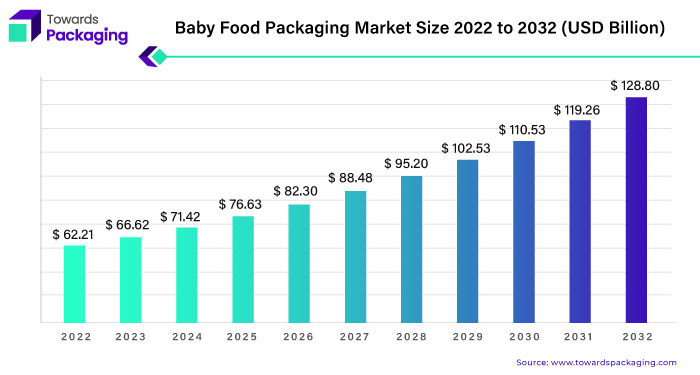

Ottawa, March 12, 2024 (GLOBE NEWSWIRE) -- The baby food packaging market size was valued at USD 66.62 billion in 2023 and is projected to surpass around USD 110.53 billion by 2030, study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

- Propelling Asia-Pacific's infant food market.

- North America's escalating path in baby food packaging.

- Dominance of plastic containers in the baby food packaging sector.

- Exploring the protective role of packaging in powdered infant nutrition.

- Empowering parents with the emergence of pouches in baby food packaging.

The baby food packaging market is a part of the packaging industry segment that focuses on creating, manufacturing, and distributing packaging solutions specifically for food products intended for infants and toddlers. The company's mission is to ensure the safety, nutritional integrity, and convenience of its goods for parents and carers.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5109

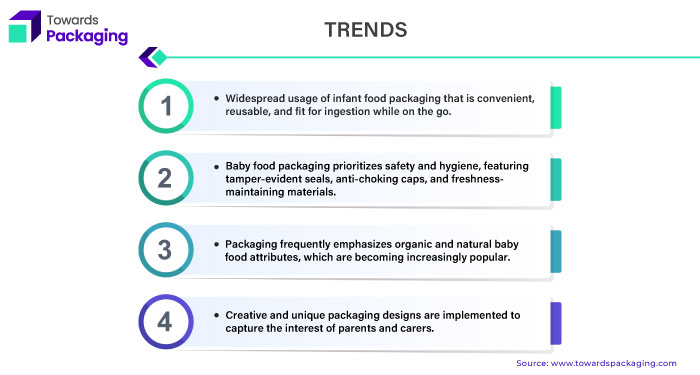

Infant food manufacturers are witnessing a significant shift in packaging tactics, driven by the rise of millennial parents as the most influential consumer demographic. Traditional eye-catching labels and unique imagery methods, such as the iconic Gerber baby, are no longer sufficient. The landscape of infant food packaging is transforming, necessitated by the evolving concerns, preferences, and lifestyles of millennial parents, who now hold the reins of the market. Millennial parents, known for demanding brand transparency, are attracted to visually appealing products with imaginative designs for their infants. Numerous well-known baby food businesses have switched to flexible stand-up pouches with spouts, moving away from the traditional tiny paper label on a tiny jar. The drawbacks of these conventional methods include limited space for information, less visual appeal, and less convenience for on-the-go feeding. These creative packaging ideas are aesthetically pleasing and a vital component of the marketing plan as they package and safeguard baby food.

The safety and quality of baby food are greatly dependent on the packaging. Nutritional integrity is preserved by contamination prevention provided by childproof and sanitary packaging. Parental decision-making is facilitated by clear labelling, and portion-sized packaging makes feeding on-the-go more feasible while putting the health and convenience of young consumers first.

Baby food packaging that adapts to consumers' changing requirements and lifestyles is preferred, as evidenced by the trend towards flexible stand-up pouches. Excellent design and communication versatility are possible with these pouches, which provide a more contemporary and dynamic alternative. The functionality of these pouches corresponds with the tastes of millennial parents, who value ease of use and are drawn to packaging that not only holds but also successfully preserves infant food items. Packaging for baby food has evolved in response to shifting consumer demands and the demographic situation. Brands carefully choose container styles, such as flexible stand-up pouches, to satisfy the needs of millennial parents while ensuring the correct containment and preservation of their baby food items.

