Dublin, Oct. 19, 2023 (GLOBE NEWSWIRE) -- The "Next-Generation IVD Market - A Global and Regional Analysis: Focus on Products, Type, Application, End User, and Regional Analysis - Analysis and Forecast, 2023-2033" report has been added to ResearchAndMarkets.com's offering.

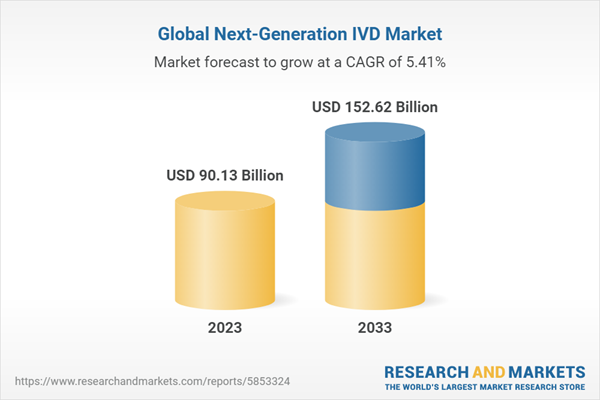

The next-generation IVD market was valued at $86.21 billion in 2022 and is expected to reach $152.62 billion by 2033, growing at a CAGR of 5.41% between 2023 and 2033

The market for next-generation in-vitro diagnostics (IVD) is poised for substantial growth, driven by various key factors. These include advancements in IVD technology, a growing elderly population, an increasing prevalence of chronic illnesses, rising demand for personalized medicine, and the need for more efficient diagnostic solutions.

In 2022, the North American next-generation IVD market emerged as the global leader, with a market value of $35.97 million. It is expected to maintain its dominance throughout the forecast period from 2023 to 2033. However, the Asia-Pacific (APAC) region, comprising several emerging economies, is projected to witness the highest compound annual growth rate (CAGR) of 7.05% during this forecast period.

These cutting-edge diagnostic tools represent a significant advancement in the field, offering improved accuracy, efficiency, and reliability in the detection and monitoring of various diseases and conditions. Nevertheless, the next-generation IVD industry faces challenges such as stringent regulations, industry consolidation, evolving healthcare reforms, and changing demographics.

Despite these challenges, the introduction of new diagnostic technologies and innovations has the potential to stimulate the growth of the next-generation IVD market. Molecular diagnostics, genomics, and Next-Generation Sequencing (NGS) are expected to be key drivers of this growth, offering novel avenues for enhanced disease diagnosis and redefining patient outcomes.

The impact of industrial growth in emerging countries, including developing nations, is significant for the next-generation in-vitro diagnostics (IVDs) market. These regions are witnessing an increasing demand for improved healthcare infrastructure, better access to high-quality diagnostics, and the adoption of advanced technologies to effectively address diseases. This presents a valuable opportunity for market development in these countries.

Furthermore, the regulatory landscape and reimbursement policies play a crucial role in shaping the adoption and expansion of next-generation IVDs on a global scale. Favorable regulations and reimbursement frameworks that facilitate the seamless integration of these technologies into routine healthcare practices can greatly boost market growth.

Overall, the global IVD market has demonstrated consistent growth, and the introduction of next-generation IVD technologies is expected to further propel market expansion, maintaining a robust growth trajectory in the years to come.

Market Segmentation

Core Laboratories Segment to Continue its Dominance as the Leading Type

The next-generation IVD market based on type is led by the core laboratories, with a 69.90% share in 2022.

Core laboratory technologies in IVD encompass a range of analytical instruments and platforms used for centralized testing in laboratory settings. These technologies play a crucial role in clinical diagnostics and patient care. Core laboratory diagnostics include technologies such as immunoassay, hematology, and clinical chemistry, among others.

Consumables Expected to Continue to Dominate the Product Segment

The next-generation IVD market based on product is led by consumables panels based on product, with a 69.94% share in 2022.

Next-generation in-vitro diagnostics (NG-IVD) uses a various range of consumables that are instrumental in conducting sample testing and analysis for any experiment undertaken in the laboratories.

These consumables are essential for ensuring the precise and effective implementation of IVD technologies.

