NEWTOWN, Conn., Aug. 27, 2013 (GLOBE NEWSWIRE) -- In the face of dwindling defense budgets worldwide, Forecast International (FI) anticipates that production of military aircraft – predominantly Western-built fixed - and rotary-wing systems – will decline over the next 10 years. However, not all segments of the market will see decreasing production levels. Some segments are expected to simply remain flat, while certain others are anticipated to actually expand, especially as such new aircraft as the Lockheed Martin F-35 fighter and the Airbus A400M transport shift into full-scale production.

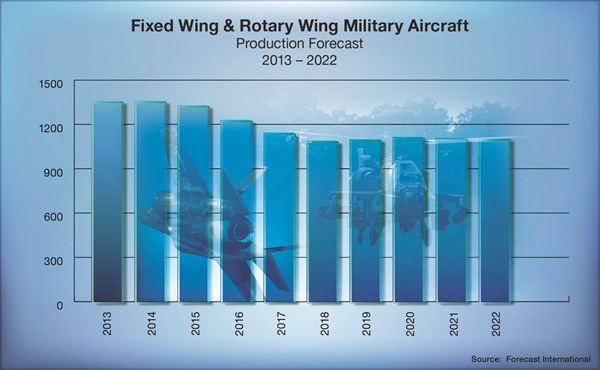

According to FI's Platinum 2.0 Forecast System™, about 11,940 military aircraft, worth an estimated $480 billion, will roll off production lines during the 2013-2022 period. Yearly production will peak at 1,367 units in 2014, drop to a low of 1,095 in 2018, and then rise slightly to 1,122 by 2020 before tapering off for the remainder of the period. Rotorcraft will account for 52 percent of all units produced during the 2013-2022 timeframe, with fixed-wing aircraft accounting for the remaining 48 percent. However, in terms of value of production, the more expensive fixed-wing group will outpace the rotorcraft segment by a wide margin over the 10-year timeframe: 72 percent to 28 percent.

Fighters – Fighter aircraft will represent the largest segment of the fixed-wing group in terms of both unit production and value of production during the 2013-2022 timeframe. FI is estimating that about 2,900 fighter aircraft, worth nearly $183 billion, will be produced during this period. Production is expected to be relatively light in the near term, and eventually rise to a decade-high 355 units in 2022.

New fighters are more reliable, require less maintenance, and are easier to upgrade throughout the aircraft's life-cycle than are their Cold War predecessors. Additionally, these newer aircraft are more effective than older models in performing the same missions, meaning fewer of them are needed for the same level of capability. On the downside, fighters are increasingly becoming too costly for many nations to afford in large numbers. These factors will limit growth in the fighter market until annual production of the Lockheed Martin F-35 Joint Strike Fighter rises sharply in the latter years of the forecast period.

The remainder of the fighter market is forecast to be split between Boeing, the Eurofighter consortium, Dassault, Saab, Chengdu, and Russia's United Aircraft Corp. India's HAL and South Korean manufacturer KAI have introduced new low-priced light fighters, but neither is expected to gain much traction on the export market.

Transports – FI projects that military transport manufacturers will deliver 848 new aircraft, worth $66.9 billion, from 2013 through 2022. During this period, production is forecast to rise to a peak of 102 aircraft in 2018, partly the result of high-rate production of Airbus Military's new A400M transport. Indeed, production of the A400M is expected to outstrip production of any other military transport during the 2013-2022 period, and account for about 25 percent of all military transport production during this timeframe.

The 2013-2022 period is also expected to see the exit from production of the Boeing C-17 strategic airlifter. In the tactical transport arena, the currently dominant Lockheed Martin C-130J will see increasing competition from Embraer's new KC-390 as well as from the hybrid (strategic/tactical) A400M.

Special Purpose – Within the Special Purpose category, FI groups fixed-wing aircraft with unique capabilities – e.g., EW, aerial tanker, maritime reconnaissance. Some 538 special purpose aircraft, worth about $78.1 billion, are earmarked for production during the 2013-2022 timeframe. Boeing is forecast to capture fully 50 percent of this segment, based on production of the KC-46A tanker for the U.S. Air Force and the P-8A Poseidon maritime patrol aircraft for the U.S. Navy and others. The Poseidon is slated to replace P-3 Orions operated by the U.S. Navy, and is also expected to do well on the international market.

Trainers – FI projects that manufacturers will produce 1,500 fixed-wing military trainers of all types from 2013 through 2022. The value of this production is forecast to total $18.5 billion.

Production of military trainers is projected to grow from 186 aircraft in 2013 to over 200 aircraft in each of 2014 and 2015. Subsequently, production will drop sharply, falling to 184 units in 2016 as procurement of T-6 turboprop trainers by the Pentagon ends. After 2016, annual trainer production will continue to fall, bottoming out in 2022 when only 97 aircraft are forecast to be produced. After 2022, however, yearly production can be expected to finally begin rising once again, as the U.S. Air Force's T-X jet trainer program kicks into gear. The T-X effort is the Air Force's program to replace its fleet of T-38 advanced jet trainers, and is expected to involve the acquisition of at least 350 aircraft.

Military Rotorcraft – Annual production of light military rotorcraft (below 6,804 kg [15,000 lb] maximum gross weight) has grown fairly steadily in recent years, but the era of growth is ending. Current acquisition programs are running their course, and few significant new procurement programs have emerged that would help keep production rates rising, or even stable, at rotorcraft manufacturers. Light military rotorcraft production (new-production units only) during the forecast period is projected to total about 1,425 units, worth some $23.3 billion.

The medium/heavy military rotorcraft market (above 6,804 kg MGW) has experienced substantial and steady growth since 2005. As with the light segment, however, the market growth is at an end. Indeed, annual production in the medium/heavy segment is expected to drop much more sharply than in the light segment. FI's projection of this market indicates that some 623 rotorcraft will be produced in 2013; thereafter, the market will enter a period of gradual decline until at least 2018. In all, 4,728 medium/heavy military rotorcraft, valued at $110.5 billion, is anticipated to be produced during the 2013-2022 period.

Beyond 2022, a significant long-term opportunity is the U.S. military's Future Vertical Lift (FVL) program, which will involve development and production of a new rotorcraft family to meet future U.S. attack, scout, and utility rotorcraft needs. Plans call for the initial FVL model to enter service around 2030.

Forecast International, Inc. (www.forecastinternational.com) is a leading provider of Market Intelligence and Analysis in the areas of aerospace, defense, power systems and military electronics. Based in Newtown, Conn., USA, Forecast International specializes in long-range industry forecasts and market assessments used by strategic planners, marketing professionals, military organizations, and governments worldwide. To arrange an interview with Forecast International's editors, please contact Ray Peterson, Vice President, Research & Editorial Services (203) 426-0800, ray.peterson@forecast1.com. Questions regarding sales may be directed to sales@forecast1.com.

Photos accompanying this release are available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=20675