For Instance,

- In May 2021, one of the world's largest food and beverage corporations, Kraft Heinz, collaborates with Gualapack to advance its environmental agenda. For its infant food Italian brand Plasmon, the company chose Pouch5®, a 100% recyclable solution that aids businesses and families in moving towards sustainability.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Baby Food Packaging Market Trends

Driving Force Behind Asia-Pacific's Infant Food Market

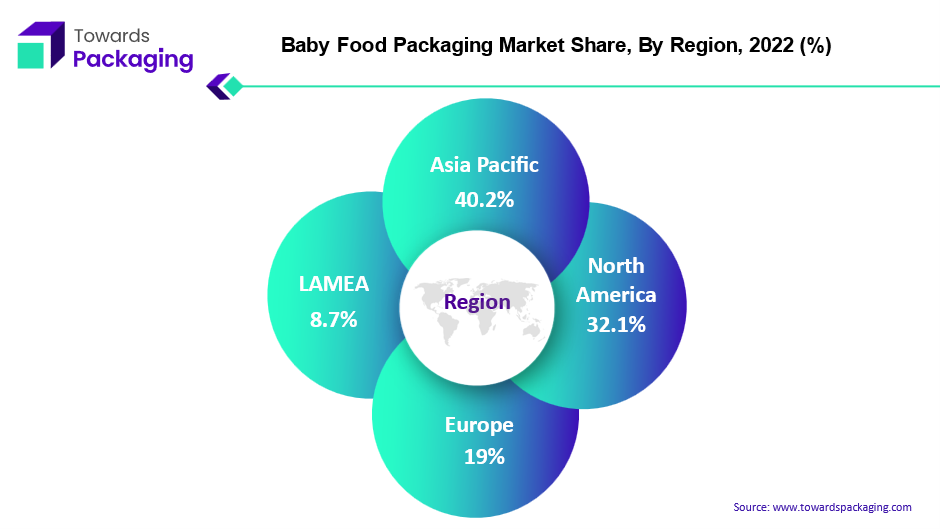

With the significant 40.2% market share in the infant food sector, the Asia-Pacific area is the centre of the worldwide baby food packaging business. The region's high birth rates and growing purchasing power, taken together, fuel the need for items based on milk formula and baby food, contributing to its dominance. China is the market leader, with the distinction of being the biggest customer in the Asia-Pacific area. Moreover, the promising economies of Indonesia and India are expected to play a pivotal role in driving the growth of the region's infant food market, offering a bright outlook for the future. Milk formula, holding the largest market share, is the preferred choice among customers, indicating a stable and reliable market demand.

The prepared baby food product industry follows closely, making a substantial contribution to the varied infant nutrition landscape of the Asia-Pacific region. The notable concentration of sales in infant food made from milk formula highlights the popularity of this category of items in the area. Supermarkets, a crucial distribution channel for the infant food sector, account for a significant portion of its total distribution. This underlines the vital role of conveniently accessible retail locations in reaching a broad customer base, ensuring the products' wide availability. In the infant food packaging industry, positioning claims emphasize three essential features: convenience packing, organic content, and no additives or preservatives. Convenience packaging stands out among these in growth, with an astounding 72% increase. Notable growth rates of 25% and 7%, respectively, are seen in the demand for organic infant food and items free of additives and preservatives. These trends show a strong demand for products that fit convenient and health-conscious lifestyles, aligning with consumers' growing preferences in the Asia-Pacific area.

Fertility Rates in India 2020-2023

| Fertility Rates in India 2020-2023 | |||

| Year | Fertility Rate | Growth Rate | |

| 2023 | 2.139 | -0.93 | % |

| 2022 | 2.159 | -0.92 | % |

| 2021 | 2.179 | -0.95 | % |

| 2020 | 2.2 | -0.90 | % |

India's fertility rate is steadily declining, estimated at 2.139 births per woman in 2023, a 0.93% drop from 2022. Factors like increased education access, contraception, urbanization, and female workforce participation contribute to this trend. If the fertility rate falls below replacement levels, it could lead to an aging population and a shrinking workforce, impacting demographics and the economy.

Asia-Pacific's infant food packaging market is essentially defined by its strong growth, high birth rates, rising purchasing power, and wide range of product preferences. The market is changing and dynamic, as seen by the prevalence of milk formula, the role retailers play in distribution, and the increase in demand for handy and health-conscious packaging.

For Instance,

- In February 2023, Little Dish, a healthy children's food business, developed a new and enhanced line with more sustainable, 100% recyclable packaging.

The North American market has emerged as the fastest-growing hub with 32.1% of market share in the vast landscape of baby food packaging. A detailed survey of over 1,000 parents in the United States was done to determine their preferences for infant food packaging. This extensive investigation dug into consumer perceptions about the convenience, value, design, safety, and overall attractiveness of several infant food brands, evaluating the visual and structural components of their packaging. The spike in organic baby food sales, which has seen a [insert percentage] increase spurred by parents' increased health concerns, has taken the stage in the US. Customers' rising concern about food safety is a crucial factor affecting this development, encouraging them to spend more money on organic infant food. This shift is primarily motivated by a desire to protect newborns from pesticides and other additives, consistent with the broader cultural trend towards health-conscious consumerism.

The widely held assumption among health professionals that infants and children benefit more from organic food than adults reinforce the health-conscious approach. This derives from the belief that children, who are more susceptible to contaminants in their meals, stand to benefit significantly from the purity and nutritious content of organic food. Studies have shown that organic food can provide [insert specific health benefits] for infants. Birth rates are expected to rise as economic conditions improve and Americans gain confidence in their prospects. This is predicted to lead to a corresponding increase in the value of infant food sales. Economic prosperity and increased confidence combine to create an optimistic prognosis for the North American baby food market, setting it for long-term expansion.

The North American baby food packaging business is rapidly expanding, driven by rigorous monitoring of parental preferences and a significant trend towards organic baby food. The convergence of health-conscious choices, worries about food safety, and the anticipated improvement in economic conditions shape the landscape, pointing to a promising path for the market's expansion in the region.

For Instance,

- In March 2021, U.S based LactaLogics, a company, focused on human milk-based nutrition for premature infants. LactaLogics is developing closed-system, shelf-stable products that can offer aseptic breast milk administration to at-risk infants.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5109

Plastic Containers' Dominance in the Baby Food Packaging Sector

The baby food packaging sector has emerged as a leader, with plastic containers emerging as the most popular material. Plastic containers have various advantages over glass counterparts. They are noticeably lighter, allowing for better handling, transit, and storage, which is especially useful for bulk shipping products. Furthermore, plastic containers are more durable and less likely to break than glass, making them a better choice for storing and handling infant food supplies. while plastic containers in the infant food packaging sector are frequently recyclable, contributing to sustainability initiatives, examining the potential downsides of using plastic containers is critical. For instance, certain types of plastic can leach harmful chemicals into the food, especially when heated. These chemicals can interfere with the baby's hormonal system and lead to health issues in the long run. The possibility that traces levels of potentially dangerous substances, such as phthalates and BPA (bisphenol A), may seep into infant food from plastic is a cause for concern. To resolve this matter, it is recommended that consumers use infant foods that bear the labels "BPA-free" or "phthalate-free."

The possibility of these chemicals leaking into the food can be increased by heat exposure, such as microwaves, or damage to plastic containers. Although BPA is prohibited in some infant goods by the U.S. Food and Drug Administration, BPA is said to be safe to use in other kinds of food packaging. However, the American Academy of Paediatrics advises parents to proceed cautiously, given that young children and newborns are especially susceptible to chemical exposure. To make educated decisions, customers should avoid plastics labeled with specific recycling codes such as 3 (phthalates), 6 (styrene), and 7 (bisphenols, including BPA). Additionally, looking for products in packaging labelled "biobased" or "greenware" is suggested, as these containers are constructed from plant-based materials. Notably, baby food bags are frequently lined with polypropylene, as indicated by recycling code 5, providing a BPA-free plastic option. Overall, recognizing plastic containers' benefits and potential drawbacks in the baby food packaging market allows consumers to make informed and health-conscious decisions for their infants.

Browse More Insights of Towards Packaging:

- The global water-soluble packaging market expected to increase from USD 3.02 billion in 2022 to set a foot on USD 5.34 billion by 2032, registered at 5.9% CAGR between 2023 and 2032.

- The global liquid packaging market experiences growth from USD 338.08 billion in 2022 and is expected to hit USD 585.74 billion by 2032, registered at 5.7% CAGR between 2023 to 2032.

- The global mushroom packaging market size is estimated to grow from USD 58.58 million in 2022 to reach an estimated USD 122.43 million by 2032, registered at 7.7% CAGR between 2023 and 2032.

- The global retort packaging market size is estimated to grow from USD 3.87 billion in 2022 to reach an anticipated USD 6.45 billion by 2032 at 5.2% CAGR from 2023 to 2032.

- The global ready-to-eat packaging market size showcasing remarkable growth from USD 361.0 billion in 2022 to unprecedented success eyeing towards USD 700.23 billion by 2032, at a growing 6.9% CAGR between 2023 and 2032.

- The global ready-to-drink packaging market size is estimated to grow from USD 145.71 billion in 2022 to reach an estimated USD 252.44 billion by 2032, at 5.7% CAGR from 2023 to 2032.

- The global modified atmosphere packaging market size is estimated to grow from USD 18.33 billion in 2022 to reach an estimated USD 34.65 billion by 2032, at 6.6% CAGR from 2023 to 2032.

- The global insulated packaging market size is estimated to grow from USD 14.38 billion in 2022 to set a foot on USD 27.64 billion by 2032, at 6.8% CAGR from 2023 to 2032.

- The global metal packaging market size was at USD 126.95 billion in 2022 to hit an estimated USD 185.21 billion by 2032, registering at a 3.9% CAGR from 2023 to 2032.

- The global sachet packaging market size is estimated to grow from USD 8.89 billion in 2022 to reach an estimated USD 15.2 billion by 2032, at 5.5% CAGR from 2023 to 2032.

For Instance,

- In November 2023, Chadwicks introduced the "Spoon-in-Lid" infant formula packaging option. Pre-cut lidding producer Chadwicks has created a spoon-in-lid solution for the infant formula industry in Australia, East Asia, and New Zealand in partnership with plastic engineering specialist Tekplas.

Unpacking the Protective Role of Packaging in Powdered Infant Nutrition

Powder baby food items dominate the baby food packaging market and have established themselves as a significant sector. Consumers worldwide favor powdered or dried infant food products for their unrivalled convenience, prolonged shelf life, and nutritional benefits. These devices are popular because of their ease of use and versatility for carers. The assortment of packaging materials used for powdered baby food items highlights their crucial role in maintaining the food's quality and freshness. Packaging serves a purpose beyond merely housing the product; it acts as a protective barrier, ensuring the nutritional value of the infant food remains intact from packaging to consumption.

Products are meticulously packaged with materials like paper and cardboard, which are used for items such as cereals, baby formulas, and snacks. The choice of packaging material plays a pivotal role in safeguarding and preserving powdered baby food. Manufacturers opt for these materials for their functionality and environmental benefits, aligning with the baby food industry's growing focus on sustainable and ethical packaging practices.

For Instance,

- In March 2021, A new Nesquik All-Natural powder was announced by Nestlé. Composed of natural ingredients and packaged in a recyclable paper pouch, the new Nesquik has a more straightforward ingredient list.

Powder baby food products are gaining popularity in the baby food packaging industry due to consumer preferences for convenience, longer shelf life, and nutritional content, anchored in worldwide consumer trends. The preservation of the quality of different infant food products is greatly aided by the packing materials, such as cardboard and paper, emphasizing the significance of well-thought-out and practical packaging solutions throughout the packaging-to-consuming process.

Rise of Pouches in Empowering Parents through Baby Food Packaging

Pouches have risen to prominence in the infant food packaging market, offering distinct advantages that meet both parents' and customers' needs and expectations. In contrast to conventional packaging, pouches provide ample' retail space' for various elements such as artwork, logos, ingredient details, nutritional information, serving suggestions, and product formulation details. This abundance of information empowers parents to make well-informed choices about the baby food products they select for their infants. Parents surveyed have shown a strong preference for stand-up pouches with spouts, recognizing them as more convenient for storing baby food and significantly safer than rigid glass jars, which pose a risk of breaking and shattering if dropped.