Consumables such as assay kits used for in-vitro diagnostics comprise of essential consumables that include reagents, chemicals, and materials necessary for specific diagnostic tests. These assay kits are designed to provide standardized components and protocols, ensuring consistent and reliable results.

Oncology/Cancer Dominates the Next-Generation IVD Market in Application

As of 2022, the global next-generation IVD market (by application) was dominated by the oncology/cancer segment, holding a 34.95% market share, and is growing with a CAGR of 5.10%.

Increasing prevalence of cancer cases across the globe and efforts by the diagnostics companies for carrying out treatment regimen for treating cancer is driving the market growth of this segment.

Hospital and Clinics Dominates the Next-Generation IVD Market by End User

The next-generation IVD market by end user is led by hospitals and clinics, with a 44.14% share in 2022.

Hospitals and clinics are the major end users for the next-generation IVD market. Apart from the central laboratory testing at hospitals, IVD is being increasingly adopted for the rapid and bed side analysis for various parameters.

These are usually performed by the non-laboratory trained individuals such as nurses, paramedics, and physicians, among others. Hospitals and clinics rely extensively on next-generation in-vitro diagnostics (IVD) as an integral part of their daily functioning. These diagnostic tests play a vital role in ensuring accurate disease diagnosis, monitoring patient well-being, and informing treatment strategies. IVD is essential in various healthcare settings.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The global next-generation IVD market has been extensively segmented on the basis of various categories, such as product, type, application, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Synergistic activities, product launches, and approvals accounted for the maximum number of key developments, i.e., nearly 80% of the total developments in the global next-generation IVD market were between January 2021 to June 2023.

Competitive Strategy: The global next-generation IVD market has numerous startups paving their way into manufacturing kits, panels, assays, and instruments and entering the market. Key players in the global next-generation IVD market analyzed and profiled in the study involve established players that offer various kinds of disease-specific panels and multiplex instruments.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The top next-generation IVD market type segment players who are leading capture around 69.90% of the presence in the market. Players in other industries, such as POC testing, and molecular diagnostics, account for approximately 12.24% and 17.86% of the presence in the market.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 325 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value (USD) in 2023 | $90.13 Billion |

| Forecasted Market Value (USD) by 2033 | $152.62 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

Market Dynamics

Market Drivers

- Technological Advancements in Next-Generation In-Vitro Diagnostics Transforming Healthcare System

- Rising Demand of POC Testing Boosting Next-Generation IVD Market

- Growing Incidence of Chronic and Acute Diseases Demanding for Early Treatment

- Boost in the Next-Generation IVD Market during COVID-19 Pandemic

Market Opportunities

- Rising Number of Next-Generation IVD Companies Involved in Business Expansion

- Inclination of Emerging Companies toward Next-Generation IVD

Business Strategies

- Product Launches and Approvals

- Business Expansions, Fundings, and Other Activities

Global Next-Generation IVD Market Outlook

- POC-IVD

- Global Diagnostic Expenditures

- Pricing Patterns of Next-Generation IVD

- Market Size and Growth Potential

- Short-Term Impact (2020-2025)

- Long-Term Impact (2026-2033)

- Product Benchmarking by Next- Generation In-vitro Diagnostics Market, (by Type)

Market Challenges

- Regulatory Hurdles Related to Next-Generation IVD Technologies

- Poor Reimbursement Scenario

COVID-19 Impact on the Next-Generation IVD Market

- Impact on Operations

- COVID-19 Impact: Current Scenario of the Market

- Pre-COVID Assessment

- Post-COVID-19 Market Assessment

Competitive Landscape

- Corporate Strategies

- Acquisitions

- Synergistic Activities

- Market Share Analysis

- Market Share Analysis (by Company)

- Growth Share Analysis

- Growth Share Analysis (by Product)

Key Companies Profiled:

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- bioMerieux SA (BioFire Diagnostics)

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd. (Roche Molecular Systems, Inc.)

- Guardant Health

- Illumina, Inc.

- Invivoscribe, Inc.

- PerkinElmer Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Sysmex Corporation

- Laboratory Corporation of America Holdings.

- Myriad Genetics, Inc.

- Siemens Healthineers AG

- Tempus

- Thermo Fisher Scientific Inc.

For more information about this report visit https://www.researchandmarkets.com/r/l8ftsa

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment