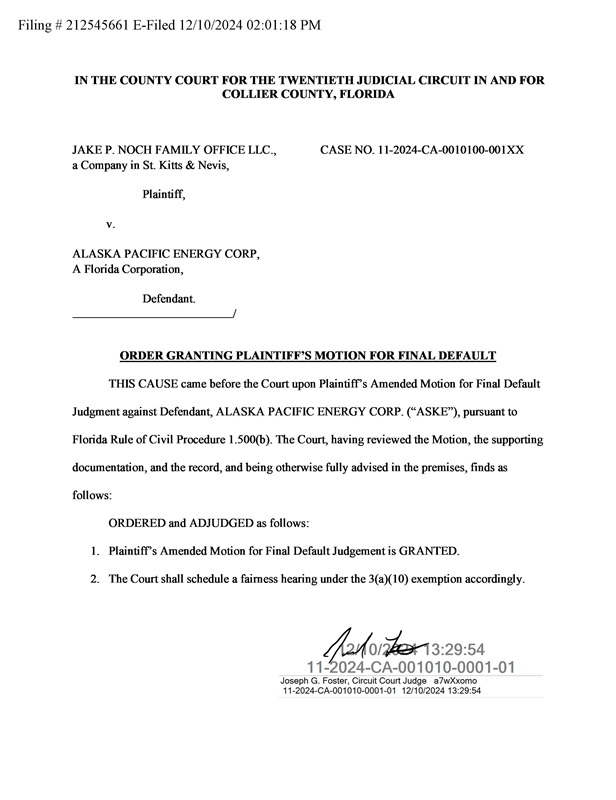

Charlestown, St. Kitts & Nevis, Dec. 11, 2024 (GLOBE NEWSWIRE) -- Jake P. Noch Family Office, LLC. is pleased to announce a landmark legal victory with the approval of its amended motion for final default judgment by the County Court for the Twentieth Judicial Circuit in Collier County, Florida. This decision marks a transformative milestone for Alaska Pacific Energy Corp. (OTC: ASKE), paving the way for compliance, strategic growth, and enhanced shareholder value.

Key Provisions of the Court’s Ruling

1. Leadership Appointments and Governance Overhaul

◦ Jake P. Noch has been appointed as Chairman of the Board of Directors (COB), Chief Executive Officer (CEO), and court-appointed custodian of ASKE. These roles grant him full authority to oversee and restructure the company’s operations, governance, and financial systems.

◦ Preferred J Class Shares have been authorized, carrying 80% voting power. These shares will be exclusively held by Jake P. Noch Family Office, LLC. or its affiliated entities to ensure effective governance and decision-making.

2. Compensation, Reimbursements, and Financial Framework

◦ Shares will be issued to Jake P. Noch Family Office, LLC. under the Section 3(a)(10) exemption until annual compensation of $6,000,000 is realized.

◦ The Family Office will also receive 50% of net profits from future ASKE ventures, ensuring alignment with the company’s success.

◦ Reimbursements for costs incurred during ASKE’s restructuring, including legal, regulatory, and operational expenses, will be provided through shares issued under the Section 3(a)(10) exemption.

◦ No securities will be issued under the Section 3(a)(10) exemption, and no securities will be sold unless and until a mandatory Fairness Hearing is held and the Court approves the transaction terms. This ensures compliance, transparency, and the protection of all stakeholders.

3. Appointment of Key Executives

◦ Rodrigo Di Federico, named Chief Technology Officer (CTO), will receive an annual compensation of $2,500,000 in shares under the Section 3(a)(10) exemption and 10% of net profits from ASKE’s future ventures.

◦ Paul Ring, appointed Chief Marketing Officer (CMO), will receive an annual compensation of $2,000,000 in shares under the Section 3(a)(10) exemption and 5% of net profits from future ventures.

4. Indemnification and Liability Protections

◦ Jake P. Noch Family Office, LLC. and all appointed executives are indemnified against unknown pre-existing liabilities, safeguarding their efforts to restore and grow ASKE.

Strategic Next Steps

Jake P. Noch Family Office, LLC. is initiating a comprehensive strategic plan to rebuild ASKE into a compliant and operationally robust company. Over the coming weeks, the following steps will be prioritized:

• Reinstatement with the Florida Secretary of State: Restoring ASKE’s legal standing.

• Amendment of Articles of Incorporation: Aligning corporate governance with the company’s new strategic objectives.

• Accessing Books and Records: Collaborating with the transfer agent to secure critical corporate documentation for financial and operational review.

• Regulatory and Financial Filings: Updating all financial statements and regulatory filings to achieve full compliance and enable active market participation.

Future Plans for ASKE

As part of its strategic realignment, Jake P. Noch Family Office, LLC. plans to transform ASKE into a holding company within the online gambling industry, with a focus on a unified online casino and sports betting platform. This platform will:

• Be operated by a third-party operator through a white-label solution.

• Combine a fully licensed offshore online casino with integrated sports betting capabilities.

These initiatives are designed to position ASKE as a competitive player in the growing online gambling market, leveraging third-party expertise to optimize efficiency and drive shareholder value.

Regulatory Compliance through Section 3(a)(10) Exemption

The Section 3(a)(10) exemption under the Securities Act of 1933 provides a streamlined mechanism for addressing outstanding claims without requiring SEC registration. No securities will be issued under the Section 3(a)(10) exemption, and no securities will be sold unless and until a mandatory Fairness Hearing is held and the Court approves the transaction terms. This commitment underscores Jake P. Noch Family Office, LLC.’s dedication to transparency, accountability, and regulatory compliance.

Commentary from Jake P. Noch Family Office, LLC.

“This ruling is a defining moment for ASKE and its shareholders. With this court approval, we are equipped to implement vital structural reforms, achieve regulatory compliance, and unlock new growth opportunities in the online gambling industry,” said Jake P. Noch, Chairman of the Board of Directors, Chief Executive Officer, and court-appointed custodian of ASKE.

Court Order & Amended Motion For Default

About Jake P. Noch Family Office, LLC

https://jakepnoch.com/

Jake P. Noch Family Office, LLC. is a single-family office dedicated to acquiring controlling interests in dormant and distressed public companies, with the goal of restoring regulatory compliance, operational integrity, and shareholder value. We operate as a private entity under exemptions outlined in the Dodd-Frank Act, and we do not serve outside clients or function as a financial advisor, broker-dealer, or similar regulated entity.

Our approach often involves employing court-approved Section 3(a)(10) mechanisms to settle claims without direct cash payments, ensuring lawful, transparent transactions. By resolving outstanding filings, enhancing governance, and introducing new business models, we help turn struggling issuers into sustainable enterprises. While not every initiative will succeed, our objective is to provide each company with a credible pathway toward long-term resilience and growth.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created thereby. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including without limitation, the ability of Jake P. Noch Family Office, LLC. to accomplish its stated plan of business. Although Jake P. Noch Family Office, LLC. believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore, there can be no assurance that the forward-looking statements included in this press release will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by Jake P. Noch Family Office, LLC., or any other person.

Non-Legal Advice Disclosure

This press release does not constitute legal advice, and readers are advised to seek legal counsel for any legal matters or questions related to the content herein.

Non-Investment Advice Disclosure

This communication is intended solely for informational purposes and does not in any way imply or constitute a recommendation or solicitation for the purchase or sale of any securities, commodities, bonds, options, derivatives, or any other investment products. Any decisions related to investments should be made after thorough research and consultation with a qualified financial advisor or professional. We assume no liability for any actions taken or not taken based on the information provided in this communication.

Contact

investors@ProMusicRights.com

Twitter: https://twitter.com/JPNFamilyOffice

SOURCE: Jake P. Noch Family Office, LLC.