The stand-up pouch with a spout was recognized as safer and more practical, even by parents initially content with glass jars. Concerning grocery stores, an overwhelming majority of respondents, accounting for 73.61%, believe that stand-up pouches with spouts would garner greater visibility on the shelves compared to glass jars. In the baby food packaging sector, pouches exhibit adaptability and can be customized to fulfil diverse purposes. They can be produced in multiple sizes, shapes, and structures to meet product requirements and maintain brand recognition. This versatility also mirrors the ability to fit into modern parents' diverse preferences and active lifestyles.

For Instance,

- In November 2022, Plum Organics, a company encouraging babies and toddlers to expand their palates, declared that it would entirely revamp its packaging. The changes to the full line of wholesome pouches and snacks emphasize ingredient clarity, which makes it simple for parents to feel comfortable about the food they're giving their kids.

Several baby food businesses have already adopted spouted pouches for their products, drawn by their safety features, ease of use for busy parents, and the ability to print in vibrant colors, sizes, and shapes that appeal to young children. Pouches offer greater space efficiency than bulky, rigid containers due to their portability, making them a perfect fit for diaper bags and household pantries. Furthermore, pouches are cost-effective for manufacturers, contributing to their widespread acceptance in the evolving infant food packaging market.

Competitive Landscape

The competitive landscape of the baby food packaging market is characterized by established industry leaders such as Ardagh Group, Amcor PLC, Mondi Group, Winpak Ltd, Sonoco Products Company, Bemis Company, Inc., Rexam PLC, RPC Group, Bericap India Pvt Ltd. And Hindustan National Glass & Industries Ltd. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

The packaging specialists at Amcor use a wide range of pioneering techniques to enhance packaging sustainability. Amcor’s products guide the process of confirming and promoting the recyclability of packaging; R&D teams may draw in 84% of consumers and increase their market share. Winpak is dedicated to investing in sturdy and safe packaging materials to meet the needs of our youngest customers, infants and toddlers. Winpak has been developing liquid packaging solutions with various filling technologies and flexible and rigid packaging materials for over 30 years. The company's products include functional and aesthetically pleasing pouches and cups. Sonoco Products Company provides largest player in infant puree packaging with quality and convenience.

Baby Food Packaging Market Players

Ardagh Group, Amcor PLC, Mondi Group, Winpak Ltd, Sonoco Products Company, Bemis Company, Inc., Rexam PLC, RPC Group, Bericap India Pvt Ltd., Hindustan National Glass & Industries Ltd., Tata Tinplate Company of India (TCIL), Cascades, Inc., FPC Flexible Packaging Corp., Hood Packaging Corp., AptarGroup, Inc., and Essel Propack Limited.

Recent Developments:

- In January 2022, US-based baby food company LactaLogics finalized a partnership with flexible packaging manufacturer Scholle IPN to develop aseptic packaging technology.

- In January 2023, According to a definitive agreement, the FDA-registered packaging and blending plant Cascadia Nutrition in Portland, Oregon, is being acquired by ByHeart, a next-generation baby nutrition firm.

- In June 2023, The North American cereal and snack food company Nature's Path Organic Foods revealed that it had purchased the Canadian infant food and kids snack brand Love Child Organics.

- In July 2023, Infant formula manufacturer Bobbie acquired The Ohio-based paediatric nutrition startup Nature's One. The purchase was made a year after a nationwide scarcity of newborn formula and less than three years after Bobbie's debut.

- In September 2023, A healthy snack brand called Yoga Bar entered the infant food market. The items, which range in price from Rs. 150 to Rs. 220, were introduced by the ITC-acquired company and will be offered in the following varieties: sprouted ragi mango, sprouted ragi strawberry, sprouted ragi, saffron, oats, dates, and millets.

Market Segments

By Material

- Plastic

- Paperboard

- Glass

- Metal

By Product Type

- Powder

- Liquid

By Packaging

- Pouches

- Bottles

- Cartons

- Cans

- Others

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5109

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/